Understanding Malpractice Risk in Cardiothoracic Surgery

Cardiothoracic surgery is one of the most high‑stakes fields in medicine. You work on the heart, lungs, and major vessels; patients are often critically ill; and complications can be catastrophic even when care is excellent. This combination drives some of the highest malpractice risk and highest premiums in all of clinical practice.

For residency applicants and trainees, malpractice insurance can feel like a distant, “attending‑only” issue. In reality, your decisions about training programs, fellowships, and eventual practice structure are all tied to how medical liability insurance works—especially in a field where claims can involve long operative times, complex postoperative courses, and multi-million‑dollar payouts.

This guide is tailored to those pursuing a cardiothoracic surgery residency or fellowship and early‑career cardiothoracic surgeons. You’ll learn:

- What malpractice insurance is and why CT surgeons need robust coverage

- How claims made vs occurrence policies differ and why it matters

- How coverage works during residency, fellowship, and early practice

- Typical policy limits and cost drivers in heart surgery training and practice

- Practical steps to protect yourself—legally, financially, and professionally

Basics of Malpractice Insurance for Cardiothoracic Surgeons

What is Medical Malpractice Insurance?

Medical malpractice insurance is a type of professional liability insurance that protects clinicians and institutions when a patient alleges harm due to medical negligence or error. It typically pays for:

- Legal defense (attorneys, expert witnesses, court costs)

- Settlements or judgments (up to policy limits)

- Certain administrative and licensing board proceedings (depending on the policy)

For cardiothoracic surgeons, allegations commonly involve:

- Intraoperative complications (e.g., major vessel injury, air embolism, retained foreign objects)

- Postoperative management issues (e.g., missed tamponade, delayed return to OR, failure to anticoagulate or over‑anticoagulation)

- Diagnostic or decision‑making issues (e.g., delay in surgery, inappropriate candidate selection, failure to obtain adequate informed consent)

Even when the care is appropriate, a poor outcome in heart surgery can lead to litigation. Malpractice insurance is not just about guilt or innocence; it is about financial protection in a system where lawsuits are common and expensive.

Why Cardiothoracic Surgery is High-Risk

Several specialty‑specific features increase risk and premiums:

Severity of potential injury

- Death, severe neurologic deficits, organ failure, and prolonged ICU stays are frequent risks.

- Juries and plaintiffs’ attorneys are more likely to pursue cases involving severe and permanent harm.

Clinical complexity

- Multi‑hour operations, complex anatomy, and fragile physiology make adverse events more likely.

- Many cases span multiple teams (CT surgery, anesthesia, cardiology, ICU), complicating liability allocation.

Documentation and communication demands

- Long and complex consent discussions.

- Extensive postoperative notes and multidisciplinary handoffs.

High financial stakes

- Settlements and verdicts involving cardiac surgery can reach multi‑million‑dollar amounts, particularly for young patients with life‑long disability.

As you move through heart surgery training, it’s important to recognize that your specialty choice itself places you in a high‑exposure category. That doesn’t mean you should fear litigation constantly—but you should approach practice with informed consent, careful documentation, and a clear understanding of your coverage as part of your professional toolkit.

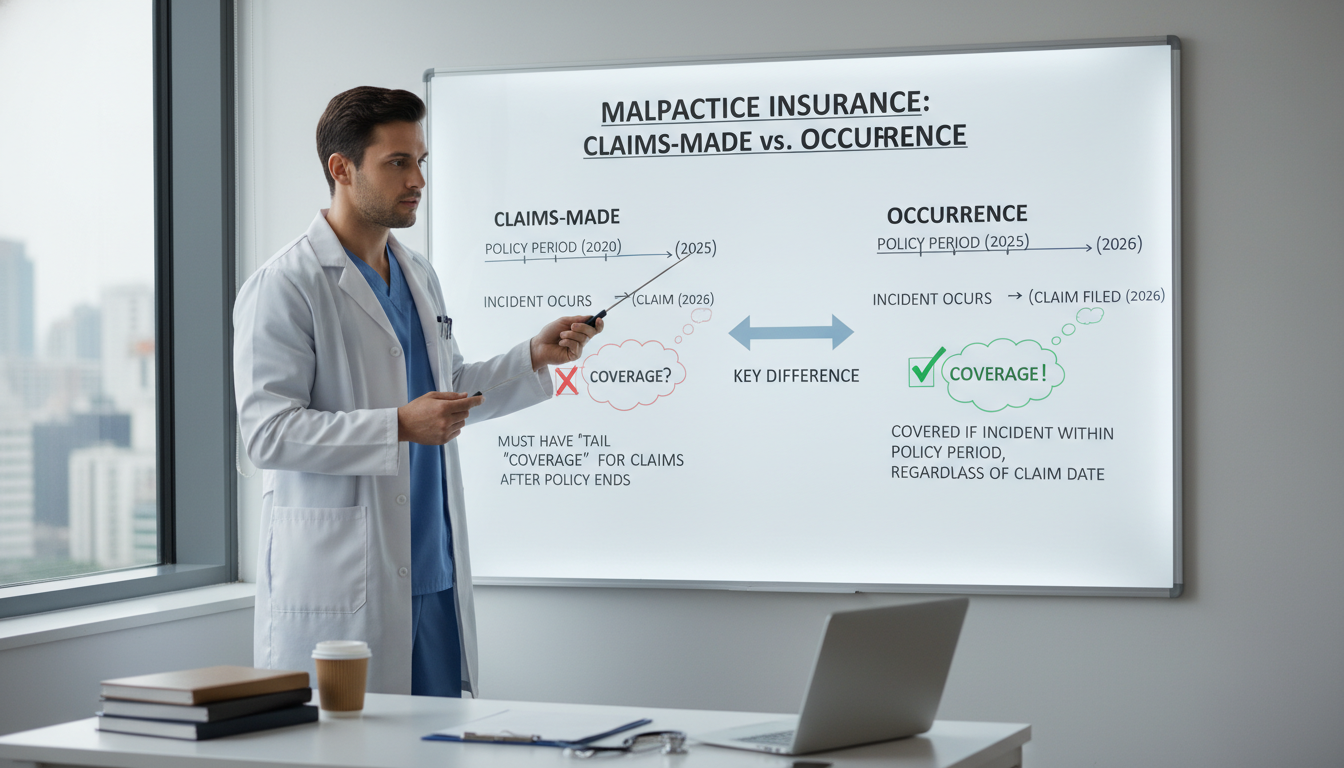

Claims-Made vs Occurrence Policies: What Cardiothoracic Surgeons Must Know

One of the most critical distinctions in medical liability insurance is claims made vs occurrence coverage. This is especially important when you move from a cardiothoracic surgery residency to fellowship, and then to your first attending job.

Occurrence Policies

Occurrence policies cover any incident that occurs during the policy period, regardless of when the claim is filed.

- If you perform a CABG in 2026 while covered by an occurrence policy and the patient sues you in 2030, the 2026 policy responds—even if it is no longer active.

- Once purchased and paid for, each policy year covers you permanently for events in that year.

Pros:

- Simpler to understand; no need for “tail” coverage when you leave a job.

- Long‑term peace of mind—each year of occurrence coverage “locks in” your protection for that year.

Cons:

- Premiums are typically higher per year than comparable claims‑made policies.

- Less commonly offered in some states and hospital systems, especially for high‑risk specialties.

For cardiothoracic surgeons, occurrence policies are appealing due to long latency periods for claims (e.g., complications discovered years later). However, many hospital‑employed surgeons and group practices use claims‑made forms instead.

Claims-Made Policies

Claims‑made policies cover you for claims that are both:

- Filed during the time the policy is in force, and

- Arise from incidents that occurred after the policy’s retroactive date.

The retroactive date is usually your hire date or the date your coverage began with that insurer.

Example:

- You start at Hospital A on July 1, 2028, with a claims‑made policy (retroactive date: 7/1/2028).

- You leave Hospital A on June 30, 2032.

- A patient from 2029 sues you in 2033.

If you did nothing else, the 2033 lawsuit would not be covered—because the policy ended in 2032. To stay protected, you need tail coverage or new coverage that honors your retroactive date.

Tail Coverage (Extended Reporting Endorsement)

Tail coverage allows you to report claims after your main claims‑made policy ends, for incidents that occurred during that policy period.

- Often required when you leave a practice, retire, or change insurers.

- Can be expensive—commonly 150–250% of your last annual premium for that policy.

- Usually a one‑time purchase that protects you indefinitely for that prior period.

For cardiothoracic surgeons, tail coverage costs can be tens of thousands of dollars or more, particularly in high‑risk states. Negotiating who pays for tail is a crucial part of your first attending contract.

Nose Coverage (Prior Acts Coverage)

When you join a new practice, your new insurer might agree to cover your prior acts—essentially assuming the liability for incidents that occurred while you were covered elsewhere but are now being claimed.

- This is sometimes called “nose coverage.”

- The new insurer sets a retroactive date that matches your original one.

- This can be an alternative to purchasing tail from your old insurer.

Why Claims-Made vs Occurrence Matters to Trainees

During residency and fellowship, your institution almost always provides group coverage. But as you transition to independent practice:

- Understand whether your job offers claims‑made vs occurrence coverage.

- If claims‑made, clarify who is responsible for funding tail coverage if you leave—you, the group, or the hospital.

- Ask specifically, in writing, about:

- Retroactive date

- Tail terms upon termination (with or without cause)

- Effects of retirement, disability, or death

This is one of the most financially consequential parts of a cardiothoracic surgeon’s first employment contract.

How Coverage Works in Cardiothoracic Surgery Residency and Fellowship

Are Residents and Fellows Personally Covered?

In almost all ACGME‑accredited cardiothoracic surgery residency and fellowship programs, your:

- Malpractice insurance is provided by the sponsoring institution (hospital or university system).

- Coverage is automatic and mandatory—you do not need to buy your own policy separately for your residency clinical work.

The coverage typically applies to:

- All patient care within the scope of your training program

- Rotations at affiliated hospitals or clinics listed in your program

- Most supervised moonlighting done under institutional arrangements (check your GME policies)

However, policy terms, limits, and structures differ by institution.

Occurrence vs Claims-Made in Training Programs

Residency and fellowship programs may use either:

- Occurrence coverage – common for large academic centers and teaching hospitals

- Claims‑made coverage with institutional tail – the hospital maintains group policies and takes responsibility for any needed tail coverage if they switch carriers

From your perspective as a trainee:

- You typically do not buy your own tail coverage for residency work.

- The institution’s coverage, including any tail needs, is usually handled at the GME or risk‑management level.

Still, it’s wise to ask your GME office:

- What are the policy limits for residents and fellows?

- Is the coverage occurrence or claims‑made?

- Does it include legal defense for board complaints or only civil lawsuits?

Coverage for Moonlighting and Outside Work

If you do moonlighting—inside or outside the training institution—be very clear about coverage:

- Internal moonlighting (within your hospital system) is often covered by the same institutional policy, but confirm in writing.

- External moonlighting may require separate malpractice insurance:

- Some facilities provide you with coverage under their policy.

- In other cases, you must purchase an individual policy.

For cardiothoracic residents and fellows, moonlighting often occurs in:

- General surgery call pools

- Surgical ICU coverage

- Emergency department procedure coverage

You should never perform procedures (central lines, chest tubes, emergent thoracotomies) without knowing how medical liability insurance applies in that setting.

What Happens if You’re Named in a Lawsuit as a Trainee?

Even as a resident or fellow, you may be named in a lawsuit, typically along with:

- Attending surgeons

- Hospital systems

- Other clinicians involved in the case

In such a situation:

- Your institution’s policy should assign you legal representation.

- Defense costs (attorneys, depositions, expert witnesses) are covered up to policy terms.

- Settlements or judgments are generally paid by the hospital’s malpractice insurer, not out of your personal assets.

Although unfavorable outcomes are stressful, you are rarely financially exposed as a trainee unless you acted far outside the scope of your role or engaged in intentional misconduct. Nonetheless, you must:

- Notify risk management or your program director immediately if you receive any legal documents.

- Never alter the chart or communicate with the plaintiff’s attorney directly.

- Follow institutional instructions carefully.

Policy Limits, Costs, and Typical Structures in Cardiothoracic Surgery

Typical Policy Limits

In the U.S., a common structure is:

- $1 million per claim / $3 million aggregate per year (often shortened to “1/3”)

Some states, hospital systems, or carriers require higher limits, such as:

- $2 million / $4 million

- $5 million / $5 million (less common but seen in certain high‑risk environments)

For cardiothoracic surgeons—especially those doing high‑volume, high‑risk cases such as complex adult cardiac, aortic surgery, or transplant—higher limits may be beneficial, or mandated by the hospital.

Cost Drivers for Cardiothoracic Surgeons

Malpractice premiums for CT surgeons can be substantial. While residents and fellows typically do not see these bills, attendings must budget for them. Key factors include:

Geographic location

- States with high litigation rates and large verdicts (e.g., certain parts of New York, Florida, Pennsylvania) have higher premiums.

- States with strong tort reform may have more moderate costs.

Practice type

- Solo or small‑group private practice often bears higher per‑surgeon premiums.

- Large hospital‑employed groups may negotiate better group rates.

Clinical scope

- High‑risk procedures (redo sternotomies, complex aortic reconstructions, LVADs and transplants) may increase risk profile.

- Mixed practices (cardiac + thoracic + structural heart procedures) can add complexity to rating.

Claims history

- Multiple past claims or large payouts can lead to surcharges or coverage restrictions.

- Clean records over years can attract discounts (often after 5–10 years of practice).

Policy structure

- Claims‑made premiums “step up” over the first 4–5 years as your risk of new claims accumulates.

- Occurrence policies avoid step‑up but start with higher annual prices.

Shared Limits vs Individual Limits

Some group policies assign shared limits:

- One large limit per policy year for the entire group or for all surgeons at a particular hospital.

Others assign individual limits:

- Each surgeon has a specified per‑claim and aggregate limit.

As you approach graduation, learn to:

- Ask whether coverage is individual or shared.

- Understand whether co‑defendants (hospital, other surgeons) may compete for the same pool of funds in a catastrophic case.

This detail is rarely discussed in medical school or residency, but it’s valuable to understand before signing a contract.

Practical Risk Management for Residents and Early-Career CT Surgeons

Malpractice insurance is your financial backstop, but your first line of defense is how you practice. The same habits that improve patient outcomes also reduce legal exposure.

1. Master Informed Consent

For cardiothoracic surgery, informed consent is both clinically and legally vital.

Key elements:

- Clearly explain the indication for surgery: Why is this CABG, valve replacement, or aortic repair needed now?

- Discuss alternatives, including non‑surgical management when appropriate.

- Spell out specific risks relevant to CT surgery:

- Death

- Stroke and neurologic injury

- Myocardial infarction

- Renal failure and dialysis

- Prolonged ventilation or tracheostomy

- Re‑operation for bleeding or graft failure

- Infection, including mediastinitis

- Assess understanding: Ask the patient (or surrogate) to repeat the plan in their own words.

- Document thoroughly:

- Who was present (patient, family, interpreter)

- Key risks discussed

- Opportunity for questions and patient’s expressed understanding

Poorly documented consent is a common point of attack in cardiac surgery lawsuits, even when the technical work was defensible.

2. Communicate Clearly and Early—Especially When Things Go Wrong

Adverse events are inevitable in a high‑acuity specialty.

Helpful practices:

- Early disclosure: Let patients and families know about complications promptly and honestly. Many institutions support “disclosure and apology” frameworks.

- Use the team: Involve your attending, risk management, and sometimes patient relations when delivering difficult news.

- Avoid speculation in the chart: Chart the facts and your clinical reasoning; avoid accusatory language or assigning blame to other providers.

Patients who feel misled or abandoned are more likely to pursue litigation, even when the complication was a known and unavoidable risk.

3. Document Like a Future Surgeon, Not Just a Trainee

Cardiothoracic surgery demands especially strong documentation:

- Pre‑op notes: Risk stratification, prior cardiac history, imaging review, multidisciplinary discussions (e.g., heart team meetings).

- Operative reports:

- Clear description of anatomy, findings, and technical steps.

- Any intraoperative complications and management.

- Flow of the case (e.g., cross‑clamp times, bypass duration).

- Post‑op notes:

- Early postoperative status, ICU handoff details.

- Daily progress, rationale for interventions or watchful waiting.

- Prompt documentation of deterioration or concern—and your actions.

From a legal standpoint, “if it isn’t documented, it’s much harder to defend.” As you progress in heart surgery training, treat your notes as if a future attorney, judge, or jury might read them.

4. Understand and Use Institutional Support Systems

Know your hospital’s:

- Risk management office – how to contact them if you anticipate a potential claim.

- Incident reporting system – where to document near‑misses or sentinel events.

- Policies on disclosure and apology – many institutions provide scripts and legal support.

As a trainee:

- Loop in your attending or program director early if something concerning happens.

- Never respond to legal correspondence alone—always involve the institution.

5. Protect Your Future Insurability

As you move from residency to fellowship to your first job:

- Keep personal records of:

- Academic and clinical appointments

- Any formal complaints or investigations and their resolutions

- Lawsuits, even if you were dismissed or not at fault

When applying for privileges or insurance later, you must disclose prior claims honestly. Attempting to hide past cases can jeopardize your license, privileges, and coverage more than the claim itself.

Key Takeaways for Cardiothoracic Surgery Trainees

For those in or considering a cardiothoracic surgery residency and eventual practice:

- Your specialty carries significant malpractice risk, reflected in premium costs and litigation exposure.

- Understand the difference between claims made vs occurrence policies—especially as you transition to attending practice.

- During training, you’re typically covered by institutional medical liability insurance; nonetheless, always verify coverage for outside work.

- As an attending, negotiate your contracts carefully:

- Policy type

- Limits

- Who pays for tail coverage

- What happens if you leave or the group dissolves

- Practice strong risk management:

- High‑quality consent

- Clear and honest communication

- Meticulous documentation

- Use of institutional support in adverse events

Approach malpractice coverage as a core professional competency, not an afterthought. Knowing how your insurance works allows you to focus your energy where it belongs—providing excellent, compassionate, technically superb care to some of the sickest patients in medicine.

FAQ: Malpractice Insurance in Cardiothoracic Surgery

1. Do I need my own malpractice insurance during cardiothoracic surgery residency or fellowship?

In almost all accredited programs, no—your hospital or university provides malpractice coverage for your residency and fellowship activities. You may need separate coverage if you participate in external moonlighting that is not explicitly covered by your training institution. Always confirm in writing with your GME office and any outside facility.

2. What is the difference between claims-made and occurrence coverage for CT surgeons?

- Occurrence coverage protects you for any incident that happens during the policy period, regardless of when the claim is filed. No tail is needed when you leave.

- Claims‑made coverage protects you only if the claim is made while the policy is active and the incident occurred after your retroactive date. When you leave a job, you usually need tail coverage or new coverage that picks up prior acts. This distinction is crucial for cardiothoracic surgeons due to the high cost of tail coverage.

3. How much malpractice insurance coverage do cardiothoracic surgeons usually carry?

A common minimum in the U.S. is $1 million per claim / $3 million aggregate per year, though this varies by state, hospital, and insurer. Some high‑risk environments or systems may require higher limits (e.g., 2/4 or 5/5). As you approach independent practice, ask your employer, hospital, or insurer what limits are typical and whether they meet credentialing and hospital‑bylaw requirements.

4. What should I look for regarding malpractice insurance in my first attending contract?

Key points to clarify in writing:

- Type of policy: claims‑made vs occurrence

- Policy limits: per claim and annual aggregate

- Tail coverage:

- Who pays if you leave, retire, or are terminated?

- Is tail guaranteed in the contract?

- Retroactive date (for claims‑made)

- Whether coverage includes:

- Board complaints and administrative hearings

- Legal representation in licensing matters

- Shared vs individual limits within the group

Given the high stakes in cardiothoracic surgery, consider having an experienced healthcare attorney review your contract before signing.

Category: RESIDENCY_APPLICATIONS

Phase: RESIDENCY_MATCH_AND_APPLICATIONS

Specialty Context: Cardiothoracic Surgery