Introduction: Why Physician Salaries and Inflation Matter Now

In recent years, conversations about physician salaries have shifted from “How high are they?” to “Are they actually keeping up with inflation and the rising cost of living?” For medical students, residents, and attending physicians alike, this is not just an abstract economics question—it's a matter of long-term financial wellbeing, career satisfaction, and even specialty choice.

As healthcare economics evolve, physician salaries face pressure from multiple directions: changing reimbursement models, consolidation of healthcare systems, administrative overhead, and policy shifts. At the same time, inflation—especially the historically high rates seen in 2021–2023—has eroded the purchasing power of every dollar physicians earn.

This article examines how physician salaries compare to inflation, what that means for your real income over time, and how you can proactively protect your financial stability throughout your medical career.

Understanding Physician Salaries in Today’s Healthcare Economics

Key Drivers of Physician Compensation

Physician salaries are the product of a complex interplay of market demand, policy, and organizational priorities. Several consistent factors shape income across the medical profession:

Specialty and Scope of Practice

- Procedural and surgical specialties (e.g., orthopedic surgery, cardiology, gastroenterology, anesthesiology) often command higher compensation.

- Cognitive and primary care specialties (e.g., family medicine, internal medicine, pediatrics, psychiatry) historically earn less, despite high demand.

- Subspecialization (e.g., interventional cardiology vs. general cardiology) usually increases earning potential but often comes with longer training.

Practice Setting

- Private practice physicians may have higher earning potential but greater financial risk and administrative burden.

- Employed physicians (hospital or health system) often receive more predictable salary structures, RVU-based compensation, or hybrid models with bonuses.

- Academic medicine typically pays less in base salary but may offer job stability, benefits, and academic/research opportunities.

Geographic Location

- Urban centers with high cost of living may provide higher nominal salaries, but not necessarily better real purchasing power.

- Rural or underserved areas sometimes offer higher salaries, loan repayment incentives, and signing bonuses to attract physicians.

- State-level Medicaid rates and local payer mix (commercial vs. public insurance) also influence compensation.

Experience and Career Stage

- Entry-level attending salaries (post-residency/fellowship) are lower but often increase with years in practice, productivity, and leadership roles.

- Senior physicians may see slower salary growth but can benefit from partnership status, profit-sharing, or administrative positions.

National Averages: The Numbers Behind Physician Pay

Physician compensation surveys (e.g., Medscape, MGMA, Doximity) consistently show six-figure incomes, but the headline numbers can be misleading if you ignore inflation.

For context (round figures, recognizing annual variability):

- Overall average physician salary in the U.S. has often been reported in the low-to-mid $300,000 range in recent years.

- Primary care physicians frequently fall in the $230,000–$280,000 range.

- Specialists often earn between $350,000–$600,000+, with highly paid fields (like orthopedics or interventional cardiology) exceeding that.

These numbers might look impressive in isolation, but they must be interpreted through the lens of inflation, high training debt, and delayed entry into the workforce compared with other professions.

Inflation and Healthcare: The Erosion of Real Income

What Is Inflation and Why Should Physicians Care?

Inflation is the sustained increase in the general price level of goods and services over time. When inflation is high, each dollar buys less than it did before—your real income (purchasing power) declines unless your salary grows at least as fast.

For physicians, inflation affects:

- Housing costs (rent or mortgages)

- Childcare and education expenses

- Malpractice premiums and practice overhead (for private practice)

- Health, disability, and life insurance costs

- Everyday living expenses—food, transportation, services

You might receive a contract renewal with a 2–3% raise and feel you’re progressing financially—but if inflation is running at 5–7%, your real income is falling.

Recent U.S. Inflation Trends: Context for the Medical Profession

Over the past decade, inflation has not been static:

- 2013–2019: Generally stable, often around 1.5–2.5% per year.

- 2020: Lower inflation (~1–2%) due to pandemic-related economic slowdown.

- 2021–2022: Inflation spiked significantly, at times exceeding 7–8%, driven by:

- Supply chain disruptions

- Housing market surges

- Labor shortages

- Fiscal and monetary policy responses to COVID-19

- 2023–2024: Inflation moderated but remained above the Federal Reserve’s 2% target at various points, keeping cost-of-living pressures elevated.

Why Medical Professionals Are Particularly Vulnerable

Physicians often face several structural disadvantages when it comes to inflation:

- Delayed earning: Training can extend into your early to mid-30s (or beyond), meaning fewer total years of high earning and compounding investment growth.

- Fixed contracts: Many physicians are locked into 1–3 year employment contracts with predetermined raises that may not adjust for unexpected inflation surges.

- Regulated reimbursement: Physician pay is tightly linked to Medicare, Medicaid, and insurance reimbursement structures that do not move quickly with inflation.

This combination makes it especially important for physicians to understand how inflation interacts with salary growth.

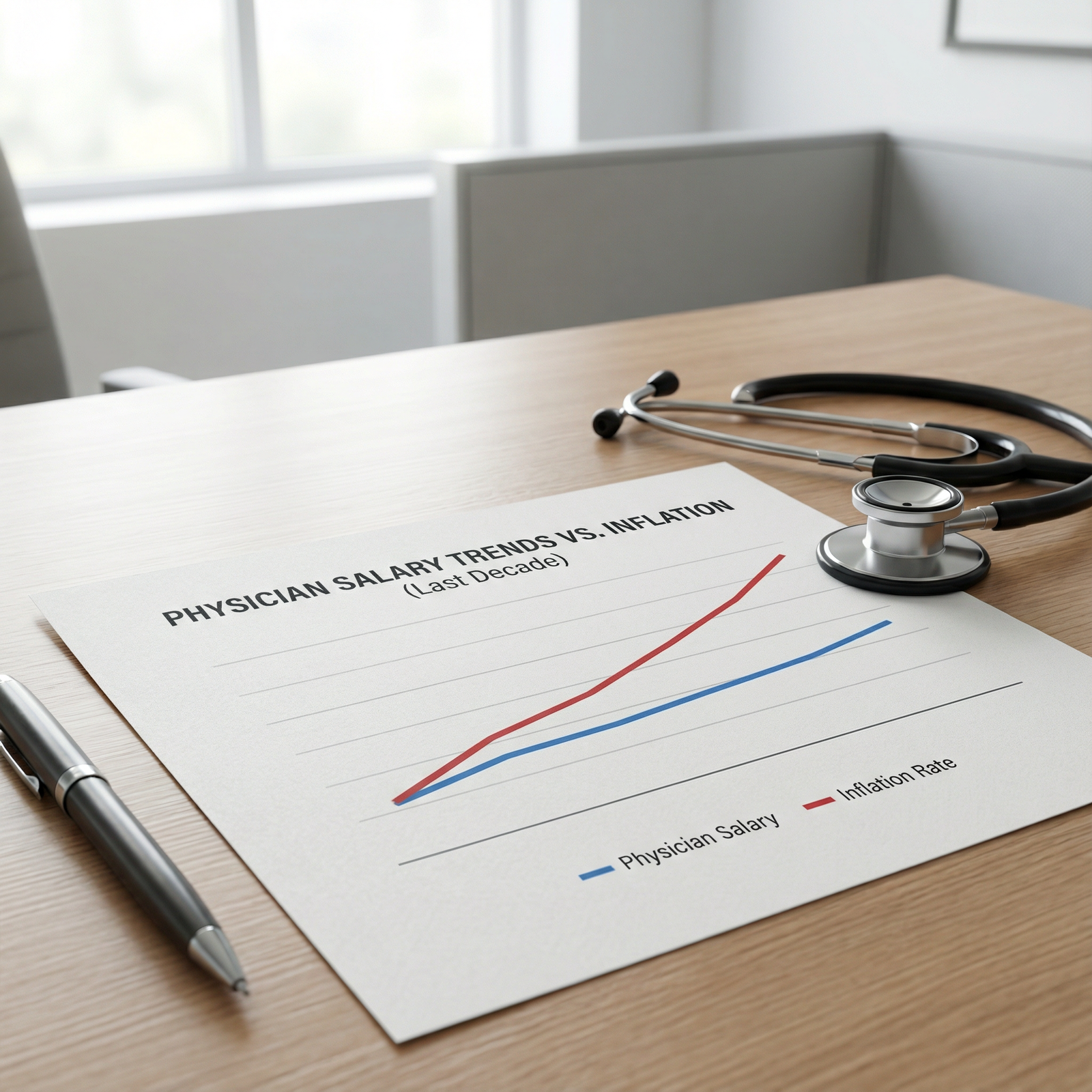

Are Physician Salaries Actually Keeping Up With Inflation?

Comparing Nominal vs. Real Physician Salaries

When talking about physician salaries, it’s essential to distinguish between:

- Nominal salary: The actual dollar amount you earn (e.g., $300,000 per year).

- Real salary: Your income adjusted for inflation—what those dollars can actually buy compared to prior years.

A 3% raise in a year where inflation is 7% means your nominal income rose, but your real income dropped by roughly 4%.

Recent compensation reports have noted:

- Annual salary increases in many specialties have often been in the 1–4% range.

- In high-inflation years, these increases were insufficient to maintain previous purchasing power.

- Over a 10-year horizon, some high-demand specialties have outpaced inflation, while many primary care and cognitive fields have only barely kept up—or lagged behind.

Specialty-Level Examples: Winners, Losers, and the Middle

Internal Medicine (General Adult Medicine)

- Typical compensation in the mid-$200,000s for many regions.

- In years when inflation has surged, modest annual raises (e.g., 2–3%) have often failed to match price increases, leading to:

- Stagnant or declining real income

- Increased financial stress in high-cost-of-living areas

- Challenges repaying significant education debt while supporting a family

Orthopedic Surgery

- Commonly cited compensation in the $500,000+ range.

- Some periods have seen salary growth at or above inflation, depending on:

- Productivity incentives

- Payer mix and local market

- Procedural volume and subspecialty practice (e.g., spine vs. sports)

- While these physicians may experience better protection against inflation, they are not immune—particularly as hospitals and payers scrutinize high-cost procedures.

Primary Care vs. Procedure-Heavy Specialties

- Primary care:

- Often experiences smaller annual raises.

- More dependent on RVU-based compensation in a system that historically undervalues cognitive work.

- Particularly vulnerable to inflation, especially without robust bonuses or incentives.

- Procedural specialties:

- May be better able to leverage productivity and case volume.

- Still face downward pressure from payers and potential changes in fee schedules.

The bottom line in current healthcare economics: not all physician salaries are created equal when it comes to keeping up with inflation, and primary care commonly bears the brunt of this imbalance.

Debt, Delayed Earnings, and Long-Term Financial Wellbeing

The Burden of Medical Education Debt

Most new physicians start their careers heavily indebted:

- Median medical school debt commonly falls around $200,000 or more.

- Many also carry:

- Undergraduate loans

- Credit card or personal debt from training

- Delayed savings for retirement and home ownership

When physician salaries fail to keep pace with inflation, this debt burden becomes even more acute:

- Loan payments consume a larger fraction of income.

- Rising interest rates can increase the cost of borrowing for mortgages and refinancing.

- The ability to build emergency funds, invest, and save for retirement is compromised.

Financial Wellbeing Beyond the Paycheck

Financial wellbeing for physicians is more than a high nominal salary; it encompasses:

- Adequate emergency savings

- Sustainable loan repayment strategies

- Retirement planning (401k/403b, IRAs, defined benefit plans)

- Appropriate insurance coverage (disability, life, malpractice, health)

- Reasonable work–life balance and mental health

If salary growth lags behind inflation, even high-earning physicians may feel “rich on paper, poor in reality”—especially in expensive metropolitan areas where housing, childcare, and taxes consume large portions of income.

Actionable Strategies to Protect Your Financial Future

Physicians at all stages can take concrete steps:

Contract Review and Negotiation

- Seek cost-of-living adjustment (COLA) language or explicit inflation-linked raises where possible.

- Negotiate for sign-on bonuses, relocation assistance, and loan repayment incentives.

- Understand productivity metrics (RVUs, collections) and thresholds before signing.

Debt Management

- Evaluate income-driven repayment (IDR) vs. private refinancing (especially post-training).

- If eligible, consider Public Service Loan Forgiveness (PSLF) or state-specific loan repayment programs.

- Avoid lifestyle inflation—delaying large purchases can dramatically improve financial resilience.

Early and Consistent Investing

- Maximize employer retirement matches (e.g., 401k/403b).

- Invest in low-cost index funds and tax-advantaged accounts.

- Consider working with a fiduciary financial advisor familiar with the medical profession.

Geographic and Practice-Setting Choices

- Compare net purchasing power, not just nominal salaries. A slightly lower salary in a low-cost area may leave you better off than a higher salary in an expensive city.

- Explore hospital-employed vs. private practice structures to see which best aligns with your goals and risk tolerance.

System-Level Consequences: Physician Salaries, Burnout, and Patient Care

Workforce Retention, Burnout, and Specialty Choice

When physician salaries do not keep pace with inflation, the consequences extend beyond individual budgets:

Burnout and moral injury

- Financial stress compounds long hours, administrative burden, and productivity pressures.

- Feeling undercompensated relative to training investment and workload can worsen burnout and decrease job satisfaction.

Specialty selection trends

- Medical students may be deterred from lower-paying fields, especially primary care, pediatrics, and psychiatry, despite high societal need.

- This can widen workforce shortages and maldistribution of care.

Attrition and early retirement

- Mid-career and senior physicians who feel their real income is eroding may reduce clinical hours, shift to non-clinical roles, or retire earlier than planned.

- This exacerbates access problems, particularly in rural and underserved regions.

The Role of Healthcare Economics and Policy

Physician compensation is closely tied to broader healthcare economics:

Medicare and RVU-based reimbursement

- Physician services are often undervalued compared with hospital and facility fees.

- Office-based, cognitive specialties are particularly affected by stagnant or reduced relative value units (RVUs).

Value-based care and alternative payment models

- As the system shifts from fee-for-service to value-based care, compensation frameworks will continue to evolve.

- There is potential for improved pay in models that reward outcomes and coordination—but also risk if practices are not well-structured to benefit from these systems.

Advocacy and professional organizations

- Groups like the AMA, specialty societies, and state medical associations lobby for:

- Updating reimbursement schedules

- Protecting physician compensation from across-the-board cuts

- Adjusting payment structures in line with inflation and increased practice expenses

- Groups like the AMA, specialty societies, and state medical associations lobby for:

Engagement in professional organizations and awareness of healthcare policy are increasingly important for physicians concerned about long-term financial wellbeing and sustainability of the medical profession.

Looking Ahead: The Future of Physician Salaries in an Inflationary World

Trends to Watch

For medical trainees and practicing physicians, several evolving trends will shape the future of compensation:

- Ongoing consolidation of hospitals and group practices, which can reduce individual bargaining power but may stabilize income.

- Telemedicine and digital health, which could open new revenue streams but may also face downward reimbursement pressure.

- Non-traditional career paths (consulting, pharmaceutical/biotech, health tech, administration) offering alternative or supplemental income.

- Shifts in patient demographics and population health needs, potentially increasing demand in geriatrics, primary care, and behavioral health.

What You Can Do at Each Stage of Training

Medical Students

- Factor repayment, likely income, and lifestyle into specialty choice—but don’t let salary be the only driver.

- Learn the basics of healthcare economics, physician contracts, and personal finance early.

Residents and Fellows

- Treat this as a low-income but high-opportunity period to build financial literacy.

- Start retirement contributions if at all possible, even modestly.

- Use moonlighting strategically, balancing financial needs with burnout risk.

Early-Career Attendings

- Be deliberate about lifestyle creep—your first few years of attending income are crucial for debt reduction and investing.

- Revisit your contract regularly and benchmark your compensation against national and regional data.

- Consider side income (locums, telemedicine, consulting) if aligned with your priorities.

FAQs: Physician Salaries, Inflation, and Your Financial Stability

Q1: How can I tell if my physician salary is really keeping up with inflation?

To evaluate this, compare your year-over-year salary increase to the annual inflation rate (e.g., CPI data). If your salary grew by 2% but inflation was 5%, your real income effectively decreased by about 3%. Online inflation calculators can help you convert past salaries into present-day dollars, giving you a clearer sense of whether your purchasing power has improved or worsened.

Q2: Are some medical specialties better protected from inflation than others?

Yes. In general, procedure-heavy specialties (e.g., orthopedics, cardiology, gastroenterology) often have more room to increase productivity and income, and may have seen compensation that keeps pace with or exceeds inflation in certain periods. Primary care and cognitive specialties (e.g., internal medicine, family medicine, pediatrics, psychiatry) tend to have slower salary growth and are more susceptible to real income erosion when inflation rises rapidly.

Q3: What practical steps can I take during residency and early attending years to offset inflation’s impact?

- Live below your means during the transition from trainee to attending—avoid rapid lifestyle inflation.

- Prioritize high-interest debt repayment and begin retirement investing as early as feasible.

- Educate yourself on basic investing, retirement accounts, and student loan strategies.

- Negotiate first contracts carefully (sign-on bonus, relocation, loan assistance, and COLA where possible).

- Consider geographic regions or practice settings where your net purchasing power—not just salary—is maximized.

Q4: How can advocacy and policy changes improve physician financial wellbeing?

Organized medicine can influence healthcare economics in several ways:

- Lobbying to update and protect physician reimbursement under Medicare and other payers.

- Advocating for inflation-adjusted payment schedules and fair valuation of cognitive services.

- Supporting loan forgiveness, repayment programs, and GME funding to ease debt burdens.

- Pushing for reforms that reduce administrative burden and allow physicians to focus more on care and less on paperwork.

Participation in local and national medical societies gives physicians a voice in these discussions and can help shape a more sustainable financial future for the profession.

Q5: If physician salaries are high compared with other professions, why is inflation still such a concern?

Even though physicians often earn high nominal salaries, they face:

- Large educational debt and many years of training with limited income.

- Entry into peak earning years later than most professions, reducing total years of high earning and investing.

- Elevated costs related to licensure, malpractice, and continuing education.

- High costs of living in areas where major medical centers are concentrated. When inflation is high and compensation doesn’t keep pace, these factors combine to significantly impact long-term financial wellbeing, retirement readiness, and overall quality of life—even for high-income physicians.

Understanding how physician salaries intersect with inflation is critical for navigating your career, making informed financial decisions, and advocating for a fair and sustainable healthcare system. By staying informed, negotiating thoughtfully, and planning proactively, you can better protect your real income and long-term financial stability in an evolving medical landscape.