Introduction: Why Physicians Should Look Beyond Traditional Investments

Physicians spend years mastering clinical skills, often at the expense of learning about money. Long hours, high stress, and delayed earning years can make it feel like there’s no time to think deeply about wealth management. Yet your income potential—and the financial risks you shoulder—make it critical to have a deliberate, evidence-informed financial strategy.

Most doctors are familiar with traditional investments:

- Employer retirement plans (401(k), 403(b), 457)

- IRAs and Roth IRAs

- Broad stock and bond index funds

- Target-date mutual funds

These are the foundation of sound investing. But to build durable, long-term wealth and hedge against market volatility and inflation, many physicians also consider Alternative Investments—assets outside the typical stock/bond/cash universe.

This guide explores how alternative investments can fit into physician finance, especially for those already on a solid footing with basic retirement and emergency savings. You’ll learn:

- What alternative investments are and how they differ from traditional assets

- Why they’re relevant to physicians’ unique careers and risk profiles

- The main types (with a focus on Real Estate and other practical options)

- How to thoughtfully incorporate them into your overall financial strategy

- Common pitfalls and how to avoid them

The goal is not to turn you into a day-trader or real estate mogul, but to help you become a well-informed, strategic investor who can confidently evaluate opportunities beyond the market’s walls.

Understanding Alternative Investments in a Physician’s Context

What Are Alternative Investments?

Alternative investments are assets that fall outside the traditional categories of publicly traded stocks, bonds, and cash. Common examples include:

- Real Estate (direct ownership, syndications, funds, or REITs)

- Private Equity and Venture Capital

- Hedge Funds

- Commodities (gold, oil, agricultural products)

- Private Credit / Private Debt

- Cryptocurrencies and Digital Assets

- Collectibles (art, wine, rare coins, classic cars)

- Crowdfunded investments (startups, property platforms, niche funds)

These investments:

- Often have lower correlation to stock and bond markets

- May be less liquid (harder to sell quickly)

- Can be more complex and less transparent

- Frequently require accredited investor status or higher minimums

For physicians who already have a strong base of diversified index funds, alternatives can be a tool to:

- Diversify risk

- Seek enhanced returns

- Hedge against inflation

- Align investments with personal interests (e.g., real estate, tech startups)

Why Alternative Investments Matter for Physician Finance

Physicians face a particular financial trajectory:

- Late career start: Years of training delay significant income.

- High debt burden: Six-figure student loans are common.

- High, relatively stable income: Once established, earnings are strong.

- Limited time: Clinical work leaves little bandwidth for active investing.

Because of these factors, your wealth management strategy should prioritize simplicity and risk management. Alternative investments can still play a role—but only after you’ve secured:

- An emergency fund (3–6 months of expenses or more, depending on your risk tolerance)

- Adequate disability and life insurance

- Regular contributions to retirement accounts

- A basic diversified portfolio in low-cost index funds

Once these are in place, allocating a modest slice of your portfolio to vetted alternative investments can add resilience and return potential.

Key Benefits of Alternative Investments for Physicians

1. Diversification Beyond the Stock Market

Diversification—spreading money across different types of assets—is one of the core pillars of sound investing. When all your investments rise and fall with the same market (e.g., just U.S. stocks), your portfolio is vulnerable to large swings.

Alternative investments help diversify in several ways:

Different return drivers:

Real estate values are driven by local markets, rents, interest rates, and demographic trends, not only corporate earnings.Reduced correlation:

Some alternatives (like commodities or certain real estate) may perform better when stocks struggle, potentially smoothing your overall returns.Broader opportunity set:

You’re no longer limited to what’s publicly traded on major exchanges.

For a physician nearing retirement, for instance, having 10–20% of a portfolio in real estate or other alternatives may reduce reliance on public market performance during downturns, though the right percentage will depend on your goals and risk tolerance.

2. Potential for Higher, Differentiated Returns

Many alternative asset classes have historically offered attractive long-term returns, often with income components:

Real Estate:

- Rental income plus potential property appreciation

- Tax benefits (depreciation, deductions, 1031 exchanges in some cases)

Private Equity/Venture Capital:

- Potential for outsized gains if companies grow or are acquired

- Access to segments of the economy not represented in public markets

These strategies may come with higher risk, fees, and illiquidity, so they’re not appropriate as the core of a portfolio—but as a satellite allocation, they can enhance overall performance when selected carefully.

3. Inflation Protection and Real Assets

Physicians, especially those with long careers ahead, face the silent risk of inflation eroding purchasing power over decades.

Certain alternative investments act as real assets that tend to keep pace with or exceed inflation:

- Real estate: Rents and property values can rise with inflation.

- Commodities: Commodity prices often move with inflationary pressures.

- Infrastructure funds: Toll roads, utilities, and energy infrastructure can have inflation-linked revenue.

These can be helpful components of a comprehensive financial strategy that protects your future lifestyle.

4. Access to Unique Networks and Opportunities

As a physician, you may encounter:

- Colleagues investing in medical office buildings

- Hospital-related real estate deals

- Startup opportunities in digital health or biotech

- Practice buy-ins or private equity roll-ups

These can be powerful wealth-building opportunities—but also sources of concentrated risk and conflicts of interest. Understanding how alternatives work gives you the tools to evaluate these opportunities objectively, rather than saying yes (or no) by default.

Types of Alternative Investments Especially Relevant to Physicians

1. Real Estate: A Cornerstone Alternative Investment

Real Estate is often the first alternative asset physicians explore, and it’s a natural entry point into more diversified investing.

A. Direct Ownership: Residential and Commercial Properties

Physicians commonly invest in:

Single-family rentals:

- Pros: Tangible asset, potential cash flow, long-term appreciation.

- Cons: Active management, tenant issues, geographic concentration risk.

Small multifamily properties (2–4 units):

- Pros: Economies of scale vs. single-family, multiple income streams.

- Cons: More complex financing and management.

Commercial properties (offices, retail, warehouses):

- Pros: Longer leases, potentially higher returns.

- Cons: Cyclical demand, vacancy risk, often more complex to underwrite.

Example for physicians:

A hospitalist couple buys a small fourplex near their hospital. Over 10 years:

- They pay down the mortgage with rent

- The property appreciates modestly

- They build equity that later funds their children’s college or an early partial retirement

This is an example of turning clinical income into a tangible wealth-building asset.

B. Real Estate Syndications and Funds

Instead of actively buying and managing properties, you can invest passively via:

- Syndications: Pooled investments in specific properties (e.g., a 200-unit apartment complex).

- Private real estate funds: Funds that acquire and manage a portfolio of properties.

Pros:

- Professional management

- Diversification across projects or geographies

- Potentially attractive income and tax benefits

Cons:

- Illiquidity (your money may be tied up for 5–10 years)

- Requires careful due diligence on the sponsor

- Often limited to accredited investors

C. Real Estate Investment Trusts (REITs)

For physicians seeking the simplicity and liquidity of public markets but exposure to property:

- Publicly traded REITs can be bought like stocks via your brokerage or retirement accounts.

- Private REITs and interval funds provide similar exposure but may have different fee structures and liquidity rules.

REITs allow exposure to:

- Apartment buildings

- Medical office buildings

- Industrial warehouses

- Data centers, cell towers, and more

They’re a straightforward way to introduce real estate into a portfolio without becoming a landlord.

2. Private Equity and Venture Capital

Private equity and venture capital involve investing in private companies or taking public companies private, with the goal of improving operations and selling at a profit later.

For physicians, this may include:

- Investing in a private equity fund

- Participating in a fund that acquires physician practices or healthcare businesses

- Angel investing in early-stage healthcare startups

Considerations:

- Very illiquid (capital may be locked up 7–10+ years)

- High risk of loss, especially in early-stage companies

- Potential for outsized gains if companies succeed

Physicians may be particularly drawn to healthcare-related ventures where they have domain expertise, but it’s vital to separate clinical judgment from investment judgment and assess the financials, governance, and capital structure objectively.

3. Hedge Funds and Complex Strategies

Hedge funds use a variety of advanced strategies—long/short equity, arbitrage, derivatives, macro bets—to generate returns uncorrelated with the market.

For most physicians:

- High fees and complexity

- Limited transparency

- High minimum investments

make hedge funds more suitable only for those with very high net worth and access to robust, independent advice. For many, low-cost diversified funds plus simple alternatives like real estate are sufficient.

4. Commodities and Real Assets

Commodities (e.g., gold, silver, oil, agricultural products) can:

- Hedge against inflation or currency risk

- Provide diversification away from equity markets

Physicians typically access commodities through:

- Commodity ETFs

- Broad “real asset” funds

- Futures-based mutual funds (less common for individual investors)

Given their volatility and lack of income generation, commodities usually play a small, tactical role—often a few percent of a portfolio, if used at all.

5. Cryptocurrencies and Digital Assets

Cryptocurrencies like Bitcoin and Ethereum have gained attention as a new type of asset:

- Extremely volatile, often experiencing large swings in short periods

- Regulatory environment and tax treatment are evolving

- Long-term role in global finance still uncertain

For physicians, a reasonable approach, if interested, is:

- Limit allocation to a small percentage of your net worth (e.g., 1–3%)

- Use reputable exchanges and secure storage

- Understand tax reporting requirements

- Treat it as a speculative satellite holding, not a core retirement plan

6. Collectibles and Passion Investments

Collectibles—art, wine, rare coins, classic cars—can be intellectually and emotionally rewarding. However:

- Valuations are subjective

- Markets can be illiquid

- Storage, insurance, and maintenance costs add up

If you enjoy these areas, it’s best to treat them as hobby or passion investments, kept to a small slice of your net worth and not relied upon for essential retirement goals.

How to Incorporate Alternative Investments into a Physician’s Financial Strategy

Step 1: Clarify Your Financial Foundation and Goals

Before adding complexity, ensure the basics of physician finance are in place:

- Emergency fund fully funded

- High-interest debt paid down

- Adequate disability and life insurance

- Consistent retirement contributions (ideally 15–25% of gross income, if feasible)

Then define clear goals for any alternative allocation:

- Are you seeking more income, more growth, or inflation protection?

- What is your time horizon for this money?

- How comfortable are you with illiquidity and complexity?

Your answers determine whether you prioritize real estate, private debt, or other options.

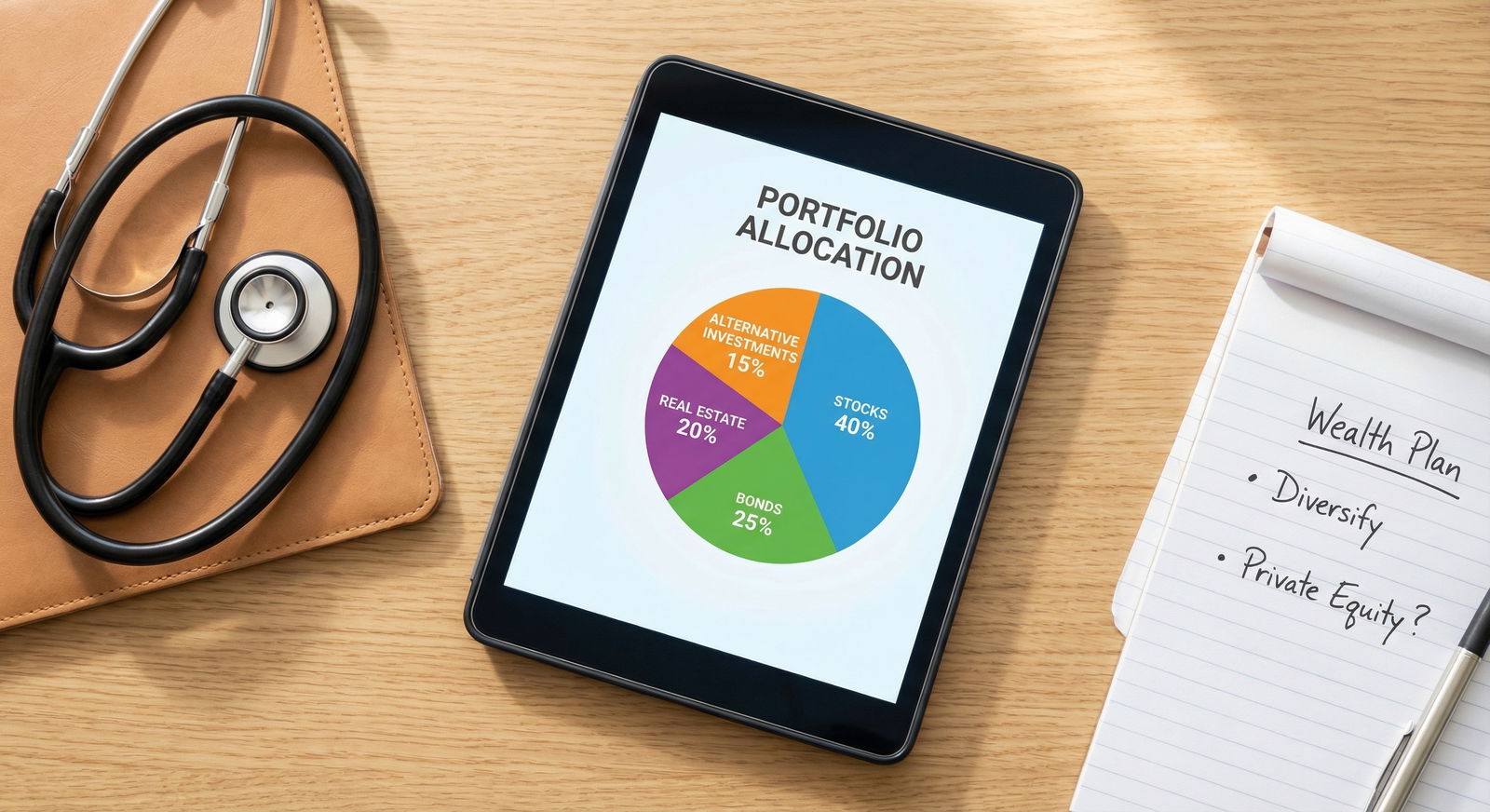

Step 2: Decide on an Allocation Range

Many financial planners suggest a 5–20% allocation to alternative investments for individuals with solid traditional portfolios and higher risk capacity.

Example allocation for a mid-career physician:

- 70–80%: Low-cost diversified stocks and bonds

- 10–20%: Real estate (direct, syndications, or REITs)

- 0–10%: Other alternatives (private equity, commodities, crypto, etc.)

The exact blend should be tailored with a fiduciary financial advisor and revisited periodically.

Step 3: Educate Yourself Thoroughly

Before committing capital:

- Read books and reputable blogs on physician-specific investing

- Attend webinars or courses on real estate or private investments

- Join physician finance communities (but verify claims independently)

- Learn to read key documents:

- Private Placement Memorandums (PPMs)

- Offering circulars

- Operating agreements

A working understanding of fees, liquidity terms, and risk factors is essential.

Step 4: Work With the Right Advisors

Consider partnering with:

- Fee-only, fiduciary financial planners who understand alternative assets and physician compensation models

- CPAs experienced in real estate and private investments

- Attorneys for entity structuring (e.g., LLCs for property ownership) and contract review

Avoid conflicted advice from product salespeople who are paid commissions or sharing in deal profits without clear disclosures.

Step 5: Start Small and Review Regularly

Begin with:

- A single REIT fund in your retirement account, or

- A small passive real estate deal you’ve carefully vetted, or

- A modest percentage in a diversified private credit or real asset fund

Then:

- Track performance vs. expectations

- Monitor cash flows, tax implications, and your comfort level

- Rebalance your total portfolio annually to maintain your target allocation

Over time, you can scale up or down depending on results, changing goals, and your evolving risk tolerance.

Case Studies: How Physicians Have Used Alternative Investments

Case Study 1: The Real Estate-Focused Hospitalist

Dr. Sarah, a family medicine physician, started with one single-family rental home during residency. Over 10 years:

- She carefully selected properties in stable, growing neighborhoods

- Hired a property manager to minimize time demands

- Reinvested cash flow and used 1031 exchanges to upgrade properties

Outcome:

- Built a portfolio of several rentals producing steady income

- Used the cash flow to accelerate student loan payoff

- Entered her 40s with a diversified net worth across retirement accounts and real estate

Key takeaway: She approached real estate as a long-term business, not a get-rich-quick scheme, and scaled gradually.

Case Study 2: The Crypto-Selective Specialist

As a pre-med student, Dr. Tom experimented with small cryptocurrency investments. Later, as an attending:

- He limited crypto to a small portion (2–3%) of his portfolio

- Used dollar-cost averaging rather than large lump-sum bets

- Took profits strategically during major run-ups

Outcome:

- Crypto gains helped him pay off a portion of his loans

- Volatility did not derail his retirement plan because it was a small, capped allocation

Key takeaway: Treating speculative assets as a controlled slice of a diversified strategy helped harness upside while controlling risk.

FAQs: Alternative Investments and Physician Finance

1. How much money do I need to start investing in alternative assets?

It varies widely by asset type:

- Public REITs or ETFs: You can start with a few hundred dollars through a brokerage or retirement account.

- Crowdfunded real estate platforms: Minimums often range from $1,000 to $25,000.

- Private real estate syndications or private equity funds: Common minimums are $25,000–$250,000 and often require accredited investor status.

- Cryptocurrencies: You can start with very small amounts, but risk management is crucial.

As a rule of thumb, don’t allocate to alternatives until your basic savings, retirement contributions, and emergency fund are in place.

2. Are alternative investments riskier than traditional investments?

They can be—but not always in the same way:

- Illiquidity: Many alternatives lock up capital for years.

- Complexity: Strategies may be hard to understand or evaluate.

- Less regulation and transparency: Particularly in private deals and funds.

- Concentration risk: A single real estate deal or startup may represent a large chunk of your capital.

Because of this, many physicians use alternatives as a complement to, not a replacement for, a solid core of diversified stock and bond index funds.

3. Can I invest in alternative assets as a beginner physician or resident?

Yes, but the sequence matters:

- Build a basic emergency fund.

- Maximize employer retirement matches and start low-cost index investing.

- Pay down high-interest debt.

Once those steps are underway, you can explore simpler alternatives such as:

- REIT index funds in your 403(b) or IRA

- A small, diversified real estate or real asset fund

More complex investments (private equity, syndications, hedge funds) are generally best left until you have higher net worth, more experience, and professional guidance.

4. How do I evaluate whether an alternative investment is legitimate and suitable?

Key steps include:

Check alignment and incentives:

- How does the sponsor or manager get paid?

- Are fees reasonable and transparent?

Review track record and references:

- How have prior deals or funds performed?

- What do other investors report?

Understand the downside scenario:

- What happens if rents fall, interest rates rise, or a startup fails?

- How much could you lose, and how easily could you exit?

Seek independent advice:

- Use a fee-only financial advisor or CPA not affiliated with the investment.

Never invest in something you don’t understand—and don’t be rushed by high-pressure sales tactics.

5. How are alternative investments taxed for physicians?

Tax treatment varies by asset:

Real estate:

- Rental income is taxable but can be offset by deductible expenses and depreciation.

- Capital gains and depreciation recapture apply upon sale.

REITs:

- Distributions may include ordinary income, capital gains, and return of capital.

Private equity and hedge funds:

- Can generate complex K-1 forms with various types of income.

Cryptocurrencies:

- Taxed as property; each sale or trade triggers capital gains or losses.

Given physician income levels and complexity, working with a CPA experienced in investments and real estate is highly advisable to optimize after-tax returns and ensure compliance.

Final Thoughts: Building a Thoughtful Investment Life Beyond the Hospital

Alternative investments—whether real estate, private equity, commodities, or carefully limited cryptocurrency—can be powerful tools within a broader physician finance and wealth management plan. They offer the potential to:

- Diversify beyond public markets

- Generate additional income streams

- Protect against inflation

- Align investments with your interests and expertise

But their benefits come with trade-offs: illiquidity, complexity, and risk. As a physician, your most valuable asset is your career and time. Use that time to build a strong financial foundation first, then approach alternatives strategically:

- Start with education, not dollars

- Keep alternatives a minority share of your portfolio

- Prefer simplicity and transparency over complexity and hype

- Partner with unbiased experts when needed

By deliberately integrating alternative investments into a disciplined, long-term financial strategy, you can move beyond merely earning a high income and toward building durable, flexible wealth that supports your career, your family, and your life beyond the clinic walls.