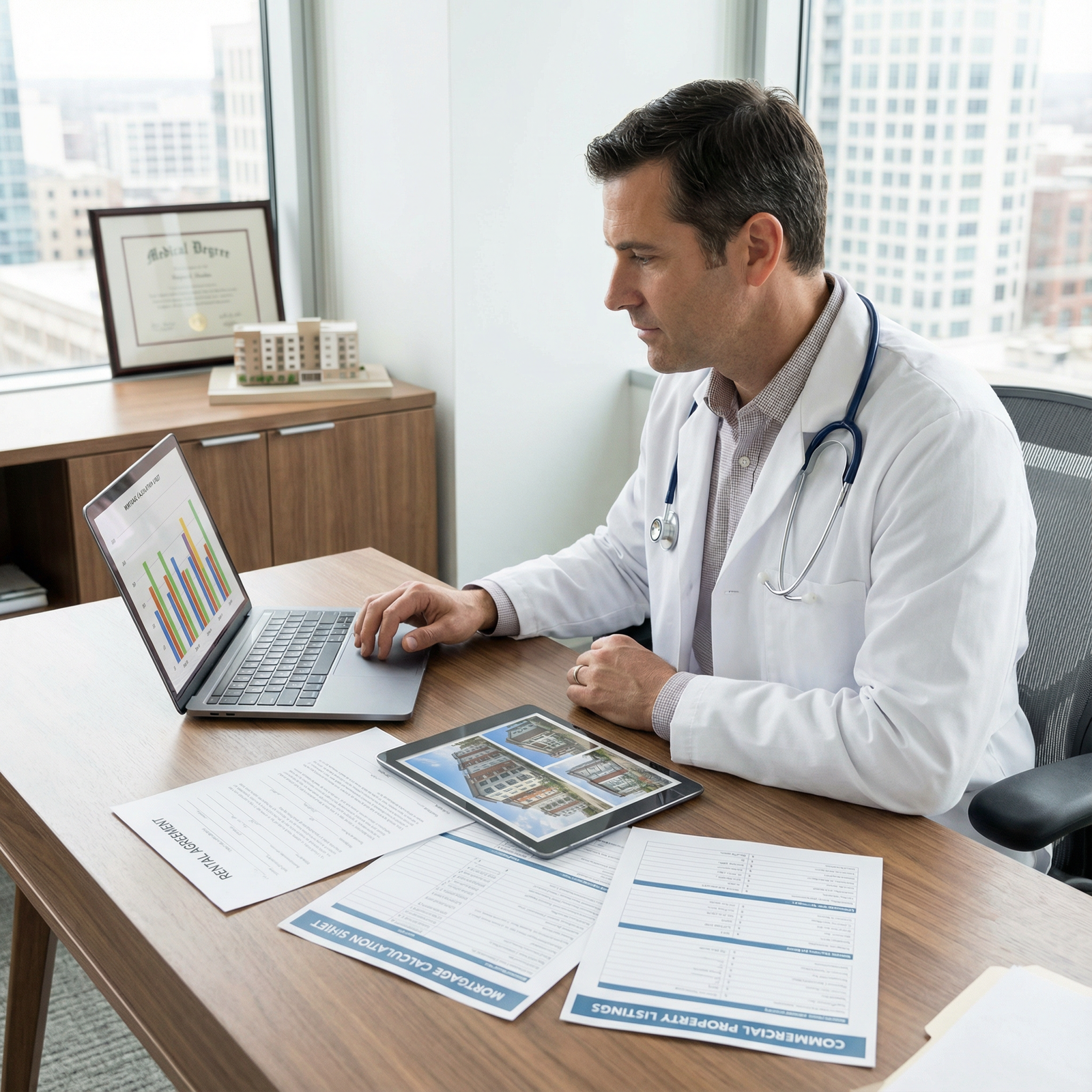

Introduction: Why Real Estate Investing Matters for Physicians

Physicians are uniquely positioned in the world of personal finance. You have:

- High earning potential—but often delayed

- Significant student loan debt

- Intense, time-consuming work schedules

- A later start to serious saving and investing compared with other professionals

These realities can make long-term Wealth Building feel both urgent and daunting. Many doctors recognize that relying solely on clinical income is risky: reimbursement models change, burnout is real, and careers can be disrupted by illness, injury, or family needs.

Real Estate Investing offers a powerful way for physicians to:

- Diversify beyond stock-based portfolios

- Create additional income streams not tied to their time in the hospital or clinic

- Hedge against inflation with hard assets

- Build generational wealth and earlier financial independence

This guide walks through five core real estate strategies every physician should understand:

- Buy-and-hold rental properties

- House hacking

- Real Estate Investment Trusts (REITs)

- Fix-and-flip projects

- Short-term rentals

You do not need to use all of them. Your choices should match your risk tolerance, time availability, and financial goals. Used thoughtfully, these Financial Strategies can turn your high but volatile earning power into durable, long-term wealth.

1. Buy-and-Hold Rentals: The Foundational Strategy for Physicians

The buy-and-hold approach is often the backbone of physician-focused Real Estate Investing.

What the Buy-and-Hold Strategy Involves

You purchase a property—often a single-family home, small multifamily, or condo—with the intention to:

- Rent it out for ongoing monthly income

- Hold it for many years while it appreciates

- Benefit from loan amortization (your tenants help pay off your mortgage)

- Enjoy tax advantages such as depreciation and interest deductions

Your return comes from 4 major sources:

- Cash flow: rent minus expenses (mortgage, taxes, insurance, maintenance, Property Management, etc.)

- Appreciation: property value increases over time

- Loan paydown: your tenants gradually pay off the principal

- Tax benefits: depreciation and other write-offs reduce taxable income

Why Buy-and-Hold Fits Physicians Well

For physicians, buy-and-hold is often the most natural first step in Real Estate Investing:

- Long-term horizon: You typically have decades of earning ahead—ideal for compounding.

- Stable income: Once attending, you can qualify for favorable mortgage terms and comfortably manage temporary vacancies or repairs.

- Time constraints: Properly managed, buy-and-hold rentals can be relatively passive compared with active flips or self-managed short-term rentals.

This strategy works especially well if you:

- Want predictable, semi-passive income

- Are willing to hold properties for 10+ years

- Prefer to hire Property Management instead of handling everything yourself

Real-World Example

Dr. Smith, an orthopedic surgeon, purchased a 3-bedroom single-family home in a growing suburb near a major academic hospital. The area had:

- Strong school districts

- Stable employment base

- Rising population and limited new home construction

He purchased with a 20% down payment and hired a reputable local property manager. Over several years:

- The property appreciated substantially

- Rents increased in line with market trends

- His mortgage balance steadily declined

After 7 years, Dr. Smith refinanced the property, extracting equity through a cash-out refinance. He used that capital as a down payment on a second rental. Over time, the rental portfolio grew into a significant passive income stream, eventually covering a large percentage of his family’s living expenses.

Practical Steps and Tips for Physicians

- Target solid, stable markets: Avoid purely speculative “hot” markets. Look for strong job and population growth, good schools, and low crime.

- Run the numbers carefully: Consider all expenses—income tax, maintenance, capital expenditures (roof, HVAC), vacancies, property management. Don’t assume constant 100% occupancy.

- Use leverage wisely: Mortgages amplify your returns but also your risk. Avoid overleveraging—stress-test your numbers against rent dips or higher interest rates.

- Consider professional Property Management: A manager typically costs 8–12% of monthly rent plus leasing fees, but frees you from midnight calls and day-to-day tasks—critical for busy physicians.

2. House Hacking: Supercharging Early Wealth Building

House hacking is one of the most powerful and underutilized strategies for early-career physicians, especially medical students, residents, and fellows.

What House Hacking Means

House hacking is essentially living in your own real estate investment. You:

- Buy a duplex, triplex, or fourplex and live in one unit, renting the others, or

- Buy a single-family home and rent out individual rooms, a basement suite, or an accessory dwelling unit (ADU)

The rental income offsets or even fully covers your mortgage and housing costs.

Why House Hacking Is Ideal for Trainees and Young Attendings

For physicians in training, housing is often the single largest expense. House hacking helps by:

- Reducing living costs: You turn your home from a liability into an asset that generates income.

- Accelerating student loan payoff: Extra monthly cash can go directly to debt reduction or savings.

- Letting you own instead of rent: You gain potential appreciation and principal paydown during residency or early practice.

- Creating a “training ground” for landlording: You learn tenant screening, leases, and basic maintenance on a smaller, more manageable scale.

Even for new attending physicians, house hacking can be a fast track to Financial Strategies that accelerate wealth early in your career.

Real-World Example

Dr. Johnson, a family medicine resident, purchased a duplex near her hospital.

- She lived in the lower unit.

- She rented the upper unit to a fellow resident.

The rent from the upstairs unit covered about 80% of her mortgage payment. Between that savings and a modest side hustle, she:

- Built an emergency fund

- Paid extra toward her student loans

- Gained confidence managing a property and tenants

When she graduated, Dr. Johnson kept the duplex as a pure rental. The transition from “house hack” to full investment property was seamless and produced ongoing passive income.

Considerations and Practical Advice

- Financing: Owner-occupied properties often qualify for better interest rates and lower down payments (e.g., FHA loans, physician loans), especially helpful for physicians with high debt-to-income ratios.

- Local landlord-tenant laws: Understand notice periods, eviction processes, and fair housing regulations. This is especially important when tenants are close neighbors or co-workers.

- Lifestyle fit: House hacking doesn’t mean sacrificing all privacy or comfort. Look for layouts that separate owner and tenant spaces (separate entrances, sound insulation).

- Tenant selection: Screen tenants carefully—credit checks, references, employment verification. Boundaries matter, particularly if you rent to colleagues or friends.

House hacking may not be forever, but even 3–5 years can have an outsized impact on your long-term Wealth Building trajectory.

3. REITs: Real Estate Exposure Without Owning Property Directly

Not every physician wants the responsibilities of direct Property Management. That’s where Real Estate Investment Trusts (REITs) come in.

What REITs Are and How They Work

REITs are companies that own, operate, or finance real estate assets. When you buy REIT shares, you’re buying partial ownership of their underlying properties or mortgages.

Common REIT types include:

- Equity REITs: Own and operate real properties (apartments, offices, malls, data centers, warehouses).

- Mortgage REITs: Invest in mortgages and real estate debt.

- Hybrid REITs: Combine both approaches.

Many REITs are publicly traded on major stock exchanges, making them as easy to buy and sell as stocks or ETFs.

Why Physicians Should Consider REITs

REITs can be particularly attractive to physicians because they provide:

- Liquidity: You can quickly enter or exit positions without selling a physical property.

- Diversification: A single REIT may own hundreds of properties across multiple markets and sectors.

- Hands-off investing: No tenants, toilets, or late-night calls—professional management handles the properties.

- Dividend income: By law, many REITs distribute at least 90% of taxable income as dividends, providing regular cash flow.

For extremely busy clinicians or those still building foundational investment knowledge, REITs offer an accessible entry into Real Estate Investing.

Real-World Example

Dr. Brown, an anesthesiologist, preferred to keep her evenings and weekends free from landlord duties. She chose to:

- Invest in a diversified REIT index fund through her employer-sponsored retirement plan

- Add a few sector-specific REITs (e.g., healthcare facilities, industrial logistics) in her taxable brokerage account

This approach gave her:

- Exposure to real estate returns

- Quarterly dividend income

- No need to evaluate individual properties or markets in detail

Over time, her REIT holdings complemented her traditional stock and bond investments, smoothing portfolio volatility and adding another income stream.

Key Metrics and Selection Tips

When analyzing REITs, focus on:

- Funds from Operations (FFO): A better measure than simple earnings for REITs.

- Dividend yield and payout ratio: High yield can be attractive but ensure the payout is sustainable.

- Debt levels and interest coverage: Overleveraged REITs are riskier, particularly in rising rate environments.

- Sector and geographic focus: Consider how trends (e-commerce, telehealth, remote work) may affect certain property types.

REITs are typically best used as one component of a physician’s broader Wealth Building and Financial Strategies—not a total portfolio replacement.

4. Fix-and-Flip: High Reward, High Involvement

Fix-and-flip investing involves buying distressed or underperforming properties, renovating them, and selling them quickly for profit.

How Fix-and-Flip Works

The basic steps:

- Identify a property significantly below market value (often due to condition, mismanagement, or distress).

- Purchase it, often with short-term or hard money financing.

- Renovate strategically—focusing on improvements that maximize resale value.

- List and sell the property at a profit once rehab is complete.

Profits depend on buying well, controlling renovation costs, and accurately predicting the after-repair value (ARV).

Why Some Physicians Are Drawn to Flips

Fix-and-flip can appeal to physicians who:

- Enjoy projects with clear start and end points

- Are comfortable with some calculated risk

- Have strong income and can absorb delays or cost overruns

- Want to actively participate in Real Estate Investing without long-term Property Management

However, it is far from passive. Flipping is essentially running a small real estate business on the side.

Real-World Example

Dr. Kim, a cardiologist, found a neglected property near a rapidly revitalizing urban neighborhood. She:

- Partnered with an experienced contractor

- Purchased the property below market value

- Renovated the kitchen, bathrooms, floors, and exterior curb appeal

The project took 6 months. The property sold quickly at nearly double her total investment (purchase + rehab + holding costs).

Rather than spending the profit, she used the gain to:

- Pay down student loans

- Fund a down payment for a long-term rental property

Flipping provided a capital boost that accelerated her overall Wealth Building plan.

Risks and How to Mitigate Them

Fix-and-flip carries meaningful risks:

- Renovation overruns: Costs often exceed the initial estimate.

- Time delays: Permits, contractor delays, and supply issues can lengthen the project.

- Market risk: A downward shift in the local market can compress margins or eliminate profits.

- Time and cognitive load: Managing a flip on top of a demanding call schedule can be stressful.

Risk-mitigation strategies:

- Start small and local for your first project.

- Build a trusted team (contractor, real estate agent, inspector, lender).

- Add a contingency buffer (10–20%) to your renovation and time estimates.

- Avoid assuming best-case scenarios in your profit projections.

For many physicians, fix-and-flip is best pursued only after building foundational investment knowledge and a stable financial base.

5. Short-Term Rentals: Leveraging Travel and Lifestyle Markets

Short-term rentals (STRs)—through platforms like Airbnb and Vrbo—have exploded in popularity. They can generate significantly more income than traditional long-term rentals, but with added complexity.

What Short-Term Rentals Involve

You rent out a property (or part of it) for periods typically ranging from 1 night to a few weeks. Common STR types:

- Vacation homes in tourist destinations

- Urban apartments serving business travelers or visiting clinicians

- Secondary homes rented when the owner is away

Income comes from nightly rates, cleaning fees, and sometimes additional services (early check-in, pet fees).

Why Short-Term Rentals Attract Physicians

Physicians may find STRs appealing because they:

- Often generate higher gross income than long-term rentals

- Allow personal use of the property during select weeks

- Offer flexible pricing and dynamic adjustment to demand

- Can be managed remotely with the help of co-hosts or Property Management companies

For doctors who own a second home in a desirable location, turning it into a short-term rental can transform a pure expense into a productive asset.

Real-World Example

Dr. Lee, a hospitalist, owned a small condo in a popular ski and summer destination. He:

- Used the condo for personal vacations several weeks per year

- Listed it as a short-term rental for the remainder of the year

The rental income:

- Covered the mortgage, HOA dues, and Property Management costs

- Generated additional profit that he used to fund family travel

By combining personal enjoyment with income production, the property became a flexible piece of his overall Real Estate Investing strategy.

Considerations Specific to Short-Term Rentals

- Local regulations: Many cities have strict rules or caps on STRs, including registration, taxes, and zoning requirements. Always confirm legality before buying.

- Seasonality: Income can fluctuate widely by season; budget for slower periods.

- Management intensity: STRs involve more cleaning, guest communication, and pricing adjustments than long-term rentals.

- Reputation management: Reviews are crucial. Poor service can quickly damage your listing’s performance.

Busy physicians can manage STRs with:

- A full-service vacation rental Property Management company (often 20–30% of revenue)

- A trusted co-host and cleaning team

- Automation tools for messaging, pricing, and calendar syncing

STRs can be powerful income generators but demand careful due diligence and realistic expectations about time and risk.

Aligning Real Estate Strategies with Your Physician Career

Choosing the right Real Estate Investing path is as much about self-awareness as it is about numbers.

Factors to Consider

- Time availability: Do you have hours each week to manage renovations or tenants, or do you prefer “set it and forget it” options?

- Risk tolerance: Are you comfortable with market swings, vacancy risk, or renovation surprises?

- Stage of career: Trainees may benefit from house hacking and learning the basics; attendings may be better positioned for larger buy-and-hold portfolios or selective REIT allocations.

- Geographic flexibility: Are you willing to invest out-of-state if your local market is too expensive or low-yield?

- Long-term goals: Are you aiming for partial financial independence, early retirement, or simply more security and options?

There is no single “best” strategy for all physicians. Many successful doctor-investors:

- Start with education and simple steps (REITs, a house hack, or one buy-and-hold property)

- Gradually layer in more complex strategies as their confidence and capital grow

- Delegate Property Management as their portfolio or clinical responsibilities expand

The key is to ensure your real estate activities support—not compete with—your medical career, family life, and well-being.

Frequently Asked Questions (FAQ)

1. What is the best real estate investment strategy for a busy physician?

For most busy physicians, buy-and-hold rentals with professional Property Management or REITs are the most practical entry points.

- Buy-and-hold can provide tax benefits, long-term appreciation, and a growing income stream with moderate ongoing oversight.

- REITs offer immediate diversification and liquidity with minimal time commitment.

You can always expand into more active strategies (like fix-and-flip or self-managed short-term rentals) once your knowledge, systems, and comfort level grow.

2. Do I need to be a real estate expert before I start investing?

No—but you do need a basic working knowledge before deploying significant capital. Start by:

- Reading reputable books and physician-focused investing blogs

- Listening to podcasts created for healthcare professionals in Real Estate Investing

- Joining local real estate investor meetups or online communities

- Considering mentorship or coaching from experienced investors

Begin small—such as a single REIT position or one modest rental—and scale as your understanding and confidence increase.

3. How much capital do I need to begin Real Estate Investing as a physician?

It depends on the strategy:

- REITs: You can start with a few hundred dollars through a brokerage account.

- House hacking or buy-and-hold rentals:

- Often require 3–5% down for certain owner-occupied loans, or 15–25% down for investment loans.

- Many physicians leverage special “physician mortgage” products for owner-occupied properties.

- Fix-and-flip or short-term rentals:

- Typically require more capital for down payments, renovation costs, and reserves.

Regardless of strategy, maintain an emergency fund and avoid investing money you might need in the short term.

4. What are the main risks of Real Estate Investing for physicians?

Key risks include:

- Market risk: Property values and rents can fall.

- Liquidity risk: Physical real estate can be hard to sell quickly without discounting.

- Property-specific issues: Vacancies, unexpected repairs, difficult tenants, or local regulatory changes (especially for short-term rentals).

- Leverage risk: High debt magnifies losses in downturns or if cash flow is tight.

Mitigation strategies:

- Conservative underwriting and not stretching finances too thin

- Adequate cash reserves

- Proper insurance (landlord policies, umbrella coverage)

- Diversification across markets and property types

5. How can I integrate real estate into my overall financial and retirement plan?

Think of real estate as one pillar of a comprehensive Wealth Building strategy that also includes:

- Tax-advantaged retirement accounts (401(k), 403(b), 457(b), IRAs)

- Broad-based stock and bond index funds

- Appropriate insurance coverage

- A clear debt-management plan, especially for student loans

Work with a fiduciary financial planner who understands the unique financial profile of Physicians and your Real Estate Investing goals. Together, you can:

- Determine appropriate allocations to real estate versus other asset classes

- Decide how much to use leverage safely

- Plan for tax-efficient ownership structures (e.g., LLCs, trusts where appropriate)

- Align investing decisions with your target timeline for financial independence or partial retirement

Thoughtfully chosen and well-managed, real estate can be a powerful complement to your clinical career—transforming a high but time-bound income into sustainable, diversified wealth and greater freedom throughout your life as a physician.