Understanding Malpractice Insurance in Orthopedic Surgery

Malpractice insurance is one of the least glamorous but most critical aspects of an orthopedic surgery career. As a future orthopaedic surgeon, you will perform high‑stakes procedures with the potential for major complications. That clinical reality is exactly why orthopedic surgery malpractice premiums are among the highest of all specialties—and why understanding your coverage before you sign a contract is non‑negotiable.

This guide is written for medical students, residents, and fellowship applicants pursuing orthopedic surgery. It walks through the essentials of malpractice coverage, explains key terms like claims made vs occurrence, and shows you how to evaluate offers during your ortho match and early career.

Why Orthopedic Surgeons Need Robust Malpractice Coverage

Orthopedic surgery is consistently one of the most frequently sued specialties. Several factors drive this risk:

- High‑impact outcomes: Orthopedic procedures affect mobility, independence, and quality of life. Poor outcomes—whether due to complications or perceived errors—can profoundly affect patients.

- Elective procedures with high expectations: Joint replacements, sports medicine surgeries, and spine operations often involve patients with high expectations for pain relief and function.

- Complex anatomy and comorbidities: Trauma cases, revision surgeries, and patients with multiple comorbid conditions increase complication risk.

- Documentation and follow‑up issues: Missed follow‑up, unclear documentation, or communication failures can be perceived as negligence even when care is appropriate.

Common Orthopedic Malpractice Allegations

While every case is unique, typical allegations in orthopedic claims include:

- Improper surgical technique

- Nerve injury during joint replacement

- Malaligned fracture fixation

- Compartment syndrome missed or treated late

- Failure to diagnose or delayed diagnosis

- Missed fractures, dislocations, or ligament injuries

- Missed septic arthritis or osteomyelitis

- Inadequate informed consent

- Patient claiming they were not informed of realistic risks and alternatives

- Postoperative management errors

- Poor follow‑up of infection, DVT/PE, or wound problems

- Wrong‑site surgery

- Operating on the wrong side or wrong level (especially in spine cases)

Because the stakes are so high—both clinically and financially—medical liability insurance is not optional; it is essential risk protection for your entire career.

Core Concepts in Medical Liability Insurance

Before you read any contract, you need to understand a few foundational terms. These concepts apply across specialties but are particularly relevant in orthopedic surgery due to high claim value and frequency.

What Malpractice Insurance Actually Covers

A standard malpractice policy for an orthopedic surgeon typically covers:

- Defense costs: Attorney fees, expert witnesses, court costs

- Settlement amounts: Money paid to plaintiffs in pre‑trial settlements

- Judgment amounts: Damages awarded by a court up to your policy limits

- Licensing board actions (in some policies): Defense for investigations or disciplinary actions

- Coverage for acts within the scope of practice: Care delivered as part of your orthopedic practice, usually within defined settings

What it usually does not cover:

- Criminal acts

- Sexual misconduct

- Fraudulent or intentionally harmful behavior

- Activities outside the scope of your covered practice (e.g., unapproved moonlighting)

Policy Limits: “Per Claim / Aggregate”

You will see language like:

- $1 million / $3 million

- $1 million = maximum payout per claim

- $3 million = maximum total payout per policy year

For an orthopedic surgery residency or early attending role, common limits are $1M/$3M or $2M/$4M, depending on region and institution. In high‑litigation states, higher limits may be preferred or required.

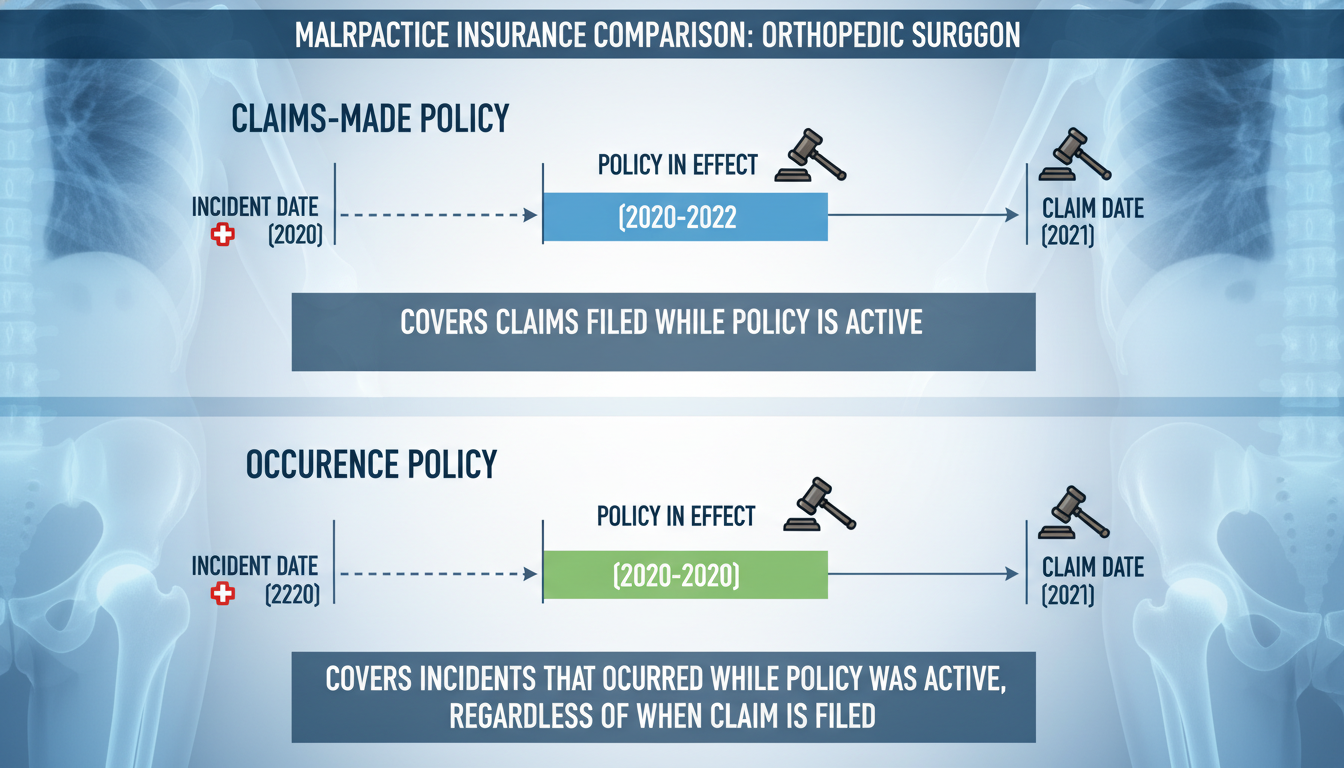

Two Main Policy Types: Claims Made vs Occurrence

This distinction is one of the most important in understanding your malpractice coverage.

Claims-Made Coverage

- A claims made policy covers you only if:

- The incident occurred after your retroactive date, and

- The claim is made while the policy is active (or during an extended reporting period like tail coverage)

Key points:

- You must maintain continuous coverage; gaps can leave you exposed.

- When you leave a job, you typically need tail coverage (or your new employer must provide “nose coverage”) to protect against future claims for past care.

Occurrence Coverage

- An occurrence policy covers you for any incident that occurs while the policy is active, even if the claim is made years later after the policy ends.

Key points:

- No tail coverage is required when you leave.

- Typically more expensive per year than claims made, especially early in your career.

- Less common in physician employment contracts compared to claims made, especially in high‑risk specialties like orthopedics.

Claims Made vs Occurrence: A Simple Orthopedic Example

Imagine you perform a complex knee reconstruction in 2027 while working for Hospital A:

- In 2027, you have a claims made policy with Hospital A.

- You leave Hospital A in 2028 and move to Hospital B.

- In 2030, the patient sues you for alleged negligence related to that 2027 surgery.

What determines whether you are covered?

- If you had a claims made policy:

- You are covered only if you have tail coverage from Hospital A or nose/prior‑acts coverage with Hospital B that starts from your 2027 retroactive date.

- If you had an occurrence policy in 2027:

- You are covered by the 2027 policy, even though you left Hospital A years ago.

This is why understanding claims made vs occurrence is essential during residency and when evaluating attending contracts.

Tail Coverage, Nose Coverage, and Other Critical Details

For most orthopedic surgery jobs, you will be offered a claims made policy. That brings two critical concepts into play: tail coverage and nose coverage.

Tail Coverage (Extended Reporting Endorsement)

Tail coverage extends the time you can report a claim for services you performed while covered by a claims made policy—even after you leave the job.

- It does not cover new incidents after you leave.

- It only covers claims arising from care delivered during your time at that practice.

- It is typically required by hospitals and credentialing bodies before they grant privileges.

For a high‑risk specialty like orthopedic surgery, tail coverage can be expensive—sometimes 150–300% of your last annual premium. For example:

- If your last‑year premium at a group practice is $60,000,

- Tail coverage could be $90,000–$180,000, paid in a lump sum when you depart.

Who pays for tail coverage should be explicitly stated in your contract. This is one of the most important financial details in any orthopedic surgery employment agreement.

Nose (Prior‑Acts) Coverage

Nose coverage is purchased by your new employer to cover your prior acts under a previous claims made policy.

- Instead of buying a tail at your old job, your new job’s malpractice policy takes over the risk for prior care going back to a specific retroactive date.

- This can be more cost‑effective than tail, especially if you are early in your career.

For orthopedic surgeons, nose coverage is often used when moving between large hospital systems or academic centers that negotiate directly with insurers.

Retroactive Date

Your retroactive date is the earliest date from which your care is covered under the policy.

- For a claims made policy, anything that happened before this date is not covered.

- When you change jobs, maintaining the same retroactive date—via tail or nose coverage—is crucial.

As a resident or fellow, note the retroactive date on:

- Your program’s malpractice coverage (often the start of your training)

- Any moonlighting policies

- Any coverage linked to away rotations, locums, or research appointments

Malpractice Insurance During Orthopedic Residency and Fellowship

During residency and fellowship, your primary focus is training, but your legal exposure is real. Fortunately, your institution usually manages your medical liability insurance, but you must understand what is—and is not—covered.

How Coverage Usually Works in Training

Most orthopedic surgery residency programs and fellowships provide:

- Claims made coverage under an institutional policy

- Coverage for all activities:

- Within the program’s hospitals and clinics

- At affiliated training sites

- During supervised procedures and clinical duties

- Policy limits that meet state and hospital requirements

Importantly:

- The program typically provides tail coverage for your training time once you graduate.

- This means you usually do not personally purchase tail related to residency/fellowship activities.

However, this is not guaranteed everywhere—always confirm with:

- Your Graduate Medical Education (GME) office

- The program director or coordinator

- Written policy documents (not just verbal statements)

Moonlighting: A High-Risk Blind Spot

Moonlighting is common in orthopedic residency, especially in senior years and during fellowship. Coverage for moonlighting is not automatic:

Questions you must clarify before moonlighting:

- Does the residency program’s malpractice policy cover moonlighting?

- Often it does not, especially if outside the primary institution.

- If not, who provides coverage?

- The moonlighting site (e.g., community hospital, urgent care, ED)

- A separate individual policy purchased by you

- What are the policy limits and type (claims made vs occurrence)?

- Is tail coverage provided when you stop moonlighting?

Example:

You moonlight at a community ED, doing reductions and splinting for fractures. If you miss a compartment syndrome and the patient sues two years later, you need to know exactly which policy covers that care—and whether tail coverage will still be in place.

Never assume your residency coverage automatically extends to outside work. Get it in writing.

International Rotations and Away Electives

If you are participating in:

- International mission trips

- Elective rotations at outside hospitals

- Visiting fellowships or observerships

You must clarify:

- Does your home institution’s malpractice policy extend to that site or country?

- Does the host institution provide coverage?

- Are there separate waivers or special short‑term policies required?

In some cases, you may need temporary or additional coverage for international work, especially in surgical mission settings.

Evaluating Malpractice Insurance in Your First Orthopedic Job

As you approach the ortho match, you will start thinking about fellowships and ultimately your first attending role. When evaluating job offers, malpractice insurance details can easily be overlooked—but they have major financial and career implications.

Key Questions to Ask About Coverage

For each attending job offer, explicitly ask:

- What type of policy is provided?

- Claims made vs occurrence

- What are the policy limits?

- Per claim / aggregate

- Who is the named insured?

- You individually, the group, or the hospital

- Who pays the premium?

- Employer, shared cost, or employee

- Who pays for tail coverage when the contract ends?

- Employer, employee, shared, or conditional on reason for departure

- Are I covered for all of my work locations and activities?

- Main hospital, surgery center, clinic, research, telemedicine, etc.

- Is there coverage for administrative, teaching, or consulting roles?

- Is there coverage for leadership roles (e.g., department chair, medical director) that you might grow into?

Common Coverage Structures for Orthopedic Surgeons

Different practice settings approach malpractice differently:

Academic Medical Centers

- Usually provide institutional claims made coverage.

- Frequently cover tail if you leave.

- Limits may be lower in some states, but institutional backing is strong.

- You have less control but more security around insurance details.

Large Hospital-Employed Groups

- Similar to academic centers in structure.

- Often provide robust coverage, sometimes self‑insured.

- Tail frequently covered, but confirm explicitly.

Private Practice Groups

- May have group policies, sometimes with shared limits.

- Tail coverage can be a major negotiation point:

- Some groups cover tail after a certain number of years

- Some require the physician to pay tail if they leave voluntarily

- Pay attention to restrictive covenants (non‑competes) tied to tail obligations.

Locum Tenens / Contract Work

- Often provide occurrence coverage per assignment.

- Clarify whether any claims made coverage requires you to manage tail.

Practical Red Flags in Contracts

For a new orthopedic attending, consider these malpractice‑related red flags:

- You are responsible for 100% of tail coverage if you leave for any reason.

- Policy limits significantly lower than regional norms for high‑risk surgery.

- Coverage that does not clearly include:

- All hospitals/surgery centers where you operate

- Trauma call, if that is part of your responsibilities

- No written details on:

- Claims made vs occurrence

- Who pays tail coverage

- Retroactive date

When in doubt, have an experienced health‑care attorney review your contract, particularly the malpractice and termination sections.

Risk Management: Protecting Yourself Beyond Insurance

Even the best medical liability insurance is reactive—used only after something goes wrong. As an orthopedic surgeon, your daily practice can significantly reduce your risk of being sued, regardless of coverage.

Communication and Informed Consent

Plaintiffs frequently cite poor communication, not just poor outcomes, as a motivation for suing. Effective strategies:

- Provide realistic expectations:

- Clarify that pain relief and function improvements vary.

- Discuss potential complications: infection, nerve injury, stiffness, failure to relieve pain, need for revision.

- Use written materials and diagrams:

- Knee replacement, spine surgery, rotator cuff repair—give procedure‑specific handouts.

- Document thoroughly:

- Key risks discussed

- Alternatives considered

- Patient questions and your responses

Meticulous Documentation

Well‑documented care is your strongest defense in a malpractice claim.

For orthopedic surgeons, high‑yield documentation includes:

- Preoperative assessment:

- History, exam findings, imaging review, non‑operative measures attempted

- Intraoperative notes:

- Approach, implants used (with lot/batch numbers), intraoperative complications and management

- Postoperative care:

- Wound checks, VTE prophylaxis decisions, early recognition of complications

- Patient complaints:

- Pain, numbness, swelling, fevers—note your assessment, differential, and plan.

Systems-Based Practice

Engage with systems that reduce error risk:

- Time‑outs and site marking to prevent wrong‑site surgery.

- Standardized order sets for postoperative care and DVT prophylaxis.

- Early escalation protocols for suspected compartment syndrome, infection, or neurologic deficits.

- Multidisciplinary rounds in trauma and complex cases.

While these are quality and safety practices, they also have direct impact on your medico‑legal risk profile.

Personal Legal Preparedness

Even with great coverage, being named in a lawsuit is stressful. As you progress from resident to attending:

- Understand your insurer’s:

- Claim reporting procedures

- Right to consent to settle (do you have it?)

- Keep your own records:

- Copies of contracts and insurance declarations

- Documentation of CME in risk management or communication skills

- Never alter the medical record after an adverse event; that can be more damaging than the event itself.

FAQs: Malpractice Insurance for Future Orthopedic Surgeons

1. Do I need to buy my own malpractice insurance as an orthopedic resident?

Usually no. Most orthopedic surgery residencies and fellowships provide malpractice coverage for clinical activities within their system and affiliated sites, including tail coverage after you graduate. However, if you moonlight or work outside the program’s defined sites, you may need separate coverage. Always confirm in writing whether moonlighting is covered and by whom.

2. What’s more important in my first job: salary or malpractice terms?

Both matter, but malpractice terms can have major hidden financial consequences. A seemingly high salary may be offset by:

- Low policy limits that don’t match your risk profile

- A requirement that you pay for expensive tail coverage when leaving

- Coverage gaps for certain procedures or locations

During negotiations, ask specifically about claims made vs occurrence, who pays tail coverage, and the policy limits. A slightly lower salary with robust malpractice coverage can be a much better deal over the long term.

3. Should I avoid jobs with claims-made policies and only accept occurrence coverage?

Not necessarily. In many regions, especially for orthopedic surgery, claims made is the dominant model. What truly matters is:

- Whether the policy is comprehensive and continuous

- How tail coverage is handled when you leave

- That your retroactive date is maintained through your career transitions

If the employer provides coverage for tail or prior‑acts (nose) coverage, a claims made policy can be perfectly acceptable.

4. How can I learn more about malpractice risk specifically in orthopedic surgery?

Practical steps include:

- Attend risk management CME courses offered by your hospital or specialty societies.

- Review malpractice case summaries from your institution, risk management office, or professional organizations.

- Ask senior residents and attending orthopedic surgeons about:

- High‑risk scenarios they see often

- Documentation strategies

- Informed consent language they’ve refined over time

Finally, when you receive a contract, consider consulting a health‑care attorney who understands orthopedic surgery residency transitions and early‑career needs. They can help you interpret malpractice insurance terms, evaluate claims made vs occurrence options, and avoid costly surprises later in your ortho career.