Navigating Social Security to Maximize Benefits Before Retirement

As retirement approaches, Social Security becomes one of the most important pillars of your long-term Financial Security. For many retirees, it provides a foundation of guaranteed income that can last for life. Yet, the rules around when and how to claim are complex, and small decisions can result in tens—or even hundreds—of thousands of dollars of difference over your lifetime.

This guide expands on the core strategies to help you make informed decisions, align Social Security with your broader Retirement Planning, and use smart Earnings Strategies to maximize benefits. Whether you’re within a few years of retirement or still a decade away, understanding these principles now can significantly improve your financial outlook later.

1. Social Security Basics: What the Program Really Provides

Before you can optimize your benefits, it’s essential to understand what Social Security is—and what it is not.

1.1 The Core Types of Social Security Benefits

Social Security is more than just a retirement paycheck. The system provides three major categories of benefits that contribute to Financial Security:

Retirement Benefits

Based on your lifetime earnings history, retirement benefits are the monthly payments you receive when you claim Social Security. They are designed to replace a portion of your pre-retirement income—typically a higher percentage for lower lifetime earners and a smaller percentage for higher earners.Disability Benefits

If you become disabled and meet specific medical and work-history rules, Social Security Disability Insurance (SSDI) can provide income before you reach retirement age. When you hit your Full Retirement Age (FRA), disability benefits convert to retirement benefits, often at the same rate.Survivor Benefits

If you die, your eligible spouse, children, or other dependents may receive benefits based on your earnings record. This makes your Social Security claiming strategy not just an individual decision, but a family-level protection strategy.

1.2 What Social Security Is Not

To build a realistic Retirement Planning strategy, recognize these limits:

- It is not meant to be your only retirement income.

- It does not automatically maximize itself—you must choose when to claim.

- It does not account for all your financial goals; you need savings, investments, or pensions to supplement it.

Understanding these parameters helps you treat Social Security as one component of a comprehensive Financial Security plan rather than as your sole safety net.

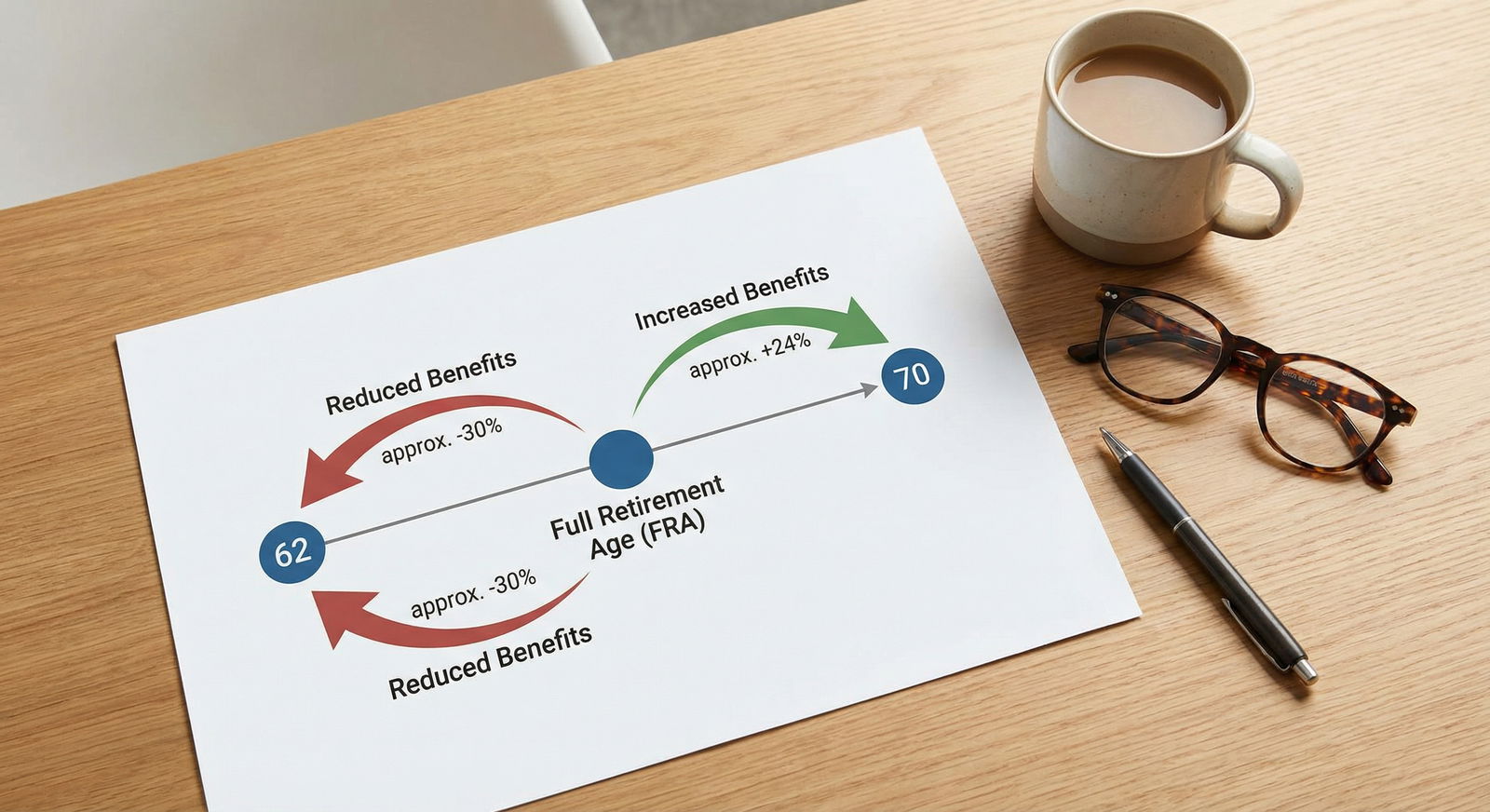

2. Full Retirement Age, Early vs. Late Claiming, and Lifetime Impact

Your age when you start benefits is one of the most powerful levers you can use for Maximizing Benefits.

2.1 What Is Full Retirement Age (FRA)?

Your Full Retirement Age (FRA) is the age at which you can receive 100% of your “primary insurance amount” (PIA)—the benefit you’re entitled to based on your full earnings record. FRA depends on your birth year:

- Born 1943–1954: FRA is 66

- Born 1955–1959: FRA gradually increases from 66 and 2 months to 66 and 10 months

- Born 1960 or later: FRA is 67

You can find your exact FRA on your Social Security statement or on the SSA website.

2.2 Claiming Early: Pros and Cons

You can start retirement benefits as early as age 62, but your monthly benefit will be permanently reduced if you claim before your FRA.

- Claiming at 62 when your FRA is 67 generally means about a 30% reduction in your monthly benefit.

- That reduction lasts for the rest of your life and affects survivor benefits for a spouse who might later rely on your record.

When early claiming may be reasonable:

- You have serious health concerns or a shorter-than-average life expectancy.

- You need immediate income and have limited savings.

- You plan to stop working completely and won’t be subject to the earnings test (or your earnings will be very low).

2.3 Delaying Benefits to Age 70: The Power of Delayed Retirement Credits

If you wait beyond your FRA to claim, you earn delayed retirement credits of about 8% per year (simple, not compounded) until age 70.

- Waiting from FRA (e.g., 67) to 70 can increase your benefit by up to 24%.

- This increase also enhances survivor benefits for a spouse who may outlive you.

Why delaying can be a strong Maximizing Benefits strategy:

- The higher payment continues as long as you live.

- Social Security benefits are inflation-adjusted with annual cost-of-living adjustments (COLAs), so that 8% increase compounds over time as COLAs are applied to a larger base.

2.4 Thinking in Terms of Lifetime, Not Just Monthly Checks

Social Security decisions should be evaluated in terms of lifetime income, not just the size of the first check:

- Claim early: You get more years of payments, but each check is smaller.

- Delay: Fewer years of payments, but each check is larger.

Financial planners often use “break-even” analysis—the age at which total benefits from claiming later exceed the total from claiming earlier, typically in your late 70s or early 80s. If you expect to live into your 80s or beyond—and especially if you’re the higher earner in a married couple—delaying often provides greater lifetime Financial Security.

3. Earnings Strategy: How Your Work History Shapes Your Benefit

Your benefit is not based on your last job alone. It’s rooted in a detailed calculation that looks across decades of work.

3.1 How the 35-Year Rule Works

Social Security calculates your retirement benefit based on:

- Your highest 35 years of earnings that were subject to Social Security tax.

- Those earnings are indexed for inflation (adjusted to reflect wage growth over time).

- The SSA then averages those 35 years to determine your Average Indexed Monthly Earnings (AIME).

- A progressive formula converts AIME into your benefit (your PIA).

If you worked fewer than 35 years in Social Security-covered jobs, the missing years are counted as zero—which drags down your average and your eventual benefit.

3.2 Boosting Your Benefits Late in Your Career

Even in your 50s and 60s, you may be able to improve your Social Security outcome:

Replace zero years

If you have fewer than 35 years of earnings, continuing to work adds new years and replaces those zeros.Replace low-earning years

Even if you already have 35 years, high-income years late in your career can replace lower-earning years in your record, pushing your average up.Increasing hours or pay

Negotiating a raise, taking on additional responsibilities, or working part-time rather than fully retiring can all contribute to a better Earnings Strategy over your remaining working years.

3.3 Checking and Correcting Your Earnings Record

It is critical to ensure Social Security has accurate data on your earnings:

- Create or log in to your my Social Security account at ssa.gov.

- Download your earnings record and review it year by year.

- Look for missing years or unexpectedly low earnings that don’t match your tax returns or W-2s.

If there are errors, contact the Social Security Administration and be prepared to provide documentation (e.g., W-2s, tax returns, pay stubs). Correcting mistakes—especially in high-earning years—can significantly improve your benefit.

4. Working While Claiming: Earnings Test and Recalculation

Retirement is more flexible than ever, and many people choose to work while collecting Social Security. This can be a powerful Earnings Strategy if you understand the rules.

4.1 The Earnings Test Before Full Retirement Age

If you claim before your FRA and continue to work, your benefits may be temporarily reduced under the earnings test:

- In 2025 (example numbers; check current thresholds), if you are under FRA all year, Social Security withholds $1 in benefits for every $2 you earn above a certain annual limit.

- In the year you reach FRA, a higher threshold applies, and SSA withholds $1 for every $3 above that higher limit until the month you hit FRA.

These reductions are not lost forever. After you reach FRA, Social Security recalculates your benefit, crediting you for the months when payments were withheld, which results in a higher monthly benefit going forward.

4.2 After Full Retirement Age: No Earnings Limit

Once you reach your FRA:

- You can earn any amount from work without having your Social Security checks reduced.

- Your benefit may still increase over time if you continue working and your new earnings replace earlier, lower-earning years in your 35-year record.

4.3 Strategic Considerations

- If you have a high-paying job and are under FRA, it often makes sense to delay claiming to avoid substantial temporary withholdings.

- If you plan minor part-time work below the earnings threshold, claiming early may still be reasonable.

- Always consider the interaction with taxes, as Social Security benefits can become taxable depending on your total income.

5. Spousal, Divorced, and Survivor Benefits: Maximizing at the Household Level

Social Security is not just about individual benefits. For many households, smart coordination of spousal and survivor benefits is where major gains in Maximizing Benefits arise.

5.1 Spousal Benefits for Married Couples

A lower-earning spouse may receive:

- A spousal benefit of up to 50% of the higher earner’s FRA benefit (not including delayed credits), if claimed at their own full retirement age.

- If the lower earner claims earlier than their FRA, the spousal benefit is reduced.

Key points:

- The higher-earning spouse must have filed for benefits for the other to receive a spousal benefit. The previously popular “file and suspend” strategy is largely no longer available under current law.

- The lower earner can claim their own benefit first, and if the spousal amount is higher once the other spouse files, SSA will automatically “top up” to the higher amount.

5.2 Coordinating When Each Spouse Claims

In many cases, it’s advantageous for the higher earner to:

- Work longer (if possible),

- Delay benefits until FRA or even age 70, and

- Build the largest possible benefit, which also sets a strong survivor benefit floor.

The lower earner may:

- Claim earlier (depending on health, employment, and cash needs), or

- Wait until FRA to get the maximum spousal benefit.

This household-level approach focuses not only on today’s income but also on long-term Financial Security for the surviving spouse.

5.3 Divorced Spouse Benefits

If you are divorced, you may still qualify for spousal benefits based on your ex-spouse’s record, if:

- The marriage lasted at least 10 years.

- You are currently unmarried.

- You are 62 or older.

- Your own benefit is less than the benefit you’d receive as a divorced spouse.

Your claiming will not reduce your ex-spouse’s benefits or their current spouse’s benefits. This can be a valuable source of additional income for those who meet the conditions.

5.4 Survivor Benefits: A Key Part of Family Financial Security

If a spouse dies, the surviving spouse may be eligible for a survivor benefit up to:

- 100% of the deceased spouse’s benefit (including delayed retirement credits), if claimed at full retirement age for survivors.

The survivor can switch from their own retirement benefit to a higher survivor benefit if eligible. This is why having the higher earner delay claiming is often a powerful strategy—it locks in a higher survivor benefit for the family’s long-term Financial Security.

6. Timing Your Claim: Health, Longevity, Taxes, and Other Income

Choosing your Social Security start date isn’t just a math problem—it’s a holistic Retirement Planning decision that should consider health, family history, and your broader financial situation.

6.1 Personal Health and Longevity Expectations

Factors to weigh:

- Your current health and chronic conditions.

- Family history of longevity (did parents or grandparents often live into their 80s or 90s?).

- Lifestyle factors: smoking, exercise, diet.

If you expect a shorter-than-average life expectancy, earlier claiming might be reasonable. If you have average or above-average longevity expectations, delaying can be a powerful Maximizing Benefits strategy.

6.2 Other Retirement Income Sources

Consider how Social Security interacts with:

- Employer pensions

- 401(k), 403(b), or IRA accounts

- Annuities

- Rental or business income

In some situations, it can make sense to spend down some retirement savings first while delaying Social Security to age 70, transforming those savings into a larger, inflation-adjusted lifetime benefit.

This approach can reduce longevity risk (the risk of outliving your assets) because Social Security is guaranteed for life and adjusted for inflation.

6.3 Tax Implications and Withdrawal Strategy

Depending on your total income, up to 85% of your Social Security benefits may be taxable. A coordinated strategy might:

- Draw from tax-deferred accounts (like traditional IRAs) before claiming Social Security to reduce required minimum distributions (RMDs) later.

- Take advantage of years with no or low Social Security income to execute Roth conversions, potentially improving your long-term tax position.

A tax-aware claiming strategy can further enhance Financial Security in retirement.

7. Tools, Resources, and Professional Guidance

You don’t need to navigate these decisions alone. Several tools can help you estimate and compare different claiming ages and Earnings Strategies.

7.1 Social Security Administration (SSA) Resources

Use the official SSA website (ssa.gov) to:

- Create a my Social Security account.

- Review your earnings history.

- View personalized estimates for:

- Claiming at 62

- Claiming at FRA

- Claiming at 70

- Use the Retirement Estimator to model different scenarios (e.g., working longer, higher final earnings).

7.2 Financial Planning Software and Calculators

Independent calculators and planning tools can:

- Run “what if” scenarios comparing early, FRA, and delayed claims.

- Model survivor outcomes, showing the impact on a surviving spouse’s income.

- Integrate your Social Security decisions into broader Retirement Planning: investment withdrawals, taxes, and estate plans.

7.3 Professional Advice: When to Talk to an Expert

Consider consulting:

- A fee-only financial planner with Social Security expertise.

- A retirement income specialist who regularly models claiming strategies.

- An elder law or estate planning attorney if you have complex family or legal circumstances.

An experienced professional can help you weigh non-financial factors (health, family situation, risk tolerance) along with the mathematics of Maximizing Benefits.

8. Expanded Case Study: Integrating Social Security into a Household Plan

Let’s revisit and expand on the hypothetical couple, John and Mary, to see how all these elements come together.

8.1 Their Situation

- John and Mary are both 62.

- John’s historical earnings: approximately $60,000 per year.

- Mary’s historical earnings: approximately $25,000 per year (more time spent out of the workforce caregiving).

- John’s FRA: 67. Mary’s FRA is also 67.

- They have modest retirement savings and a small pension from John’s former employer.

8.2 Their Options

Both claim at 62

- John’s benefit is reduced by about 30%.

- Mary’s own benefit is also reduced.

- They receive more years of payments, but at permanently lower rates.

Wait until FRA (67) for both

- Both receive 100% of their respective FRA benefits.

- They rely more heavily on savings for the first five years of retirement.

Hybrid strategy—Mary early, John delayed

- Mary claims at 62 (reduced benefit), providing some income.

- John continues working and delays his Social Security until 67 or 70, boosting his benefit and Mary’s eventual survivor benefit.

8.3 Analysis and Long-Term Impact

After running detailed projections:

- Mary’s early benefit provides cash flow that allows them to draw less from their savings in their early 60s.

- John delays to 70, receiving delayed retirement credits. His monthly check at 70 could be roughly 24% higher than at 67 and significantly higher than at 62.

- If John dies first, Mary can switch to John’s higher survivor benefit, maintaining a more secure income level in widowhood.

This combination gives them:

- Better household income later in retirement when healthcare costs are likely higher.

- Stronger survivor protection for Mary.

- A smoother integration of retirement savings, pension income, and Social Security in their overall Retirement Planning.

Frequently Asked Questions (FAQs)

1. How do I find out my exact Full Retirement Age and estimated benefit?

Create a my Social Security account at ssa.gov. Your online statement shows your Full Retirement Age, your full retirement benefit, and estimates for claiming at 62, FRA, and 70. It also lists your annual earnings record so you can verify accuracy.

2. Can I change my mind after I start receiving Social Security benefits?

Yes, but options are limited:

- Within 12 months of first claiming, you can withdraw your application once and must repay all benefits received (including any spousal or dependent benefits paid on your record). You can then reapply later at a higher age.

- After FRA, you may be able to voluntarily suspend benefits to build delayed retirement credits up to age 70 (this also suspends spousal benefits on your record in most cases).

3. What happens if I work and get Social Security before my Full Retirement Age?

If you are under FRA and your earnings exceed the annual limit, some of your Social Security benefits will be withheld under the earnings test. These withheld benefits are not lost permanently; once you reach FRA, SSA recalculates your benefit to account for months when payments were withheld, usually resulting in a higher monthly benefit going forward.

4. What if I have fewer than 35 years of earnings?

Any missing years are counted as zero in the 35-year calculation, lowering your benefit. Working additional years—especially in your highest earning capacity—can replace those zero or low-earning years and meaningfully increase your Social Security benefit.

5. Are my Social Security benefits taxable?

They can be. Depending on your combined income (adjusted gross income + nontaxable interest + half of your Social Security benefits), up to 85% of your Social Security income may be subject to federal income tax. State tax treatment varies. Coordinating the start of Social Security with withdrawals from retirement accounts can help manage your long-term tax burden.

Thoughtful Social Security decisions are one of the most impactful steps you can take for long-term Financial Security. By understanding your Full Retirement Age, optimizing your Earnings Strategy, coordinating spousal and survivor benefits, and timing your claim within a broader Retirement Planning framework, you can transform Social Security from a basic safety net into a powerful, inflation-adjusted income stream for life.