Neurology is one of the most intellectually rewarding specialties—but it also carries unique medicolegal risk. As you move through the neurology residency match and into practice, understanding malpractice insurance is critical to protecting yourself, your patients, and your career.

This guide explains the essentials of malpractice insurance for neurology residents and early-career neurologists: what it is, why it matters, how different policy types work (including claims made vs occurrence), and how to make smart decisions during the neuro match and beyond.

Understanding Malpractice Insurance in Neurology

Medical malpractice insurance—also called medical liability insurance—is a policy that protects you against financial losses if a patient (or their family) alleges that your professional actions (or lack of action) caused harm.

Why neurology is a higher-risk specialty

Neurology is considered a moderate-to-high medicolegal risk field for several reasons:

- High-stakes diagnoses: Stroke, status epilepticus, CNS infections, spinal cord compression, and neuromuscular crises are time-sensitive and potentially devastating if missed or delayed.

- Diagnostic uncertainty: Many neurologic conditions present subtly or evolve over time, making early diagnosis challenging and easier to second-guess in hindsight.

- Long-term disability: Neurologic injuries frequently result in permanent impairment, loss of independence, or inability to work—driving higher financial damages in lawsuits.

- Complex documentation: Detailed neuro exams, imaging interpretations, and nuanced decision-making must be clearly documented. Poor documentation is a common issue in malpractice cases.

As a future or current neurology resident, you are typically covered by your institution’s insurance—but the way that coverage works, and what happens after you graduate, matters more than many trainees realize.

Key Concepts: What Neurology Residents Must Know

Before comparing policies or reading fine print, it helps to know key malpractice insurance terms that will show up in your contracts and hospital credentialing documents.

1. Policy limits

Policy limits define how much the insurer will pay:

- Per claim / per occurrence limit: Maximum amount the insurer will pay for a single claim, e.g., $1,000,000 per claim

- Annual aggregate limit: Maximum total the insurer will pay for all claims in a policy year, e.g., $3,000,000 per year

For neurology, you’ll commonly see limits such as $1M / $3M or $2M / $4M, depending on state and practice setting.

2. Who is covered?

Policy language will specify whether it covers:

- Individual physician (you)

- Group practice or faculty group

- Hospital or health system

- Residents and fellows (often under institutional coverage)

As a resident, your GME contract usually includes malpractice coverage—but always confirm:

- Does it cover only hospital duties or also moonlighting?

- Are you covered for tele-neurology or work at affiliated sites?

- Does it include defense costs (lawyer fees) within or in addition to policy limits?

3. What is considered “malpractice”?

Insurance typically covers:

- Allegations of negligence (failure to meet standard of care)

- Errors or omissions in clinical decision-making

- Failure to diagnose or delay in diagnosis

- Improper treatment or procedural complications

- Lack of informed consent

For neurology, this may include:

- Missed or delayed stroke diagnosis

- Failure to identify spinal cord compression or cauda equina syndrome

- Delayed workup of new-onset seizures

- Complications from lumbar punctures, botulinum toxin injections, EEG monitoring, or EMG/NCS procedures

- Adverse outcomes from immunosuppressive therapy (e.g., PML with natalizumab)

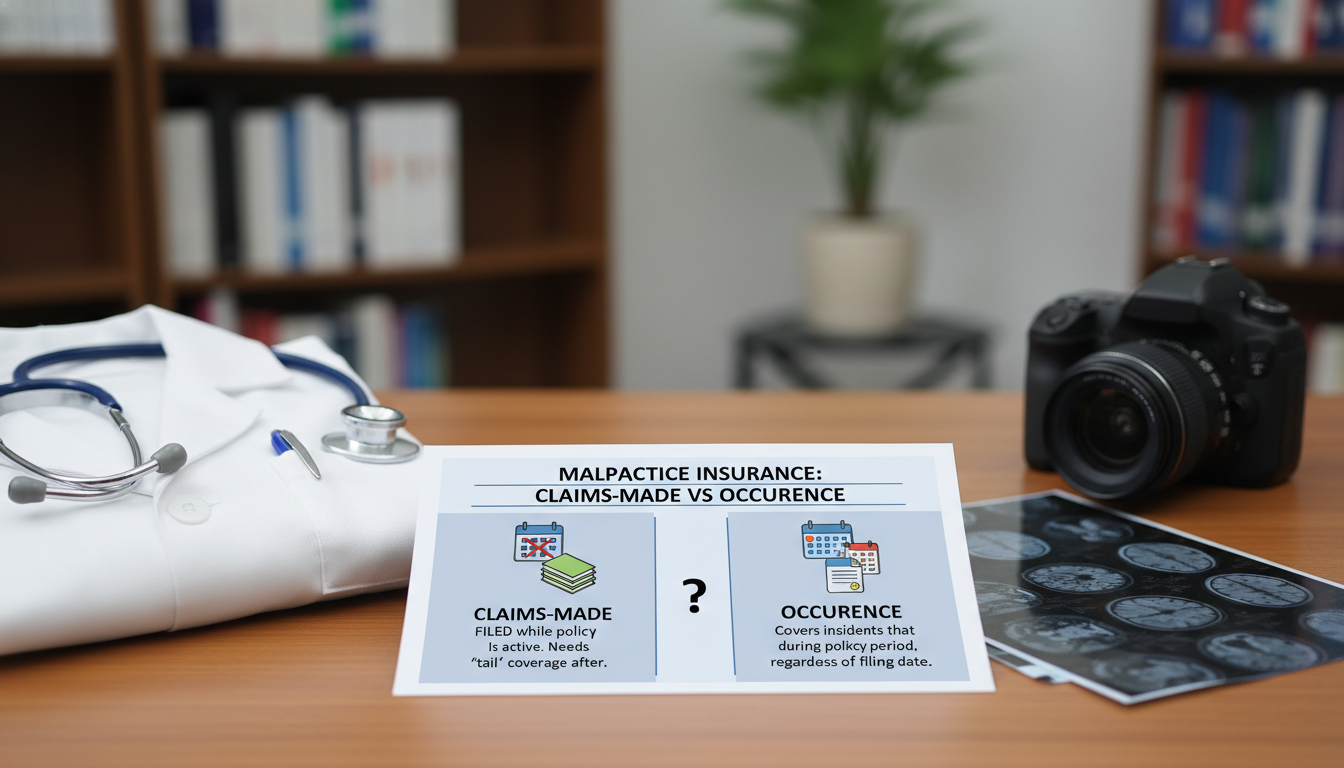

Claims Made vs Occurrence: The Most Important Policy Choice

One of the most confusing—but essential—topics for neurology residents is understanding claims made vs occurrence malpractice insurance. This choice affects your future financial obligations and your mobility between jobs.

Occurrence policies

An occurrence policy covers you for any claim arising from care you provided during the policy period, regardless of when the claim is filed.

- If you’re insured with an occurrence policy from 2026–2028, and a patient sues you in 2032 for care you delivered in 2027, the 2027 occurrence policy still responds.

- You do not need tail coverage when you leave an occurrence policy.

Pros:

- Simpler—no need to buy tail coverage when you move or retire.

- Long-term protection for care provided during the policy period.

- Often preferred by physicians who value flexibility.

Cons:

- Typically more expensive annually than claims-made policies.

- Less commonly offered by some employers or health systems.

Claims-made policies

A claims-made policy covers you only if:

- The incident occurred while the policy was in force, and

- The claim is filed while the policy is still active (or during an extended reporting period—tail coverage).

If either condition is not met, the policy will not respond.

This is where tail coverage becomes critical.

Tail coverage

Tail coverage (also called an extended reporting endorsement) allows you to report claims after the policy ends for incidents that occurred while it was active.

Example for a new neurologist:

- You work for Hospital A from 2028–2031 with a claims-made policy.

- In 2032, a former patient sues for a stroke you managed in 2030.

- If you didn’t buy tail coverage from Hospital A’s insurer, and your new employer’s policy doesn’t include prior acts coverage, you may be personally exposed.

Key points about tail coverage:

- Often costs 150–250% of your final year’s premium.

- Usually a one-time purchase when leaving a claims-made policy.

- Can be negotiated in your employment contract (who pays—hospital or physician?).

Which is better for neurology?

There is no universally “best” choice; it depends on your career path.

Occurrence policy may be better if:

- You anticipate frequent job changes or locums work.

- You want to avoid worrying about tail coverage.

- You practice in a state or system where occurrence coverage is standard.

Claims-made policy may be fine if:

- Your employer pays for tail when you leave (common in academic or large hospital systems).

- You expect to stay long-term with one employer.

- You understand your obligations around tail coverage for any future transitions.

When evaluating a neurology job offer, always ask explicitly:

- Is the malpractice coverage claims made vs occurrence?

- If claims-made, who pays for tail coverage if I leave or retire?

- Does the policy include prior acts coverage if I’m transitioning from a previous claims-made policy?

Malpractice Coverage During Neurology Residency and Fellowship

During the neurology residency match and application process, malpractice insurance may not be the first thing on your mind—but it should be one of the factors you understand before ranking programs.

How malpractice insurance typically works in training

Most ACGME-accredited neurology residency programs provide:

- Institutional coverage under a group malpractice policy

- Coverage for all duties required by the program (inpatient, outpatient, consults, procedures)

- Coverage limits that meet state and hospital credentialing requirements

This coverage generally:

- Is claims-made (common), with the institution maintaining continuous coverage (so tail is not your personal concern).

- Covers you only for activities within the scope of training and approved moonlighting, if explicitly stated.

Key questions to ask programs (tactfully)

During interviews or second looks, you can ask program leadership or the GME office:

- “Is malpractice coverage provided for residents, and what are the policy limits?”

- “Does our coverage include off-site rotations and tele-neurology consults?”

- “Is approved internal or external moonlighting covered under the program’s malpractice insurance, or do we need separate coverage?”

- “Does the institution’s policy provide tail coverage for work performed during residency after we graduate?”

You don’t need to ask like a lawyer; simple, direct questions signal maturity and professionalism.

Moonlighting and coverage gaps

Many neurology residents moonlight during senior years:

- In-house neurology call coverage

- General inpatient coverage

- Tele-stroke or teleneurology work

- EEG or EMU coverage

Do not assume your training program’s medical liability insurance covers all moonlighting. Confirm:

- Internal moonlighting (within the same hospital): Usually covered, but must be explicitly permitted.

- External moonlighting (outside hospitals/clinics): Often not covered by your residency policy. You may need:

- A separate malpractice policy provided by the moonlighting site, or

- Your own individual policy.

If you are doing neurophysiology procedures (EEG, EMG), interventional work, or tele-neurology moonlighting, double-check that these services are specifically included in the coverage.

Risk Areas in Neurology and How Insurance Interacts

Malpractice insurance is the safety net; good risk management keeps you from needing it. Certain neurologic scenarios are more frequently involved in litigation.

Common malpractice allegations in neurology

- Missed or delayed stroke diagnosis

- Failure to recognize TIA or early stroke symptoms

- Delay in ordering imaging or calling stroke code

- Not offering thrombolysis or thrombectomy when indicated

- Spinal cord and cauda equina syndromes

- Not acting on red-flag symptoms (urinary retention, saddle anesthesia, rapid weakness)

- Delay in MRI or neurosurgical consult

- Seizure and status epilepticus management

- Misdiagnosing seizure as syncope or psychogenic

- Inadequate monitoring or delayed escalation of treatment in status epilepticus

- Diagnostic workup delays

- Progressive weakness misattributed to functional or musculoskeletal causes instead of GBS or myelopathy

- Delayed imaging or CSF studies for suspected CNS infection

- Procedural complications

- Post-lumbar puncture herniation in patients with mass effect

- Nerve injury from EMG or injection procedures

- Hemorrhage in anticoagulated patients

Documentation and communication: Your first line of defense

Regardless of your malpractice insurance type, your everyday habits dramatically affect your legal risk.

- Document clinical reasoning. Even if you are wrong in hindsight, thoughtful, clearly documented decision-making often provides strong legal defense.

- Informed consent. Especially for high-risk treatments (thrombolytics, immunosuppressants, anticoagulation), document:

- Risks and benefits discussed

- Alternatives considered

- Patient or surrogate’s questions and decisions

- Handoffs. In neurology, weekend and overnight handoffs are common. Poor communication about evolving neurologic symptoms is a recurring theme in lawsuits.

How malpractice insurance responds

When a claim or lawsuit is filed:

- You notify your institution’s risk management or your own insurer.

- The insurer typically:

- Assigns an attorney

- Covers defense costs (subject to policy terms)

- Pays any settlement or judgment up to policy limits

- In some policies, defense costs erode (are included within) the policy limits; in others, they are paid in addition. Know which applies to you.

Your role:

- Be honest and forthcoming with your defense team.

- Do not alter the medical record.

- Avoid discussing the case with others outside formal risk management or legal counsel channels.

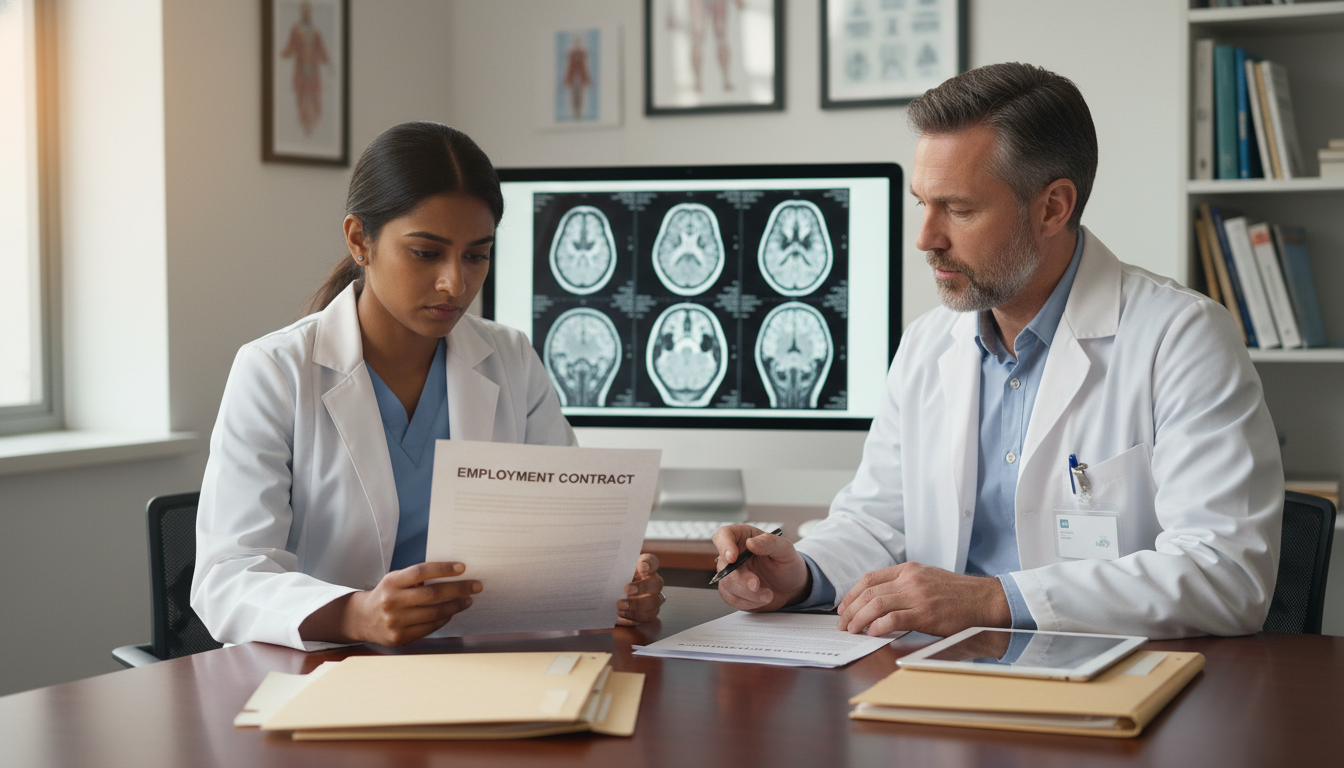

Evaluating Malpractice Insurance When You Finish Training

As you complete neurology residency and move into fellowship or attending practice, you’ll encounter malpractice insurance decisions in contracts and credentialing documents. Understanding the basics will help you negotiate more effectively and avoid costly surprises.

What to look for in your first attending contract

When you receive an offer (academic, community, hospital-employed, or private practice), carefully review:

Type of malpractice coverage

- Claims made vs occurrence

- If claims-made, details about tail coverage obligations

Who pays for what

- Does the employer pay 100% of malpractice premiums?

- For claims-made policies:

- Does the employer pay for tail if:

- You are terminated without cause?

- You resign?

- The contract is not renewed?

- Does the employer pay for tail if:

- Is there any forgiveness schedule (e.g., practice pays a higher portion of tail after 3–5 years)?

Coverage scope

- Does it include:

- Inpatient and outpatient neurology?

- Procedures (EMG, LP, Botox, EEG interpretation, EMU oversight)?

- Tele-neurology or telestroke?

- Any excluded services?

- Does it include:

Limits of liability

- Standard neurology coverage often uses $1M / $3M or higher.

- Check state and hospital minimum requirements.

Prior acts coverage

- If you’re transitioning from another claims-made policy, does the new policy cover your prior acts (instead of you needing to buy tail from the previous insurer)?

Practical example: Two job offers

Imagine you are finishing a vascular neurology fellowship and comparing two offers:

Job A: Hospital-employed

- Claims-made policy, $1M / $3M limits

- Hospital pays all premiums

- Contract states: Hospital pays 100% of tail if you work >3 years; pro-rated if <3 years.

- Coverage includes telestroke and procedures.

Job B: Private neurology group

- Occurrence policy, $1M / $3M limits

- Group pays premiums

- No tail coverage required (occurrence policy)

- Slightly higher salary but more RVU-based income.

Neither is automatically better; your choice depends on:

- Planned duration with employer

- Comfort with production-based compensation

- Desire for flexibility vs stability

- How much you value not having to worry about tail coverage

Understanding claims made vs occurrence and how malpractice insurance actually works allows you to weigh these variables intelligently.

Malpractice insurance and locum tenens neurology

Many neurologists do locums early in their careers or between positions.

- Most locums agencies provide malpractice coverage, usually claims-made, often with tail coverage included.

- Always ask:

- What are the policy limits?

- Is tail coverage included when an assignment ends?

- Are specific high-risk services (tele-stroke, EMU, ICU neurology) covered?

You should not need your own policy for work that is fully covered by the locums company, but always verify in writing.

Practical Tips for Neurology Residents and Applicants

Bringing it all together, here are actionable steps you can take during the neurology residency match and into practice.

During the neurology residency application and neuro match phase

- Research institutional culture around legal risk.

- Ask residents: “How does the program handle unexpected bad outcomes or adverse events?”

- Look for programs with robust quality improvement and M&M conferences, not blame-focused environments.

- Clarify coverage basics.

- Confirm that malpractice insurance is provided for all training activities.

- Ask about external moonlighting and whether separate coverage is needed.

During residency and fellowship

- Attend risk management workshops.

- Many hospitals offer training on documentation, disclosure, and dealing with adverse events.

- Cultivate strong documentation habits.

- Neurologic exams and clinical reasoning should be clear enough that another neurologist could follow your thinking months later.

- Be cautious with moonlighting.

- Never assume you’re covered—get written confirmation from the site or residency program.

- Report incidents early.

- If something goes wrong, or a patient threatens legal action, inform risk management promptly.

As you transition to practice

- Read your contract line by line.

- Pay particular attention to all references to:

- Medical liability insurance

- Claims-made vs occurrence

- Tail coverage

- Pay particular attention to all references to:

- Negotiate when possible.

- It is reasonable to negotiate:

- Employer-paid tail coverage

- Higher liability limits in high-risk practices (e.g., stroke heavy)

- Clarification of coverage for specific procedures or tele-neurology

- It is reasonable to negotiate:

- Keep personal records.

- Maintain a secure file with:

- Copies of your malpractice policy certificates

- Dates of coverage

- Insurer contact information

- This will help if a claim arises years later or if a credentialing body asks for historical coverage details.

- Maintain a secure file with:

FAQs: Malpractice Insurance for Neurology Residents and Early-Career Neurologists

1. Do I need to buy my own malpractice insurance as a neurology resident?

Usually not for your core residency duties. Most ACGME-accredited programs provide malpractice coverage for resident clinical activities. However, you may need separate coverage for external moonlighting or certain off-site work. Always confirm in writing with your program and any moonlighting site.

2. How does malpractice insurance affect my neurology residency match decisions?

It’s rarely a primary ranking factor, but it should be part of your due diligence. Programs should provide malpractice coverage with appropriate limits and clear policies on moonlighting. Favor programs with transparent communication about medical liability insurance and a strong culture of patient safety, supervision, and education around adverse events.

3. As a new neurologist, should I insist on occurrence coverage over claims-made?

Not necessarily. Both can be appropriate:

- Occurrence: Simpler for you, often higher annual premiums, no tail needed.

- Claims-made: Often cheaper annually, but you must address tail coverage when you leave.

The key is not the label alone, but:

- Who pays for premiums and tail?

- Are limits adequate?

- Is coverage comprehensive for the kind of neurology you’ll practice (stroke, EMU, procedures, tele-neurology)?

4. What happens if I am sued years after leaving a job?

If you had:

- An occurrence policy: The policy that was active when you treated the patient generally responds, even if you’ve left that job.

- A claims-made policy with tail (or prior acts coverage with your new job): The tail or new policy covers you if the alleged incident occurred while the policy was in force.

- A claims-made policy without tail or prior acts: You may have a coverage gap, leaving you personally exposed.

This is why understanding claims made vs occurrence and ensuring continuous protection (via tail coverage or prior acts coverage) is essential when changing jobs.

By approaching malpractice insurance as a core part of your professional planning—not just an afterthought—you’ll be better prepared to navigate the neurology residency match, protect yourself as a trainee, and negotiate wisely as you enter independent practice.