As digital health rapidly reshapes how care is delivered, Telemedicine has become a core component of modern Patient Care rather than a temporary workaround. For medical students, residents, and practicing Healthcare Providers, understanding how Telemedicine intersects with Malpractice Insurance and Legal Considerations is now essential—not optional.

This guide unpacks what you need to know about malpractice coverage in the telehealth era, the legal and regulatory landscape, and how to protect both your patients and your career as you practice virtually.

Understanding Telemedicine in the Context of Liability

What Is Telemedicine—Practically Speaking?

Telemedicine (often used interchangeably with “telehealth”) refers to the delivery of clinical care using telecommunications technologies, including:

- Synchronous video visits (e.g., virtual office visits, urgent care triage)

- Telephone consultations when video is not feasible

- Secure messaging or portals for follow-up, lab results, or medication questions

- Remote patient monitoring tools (e.g., home BP cuffs, glucometers, wearables sending real-time data)

- Store-and-forward consultations (e.g., dermatology images sent for later review)

From a malpractice and legal perspective, if you are making clinical decisions, giving medical advice, prescribing, or documenting in the chart, you are typically practicing medicine—whether you are in the same room or on a screen.

The Rise and Normalization of Telemedicine

The COVID-19 pandemic dramatically accelerated Telemedicine adoption. At the peak, some systems saw more than half of outpatient encounters delivered virtually. Several key changes emerged:

- Rapid regulatory waivers and flexibilities around licensure, privacy rules (e.g., HIPAA enforcement discretion), and reimbursement

- Expansion of payer coverage, including Medicare, Medicaid, and commercial insurers

- Permanent workflow integration in many specialties (primary care, psychiatry, endocrinology, dermatology, neurology, etc.)

Post-pandemic, many of those temporary flexibilities have either expired or been modified. However, patient expectations for convenient, digital access remain. That means Telemedicine is now a standard component of Patient Care—and malpractice and Legal Considerations must catch up.

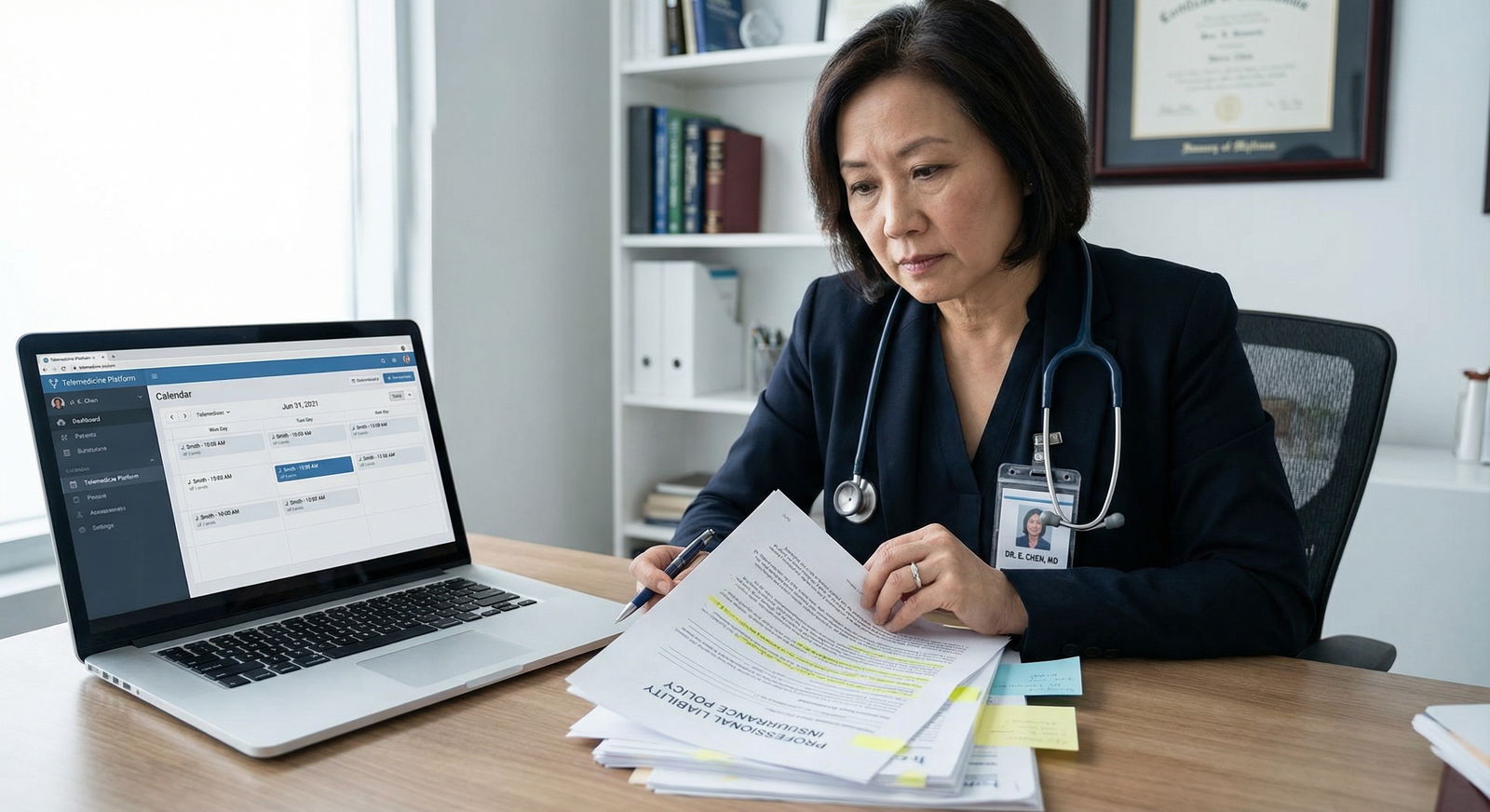

Malpractice Insurance Basics for Telemedicine Providers

What Is Malpractice Insurance?

Malpractice Insurance (professional liability insurance) protects Healthcare Providers against claims that their professional services deviated from the accepted standard of care and caused patient harm. A typical policy:

- Pays for defense costs (attorney fees, expert witnesses, court costs)

- Covers settlements or judgments up to the policy limits

- May include regulatory or board investigation coverage (varies by policy)

- Often has “claims-made” or “occurrence-based” structures, affecting coverage over time

Without adequate malpractice coverage, one serious claim can threaten your finances, your practice, and potentially your license.

Why Malpractice Insurance Still Matters—Even Behind a Screen

Some clinicians assume that virtual encounters are “lower risk” than in-person visits, but that is not always true. Telemedicine carries both overlapping and unique risk factors:

- Misdiagnosis due to limited physical exam (e.g., missed appendicitis, stroke, sepsis)

- Delayed or inadequate follow-up because the patient appears “well enough” on video

- Documentation gaps when quick virtual visits lead to rushed notes

- Technology failures causing incomplete history or miscommunication

- Cross-state care leading to jurisdictional and licensure problems

Studies show that a significant percentage of physicians will face at least one malpractice claim over the course of their career. Telemedicine does not eliminate this reality; it changes the risk profile and often adds Legal Considerations across state lines.

Key Malpractice Considerations Unique to Telemedicine

1. Does Your Policy Explicitly Cover Telehealth Services?

Do not assume your existing Malpractice Insurance automatically covers Telemedicine. Policies vary widely:

- Some explicitly include telehealth services if they are within your specialty and license.

- Some provide limited coverage (e.g., only for patients in the same state, or only video—not phone).

- Others exclude Telemedicine entirely, or require an add-on rider or endorsement.

Action steps:

- Review your declarations and policy forms for terms like telemedicine, telehealth, virtual care, remote care, or electronic consultations.

- Confirm:

- Which types of encounters are covered (video, audio-only, asynchronous messaging, remote monitoring)?

- Are you covered for new patients, or only established patients?

- Are e-prescribing and ordering tests during virtual visits covered?

- Get answers in writing from your broker or insurer if anything is unclear.

If you join a health system or large group, ask explicitly whether their malpractice coverage includes your Telemedicine activities, including any side work (e.g., moonlighting on commercial telehealth platforms).

2. Location, Jurisdiction, and Cross-State Care

With Telemedicine, where care occurs becomes a central Legal Consideration.

From a legal standpoint, the “site of care” is usually considered the patient’s physical location at the time of the encounter, not the provider’s. This affects:

- Licensure: You typically must be fully licensed in the state where the patient is located.

- Scope of practice (for NPs, PAs) depends on that state’s laws.

- Standard of care is assessed based on what a reasonably prudent provider in that state would do.

- Malpractice coverage territory must include the state or country where the patient is located.

Practical examples:

- You are a California internist doing a video visit with a patient who is temporarily in Texas. If you are not licensed in Texas, you may be practicing medicine without a license—and your insurer may deny coverage if a claim arises.

- A psychiatrist licensed in multiple states sees patients via Telemedicine across those states. Their Malpractice Insurance must explicitly cover practice in each of those jurisdictions.

Action steps:

- Confirm with your licensure board(s) whether Telemedicine across state lines is permitted and under what conditions.

- If applicable, explore Interstate Medical Licensure Compact (IMLC) or similar NP and PA compacts to streamline multi-state practice.

- Check that your policy territory includes all jurisdictions where patients may be physically located at time of service.

- Create office protocols (e.g., intake workflows) to verify and document the patient’s location at each Telemedicine encounter.

3. Informed Consent Tailored to Telemedicine

Informed consent is always required in medicine, but many states now have Telemedicine-specific consent requirements. In some jurisdictions, you must:

- Obtain explicit consent to receive care via Telemedicine.

- Disclose limitations of virtual care (e.g., inability to perform a full physical exam).

- Explain privacy and security risks (e.g., potential for data breaches, technical failures).

- Inform patients of alternatives, including in-person care, and of any follow-up plans.

To mitigate malpractice risk:

- Develop a standard Telemedicine consent script and/or digital consent form.

- Include key elements:

- Nature and purpose of Telemedicine

- Technology used and potential limitations

- How emergencies or technical failures will be handled

- Privacy safeguards and who may be present on each end

- Document explicitly:

- “Telemedicine risks and benefits discussed, patient verbalized understanding and provided consent to proceed via telehealth.”

In many EHRs, you can use templated phrases or checkboxes to standardize this process and ensure consistency across providers.

4. Maintaining the Standard of Care in a Virtual Visit

The law does not recognize a separate, lower standard of care for Telemedicine. You are expected to deliver care that is reasonable and appropriate given the mode of delivery and the clinical context.

To stay within the standard of care:

- Know when not to use Telemedicine

Avoid or quickly escalate in-person evaluation when:- You cannot obtain sufficient history or visual assessment

- The patient appears acutely ill, unstable, or in distress

- The complaint requires hands-on exam or diagnostics that cannot be delayed

- Use structured approaches to history and virtual exam:

- Develop checklists for common telehealth scenarios (URI, back pain, abdominal pain, headache, mental health visits).

- Leverage “guided self-exam” techniques (e.g., patient palpation, range of motion, orthostatic maneuvers when safe).

- Document clinical reasoning

Clearly note:- Limitations of the visit (e.g., “no vitals available, limited abdominal visualization”)

- Why Telemedicine was appropriate or why you chose not to defer to in-person

- Your safety net instructions and follow-up plan

If a case feels borderline, a low threshold for in-person evaluation is often the safest course, both clinically and medicolegally.

5. Technology, Privacy, and Confidentiality Risks

Telemedicine adds technical and cyber risks that can lead not only to malpractice claims but also privacy and regulatory investigations.

Key issues include:

- Platform security: Using non-secure platforms can raise HIPAA and privacy concerns.

- Connectivity problems: Dropouts or poor audio/video can impair assessment.

- Data storage and transmission: Screenshots, recordings, and message logs must be protected.

- Environment privacy:

- On the provider side: Others overhearing in shared spaces.

- On the patient side: Lack of privacy at home, others present off-camera.

Risk reduction strategies:

- Use HIPAA-compliant platforms and encryption whenever possible.

- Establish policies for:

- What happens if the call drops (backup phone number, rescheduling, ED instructions if urgent).

- Whether and how sessions may be recorded (usually discouraged unless strictly necessary and well-documented).

- Verify:

- Who is physically present with the patient.

- Whether the patient has adequate privacy, especially for sensitive visits (mental health, sexual health, domestic violence).

All of these practices support safer Patient Care and can be crucial in defending against malpractice or privacy-related claims.

Navigating and Optimizing Your Telemedicine Malpractice Coverage

1. Choosing the Right Malpractice Policy for Telemedicine

When evaluating or updating your Malpractice Insurance, consider:

- Policy type

- Claims-made vs occurrence-based

- Tail coverage requirements if you leave a job or telehealth platform

- Scope of covered services

- Are Telemedicine services explicitly named?

- Are certain activities excluded (e.g., prescribing controlled substances via telehealth)?

- Practice settings

- Employed by a hospital or large group

- Independent practice

- Contracting with a nationwide Telemedicine company

- Coverage for multi-state practice

- Are all relevant states or countries included?

- Are there differences in limits by location?

Some carriers now offer telehealth-specific policies designed for clinicians who practice primarily or exclusively via Telemedicine. These may better align with your risk profile, especially if you:

- See high volumes of virtual patients

- Work with national telehealth platforms

- Practice across multiple states

2. Negotiating Coverage Limits and Policy Terms

Coverage limits must be realistic for your volume, specialty, and risk exposure. Typical limits might be, for example, $1M per claim / $3M aggregate per year in the U.S.—but this varies by state, institution, and specialty.

When negotiating or selecting limits:

- Consider:

- Your specialty (e.g., psychiatry vs urgent care vs OB)

- Volume and acuity of Telemedicine encounters

- Whether you do procedural work or primarily cognitive services

- Ask about:

- Coverage for board complaints related to Telemedicine encounters

- Support for licensure or DEA investigations

- Whether cyber liability insurance is bundled or separate (data breaches, ransomware, etc.)

Discuss these variables with a knowledgeable broker or risk manager, particularly if you are early in your career and new to Telemedicine.

3. Risk Management Strategies That Strengthen Your Defense

Strong risk management not only improves safety but also makes you more defensible if a claim arises. For Telemedicine:

- Standardize workflows

- Check-in scripts

- Identity and location verification

- Consent checklist

- Documentation templates for common conditions

- Maintain accurate, detailed documentation

- Note mode of visit (video vs phone)

- Technology issues and any resulting limitations

- Rationale for Telemedicine vs in-person

- Explicit safety net instructions (“If symptoms worsen, go to ED or call 911”)

- Engage with your insurer’s risk management resources

- Many carriers offer:

- Sample Telemedicine policies and procedures

- Webinars or CME on telehealth risk

- Hotline access to risk advisors

- Many carriers offer:

Documented adherence to established protocols can be extremely helpful if your care is ever scrutinized.

Practical Telemedicine Tips for Students, Residents, and Early-Career Providers

For Trainees (Medical Students and Residents)

- Clarify supervision and liability

Ask:- Who is the attending responsible for your telehealth encounters?

- How should supervising physicians join or review virtual visits?

- Are Telemedicine visits logged and supervised differently than in-person visits?

- Learn “webside manner”

Effective communication is a major risk mitigator. Practice:- Looking into the camera to mimic eye contact

- Summarizing the plan clearly

- Explicitly asking about red flag symptoms

- Understand your institution’s policies

Familiarize yourself with:- Approved platforms

- Documentation requirements

- Consent and privacy procedures

For Early-Career Attending Physicians and APPs

- Align your Telemedicine scope with your comfort and training

Start with lower-risk follow-ups and chronic disease management as you build experience. - Create written practice policies

Even if you’re solo or in a small practice, define:- What is appropriate for Telemedicine vs in-person

- How after-hours virtual care is handled

- How messages and remote monitoring alerts are triaged

- Regularly audit your own charts

Review a sample of Telemedicine encounters:- Is your history thorough?

- Is your documentation clear on limitations?

- Are your follow-up and safety net instructions explicit?

This level of attention early on helps stabilize habits that will serve you for decades.

FAQ: Malpractice Insurance and Telemedicine for Healthcare Providers

1. Does my existing malpractice insurance automatically cover Telemedicine?

Not necessarily. Some policies include Telemedicine, others limit it, and some exclude it unless you add a rider. You should:

- Review your policy for explicit references to telehealth, remote care, or virtual visits.

- Confirm which services and locations are covered.

- Ask your insurer or risk manager in writing if Telemedicine encounters—video, phone, messaging, remote monitoring—are fully covered for your practice settings.

If coverage is unclear or limited, request an endorsement or explore telehealth-specific policies.

2. What Legal Considerations apply when I see patients in other states via Telemedicine?

Most U.S. states consider the patient’s location as the site of practice. This means:

- You typically must be licensed in the state where the patient is, even for virtual visits.

- Your Malpractice Insurance must cover practice in that jurisdiction.

- You are held to that state’s standard of care and Telemedicine regulations (e.g., consent requirements, controlled substance rules).

Interstate compacts can simplify licensure, but they do not replace the need for coverage in each state. Always verify both licensure and coverage before providing cross-state Telemedicine services.

3. Is Telemedicine-specific informed consent mandatory?

In many states, yes—or at least strongly recommended. Requirements vary by jurisdiction, but best practice is to:

- Obtain explicit consent for Telemedicine at the start of the relationship or each visit, depending on state rules.

- Explain risks, benefits, alternatives, and limitations of virtual care.

- Document consent clearly in the medical record (e.g., “Telemedicine consent obtained; patient agrees to proceed with virtual visit”).

Even where not legally mandated, Telemedicine-specific consent is a valuable risk management tool that can help defend against malpractice allegations.

4. What types of cases are too risky for Telemedicine and better suited to in-person care or ED referral?

Telemedicine is not appropriate for every clinical scenario. High-risk situations include:

- Patients who appear acutely ill or unstable (chest pain, shortness of breath, altered mental status, signs of sepsis).

- Conditions that require immediate hands-on exam or diagnostics (e.g., suspected appendicitis, acute neurologic deficits, major trauma).

- Situations where privacy cannot be assured (e.g., suspected abuse when the abuser may be present).

In these cases, you should promptly redirect the patient to in-person evaluation (clinic, urgent care, or ED as appropriate), clearly document your reasoning, and provide explicit safety net instructions.

5. How can I reduce malpractice risk while building a Telemedicine practice?

Key strategies include:

- Ensuring your Malpractice Insurance explicitly covers Telemedicine across all relevant states.

- Following your state’s Telemedicine laws and regulations, including consent, prescribing, and record-keeping requirements.

- Standardizing workflows and documentation (location verification, consent, risk disclosures, follow-up plans).

- Leveraging risk management resources from your insurer and institution.

- Maintaining a low threshold for in-person evaluation when virtual assessment is limited or concerning.

By combining appropriate coverage with thoughtful clinical practice and robust documentation, you can safely integrate Telemedicine into your career and continue to provide high-quality, patient-centered care in the digital age.