Understanding Malpractice Insurance in Emergency Medicine

Emergency medicine (EM) sits at the intersection of high acuity, rapid decision-making, and limited information. That combination makes emergency physicians uniquely vulnerable to malpractice claims. Whether you’re a medical student applying to emergency medicine residency, an intern signing your first contract, or a senior resident evaluating job offers, understanding malpractice insurance is essential for both career planning and financial protection.

This guide focuses on how malpractice insurance works specifically in emergency medicine, how it intersects with the EM match and your early career choices, and what you should know about claims made vs occurrence policies, medical liability insurance basics, and malpractice insurance terminology.

1. Why Malpractice Insurance Matters So Much in Emergency Medicine

Emergency physicians face distinct risk factors:

- Patients are often undifferentiated and unstable.

- You may have incomplete histories and no prior records.

- Time pressure and overcrowding can affect documentation.

- You frequently treat high-risk conditions (MI, stroke, sepsis, trauma, ruptured aneurysm, etc.).

- Many patients are “one-time” encounters, limiting continuity of care.

Common Types of EM Malpractice Allegations

While details vary, several patterns recur in EM malpractice claims:

- Failure to diagnose or delayed diagnosis

- Missed myocardial infarction

- Missed stroke or TIA

- Missed appendicitis, testicular torsion, ectopic pregnancy, sepsis

- Failure to treat or delayed treatment

- Delays in antibiotics, anticoagulation, reperfusion, or surgical consultation

- Inadequate workup

- Not ordering imaging or labs that a jury believes were “obvious”

- Poor documentation or communication

- Inadequate discharge instructions

- Failure to document clinical reasoning and shared decision-making

- Procedural complications

- Central line injuries, intubation complications, missed foreign bodies, sedation events

Even when care is appropriate, the ED is a frequent venue for litigation because it is often where serious conditions first present or worsen.

Why This Matters for Residents and Applicants

As you move through the emergency medicine residency training pipeline, malpractice coverage will shift:

- As a student: You’re usually covered by your medical school or rotation site.

- As a resident: The residency program or health system typically provides coverage—but details may differ.

- As an attending: You’ll need to critically evaluate malpractice terms in every contract.

Understanding these concepts now will help you:

- Ask intelligent questions on interview days.

- Compare residency programs and jobs more accurately.

- Avoid costly surprises later (especially regarding tail coverage).

2. Core Concepts: Medical Liability Insurance Basics

What Is Medical Liability (Malpractice) Insurance?

Medical liability insurance—commonly called malpractice insurance—protects you against financial costs when a patient (or family) alleges that your care caused harm. It typically covers:

- Defense costs: Attorney fees, expert witnesses, legal expenses

- Settlements: Negotiated resolution before or during trial

- Judgments: Court-ordered payments if you lose a trial (up to policy limits)

Policies usually specify:

- Per-claim limit (e.g., $1 million per incident)

- Aggregate limit (e.g., $3 million total per policy year)

For emergency physicians, limits like $1M / $3M or $2M / $4M are common in many regions, but this can vary by state and employer.

Who Buys the Policy?

Depending on your situation, malpractice insurance may be:

- Employer-provided

- Academic medical centers

- Hospital-employed emergency physician groups

- Large democratic/independent EM groups

- Self-purchased

- Some independent contractor arrangements

- Locums tenens work

- Side jobs or moonlighting (if not covered by your primary employer)

As a resident, your malpractice is usually:

- Paid for by your hospital or university.

- Limited to activities within the scope of your residency training.

- Sometimes extended to approved moonlighting—but not always.

Always clarify whether your resident policy covers:

- In-hospital moonlighting

- External moonlighting

- Volunteer activities (e.g., sporting events, free clinics)

Claims Frequency in Emergency Medicine

EM is often labeled “high-risk,” but that doesn’t mean every physician gets sued. Many emergency physicians complete their careers with few or no claims, yet the probability of facing at least one claim over a career is substantial.

Implications for you:

- You must practice and document as if your charts could be examined years later.

- You should choose malpractice coverage that recognizes the unique risk profile of the ED.

- During the EM match and job search, institutional risk culture and support (e.g., risk management, legal support, documentation training) are as important as raw coverage limits.

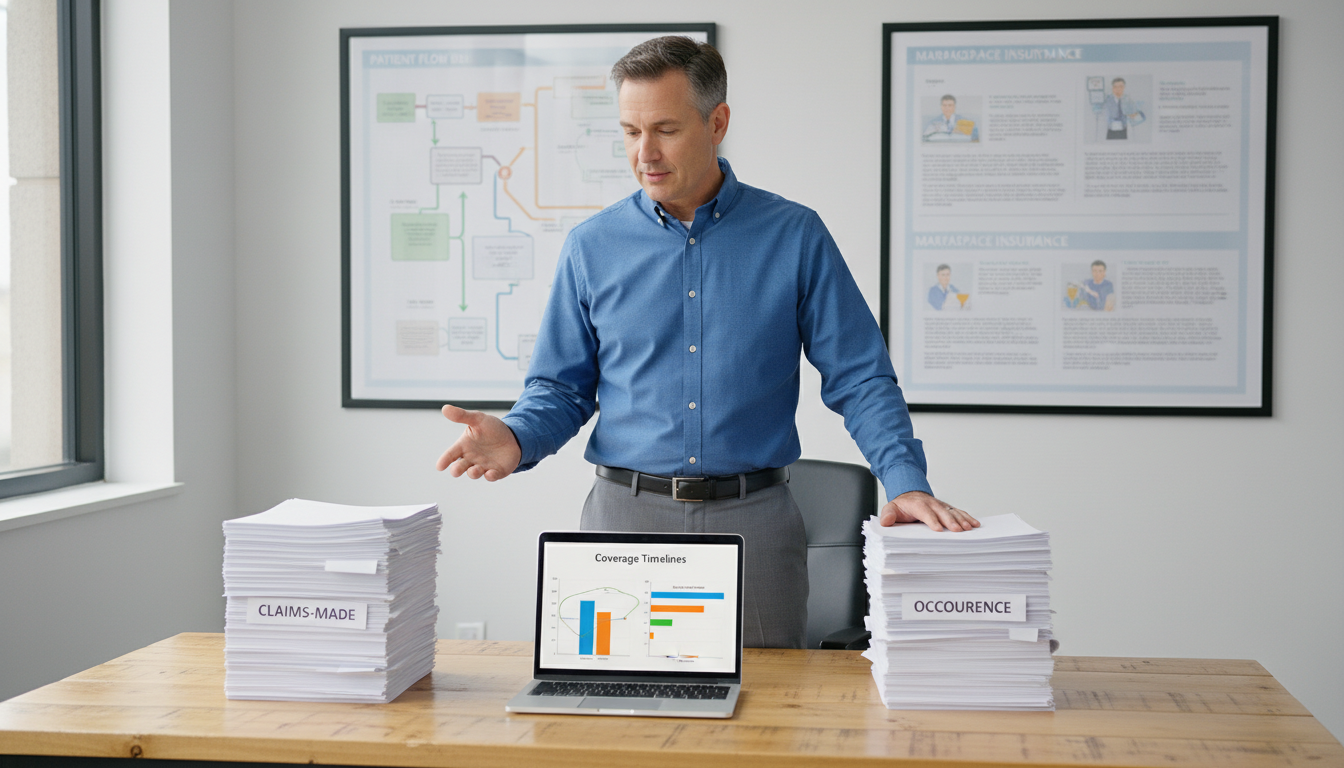

3. Claims-Made vs Occurrence: The Most Important Distinction

When evaluating malpractice policies, the claims made vs occurrence distinction is crucial. It affects your coverage today and your future financial obligations—especially when you change jobs or move states.

Occurrence Policies

An occurrence policy covers any claim for an incident that occurred during the policy period, regardless of when the claim is made.

- Incident happens in 2025 while you are covered.

- Patient sues in 2030.

- Your 2025 occurrence policy responds, even though the policy is no longer active.

Key features:

- No need to buy “tail” coverage when you leave.

- Typically more expensive in annual premium than claims-made, especially in early years.

- Less common in high-risk states and specialties but still used by some large systems.

For a new attending, an occurrence policy is simple and protective: once the year is over, you’re permanently covered for events that occurred in that year.

Claims-Made Policies

A claims-made policy covers you only if:

- The incident occurred after the policy’s retroactive date, and

- The claim is filed while the policy is active.

Example:

- You start with Employer A in 2025; your policy with them is claims-made, retroactive date 7/1/2025.

- You leave Employer A in 2028.

- A patient treated in 2027 sues in 2030.

If you do nothing when you leave Employer A, you might have no coverage for that 2027 care, because:

- The claim is made after your policy ended.

- You don’t have an active policy to respond to it.

Solution: Tail coverage.

What Is Tail Coverage?

Tail coverage (also called extended reporting endorsement) extends the period during which claims can be reported after a claims-made policy ends.

- It does not cover new incidents after you leave.

- It covers new claims about past care that occurred while the policy was active.

Tail is usually:

- A one-time purchase when you terminate or move.

- Sometimes inexpensive, often very expensive (e.g., 150–250% of your final annual premium).

- Potentially tens of thousands of dollars or more for EM attendings, depending on state and risk profile.

Prior Acts (“Nose”) Coverage

An alternative to tail is prior acts (or “nose”) coverage:

- Your new employer’s claims-made policy assumes coverage for your past exposure back to a certain retroactive date.

- This can make it unnecessary to buy tail from your old carrier.

Whether this is available depends on:

- The new employer’s insurer and policy rules.

- State regulations and the continuity of your work history.

Residents and the Claims-Made vs Occurrence Issue

For residents in emergency medicine residency, this usually plays out more simply:

- Your program’s malpractice policy (often occurrence, sometimes claims-made with institutional tail) typically covers residency care indefinitely.

- You generally do not personally purchase tail coverage for residency work.

However, problems can arise if you:

- Moonlight under separate contracts with separate policies.

- Take on outside shifts that require you to carry your own policy.

Always clarify who pays for tail coverage in any moonlighting agreement. A poorly structured part-time role as a resident could leave you with substantial tail obligations later.

4. What Residents and New Attendings Should Look For in Malpractice Coverage

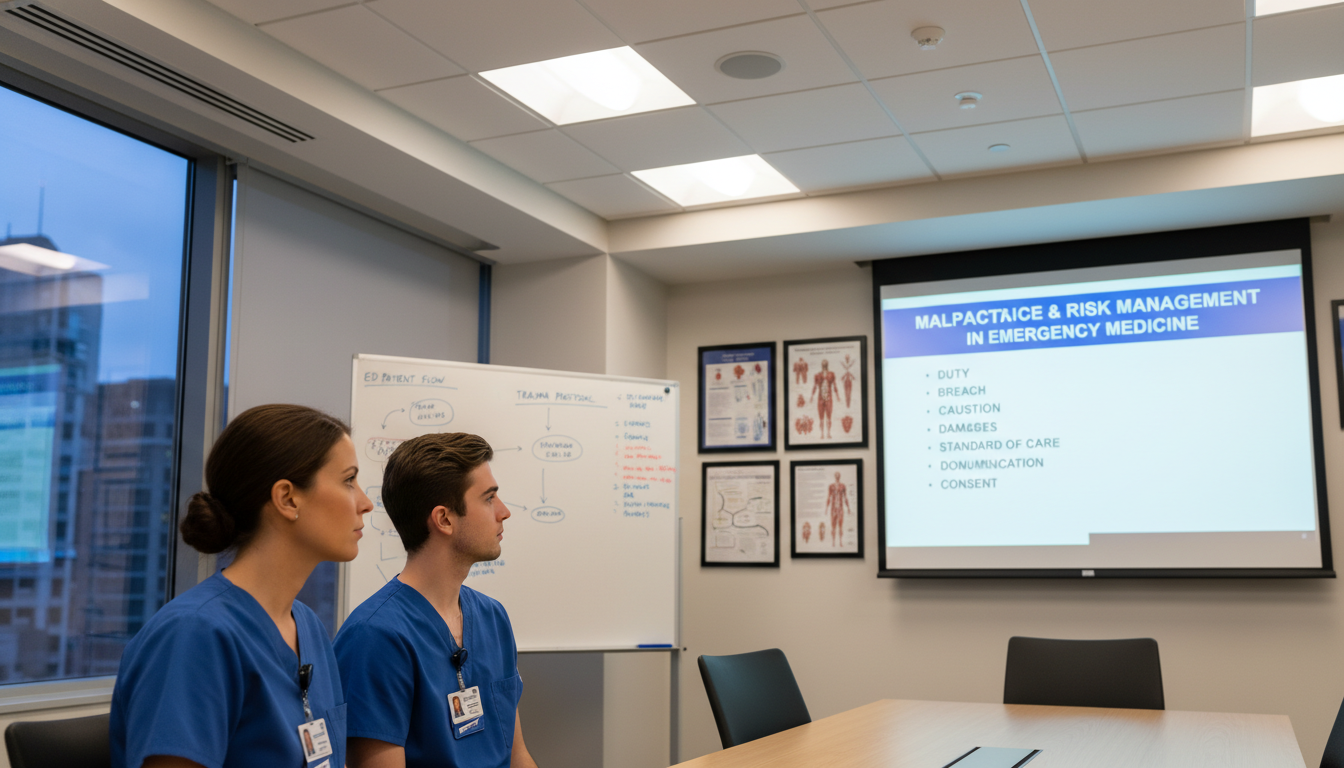

During the EM Match: Questions to Ask Programs

When interviewing for emergency medicine residency positions, you’re not expected to be an insurance expert—but thoughtful questions show maturity and awareness of real-world EM practice.

Consider asking:

What type of malpractice policy covers residents?

- Claims-made or occurrence?

- If claims-made, does the institution provide tail automatically?

What are the coverage limits?

- Typical response: “$1M / $3M”—ask if this applies per resident per incident.

Are residents covered for:

- In-hospital moonlighting?

- External moonlighting?

- Off-site volunteer activities?

How does the program support residents involved in a claim?

- Legal counsel?

- Risk management coaching?

- Psychological support (e.g., second victim programs)?

What risk management training is included?

- Documentation best practices

- Disclosure and apology practices

- Simulation of high-risk scenarios (chest pain, pediatric fever, abdominal pain, etc.)

These questions help you understand not just the policy, but the culture of safety and support where you’ll train.

Evaluating First Job Offers: Key Malpractice Clauses

As you finish residency and evaluate attending contracts, pay close attention to the malpractice insurance section. At a minimum, clarify:

Policy Type

- Claims-made vs occurrence.

- If claims-made, what is the retroactive date?

Who Pays the Premium?

- Fully employer-paid?

- Partially deducted from your compensation?

- Different arrangement for partners vs employees?

Tail Coverage Responsibility

- Does the employer purchase tail if:

- They terminate you without cause?

- You resign?

- The group loses the hospital contract?

- Is tail proportionally covered based on years of service?

- Is there a partnership track that changes tail responsibility?

- Does the employer purchase tail if:

Coverage Limits and Defense

- Per-claim and aggregate limits.

- Does defense cost erode the policy limit (so-called “burning limits”)?

- Do you have the right to consent to settlements, or can the insurer settle without your consent?

Additional Insured & Shared Limits

- Are you sharing a limit with multiple physicians per incident, or do you have your own limit?

Practical Example: Two Job Offers

Job A

- Claims-made policy, $1M/$3M.

- Employer pays premium but you pay 100% of tail if you leave.

- Estimated tail: $45,000–$60,000 after several years.

- No prior acts coverage if you come from a different state.

Job B

- Occurrence policy, $1M/$3M.

- Employer pays premium, no tail.

- Annual salary $20,000 lower than Job A.

While Job B appears to pay less each year, it may be financially safer and more predictable, especially if you’re unsure how long you’ll stay or if the group’s contract with the hospital feels unstable. Understanding these trade-offs is essential before signing.

5. Risk Management Strategies for EM Residents and Early Attendings

Malpractice insurance is your financial backstop; risk management is your first line of defense. Good practices lower your likelihood of a claim and give your defense team a stronger case if you are sued.

Documentation Essentials in the ED

Tell the Story

- Document the patient’s narrative clearly, including time course and key negatives.

- Clearly describe your clinical reasoning: “Concerned for X because Y; however, Z factors reduce likelihood…”

Capture Shared Decision-Making

- Document discussions of risks, benefits, and alternatives:

- “Discussed CT head vs observation; patient prefers observation after risk explanation; return precautions given and understood.”

- Document discussions of risks, benefits, and alternatives:

Discharge Instructions

- Provide clear, written instructions.

- Include:

- Specific warning signs and time frames

- What to do (return to ED vs call PCP)

- Document that you reviewed these with the patient and/or family.

Communication with Consultants

- Note the time of calls, name of consultant, and specific recommendations.

Communication and Empathy

Many malpractice cases begin not solely due to bad outcomes but because families feel ignored, dismissed, or uninformed. In emergency medicine:

- Introduce yourself and your role clearly.

- Make time for a brief “closing conversation” at discharge or admission.

- Avoid minimizing symptoms; acknowledge uncertainty when present.

- When an adverse event occurs, follow institutional policies on disclosure and communication.

Involving Risk Management and Legal Early

If you have:

- An extremely angry or threatening interaction,

- A serious unexpected outcome (e.g., rapid decompensation, death, major miss),

- A family explicitly mentioning “lawyer,” “lawsuit,” or “malpractice,”

Consider:

- Notifying your attending (if you are a resident) and/or your ED leadership.

- Documenting objectively what was said and done.

- Contacting institutional risk management per hospital protocol.

Programs and employers vary, but many will provide:

- Immediate guidance on documentation.

- Coaching on communication with the family.

- Instructions not to alter prior documentation (which can be legally catastrophic).

6. Practical Tips Across the Training-to-Attending Timeline

Medical Students Applying to EM (EM Match Phase)

- Learn basic malpractice vocabulary: medical liability insurance, claims-made vs occurrence, tail coverage.

- During away rotations:

- Clarify what coverage is provided by the institution.

- Understand that you practice under supervision and usually under institutional policies.

While this won’t directly affect your EM match chances, showing awareness of risk management during interviews can signal maturity and readiness for residency.

EM Residents

Review your GME contract for:

- Type of malpractice coverage.

- Extent of coverage (training vs moonlighting).

- Any conditions for external clinical work.

Before you moonlight:

- Determine if the site covers you under their policy.

- Clarify whether it’s claims-made or occurrence.

- Get in writing who pays for tail if required.

Take advantage of:

- Risk management lectures and case reviews.

- M&M conferences focusing on systems issues and documentation.

New Attendings (First 5 Years Out)

Before signing any contract:

- Have a healthcare attorney or knowledgeable mentor review malpractice clauses.

- Compare offers net of potential tail costs and other benefits.

Keep a personal record of:

- Start and end dates for each job.

- Policy type, carrier, limits, and retroactive dates.

- Any documentation of tail or prior acts coverage provided.

When changing jobs:

- Make sure there is no gap in retrospective coverage.

- Confirm in writing that tail has been purchased (if applicable) and what period it covers.

FAQ: Malpractice Insurance in Emergency Medicine

1. As an EM resident, do I need to buy my own malpractice insurance?

Typically no, for your core residency duties. Your hospital or university almost always provides malpractice coverage for resident activities within the scope of training. However, you may need separate coverage if you:

- Moonlight outside your home institution.

- Work in clinics or urgent care centers under separate contracts.

- Volunteer in settings not covered by your residency’s policy.

Always confirm in writing what is and is not covered before starting any side work.

2. Is claims-made always worse than occurrence for emergency physicians?

Not necessarily. Claims-made vs occurrence is not inherently “good vs bad,” but they carry different financial and logistical implications:

Occurrence:

- Simpler to understand.

- No tail needed.

- Often higher annual premium.

Claims-made:

- Common in EM and high-risk specialties.

- Lower initial premium that “steps up” over several years.

- Requires tail or prior acts coverage when you leave.

What matters most is:

- Who pays for tail?

- How stable is the group or hospital contract?

- How long you plan to stay in that position?

3. What should I do if I suspect I may be involved in a malpractice claim?

Follow institutional protocols, which often include:

- Notify your attending or department leadership (if you’re a resident).

- Contact risk management—they will determine when to involve legal counsel.

- Do not alter the chart; add only factual, time-stamped late entries if instructed and appropriate.

- Avoid discussing the case outside appropriate legal/peer-review channels, including on social media.

- Seek support—EM departments often have peer-support or “second victim” programs.

Your malpractice insurer and hospital legal team will guide you through next steps if a formal claim or lawsuit is filed.

4. How big of a factor should malpractice coverage be when ranking EM residency programs or job offers?

For residency, malpractice coverage is important, but:

- Most ACGME-accredited EM residency programs provide solid baseline coverage.

- Culture of safety, teaching quality, and patient volume are usually more critical differentiators.

- Still, it’s reasonable to ask about policy type, limits, and support for residents involved in claims.

For attending jobs, malpractice terms are a major part of the compensation package:

- Tail responsibility alone can be worth tens of thousands of dollars.

- Contract stability and who controls the policy (you vs group vs hospital) are key considerations.

- Evaluate malpractice alongside salary, benefits, scheduling, and long-term career fit.

Understanding malpractice insurance is a core professional skill for every emergency physician. By learning how medical liability insurance works, recognizing the trade-offs in claims-made vs occurrence policies, and paying close attention to coverage details during the EM match, residency, and early attending years, you can protect your career and focus on what drew you to emergency medicine in the first place: caring for patients at their moments of greatest need.