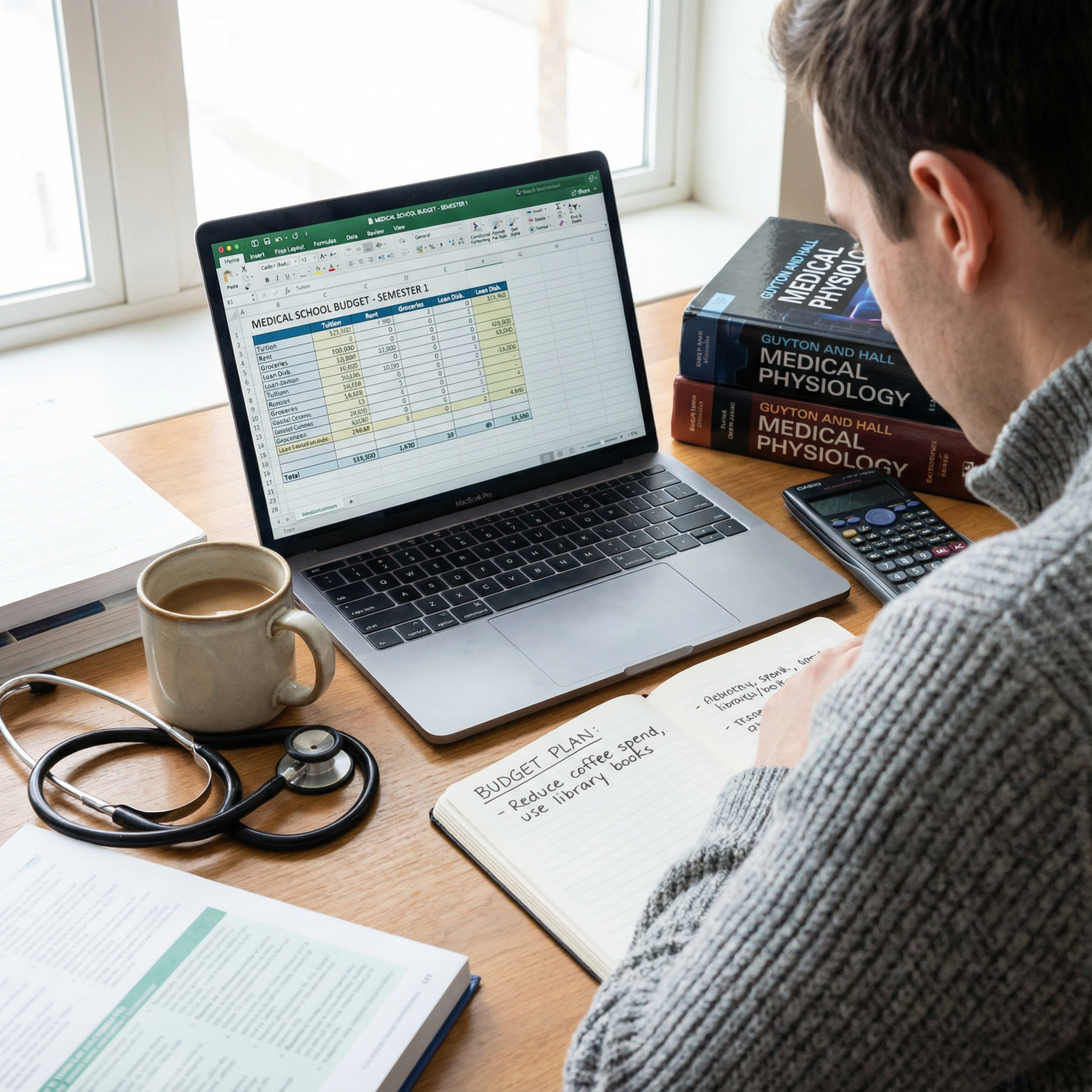

Budgeting for Medical School: Practical Strategies to Control Student Debt Growth

Entering Medical School is a life-changing achievement—but it also comes with one of the biggest financial commitments of your lifetime. For many students, the combination of tuition, fees, and living expenses leads to six-figure Student Debt by graduation. While some debt is often unavoidable, how you plan and manage your money during these years can dramatically affect your long‑term financial health.

This guide walks through step‑by‑step Financial Planning and Cost Management strategies tailored specifically for medical students. The goal is not just to “spend less,” but to make deliberate, informed choices so your debt grows as little as reasonably possible while you still maintain your well‑being and academic success.

Understanding the True Cost of Medical School

Before you can build a realistic budget, you need a clear picture of what Medical School actually costs—not just tuition, but everything required to live and learn for 4+ years.

Key Components of Medical School Expenses

1. Tuition and Mandatory Fees

This is usually your largest expense and varies widely by:

- Public vs. private school

- In‑state vs. out‑of‑state status

- Length and structure of the curriculum

Tuition and fees may increase annually, often by 2–5% or more. When planning, assume modest yearly increases so you’re not surprised later.

2. Living Expenses

These costs depend heavily on your city, lifestyle, and housing choices:

- Rent and utilities (electricity, internet, water, gas)

- Groceries and household supplies

- Transportation (public transit, gas, rideshare, parking, car maintenance)

- Personal expenses (phone bill, clothing, toiletries)

- Health-related costs not covered by insurance

Living costs are where you often have the most control through thoughtful Cost Management decisions.

3. Books, Equipment, and Academic Supplies

- Textbooks (digital or print), review books, question banks

- Stethoscope, otoscope (if required), white coats

- Laptop/tablet and software subscriptions

- Exam fees (e.g., USMLE/COMLEX, practice exams, board prep resources)

These may fluctuate by year—preclinical years are often heavier on books and subscriptions, while clinical years shift expenses toward travel, applications, and exam fees.

4. Insurance

- Health insurance (sometimes required through the school if you don’t have other coverage)

- Disability insurance (increasingly recommended, particularly in later years)

- Renter’s insurance if you have an apartment

- Malpractice insurance is typically covered by your institution during training, but confirm with your school.

5. Travel and Clinical Rotations

- Away rotations (housing, travel, food at a different location)

- Residency interview travel (may be partially virtual, but still may involve travel for some specialties)

- Visiting family, conferences, research presentations

These costs tend to spike during the clinical years and the residency application season.

How Much Should You Expect to Spend?

Many medical students can expect total annual costs of $50,000–$70,000 or more, depending on:

- School type and tuition level

- City cost of living

- Personal spending habits

Knowing these ranges allows you to set realistic expectations and avoid “surprise” reliance on extra loans later.

Laying the Foundation: Assessing Your Financial Picture

Before you create a budget, you need to know where you stand: what’s coming in, what’s going out, and what your debt will likely look like at graduation.

1. Clarify Your Income Sources

List all sources of money available each year:

- Federal loans (Direct Unsubsidized, Grad PLUS)

- Institutional or private loans

- Scholarships and grants

- Family support (if applicable)

- Savings from prior employment

- Part‑time work or side income (tutoring, research, teaching assistantships)

Convert everything to a monthly equivalent so you know what you can safely spend each month without over‑borrowing. For example:

- $60,000 in loans for the year ≈ $5,000/month gross

- Then subtract lump‑sum expenses (e.g., tuition, board fees) to see what’s truly available for living expenses.

2. Understand Your Current and Future Debt

List all existing and projected loans:

- Federal loans from undergrad

- Existing private loans

- Estimated new loans for each year of medical school

Use a simple loan calculator to project:

- Total debt at graduation

- Approximate monthly payments on a standard 10‑year plan

- How different repayment options (e.g., Income‑Driven Repayment) may change initial payments but increase total interest

Seeing the “big picture” makes your budgeting decisions feel more meaningful. For example, reducing your borrowing by $5,000 a year could save tens of thousands of dollars over the life of your loans.

3. Define Clear Financial Goals

Use SMART goals (Specific, Measurable, Achievable, Relevant, Time‑bound) to make your Financial Planning concrete:

Short‑term goals (during school)

- “Limit my annual borrowing to $55,000 or less.”

- “Build a $1,000 emergency fund by the end of MS2.”

- “Keep monthly discretionary spending under $200.”

Long‑term goals (after graduation)

- “Pay off high‑interest private loans within 5 years of residency.”

- “Qualify for Public Service Loan Forgiveness (PSLF) via an IDR plan.”

- “Begin retirement contributions no later than PGY‑2.”

These goals guide your day‑to‑day decisions and give context to your budgeting choices.

Building a Realistic and Sustainable Monthly Budget

A budget is simply a plan for how every dollar will be used. In Medical School, your “income” is often loan disbursements, so treating every dollar as borrowed money can help you stay intentional.

Core Components of a Medical Student Budget

Your monthly budget should include:

- Housing: Rent, utilities, renter’s insurance

- Food: Groceries, occasional dining out

- Transportation: Public transport passes, gas, parking, maintenance, rideshares

- Academic Expenses: Books, board prep, subscriptions, exam fees (spread across months)

- Health and Insurance: Co‑pays, medications, premiums not covered by aid

- Personal and Miscellaneous: Phone plan, clothing, laundry, small purchases

- Savings and Emergency Fund: Even small amounts matter over time

- One‑time/Irregular Costs: Away rotations, interview season (plan ahead monthly)

Here’s a sample monthly budget for a single student in a moderately priced city:

| Budget Category | Estimated Amount |

|---|---|

| Rent | $1,200 |

| Utilities & Internet | $200 |

| Groceries | $350 |

| Transportation | $150 |

| Phone | $60 |

| Books & Subscriptions* | $150 |

| Health/Medical | $75 |

| Personal Expenses | $150 |

| Entertainment | $100 |

| Emergency/Savings | $200 |

| Total | $2,635 |

*Books & subscriptions may be much higher in certain months—spreading annual or one‑off costs over 12 months avoids major budget shocks.

Practical Tips for Creating Your Budget

Start with your actual bank statements.

Look back 2–3 months to see where your money has really been going.Use digital tools.

Apps like Mint, YNAB (You Need A Budget), EveryDollar, or Spendee can help track spending automatically and categorize transactions. Many banks also have built‑in budgeting tools.Plan for “lumpy” expenses.

Break up large, irregular costs into monthly savings targets:- Example: If you expect $600 in board exam fees next year, set aside $50/month now.

Build in a modest buffer.

Rigid budgets fail quickly. Include a small “miscellaneous” line so minor surprises don’t derail you.

Smart Cost Management: Spending Less Without Sacrificing Well‑Being

Budgeting for Medical School is not about deprivation; it’s about efficiency and aligning your spending with your values and priorities.

Live Intentionally “Like a Student”

Adopting a modest lifestyle now can prevent excessive Student Debt later.

Housing Strategies

- Choose a smaller apartment or consider roommates to split rent and utilities.

- Live slightly farther from campus if safe and significantly cheaper, balancing commute costs and time.

- Avoid high‑amenity luxury buildings that inflate costs without improving your education.

Food and Daily Living

- Meal‑prep on weekends; cook larger batches and freeze portions.

- Buy staples (rice, beans, oats, frozen vegetables) in bulk.

- Limit regular takeout and coffee runs; designate specific “treat days” rather than defaulting to convenience.

Transportation

- Use student discounts for public transit where available.

- Car‑share or carpool for clinical rotations when feasible.

- If you own a car, stay on top of basic maintenance to avoid costly repairs.

Leverage Campus and Community Resources

- Use the library for textbooks and review materials before purchasing.

- Use the school gym and recreation facilities instead of a commercial membership.

- Take advantage of student discounts on software, streaming services, and public transit.

Reduce Education-Related Costs Strategically

- Buy used textbooks or older editions when appropriate.

- Share board prep question banks with friends (within license agreements) using group discounts.

- Ask upperclass students which books and resources are truly essential at your school.

Minimizing Borrowing: Scholarships, Side Income, and Smart Loan Use

Cost Management is one side of the equation; minimizing how much you need to borrow is the other.

Maximize Scholarships and Grants

Many medical students underestimate what’s available:

- Institutional scholarships offered by your school

- National organizations (e.g., specialty societies, minority physician organizations)

- Local community foundations, hospitals, and civic groups

- Service‑based scholarships (e.g., National Health Service Corps, military HPSP) in exchange for service commitments

Set a quarterly reminder to search and apply for scholarships. Even a $1,000 award directly reduces how much you need to borrow.

Consider Work-Study and Limited Part-Time Work

Working during Medical School must be carefully balanced with academics, but it can sometimes make sense.

Potential options:

- Federal Work‑Study positions on campus

- Paid research assistant roles with flexible hours

- Tutoring undergraduates or other medical students

- Teaching assistant positions for premed or basic science courses

Before committing to a job:

- Be honest about your energy and time—step away if it compromises your performance or wellness.

- Prioritize opportunities that align with your career interests so they serve dual purposes (income + experience).

Borrow Strategically

When loans are necessary, borrow as efficiently as possible:

- Prioritize federal loans (Direct Unsubsidized, then Grad PLUS) over private loans because of better protections, flexible repayment options, and potential for forgiveness.

- Only accept the amount you truly need each term; you can often request additional funds later if absolutely required.

- Return excess funds if you realize you’ve over‑borrowed after disbursement.

Maintaining and Adjusting Your Budget Over Time

A budget is not a static document—it should evolve with your training stage and life circumstances.

Build a Monthly Money Routine

Once a month (or every pay/loan disbursement):

- Review all transactions from the prior month.

- Compare spending in each category to your plan.

- Identify areas of “budget creep” (e.g., food delivery, impulse purchases).

- Decide on 1–2 small changes for the next month.

This process typically takes 20–30 minutes once you’re set up.

Reevaluate at Key Milestones

Revisit your overall Financial Planning at key transition points:

- Start of each academic year

- Transition from preclinical to clinical years

- Before away rotations and residency application season

- After major life changes (marriage, children, health issues)

At each point, update:

- Expected expenses

- Loan needs

- Savings goals

- Scholarship or work opportunities

Proactive planning at these inflection points helps you avoid emergency borrowing.

Preparing for Life After Graduation: Repayment and Long-Term Planning

Your Medical School Budgeting choices influence how flexible your future options will be, but you also need a plan for life after graduation.

Understand Federal Loan Repayment Options Early

Before your final year, learn the basics of:

- Standard 10‑year repayment (higher monthly payments, less total interest)

- Income‑Driven Repayment (IDR) plans (e.g., SAVE, PAYE, IBR), which:

- Base payments on your income and family size

- Often make sense during residency with low salaries

- Can lead to eventual forgiveness after 20–25 years (though with possible tax implications)

Use online calculators (e.g., from AAMC FIRST or Federal Student Aid) to project your payments under different scenarios.

Explore Loan Forgiveness and Service Programs

Some programs can significantly reduce long‑term Student Debt:

Public Service Loan Forgiveness (PSLF):

- Requires working full‑time for a qualifying employer (most academic hospitals, non‑profits, and government institutions).

- Make 120 qualifying payments on an IDR plan; remaining balance is forgiven tax‑free.

National Health Service Corps (NHSC) and similar:

- Provide loan repayment in exchange for service in underserved areas.

Military or Public Health Service commitments:

- Can offer stipends, tuition coverage, or loan repayment in exchange for service obligations.

Understanding these options early can help you align your specialty choice, residency type, and employment decisions with your financial goals.

Start Building Healthy Long-Term Habits

Even during residency, when money is tight, a few habits can set the stage for long‑term success:

- Maintain a basic emergency fund (even $500–$1,000 is helpful).

- Avoid lifestyle inflation as your income gradually increases.

- Learn the basics of investing and retirement accounts so that, when you can contribute, you’re ready.

Build a Support System: You Don’t Have to Do This Alone

Financial Planning in Medical School can feel overwhelming, but you have resources.

Seek Out Financial Education and Counseling

- Many schools offer financial aid counseling and workshops—attend them early and often.

- Explore resources like AAMC FIRST (Financial Information, Resources, Services, and Tools) for guides, calculators, and webinars tailored to medical students.

- Consider a one‑time consultation with a fee‑only financial planner specializing in physicians, ideally closer to graduation or in early residency.

Learn from Peers, Mentors, and Alumni

- Talk to upper‑class students or recent graduates about what they wish they had known.

- Ask residents and attendings how they approached Student Debt, PSLF, and savings.

- Join online physician financial communities for education and perspective, but always verify advice using reputable sources.

FAQs: Budgeting, Student Debt, and Financial Planning in Medical School

1. How much should I realistically budget for living expenses in Medical School?

This depends on your city and lifestyle, but many students spend between $1,500 and $2,500 per month on living costs (excluding tuition and fees). Start by checking your school’s Cost of Attendance (COA) estimate, then adjust based on real local prices for rent, food, and transportation. Aim to come in under the COA if possible to minimize borrowing.

2. Is it a mistake to work during Medical School to reduce Student Debt?

Not necessarily—it depends on your schedule, stress levels, and academic demands. Limited, flexible work (e.g., tutoring, research assistantships, work‑study) can help with Cost Management and reduce how much you borrow. However:

- Your academic performance and mental health come first.

- If work leads to burnout or failing grades, it could be far more costly long term.

- Many students find working more feasible in the preclinical years than during intense clinical rotations.

3. Should I focus more on cutting expenses or planning for loan forgiveness (like PSLF)?

Ideally, you do both:

- During school: Focus on controlling your borrowing through smart Budgeting and Cost Management.

- After graduation: Choose a repayment strategy (PSLF, IDR, aggressive repayment) based on your specialty, income, and career goals.

Even if you ultimately qualify for forgiveness, borrowing less gives you more flexibility, lowers psychological stress, and protects you if your plans change.

4. How big should my emergency fund be as a medical student?

Aim for $500–$1,000 to start, then work toward 1–3 months of living expenses if possible. This prevents minor emergencies (car repair, medical bill, sudden travel) from forcing you to take on high‑interest credit card debt or emergency private loans. You can build this fund slowly—$50–$100 per month over time.

5. What are the best tools for tracking my budget and managing loans?

Popular, student‑friendly tools include:

- Budgeting & expense tracking: Mint, YNAB, EveryDollar, your bank’s app

- Loan projections & repayment planning:

- AAMC FIRST calculators

- Federal Student Aid Loan Simulator (studentaid.gov)

- School financial aid office resources

The specific tool matters less than consistent use. Pick one system that feels intuitive and commit to reviewing it at least once a month.

Thoughtful Budgeting in Medical School won’t eliminate Student Debt, but it can significantly slow its growth and give you far more control over your financial future. With a clear understanding of your costs, a realistic plan, and steady adjustments along the way, you can focus on your training while still laying a solid financial foundation for your career in medicine.