Introduction: Why Malpractice Insurance Matters for Every Physician

Malpractice insurance is not just a legal formality or a box to check in your credentialing packet. It is one of the most important financial and professional protections you will carry throughout your medical career. A single malpractice suit—whether or not it has merit—can cost hundreds of thousands of dollars in legal fees, consume months of your time, and threaten your professional reputation.

This physician guide to malpractice insurance is designed to help you understand how insurance policies work, what types of professional liability coverage exist, how premiums are determined, and how to choose coverage that truly fits your practice. Whether you are a medical student planning ahead, a resident reviewing your first contract, or an attending physician considering a change in jobs or practice structure, a clear understanding of malpractice insurance is central to both risk management and healthcare compliance.

By the end of this guide, you should be able to:

- Explain the difference between claims-made and occurrence policies

- Identify key factors that drive malpractice premiums

- Evaluate the strength and suitability of different insurance providers

- Recognize common misconceptions that can put you at risk

- Ask the right questions before signing any malpractice insurance contract

Understanding Malpractice Insurance and Professional Liability

What Is Malpractice Insurance?

Malpractice insurance—also known as professional liability insurance—is a specific type of coverage that protects healthcare professionals from financial loss related to claims of negligence, errors, or omissions in the provision of medical care. It typically covers:

- Legal defense costs (attorney fees, court costs, expert witness fees)

- Settlements or judgments awarded to plaintiffs

- Certain related costs, such as investigation and claims handling

Malpractice insurance is one piece of the broader risk management and healthcare compliance puzzle, but it is the one that directly shields your personal and practice assets when a claim is made against you.

Who Needs Malpractice Insurance?

Most physicians and advanced practice providers require malpractice insurance, including:

- Employed physicians (hospital, academic, or corporate settings)

- Private practice physicians (solo or group)

- Locum tenens physicians

- Telemedicine providers

- Moonlighting residents and fellows

Even if your employer provides coverage, understanding that policy—and knowing when you may need supplemental individual coverage—is crucial.

Why Malpractice Insurance Is Essential

Financial Protection

Defending a malpractice claim can be extremely expensive, even if you ultimately prevail. Malpractice insurance helps cover:- Attorney’s fees

- Depositions and expert witnesses

- Court costs

- Settlements and jury awards (up to policy limits)

Without adequate coverage, your personal assets, savings, and future earnings may be at risk.

Safeguarding Professional Reputation

A good insurer does more than pay claims; they provide experienced defense counsel and public relations support when needed. This can help:- Structure appropriate settlements

- Manage media inquiries and reputational damage

- Protect your standing with hospitals, payers, and licensing boards

Licensing, Credentialing, and Contract Requirements

- Many states require malpractice insurance as a condition of medical licensure or hospital privileges.

- Hospitals, group practices, and telemedicine platforms often specify minimum coverage limits and policy types in employment or contractor agreements.

Peace of Mind and Clinical Confidence

Practicing medicine will always involve risk. Knowing you have solid professional liability coverage allows you to:- Focus on patient care

- Make difficult clinical decisions without fear of losing everything personally

- Navigate adverse outcomes with structured legal and risk management support

Types of Malpractice Insurance Policies: Claims-Made vs. Occurrence

Not all malpractice insurance policies are created equal. Understanding the two primary types—claims-made and occurrence—is fundamental before you sign any contract.

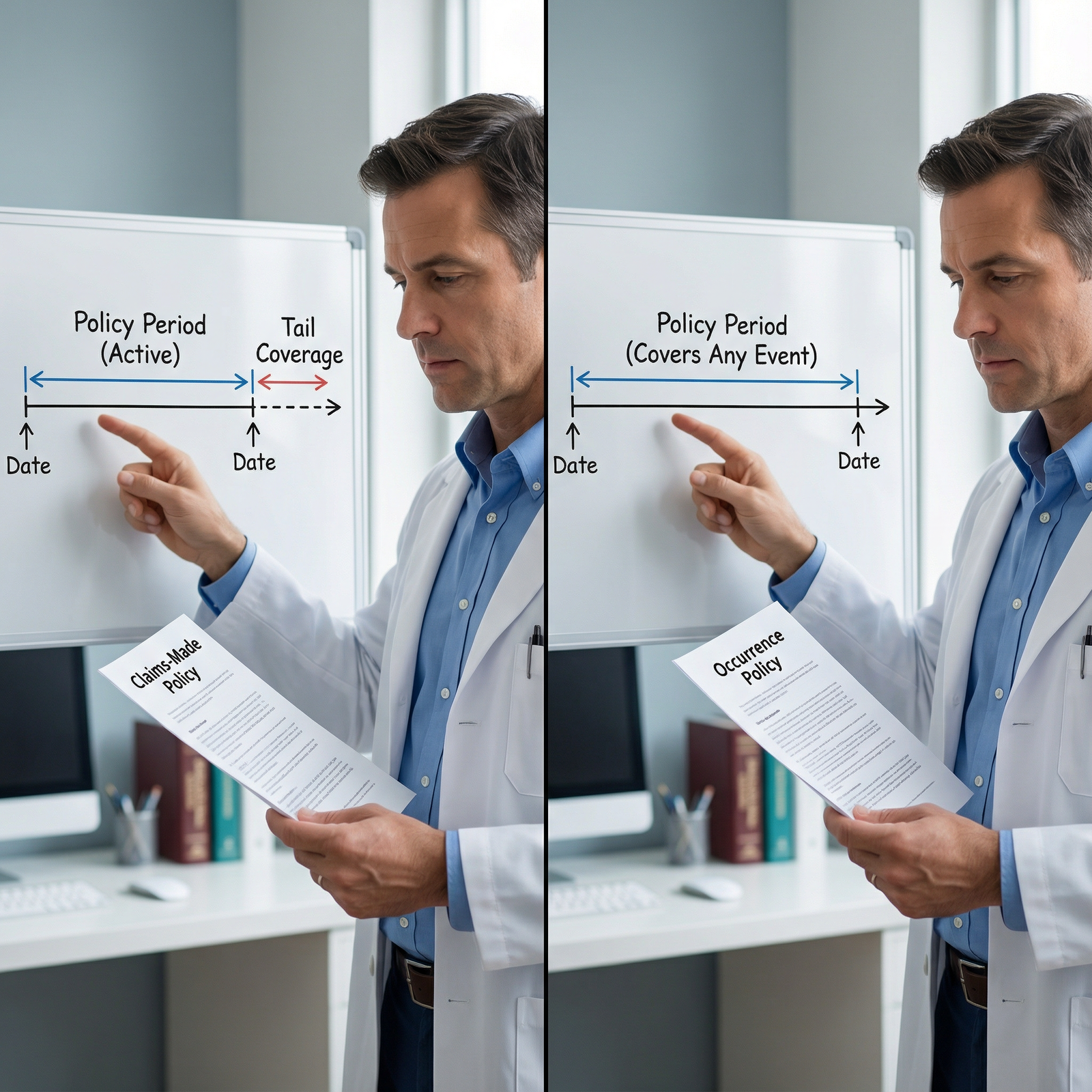

Claims-Made Policies

A claims-made policy covers you only if:

- The claim is made (filed) during the time the policy is active, and

- The incident occurred on or after the policy’s retroactive date

The retroactive date is the date from which coverage begins for past events. It is typically the day you first started coverage with that insurer under a claims-made policy.

How Claims-Made Coverage Works

- Year 1: Coverage is relatively inexpensive; premium is low because exposure is limited to one year of past care.

- Each renewal year: Premiums typically increase as more years of past exposure accumulate.

- If you leave the job, switch insurers, change practice settings, or retire: You generally need tail coverage to protect against future claims for care provided in the past.

Tail Coverage (Extended Reporting Endorsement)

Tail coverage extends the time during which a claim can be reported to your insurer after your active policy ends. It does not cover new incidents—only claims arising from care you provided while your claims-made policy was in force.

Key points about tail coverage:

- It can cost 150–250% (sometimes more) of your final annual premium.

- It is usually a one-time, non-refundable purchase.

- Some employment contracts specify who pays for tail—employer, physician, or shared. This is a critical contract point to negotiate.

Pros of Claims-Made Policies

- Often cheaper for early-career physicians

- More common in group practices and hospital-employed positions

- Easier to maintain continuous coverage when switching jobs if your new insurer provides “prior acts” coverage to absorb your retroactive date

Cons of Claims-Made Policies

- You must plan for tail coverage costs when leaving a job, changing insurers, or retiring.

- Gaps in coverage (e.g., no tail or break in coverage) can leave you personally exposed for prior care.

Occurrence Policies

An occurrence policy covers any incident that occurs during the policy period—regardless of when the claim is filed, even if it’s years later.

How Occurrence Coverage Works

- You pay a premium each year that reflects the insurer’s estimate of long-term risk for that year’s care.

- If a patient sues you years after an event that occurred during your policy period, that year’s occurrence policy responds—even though the policy is no longer active.

- No tail coverage is needed because each policy year stands on its own.

Pros of Occurrence Policies

- Long-term peace of mind for care provided during the covered period

- No tail coverage needed when you change insurers or retire (for that period of practice)

- Simpler when moving between jobs or going part-time

Cons of Occurrence Policies

- Typically more expensive in the short term compared to claims-made

- Less commonly offered for certain specialties or practice arrangements, especially in high-risk states

- Not always available through employer plans; many hospital systems standardize on claims-made

Which Policy Type Is Right for You?

Consider:

- Your career stage: Early-career physicians may accept claims-made with employer-paid tail; late-career physicians may prefer occurrence to simplify retirement.

- Job stability: If you anticipate frequent changes in employers, the cost and logistics of tail coverage become important.

- Market availability: In some regions or specialties, one type may be far more common or affordable than the other.

Whenever you receive an employment contract, ask explicitly:

- Is the malpractice policy claims-made or occurrence?

- What are the coverage limits?

- Who is responsible for tail coverage if the relationship ends, and under what circumstances (resignation, termination, non-renewal, retirement)?

What Drives Malpractice Insurance Premium Costs?

Malpractice insurance premiums are calculated based on risk. Insurers analyze multiple factors to estimate how likely you are to generate a claim and how expensive that claim might be.

1. Specialty and Scope of Practice

Specialty is one of the strongest predictors of malpractice premiums.

- Higher-risk specialties:

- OB/GYN

- Neurosurgery

- Orthopedic surgery

- Cardiothoracic surgery

- Anesthesiology

- Moderate-risk specialties:

- Emergency medicine

- Hospital medicine

- Cardiology (procedural)

- Lower-risk specialties:

- Internal medicine (primary care)

- Psychiatry

- Pathology

- Radiology (varies by procedures)

Procedural volume, invasive interventions, and potential for catastrophic outcomes all push premiums higher.

2. Geographic Location and Legal Environment

Where you practice significantly affects professional liability costs:

- States with a high frequency of malpractice claims or large jury awards have higher premiums.

- Tort reform (caps on non-economic damages, pre-suit screening panels, etc.) can moderate premiums.

- Urban areas with dense populations and more litigation may cost more than rural regions.

When considering relocation or job offers in different states, compare:

- Average malpractice premiums by specialty

- State-specific tort laws and protections

- Availability and cost of different policy types

3. Individual Claims History and Risk Profile

Your personal experience and practice patterns matter:

- Prior malpractice claims or board complaints—especially those resulting in payouts—can increase premiums or make some insurers hesitant to offer coverage.

- Frequent changes in employers or coverage gaps may raise red flags.

- A strong track record in documentation, communication, and adherence to clinical guidelines can help maintain a favorable risk profile.

Some insurers offer risk management support and audits that, if completed, may help mitigate premium increases after a claim.

4. Coverage Limits and Policy Structure

Typical malpractice coverage limits might look like:

- $1 million per claim / $3 million aggregate per year (1M/3M), or

- $2 million per claim / $4 million aggregate for higher-risk environments

Higher limits mean higher premiums. However, carrying limits that are too low may:

- Leave you personally exposed for amounts above your policy limit

- Be unacceptable to some hospitals, payers, or group practices

Other structural considerations:

- Whether defense costs are inside the limits (eroding your coverage as legal fees accumulate) or outside the limits

- Whether the policy includes coverage for administrative actions (e.g., licensing board investigations)

5. Discounts, Incentives, and Risk Management Programs

Many insurers offer discounts for:

- Membership in professional organizations or specialty societies

- Completion of risk management or patient safety training courses

- Part-time practice or reduced clinical hours

- Clean claims history over a defined period

- Use of EHRs with robust documentation and e-prescribing tools

Ask potential insurers:

- Which discounts are available and what documentation is required?

- Are there premium credits for completing CME in risk management or healthcare compliance?

- Are there step-down premiums for late-career physicians or those transitioning toward retirement?

Choosing the Right Malpractice Insurance Provider and Policy

Selecting the right malpractice insurance is not just about the cheapest premium. The quality of your coverage and the strength of your insurer become critical when you face a claim.

1. Evaluating Insurer Reputation and Financial Strength

Before you sign:

- Check independent financial ratings from A.M. Best, Standard & Poor’s, or Moody’s. Look for strong ratings (e.g., A- or better).

- Ask colleagues, risk managers, or your medical staff office about their experience with specific insurers.

- Explore how long the company has been insuring your specialty and in your state.

You are trusting this company to defend your medical judgment; their legal expertise and willingness to support you matter.

2. Understanding Coverage Scope and Policy Features

Compare policies beyond just the premium:

- Are defense costs inside or outside the policy limits?

- Are settlements subject to your consent (“consent-to-settle” clause) or can the insurer settle without your agreement?

- Does the policy cover:

- Good Samaritan care?

- Telemedicine encounters across state lines (critical for healthcare compliance)?

- Locum tenens or moonlighting work?

- Board investigations and disciplinary proceedings?

3. Service Quality and Claims Handling

When you face a claim, the insurer’s service quality becomes central:

- How are claims reported (online, phone, through a local representative)?

- How quickly are defense attorneys assigned?

- Does the insurer provide risk management support, such as:

- Charting and documentation feedback

- CME modules on communication and disclosure

- Hotline for incident reporting and early guidance

Request to see sample claims-handling timelines or ask for references from physicians who have gone through the process.

4. Policy Flexibility Over Your Career

Your practice will likely evolve over time. Look for policies that:

- Allow you to adjust coverage limits as your risk profile changes

- Offer part-time or “occurrence-based” options for physicians winding down their practice

- Permit easy addition of new practice sites, telemedicine services, or ancillary staff

Carefully review:

- Any exclusions or limitations for specific procedures (e.g., cosmetic procedures, advanced interventions)

- Requirements for notification when expanding your scope of practice

5. Tail Coverage and Career Transitions

For claims-made policies, thoroughly understand:

- Who pays for tail under various termination scenarios (resignation, termination with cause, without cause, retirement, disability).

- Any criteria for employer-paid tail (e.g., years of service before eligibility).

- Whether your new employer’s insurer will provide prior-acts coverage, potentially reducing or eliminating your need to buy tail from the old insurer.

Contract negotiation tip for residents and early attendings:

Always ask that the employer cover tail in cases of termination without cause or practice closure. This can save you tens of thousands of dollars and considerable stress.

Common Myths and Risky Assumptions About Malpractice Insurance

Myth 1: “I’ve Never Had a Claim, So I Don’t Need Insurance”

Past performance is not a guarantee of future outcomes. Even excellent clinicians face unexpected complications, communication breakdowns, or misaligned patient expectations.

- Many malpractice claims are not about blatant errors but about perceived miscommunication or poor outcomes.

- A single serious claim can be financially and emotionally devastating.

Malpractice insurance is not a reward for having had claims; it is a foundational risk management tool you should carry from day one of independent practice.

Myth 2: “My Employer’s Insurance Fully Covers Me in Every Situation”

Employer-provided coverage is valuable, but it may not be sufficient:

- The policy limits are often shared among all employed clinicians; multiple large claims in the same year could erode coverage.

- Coverage may not follow you if:

- You provide care outside the employer’s scope (moonlighting, volunteer work, telemedicine side work)

- You leave the employer and do not have tail coverage for your prior acts

Always request and review:

- A certificate of insurance listing your name, policy type, and limits

- The employer’s policy language regarding tail and coverage for former employees

Consider individual supplemental coverage if your practice pattern extends beyond what your employer’s policy contemplates.

Myth 3: “All Malpractice Insurance Policies Are Basically the Same”

Policies vary widely in:

- Covered services and settings

- Exclusions (e.g., certain procedures, cosmetic services, experimental treatments)

- Consent-to-settle language

- Defense cost handling (inside vs. outside limits)

- Support for licensing board or governmental investigations

Reading the actual policy—or having an experienced broker or healthcare attorney review it—is essential. Do not assume that a lower premium equals comparable protection.

Myth 4: “I Can Just Buy Tail Later If I Need It”

Tail coverage is:

- Time-limited to purchase (often within 30–90 days after policy termination)

- Significantly more expensive than a single year of premium

- Sometimes non-portable—if you miss the window or cannot afford tail, you may be permanently exposed

You should plan for tail before signing a contract. Clarify responsibility for tail and get it in writing.

Practical Steps for Physicians: How to Approach Malpractice Insurance Decisions

For Medical Students and Residents

- Learn the basics of claims-made vs. occurrence and tail coverage now.

- Ask your training program:

- What type of coverage they provide

- Whether moonlighting is covered or if you need separate policies

- When reviewing your first attending contract, prioritize discussions around malpractice coverage just as you would salary or call schedule.

For Early-Career Attendings

- Obtain multiple quotes through reputable brokers who specialize in healthcare.

- Compare not only premiums but also:

- Policy type

- Coverage limits

- Defense cost handling

- Tail responsibilities

- Consider your long-term career goals. If you plan to move or change specialties, think strategically about policy type and tail.

For Mid- and Late-Career Physicians

- Reassess your coverage as your practice changes (adding procedures, going part-time, moving into administrative roles).

- If you are approaching retirement:

- Clarify eligibility for free or discounted “retirement tail” (many insurers offer this after a certain number of continuous years insured and retirement from active practice).

- Review any part-time or consulting work you plan to continue and how it will be covered.

Frequently Asked Questions (FAQ) About Malpractice Insurance for Physicians

1. Do all physicians legally need malpractice insurance?

Not every state explicitly mandates malpractice insurance by law, but in practice, most physicians must carry it due to:

- Hospital medical staff requirements

- Employment or contractor agreements

- Payer credentialing standards and healthcare compliance expectations

Even if not legally required, going without malpractice insurance (going “bare”) is extremely risky and generally discouraged by risk management experts.

2. What exactly is tail coverage and when should I buy it?

Tail coverage (extended reporting endorsement) extends a claims-made policy’s reporting period after it ends. It covers future claims arising from past care delivered while the policy was active.

You generally need tail when:

- You leave a job and your employer will not maintain the old policy

- You switch insurers and your new policy does not provide prior-acts coverage

- You fully retire and will no longer maintain continuous claims-made coverage

You must usually buy tail within a short window (often 30–90 days) after policy termination, so plan ahead before changing jobs or retiring.

3. How can I realistically reduce my malpractice premiums without compromising protection?

You can often lower costs while maintaining robust coverage by:

- Choosing appropriate—but not excessive—coverage limits that still meet hospital and payer requirements

- Completing insurer-approved risk management and patient safety courses

- Asking about discounts for:

- Clean claims history

- Part-time practice

- Membership in certain medical societies

- Working with a specialized insurance broker to compare several insurers in your specialty and region

Never reduce coverage below credentialing requirements or to levels that would expose your personal assets.

4. What should I do immediately if I think a malpractice claim might be coming?

If you suspect a potential claim (adverse event, patient complaint, attorney letter, record request):

- Notify your insurer or risk management department immediately. Most policies require timely notice; failing to report can jeopardize coverage.

- Do not alter the medical record in any way. Addenda should be clearly labeled, dated, and factual if absolutely necessary for ongoing care.

- Avoid discussing the case casually or on social media.

- Follow your hospital or practice’s adverse event policies, including incident reports and disclosure to the patient/family where appropriate.

- Cooperate with your insurer and assigned defense counsel, and keep copies of all related communications.

5. How often should I review and update my malpractice insurance coverage?

You should formally review your malpractice insurance at least every 1–2 years, and whenever there is a significant change in your practice, such as:

- New procedures or expanded scope of practice

- Change in practice location or state

- Transition to part-time or telemedicine-heavy practice

- Taking on leadership, administrative, or academic roles that change your risk profile

- Approaching retirement or semi-retirement

Periodic review ensures that your coverage remains aligned with your current risks, contractual obligations, and healthcare compliance requirements.

Strengthening your understanding of malpractice insurance early—and revisiting it regularly—can protect your finances, your license, and your peace of mind throughout your career. Treat your malpractice policy as a core professional tool, not an afterthought, and you will be far better prepared when the inevitable challenges of medical practice arise.