Understanding Annuities: A Cornerstone of Secure Retirement Income

As retirement approaches, one of the most pressing questions is: “Will my money last as long as I do?” Market volatility, rising healthcare costs, and increased life expectancy make that question more complex than ever. Annuities are one of the few retirement planning tools designed specifically to turn your savings into a predictable paycheck you cannot outlive.

This enhanced guide will walk you through what annuities are, how they work, the different types available, key pros and cons, and how they compare to other retirement income strategies. You’ll also find practical tips and questions to ask before you buy, so you can decide whether annuities fit into your overall retirement planning and financial security strategy.

What Are Annuities and Why Do They Matter in Retirement Planning?

An annuity is a contract between you and an insurance company. You contribute money—either as a lump sum or through a series of payments—and in return, the insurer promises to provide income in the future, often for life. At its core, an annuity is a way to convert a portion of your retirement savings into a reliable, structured income stream.

Key Purposes of Annuities in Retirement Planning

- Lifetime income: Annuities can provide income that lasts as long as you live, helping protect against the risk of outliving your assets.

- Tax-deferred growth: Money inside many annuities grows tax-deferred, which can be attractive if you’ve already maxed out other tax-advantaged accounts.

- Income strategies diversification: Annuities can complement Social Security, pensions, and investment accounts to create a more stable and diversified retirement income plan.

- Behavioral support: Automatic, scheduled payments can make spending in retirement more predictable and reduce anxiety about market downturns.

Annuities are not a one-size-fits-all solution, but when used thoughtfully, they can be a powerful component of your retirement planning and overall financial security strategy.

How Annuities Work: From Contribution to Lifetime Income

To understand annuities, it helps to follow a typical example from start to finish.

A Simple Example: Anne’s Annuity Journey

Anne, age 60, is planning to retire at 67. She wants to ensure that a portion of her nest egg will generate guaranteed income later. Here’s how her annuity might work:

Initial Investment (Funding the Annuity)

Anne purchases an annuity through an insurance company using:- A lump sum from her 401(k) rollover, or

- Periodic contributions over several years from her savings.

The source of funds could be:

- Pre-tax (e.g., traditional IRA or 401(k) rollover)—taxable when withdrawn

- After-tax savings—earnings taxable on withdrawal; principal generally not taxed

Accumulation Phase (Growth Period)

During this phase:- Anne’s money grows tax-deferred inside the annuity.

- She doesn’t pay taxes on interest, dividends, or capital gains as they accrue.

- Depending on the annuity type (fixed, variable, indexed), her growth may be stable, market-based, or linked to an index.

Annuitization or Income Phase (Payout Period)

When Anne is ready to start receiving income—say at age 67—she has choices:- Immediate annuity: If she had purchased an immediate annuity at 67, payments would start almost right away.

- Deferred annuity: If she bought a deferred annuity at 60, payments may begin at 67 or another future date she selected.

Payment Structure (How Income Is Delivered)

Anne chooses how she wants income to be paid out:- Payout frequency: Monthly, quarterly, semiannually, or annually

- Payout duration options:

- Lifetime only (largest payment, no beneficiary continuation)

- Life with period certain (e.g., 10 or 20 years minimum)

- Joint and survivor (continues for spouse’s lifetime)

- Fixed period only (e.g., payments for 20 years regardless of lifespan)

Each option affects the amount of income she receives. Longer guarantees or survivor benefits usually mean smaller monthly payments.

Key Features of Annuities That Affect Your Income Strategy

Tax Deferral:

Earnings grow tax-deferred until you take withdrawals. This can result in higher growth over time compared to a taxable account, especially if you hold the annuity for many years.Guarantees:

- Minimum interest rates (for fixed annuities)

- Guaranteed lifetime income options

- Guaranteed death benefit or income riders (for certain products)

These guarantees are backed by the financial strength of the issuing insurer, not by the government or the stock market.

Customization Through Riders:

Optional riders—often at an additional cost—can add:- Inflation-adjusted payments

- Enhanced death benefits for heirs

- Long-term care or chronic illness benefits

- Guaranteed lifetime withdrawal benefits (GLWB) allowing withdrawals without formally annuitizing

Understanding these features helps you evaluate annuities as part of your broader investment options and income strategies.

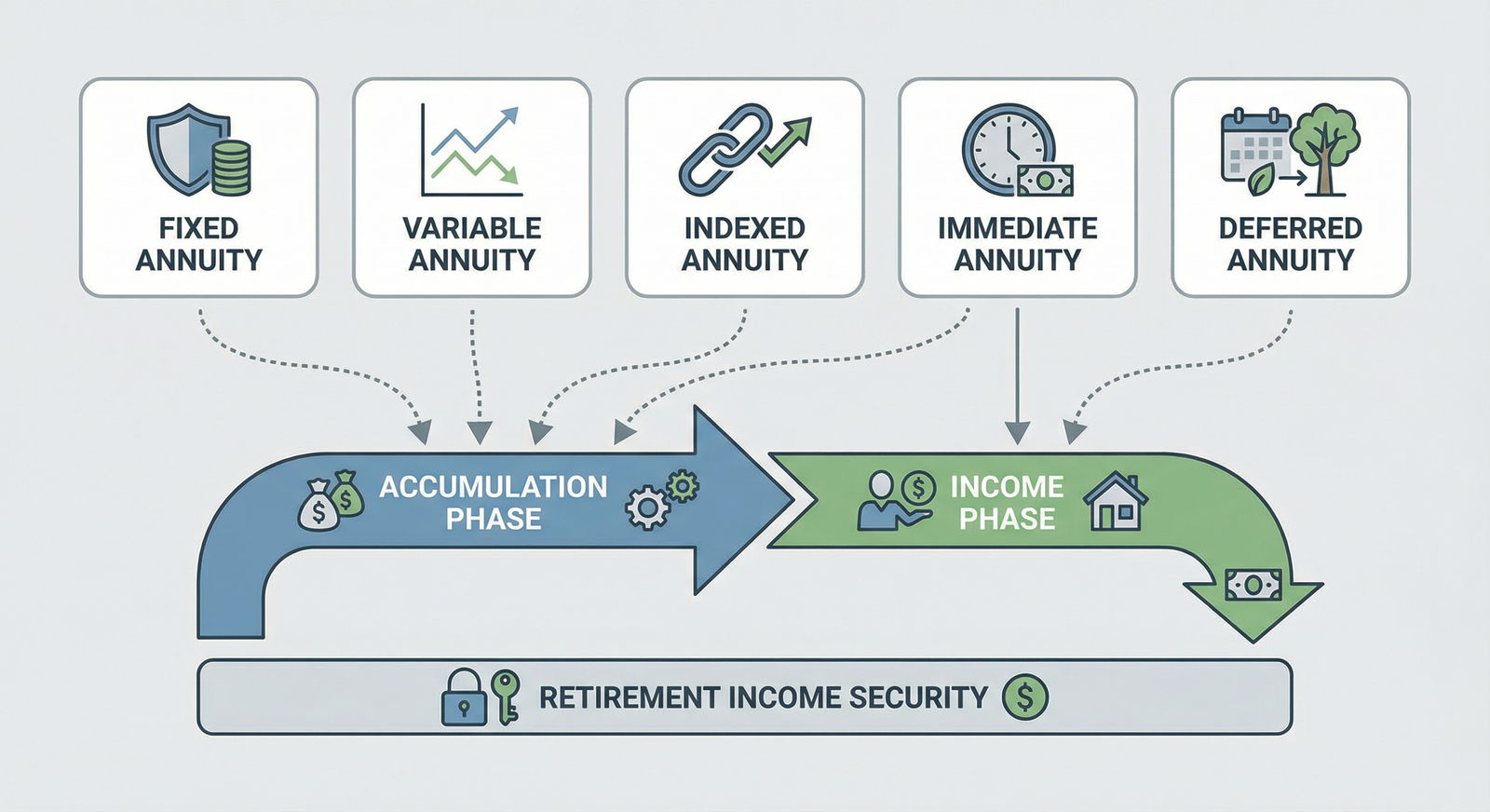

Major Types of Annuities and How They Differ

Not all annuities are created equal. Different types serve different purposes and involve varying levels of risk, growth potential, and complexity.

1. Fixed Annuities: Stability and Predictability

Fixed annuities provide a guaranteed interest rate for a set period (for example, 3, 5, or 10 years) and/or a guaranteed payout amount.

Best for:

Conservative investors who value stable, predictable income and want to minimize market risk.

Pros:

- Guaranteed interest rate and predictable income

- Principal protection when held to term

- Simple to understand compared to other annuity types

Cons:

- Returns may be lower than stocks or bonds over the long term

- May not keep pace with inflation, especially in low-interest-rate environments

Practical example:

If you put $100,000 into a 5-year fixed annuity at a 4% guaranteed rate, you know exactly how much interest you’ll earn each year, regardless of what the stock market does.

2. Variable Annuities: Market-Linked Growth Potential

Variable annuities allow you to allocate your premium among a set of investment options, often similar to mutual funds (called “subaccounts”). Your account value can grow or decline based on market performance.

Best for:

Investors with a moderate to higher risk tolerance who want tax-deferred growth and optional income guarantees and are comfortable with market volatility.

Pros:

- Potential for higher returns compared to fixed annuities

- Wide range of investment options (equities, bonds, balanced funds)

- Optional riders can provide guaranteed income even if markets underperform

Cons:

- Higher fees (mortality & expense charges, fund expenses, rider costs)

- Account value fluctuates with the market

- More complex and harder to fully understand

Practical consideration:

Variable annuities can be powerful for long-term growth, but you must be comfortable with detailed prospectuses and fee structures.

3. Indexed Annuities: A Middle Ground Between Fixed and Variable

Indexed annuities (also called fixed indexed annuities) offer returns tied to the performance of a market index, such as the S&P 500. They typically provide some downside protection with capped or limited upside.

Best for:

Investors who seek better potential returns than traditional fixed annuities but don’t want full exposure to market downturns.

Pros:

- Protection from losses in down markets (often a 0% floor)

- Opportunity for higher returns than fixed annuities in good markets

- Tax-deferred growth

Cons:

- Caps, participation rates, and spreads limit upside potential

- Complex formulas and crediting methods

- May involve surrender periods and fees

Example:

If the S&P 500 gains 10% in a year and your annuity has a 50% participation rate, your credited return might be 5%, subject to any caps or spreads.

4. Immediate Annuities: Quick Conversion to Income

Immediate annuities start paying you income within about 30 days to one year after you deposit a lump sum.

Best for:

Individuals at or near retirement who want to convert assets into an immediate, guaranteed income stream.

Pros:

- Income starts right away

- Simple structure: pay once, receive guaranteed payments

- Payments can be higher than other options because you are giving up liquidity

Cons:

- Limited or no access to principal once annuitized

- Less flexibility to change payout terms after starting

Use case:

A 70-year-old retiree might use part of an IRA rollover to buy an immediate annuity that covers essential living expenses for life.

5. Deferred Annuities: Build Now, Income Later

Deferred annuities allow you to accumulate funds over time, with income starting years or even decades in the future.

Best for:

People in their 40s, 50s, or early 60s who want to build future income, especially if they have already maxed out other tax-advantaged accounts.

Pros:

- Long accumulation period with tax-deferred growth

- Flexibility to choose when to start income

- Often allows additional contributions over time

Cons:

- Withdrawals before age 59½ may incur IRS penalties (in addition to taxes)

- Surrender charges may apply if you pull money out early

Deferred annuities are often used to create a “retirement paycheck” starting at a particular age, like 65, 70, or even 80 (for longevity annuities).

Pros and Cons of Annuities for Retirement Income

Annuities can be valuable tools, but they are not perfect. Understanding both sides helps you evaluate whether they fit your overall retirement strategy.

Advantages of Annuities

Predictable, Guaranteed Income

- You can lock in income that doesn’t depend on market swings.

- Especially useful for covering essential expenses (housing, food, utilities, healthcare).

Longevity Protection

- Lifetime payout options help protect against the risk of outliving your assets.

- This is particularly important as life expectancies continue to rise.

Tax-Deferred Growth

- Earnings grow without current taxation.

- Especially beneficial if you expect to be in a lower tax bracket in retirement.

Customizable to Your Needs

- Riders can address inflation, healthcare risks, or legacy goals.

- Choice of payout structures allows tailoring to your personal situation and goals.

Reduced Investment Management Burden

- Once annuitized, you don’t have to manage investments or worry about withdrawal strategies—the insurer does the heavy lifting.

Disadvantages and Risks of Annuities

Complexity

- Contract language, riders, and fee structures can be difficult to interpret.

- Indexed and variable annuities often require careful, detailed review.

Fees and Charges

- Possible charges include:

- Mortality & expense (M&E) fees

- Administrative fees

- Fund expenses (for variable annuities)

- Rider fees for additional features

- Surrender charges for early withdrawals

- These can significantly reduce net returns.

- Possible charges include:

Limited Liquidity

- Annuities are designed for long-term use, not for emergency cash.

- Accessing more than the free-withdrawal amount may trigger surrender penalties.

Inflation Risk

- Fixed payments may lose purchasing power over time unless you choose an inflation-adjusted option (often at a lower starting payout).

Issuer Risk

- Guarantees depend on the financial strength and claims-paying ability of the insurance company.

- While state guaranty associations may offer some protection, it is not the same as FDIC insurance.

Annuities vs. Other Retirement Income Sources

When building a comprehensive retirement income strategy, it’s helpful to see where annuities fit among other tools.

Social Security

Pros:

- Inflation-adjusted income for life

- Backed by the U.S. government

- Provides a base level of financial security

Limitations:

- May not cover all living expenses

- Claiming age significantly affects benefit size

How annuities fit:

Annuities can supplement Social Security, especially if you don’t have a pension or if you want more predictable income than your investment portfolio can guarantee.

Employer Pensions (Defined Benefit Plans)

Pros:

- Predictable lifetime income, often with survivor options

- Typically not market-dependent from your perspective

Limitations:

- Less common in the private sector today

- Benefit formulas may not fully adjust for inflation

How annuities fit:

For those without a pension—or with a smaller pension—annuities can act as a “personal pension,” converting a portion of your savings into guaranteed income.

Investment Accounts (401(k), IRA, Taxable Accounts)

Pros:

- Flexibility in withdrawals and investment strategies

- Potential for higher long-term returns

- Full liquidity (especially in taxable accounts)

Limitations:

- Market volatility and sequence-of-returns risk

- Risk of outliving your assets if withdrawals are too high

- Requires ongoing management or advice

How annuities fit:

Annuities can complement an investment portfolio by:

- Covering essential expenses with guaranteed income

- Allowing the remaining portfolio to pursue growth with less withdrawal pressure

- Reducing the behavioral stress of managing withdrawals during downturns

Critical Factors to Consider Before Buying an Annuity

Before committing to an annuity, examine how it fits into your broader retirement and financial planning strategy.

1. Your Retirement Time Horizon and Longevity

- Do you have longevity in your family?

- Are you in good health and likely to live into your 80s or 90s?

If yes, lifetime income annuities may offer significant value by hedging longevity risk.

2. Role in Your Overall Income Strategy

Clarify what the annuity is for:

- Covering basic, essential expenses?

- Providing “floor” income so you can invest the rest more aggressively?

- Funding late-life expenses (e.g., a deferred income annuity starting at age 80)?

A common strategy is to use annuities and Social Security to cover core needs, and use investment accounts for discretionary spending and legacy goals.

3. Liquidity Needs

Ask yourself:

- How much do you need in easily accessible savings for emergencies?

- Are you comfortable tying up a portion of your assets in a long-term annuity contract?

You typically don’t want to put all your savings into an annuity. A balanced approach that preserves some liquid investments is usually more prudent.

4. Fee and Surrender Charge Structure

Before you buy, make sure you:

- Request a complete fee breakdown in writing

- Understand:

- Surrender charge schedule (how long and how much)

- Annual fees (M&E, administrative, riders)

- Investment expenses (for variable products)

- Compare similar products from multiple insurers or advisors

High fees can erode the value of even a well-designed annuity.

5. Financial Strength of the Insurance Company

Since your guarantees depend on the insurer, review:

- Financial strength ratings from A.M. Best, Fitch, Moody’s, or Standard & Poor’s

- Company history and reputation

- State guaranty association protections (which vary by state and are not a substitute for strong insurer ratings)

Practical Steps Before You Commit

- Clarify your goals: Income stability, growth, legacy, tax deferral, or a combination.

- Get multiple quotes: For immediate or income annuities, compare payouts from several companies.

- Consult a fiduciary advisor: Preferably someone obligated to put your interests first and who can explain how the annuity fits your overall plan.

- Read the contract: Not just the brochure. Pay attention to fees, surrender schedules, and rider terms.

Frequently Asked Questions (FAQ) About Annuities and Retirement Income

1. Are annuities safe investments?

Annuities from financially strong insurance companies are generally considered relatively safe, especially fixed and immediate annuities. The primary risks are:

- Insurer default risk (mitigated by choosing highly rated companies)

- Inflation risk if payments are not inflation-adjusted

They are not guaranteed by the FDIC or the federal government (except certain government-related products), but state guaranty associations may provide limited protection.

2. Can I access my money in an annuity if I need it?

It depends on the contract:

- Many annuities allow you to withdraw a limited percentage each year (e.g., 10%) without surrender charges.

- Larger withdrawals during the surrender period may trigger penalties.

- Once you fully annuitize (convert to a stream of payments), you typically give up your rights to the lump sum.

If liquidity and flexibility are high priorities, you may want a smaller annuity allocation and more in accessible investment accounts.

3. What happens to my annuity when I die?

This depends on:

- The payout option you chose (life only, joint and survivor, period certain, etc.)

- Any death benefit or beneficiary provisions in your contract

Common scenarios:

- Life-only annuity: Payments stop at your death; no remaining balance for heirs.

- Life with period certain or refund options: Payments continue to a beneficiary for the remaining guaranteed period or until the original premium is returned.

- Deferred annuity with account value: Your beneficiaries typically receive the remaining account value, sometimes with a minimum guaranteed death benefit.

Review beneficiary designations regularly and clarify your legacy goals before choosing payout options.

4. How are annuities taxed?

Tax treatment varies by how and with what money you bought the annuity:

Qualified annuities (inside an IRA/401(k)):

- Contributions were typically pre-tax; withdrawals are fully taxable as ordinary income.

- Required minimum distributions (RMDs) may apply after a certain age (under current tax law).

Non-qualified annuities (purchased with after-tax money):

- Earnings are tax-deferred.

- Withdrawals are taxed on an income-first basis until earnings are exhausted; principal is generally returned tax-free.

- Income from annuitization is taxed proportionally (part earnings, part principal) based on IRS rules.

Speak with a tax professional to understand how annuity income may affect your tax bracket and other benefits (like Medicare premiums).

5. Is an annuity right for me, and how much should I allocate?

Annuities can be beneficial if:

- You value guaranteed income and peace of mind.

- You are concerned about outliving your savings.

- You are comfortable with less liquidity for a portion of your assets.

How much to allocate is highly individual, but common approaches include:

- Using annuities (plus Social Security and pensions) to cover essential expenses.

- Keeping a meaningful portion of your portfolio in liquid and growth-oriented investment options.

A fiduciary financial planner can help run projections and stress tests to determine whether, and how much, annuity income makes sense in your specific retirement plan.

By understanding how annuities work, the different types available, and how they compare to other investment options and income strategies, you can decide whether they deserve a place in your retirement planning toolkit. Used thoughtfully, annuities can enhance your financial security and help you enjoy a more confident, predictable retirement.