Introduction: Why Physician Salaries Don’t Tell the Whole Story

Physician salaries are often cited as some of the highest of any profession. Headlines focus on six-figure incomes, lucrative specialties, and salary surveys that place doctors near the top of earning lists. For premeds and residents, this can create the impression that once you “make it,” your financial future is secure.

Yet the reality is more complicated.

Behind those headline numbers are substantial hidden costs: medical school debt, prolonged training with relatively low pay, the price of malpractice insurance, growing medical practice costs, administrative burdens, and the toll of burnout on both earnings and well-being. The financial story of a physician is not just about gross income—it’s about net income, risk, time, and sustainability.

This article unpacks the less visible side of physician finances so that premeds, medical students, and residents can make informed choices. Understanding the true costs of medical practice is essential for realistic expectations, effective planning, and building a career that is both financially and personally sustainable.

The Cost of Education and Training: The Foundation of Financial Pressure

The path to becoming a physician involves more than a decade of education and training. Each phase carries its own costs—some obvious, some hidden—that shape a physician’s financial trajectory for many years.

Medical School Debt: The Price of Entry

Medical school debt is often the single largest financial burden physicians carry into their careers.

- Average debt load: In the U.S., total educational debt (undergraduate + medical school) commonly approaches or exceeds $200,000, and for many at private or out-of-state schools, it can surpass $300,000–$400,000.

- Interest accumulation: Interest often accrues during medical school and residency, meaning the total repayment amount can be far higher than the original principal.

- Repayment reality: Standard 10-year repayment plans can translate into $2,000–$3,000+ per month in loan payments—easily the size of a mortgage in many regions.

Layered Financial Burdens

Undergraduate education

Many future physicians already carry significant undergraduate debt before even starting medical school. Premed students often:- Pay for expensive science coursework and lab fees

- Fund MCAT prep courses and exam registrations

- Cover application fees and travel for interviews

Medical school tuition and fees

Annual tuition alone can range from $40,000 to $70,000+, not including:- Mandatory fees

- Health insurance

- Board exams (USMLE/COMLEX) and prep materials

- Clinical rotation-related costs (transportation, housing changes)

Cost of living

During medical school, the ability to work is extremely limited. Students often borrow not only for tuition but also:- Rent and utilities

- Food and transportation

- Health insurance and basic personal expenses

This combination means many new physicians start their careers with a negative net worth well into the six figures.

Residency Pay: Low Hourly Wages for High-Responsibility Work

Residency is a paid job, but it is not a financially generous one when adjusted for hours and responsibility.

- Typical resident salary: Approximately $60,000–$75,000 per year, depending on institution, location, and PGY level.

- Work hours: Often 60–80+ hours per week, with nights, weekends, and holidays routinely included.

- Effective hourly rate: Once you divide salary by actual hours worked, the pay can resemble that of many nonprofessional jobs—despite the high stakes and skill required.

Financial Realities During Residency

- Ongoing loan accumulation: Many residents are in income-driven repayment or forbearance, during which interest continues to accumulate.

- Limited savings ability: With modest income and high costs of living in many training cities, saving for a house, retirement, or a family can be challenging.

- Delayed life milestones: Major purchases and investments—such as buying a home or aggressively funding retirement—are often postponed, extending the time it takes to build wealth.

For many physicians, the combination of substantial medical school debt and relatively low residency income sets the stage for financial pressure that extends well into attending years.

Malpractice Insurance: Necessary Protection with Significant Costs

Malpractice insurance is an unavoidable cost of practicing medicine. While essential for protecting physicians and patients, it carries financial implications that are often underestimated during training.

Understanding Malpractice Premiums and Coverage

Malpractice insurance premiums vary widely based on:

- Specialty (high-risk vs. low-risk)

- Location (state laws, local litigation climate)

- Practice type (hospital-employed vs. independent vs. group practice)

- Claims history (past lawsuits or settlements)

Typical annual premium ranges:

- High-risk specialties (e.g., neurosurgery, OB-GYN, orthopedic surgery):

$75,000–$150,000+ per year in some regions - Moderate-risk specialties (e.g., emergency medicine, anesthesia):

$30,000–$70,000 per year - Lower-risk specialties (e.g., outpatient psychiatry, pediatrics, primary care in certain states):

$10,000–$40,000 per year

In many employed settings, the hospital or group practice pays these premiums, but that cost is indirectly factored into compensation models. For physicians in private or partnership-track practices, malpractice insurance becomes a major line item in their personal or practice budget.

Hidden Financial Implications of Malpractice Coverage

Tail coverage

When a physician leaves a practice or switches insurers, they may need tail coverage—insurance that covers claims arising from previous work. Tail coverage can cost:- 1.5–2.5 times the annual premium

- Tens of thousands of dollars due at transition points in your career

Coverage gaps and exclusions

Not all legal expenses, settlements, or board complaints are covered equally. Some physicians:- Pay out-of-pocket for additional legal representation

- Purchase supplemental coverage (e.g., for administrative or licensing defense)

Indirect income impact of a claim

Even if a case is resolved in the physician’s favor:- Time is lost to depositions, meetings, and court appearances

- Future premiums may increase

- Emotional stress can contribute to burnout or early retirement

Malpractice insurance is not just a “cost of doing business”—it shapes where and how physicians practice, and it influences overall compensation structures behind the scenes.

Administrative Burden and Medical Practice Costs: The Business Side of Medicine

Beyond salary and malpractice insurance, the practice environment itself has significant financial consequences. Whether you join a large health system or consider private practice, understanding medical practice costs and administrative burden is critical.

The Overhead of Running a Medical Practice

Independent and small-group practices function like complex small businesses. A substantial portion of revenue—often 50–70%—is consumed by overhead before physician compensation.

Common recurring costs include:

Staffing

- Nurses, medical assistants, front-desk staff

- Billing and coding specialists

- Office managers and practice administrators

Facility expenses

- Rent or mortgage for office space (especially high in urban centers)

- Utilities, cleaning, maintenance

- Parking, security

Technology and equipment

- Electronic health record (EHR) systems and licensing fees

- Practice management software and billing platforms

- Computers, servers, network infrastructure

- Medical equipment purchase, maintenance, and calibration

Regulatory compliance and fees

- HIPAA compliance tools and consultants

- Licensing fees, certifications, and mandatory trainings

- OSHA and other safety requirements

For many practices, administrative overhead alone can consume 25–35% of total revenue. When patients or students read about “average physician salaries,” those numbers often reflect revenue before many of these expenses are accounted for, especially in productivity-based models.

Time as a Hidden Cost: Paperwork, Prior Authorizations, and Non-Clinical Work

Administrative work has grown rapidly in modern healthcare, often outpacing the time spent in direct patient care.

Common time drains include:

- Prior authorizations for medications, imaging, and procedures

- Documentation requirements for billing and quality metrics

- Insurance-related tasks, denials management, and appeals

- Regulatory reporting, such as meaningful use, MIPS/MACRA, or other quality programs

This has several downstream effects:

- Reduced clinical capacity: Fewer patients seen per day can reduce revenue in productivity-based systems.

- Increased need for support staff: Scribes, care coordinators, and billing experts add to overhead.

- Extended work hours: Many physicians complete documentation in the evenings or on weekends (“pajama time”), effectively lowering their hourly compensation and encroaching on personal time.

Ultimately, administrative burden is a major driver of both medical practice costs and burnout, diminishing the practical value of even high headline physician salaries.

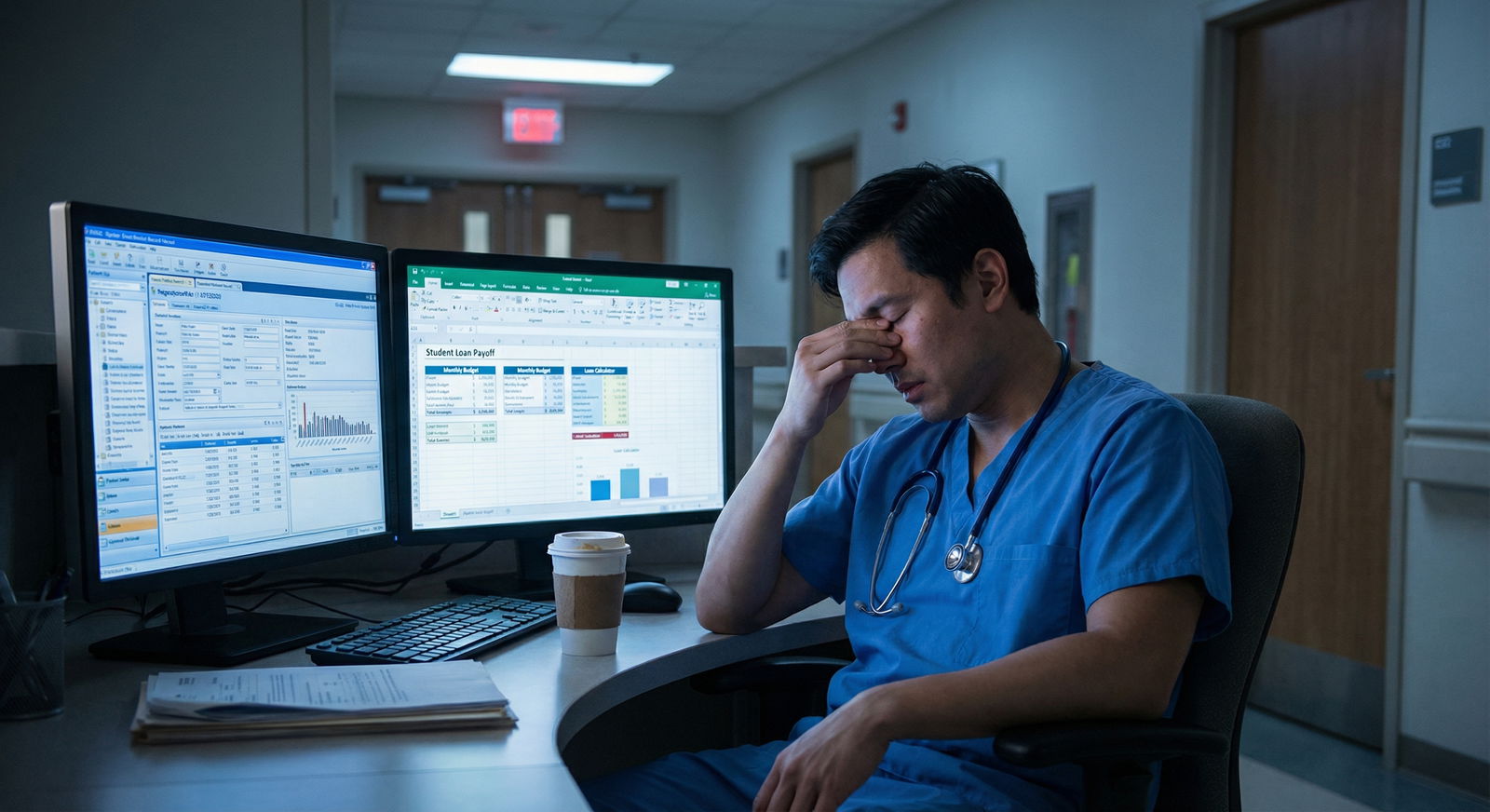

Burnout and Mental Health: The Human Cost with Financial Consequences

Burnout in medicine is not just an emotional or psychological issue; it has direct and indirect financial impacts on individual physicians and the healthcare system as a whole.

Burnout as a Financial Risk Factor

Burnout is characterized by:

- Emotional exhaustion

- Depersonalization or cynicism toward patients

- Reduced sense of accomplishment

Numerous studies show that physician burnout is associated with:

- Reduced productivity: Fewer patients seen per clinic session or year

- Higher turnover: Physicians leaving positions or the profession entirely

- Increased errors: Leading to potential malpractice risk

- Increased use of sick days and decreased engagement in leadership or academic roles

The cost of replacing a physician can exceed $250,000–$500,000 for institutions when factoring in recruitment, onboarding, and lost productivity. For individual physicians, burnout can mean:

- Lost bonuses or reduced RVU-based compensation

- Interrupted career progression

- Shortened career span with cumulative loss of lifetime earnings

Drivers of Burnout in Modern Practice

Key contributors include:

- Workload and hours: Long shifts, night call, and chronic sleep deprivation

- Loss of autonomy: Increasing corporate control over clinical decisions

- Documentation burden: EHR “click fatigue” and quality reporting requirements

- Moral distress: Treating patients in a fragmented, inequitable system

Financially, many doctors feel trapped between high incomes on paper and the reality of:

- Heavy student loan payments

- Tight margins in private practice

- Pressure to see more patients in less time to meet revenue targets

This mismatch amplifies stress and contributes to questioning whether the financial trade-offs were worth it.

Supporting Mental Health and Financial Sustainability

For trainees and early-career physicians, strategies to mitigate burnout include:

- Choosing practice settings that align with values (academic, community, concierge, etc.)

- Negotiating protected time for administrative tasks or academic work

- Seeking mentorship on realistic workload and boundary-setting

- Using employee assistance programs or mental health professionals when needed

Protecting your mental health is not separate from protecting your financial health—it is a prerequisite for a long, prosperous career in medicine.

Specialty Choice and the Pay Gap: Aligning Income, Lifestyle, and Values

Among physicians, there is a broad spectrum of income potential. But higher salary does not always mean better quality of life or greater financial security.

Understanding the Pay Gap Between Specialties

Typical income patterns (approximate, variable by region and practice type):

- High-earning specialties: Orthopedic surgery, cardiology, gastroenterology, dermatology, radiology, anesthesiology

- Often $400,000–$700,000+ annually

- Moderate-earning specialties: Emergency medicine, hospitalist medicine, general surgery, neurology

- Approximately $250,000–$400,000

- Primary care and lower-earning specialties: Family medicine, pediatrics, general internal medicine, psychiatry

- Often $200,000–$275,000, sometimes higher in rural/underserved areas or with productivity bonuses

However, there are important caveats:

- Higher-earning fields often require longer or more intense training (e.g., 6–8 years of residency and fellowship total).

- Malpractice premiums and overhead may be higher, eroding the net benefit of higher gross income.

- Lifestyle trade-offs (call frequency, night shifts, unpredictability) can have health and personal costs that are not reflected in salary figures.

Choosing a Specialty: Beyond the Salary Tables

Many medical students feel pressure to “maximize ROI” on their education by pursuing high-paying fields. While understandable, this approach has risks:

- Mismatch between personality and specialty: Choosing a specialty solely for income can lead to dissatisfaction, poor performance, or burnout.

- Ignoring long-term lifestyle: Some specialties are more demanding in call, night shifts, and intensity even well into mid-career.

- Overlooking location flexibility: Specialties with lower average salaries (e.g., primary care, psychiatry) may offer greater flexibility in geographic choice or practice type.

A more balanced approach is to ask:

- What type of patient interactions do I enjoy day to day?

- What schedule and lifestyle am I willing to tolerate long term?

- How important are factors like procedural work, continuity of care, or acute care excitement to me?

- Can I achieve my financial goals in this field with disciplined planning, even if the salary is not at the top of the spectrum?

With smart financial management, many physicians in “average” paying fields can reach financial independence on reasonable timelines—often with less stress and more satisfaction.

Practical Strategies to Navigate the Hidden Costs of Medical Practice

Understanding these hidden costs is only the first step. The next is developing a proactive plan to manage them.

Financial Planning for Trainees and Early-Career Physicians

Build financial literacy early

- Learn the basics of budgeting, compounding interest, retirement accounts (401(k), 403(b), IRA, Roth IRA), and tax brackets.

- Use reputable physician-focused financial resources, podcasts, and books.

Create a realistic budget in residency

- Track expenses for 2–3 months to understand where money goes.

- Live modestly but sustainably—avoid lifestyle creep driven by credit cards or loans.

- Consider income-driven repayment or Public Service Loan Forgiveness (PSLF) if you work in qualifying settings.

Develop a student loan strategy

- Reassess loan repayment annually as income changes.

- Consider refinancing when leaving training if PSLF is not part of your plan.

- Explore federal programs, military scholarships, and state loan repayment for underserved work.

Plan for insurance needs beyond malpractice

- Own-occupation disability insurance

- Adequate term life insurance if you have dependents or major obligations

- Umbrella liability insurance to protect personal assets

Evaluating Job Offers with Hidden Costs in Mind

When comparing offers, look beyond base salary:

- Who pays for malpractice insurance and tail coverage?

- How are productivity and bonuses calculated (RVUs, collections, quality metrics)?

- What are typical workloads (clinic days, call schedules, patient volumes)?

- What medical practice costs or overhead are deducted before physician compensation?

- Are there opportunities for partnership, leadership, or academic roles?

A slightly lower salary with better benefits, manageable workload, and institutional support for wellness may yield greater long-term satisfaction and financial stability than the highest-possible paycheck.

FAQs: Understanding the Hidden Costs Behind Physician Salaries

1. Why do physician salaries look so high compared to other professions?

Physician salaries reflect many factors: extensive education and training, high responsibility, and the revenue generated by medical services. However, those headline numbers do not account for medical school debt, prolonged training at low pay, malpractice insurance, administrative demands, and medical practice costs. Once these are factored in, the net financial advantage, while still meaningful, is more modest than the raw numbers suggest—especially early in a physician’s career.

2. How can future physicians reduce the impact of medical school debt?

Strategies include:

- Choosing lower-cost schools when possible (in-state, public options)

- Applying for scholarships, service programs (e.g., NHSC), or military HPSP programs

- Limiting lifestyle inflation during school and residency

- Using income-driven repayment and potential forgiveness programs strategically

- Refinancing privately when appropriate after training, if not using PSLF

Early, intentional decisions about where to train and how much to borrow can dramatically change long-term financial outcomes.

3. Is private practice still financially viable given overhead and malpractice costs?

Private practice can be financially rewarding, but it requires business acumen and tolerance for risk. Physicians in private practice face higher administrative burdens and must manage staff, rent, technology, and malpractice insurance. However, they may also have greater autonomy, more control over practice culture, and the potential for higher upside if the practice is well-run. For some, joining a group practice or hospital-employed model offers more stability and fewer direct business responsibilities, albeit often with less control.

4. How does burnout actually affect a physician’s financial health?

Burnout can:

- Reduce clinical productivity and thus lower RVU-based income

- Lead to part-time work or early retirement, decreasing lifetime earnings

- Increase malpractice risk through errors or impaired judgment

- Require time off or treatment, with associated financial costs

Addressing burnout proactively—through workload management, supportive practice environments, and mental health care—is essential not just for personal well-being but also for long-term financial stability.

5. What should medical students and residents focus on now to prepare for the hidden costs of practice?

Focus on:

- Gaining basic financial literacy and setting realistic expectations

- Choosing specialties and practice settings that align with both your values and lifestyle preferences

- Managing debt responsibly and avoiding unnecessary high-interest consumer debt

- Prioritizing mental and physical health, recognizing that a sustainable career is more valuable than any single paycheck

By combining informed financial planning with thoughtful career choices, you can build a medical career that is both fulfilling and financially secure—despite the hidden costs that often go unmentioned in salary discussions.

For more guidance on planning your medical career and finances, you may also find value in resources on medical school preparation, academic success strategies, and work–life balance as a physician.