Physicians in Physical Medicine & Rehabilitation (PM&R) practice in a unique risk environment—high patient volumes, frequent procedures such as injections, EMGs, and interventional spine work, and frequent involvement in disability determinations and medico-legal issues. Understanding malpractice insurance is not optional; it’s a core part of surviving and thriving in physiatry practice and navigating the physiatry match and early career decisions.

This guide walks you through what PM&R residents, fellows, and new attendings need to know about malpractice insurance: types of coverage, common pitfalls, negotiating contract terms, and how to protect yourself throughout your career.

Understanding Malpractice Insurance Basics in PM&R

Malpractice insurance (often called medical liability insurance) protects you financially and legally if a patient alleges that your professional actions—or failure to act—caused harm.

Why PM&R Physicians Need to Pay Attention

PM&R is sometimes viewed as a “lower-risk” specialty compared with surgery or OB/GYN, but physiatry carries specific exposure:

- Procedural risk:

- Trigger point injections, joint injections, nerve blocks

- Botox/chemodenervation, spasticity management

- EMG/NCS studies

- Increasingly, interventional spine procedures (epidural steroid injections, RF ablations, etc.)

- Chronic pain management:

- Opioid prescribing and monitoring

- Documentation of risk–benefit discussions

- Potential allegations of overprescribing, undertreating, or inadequate monitoring

- Rehabilitation care and disability:

- Decisions about rehab intensity, discharge timing, and placement

- Functional capacity evaluations and disability assessments

- Documentation that may later be scrutinized in workers’ comp, personal injury, or disability claims

- Team-based care:

- Overseeing therapists, physician assistants, and nurse practitioners

- Vicarious liability for team members acting under your supervision

For residency applicants and early-career physiatrists, understanding what your coverage actually does (and does not) protect is critical when comparing training programs, employers, and practice settings.

Core Concepts and Definitions

Some key terms you’ll see in any malpractice policy:

Policy limits:

Usually written as “per claim / aggregate” (e.g., $1 million / $3 million).- Per claim limit: Maximum insurer pays for a single incident.

- Aggregate limit: Maximum insurer pays in a policy year for all claims combined.

Defense costs:

Legal expenses, expert witnesses, court fees, etc.- Some policies pay defense costs outside the policy limits (better).

- Others pay defense costs inside the limits, which can quickly erode your available coverage.

Consent to settle:

Clause describing whether the insurer needs your consent to settle a claim.- “Pure consent to settle” is most favorable.

- Some policies allow the insurer to settle without your approval or penalize you if you refuse a recommended settlement.

Named insured vs. additional insured:

- Named insured: Primary person/entity on the policy (e.g., you as physician).

- Additional insured: Covered under certain circumstances (e.g., supervising physician or employed clinician).

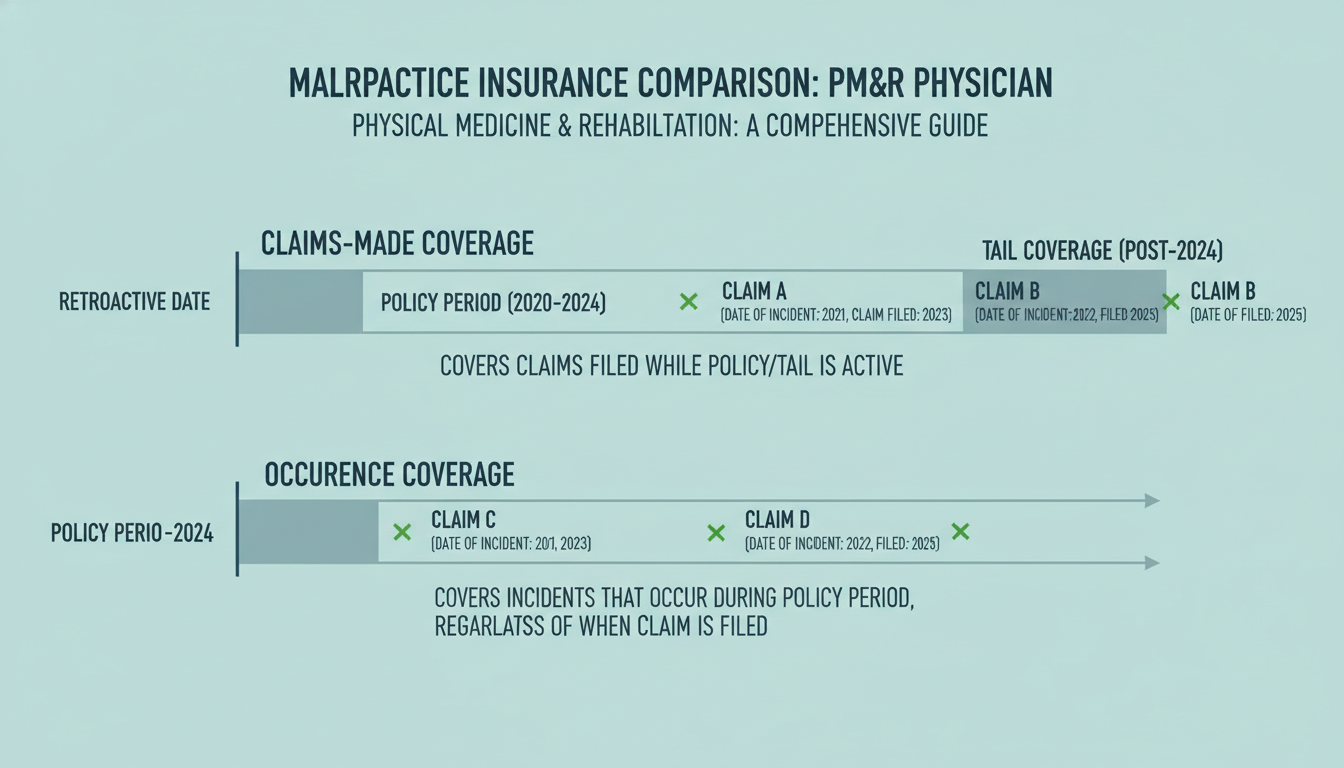

Claims-Made vs Occurrence Policies: What Physiatrists Must Know

One of the most important distinctions in medical liability insurance is claims made vs occurrence coverage. Understanding the difference is essential when comparing job offers and training programs.

Occurrence Policies

An occurrence policy covers you for any incident that occurred during the policy period, regardless of when the claim is actually filed.

- If you have an occurrence policy from 2023–2025 and a patient sues you in 2028 for something that happened in 2024, the occurrence policy still responds—even if you’ve switched jobs and insurers.

Pros:

- No need to buy tail coverage when you leave an employer.

- Once a policy year ends, coverage for that year is “locked in” for future claims.

- Easier to change jobs or carriers.

Cons:

- Premiums are typically higher than for comparable claims-made policies.

- Less commonly offered by some employers and medical groups.

Claims-Made Policies

A claims-made policy covers you only if:

- The incident occurred after the “retroactive date” (start of coverage), and

- The claim is made and reported while the policy is active.

This means you must have appropriate coverage in place at the time the claim is filed, not only when care was provided.

The Role of Tail Coverage

With a claims-made policy, when you leave an employer or switch insurers, you have a coverage gap unless you buy tail coverage (also called an extended reporting endorsement). Tail coverage allows you to report claims in the future for care you provided in the past, while your claims-made policy was active.

- Tail coverage is usually a one-time cost that can be:

- 150–250% (sometimes more) of your last annual premium.

- Paid by you, the employer, or shared according to your contract.

Example (PM&R Pain Clinic Physician)

You work at an outpatient pain and rehab clinic with a claims-made policy:

- Employed 2026–2030

- Retroactive date: 07/01/2026

- You leave on 06/30/2030

In 2032, a patient alleges an epidural injection in 2029 caused permanent harm. For coverage:

- The incident (2029) occurred after your retroactive date (2026).

- But your policy ended in 2030.

- If you bought tail coverage, you can report the claim in 2032 and be covered.

- Without tail coverage, you could be personally exposed.

Nose (Prior Acts) Coverage

Instead of buying tail coverage from your old insurer, sometimes your new insurer provides “nose coverage” (also called prior acts coverage). This means the new policy includes coverage for events that occurred during your previous employment, back to your original retroactive date.

- This is less common for residents transitioning to their first attending job, but can occur when changing attending jobs or joining a large group.

Which Is Better for PM&R Physicians?

There is no single answer, but a few guiding points:

Residents/Fellows:

Most residency and fellowship programs use group policies; they are often claims-made but institutions typically manage tail coverage. You rarely choose the type of policy as a trainee, but you must understand if your coverage extends to moonlighting (often it does not).New Attendings in Employed Settings (hospital, academic, large group):

- Many will provide claims-made coverage and may:

- Fully pay tail coverage if you leave after a certain number of years, or

- Offer graded responsibility (e.g., employer pays 25% tail per completed year).

- Some large systems offer occurrence policies, which can be attractive when considering long-term mobility.

- Many will provide claims-made coverage and may:

Interventional Pain and Procedure-Heavy PM&R:

- Higher risk procedures can increase premiums.

- Access to robust coverage and clarity around tail is particularly important.

Key Policy Features and Risk Areas in PM&R

Beyond claims-made vs occurrence, several structural aspects of malpractice insurance are particularly relevant to PM&R practice.

Coverage Limits: What’s Typical for PM&R?

Common policy limits in U.S. PM&R practice:

- $1 million / $3 million (most common)

- In higher-risk pain or interventional practices, you may see higher limits (e.g., $2 million / $4 million).

Factors influencing appropriate limits:

- State regulations and typical jury awards

- Hospital credentialing standards

- Requirements of major payors or health systems

- Your procedure profile (e.g., routine EMG vs complex spine interventions)

As a resident or early-career physiatrist, you typically accept the limits provided by the employer. Later in your career, especially in private practice, you may need to choose limits with advice from a broker or risk manager.

Scope of Practice and Procedural Coverage

You must confirm that your actual practice activities are covered by your malpractice policy. For PM&R, pay special attention to:

Injections and procedures:

- Joint, bursa, tendon, and trigger point injections

- Peripheral nerve blocks

- Epidural steroid injections, facet injections, RF ablation

- Intrathecal pump management, spinal cord stimulator management

Electrodiagnostic studies (EMG/NCS):

- Ensure policy clearly covers diagnostic procedures and related adverse outcomes (e.g., hematoma, nerve injury, infection).

Spasticity management:

- Botulinum toxin injections

- Intrathecal baclofen pump programming and refills

Chronic opioid management:

- Documentation and monitoring obligations

- Policies vary regarding coverage for controlled substance prescribing issues; some may limit or exclude coverage if care deviates from standard-of-care or laws.

If you add a new procedural skill (e.g., interventional spine), notify your insurer or group’s risk management office to confirm coverage.

Supervision of Trainees and Advanced Practice Providers

PM&R is team-based, and you may supervise:

- Residents and fellows

- Physical and occupational therapists (indirectly)

- Physician assistants and nurse practitioners

Questions to clarify:

- Are you covered for vicarious liability related to supervised providers?

- Are trainees separately insured by the institution?

- Does your policy cover chart co-signature, protocol development, and standing orders?

As an attending, especially in academic rehab, ensure all members of the care team are correctly credentialed and insured.

Malpractice Insurance Across Training, Match, and Early Career

Understanding how coverage changes from medical school to residency to attending practice can help you avoid gaps and surprises.

During PM&R Residency and Fellowship

In most ACGME-accredited programs:

- The institution provides malpractice insurance at no direct cost to you.

- Coverage usually applies only to:

- Work performed within the scope of your training program, and

- At approved practice sites.

You should confirm:

- Claims-made vs occurrence

- Many teaching hospitals use claims-made policies but manage tail coverage centrally.

- Coverage limits

- Often sufficient for trainees but ask for a certificate if you need it for licensing or credentialing.

- Moonlighting coverage

- Internal moonlighting (within the same hospital) is sometimes covered.

- External moonlighting is often NOT covered and may require:

- Separate individual malpractice policy, or

- Employer-provided malpractice from the moonlighting site.

Ask your program director or GME office specifically:

“Under what circumstances does our malpractice insurance cover moonlighting activities?”

During the Physiatry Match and Contract Negotiation

As you approach the physiatry match and later negotiate your first attending contract, consider malpractice terms as seriously as salary:

Key contract questions:

What type of policy is provided?

- Claims-made vs occurrence

- If claims-made, who pays for tail?

Tail coverage terms

- Paid by employer, you, or shared?

- Trigger conditions (e.g., must complete X years to have tail fully covered)?

- What if you are terminated without cause vs with cause?

Coverage limits

- Minimum required for hospital privileges and payor contracts?

- Coverage for your specific procedures and practice sites?

Other insured activities

- Are medical director roles, consulting, or telemedicine coverage included or excluded?

- Are chart reviews, IMEs, or disability evaluations covered?

Practical tip: Consider malpractice terms as part of the total compensation package. A job with slightly lower salary but full employer-paid tail may be financially better over time than a job with higher salary but no tail coverage.

Transitioning to Independent Practice

When leaving residency or your first job:

- Request proof of coverage (certificate of insurance) for all prior positions.

- Confirm:

- Policy type (claims-made vs occurrence)

- Dates of coverage

- Retroactive date (for claims-made)

- Whether tail coverage is in place when you depart

This documentation will be essential for future credentialing and licensure.

Practical Risk Management for PM&R Physicians

Even with strong malpractice insurance, your best protection is sound clinical practice and documentation.

High-Risk Scenarios in PM&R

Interventional Spine and Pain Procedures

- Complications: infection, bleeding, nerve injury, dural puncture, paralysis.

- Strategies:

- Meticulous informed consent, including discussion of rare but serious risks.

- Accurate procedural documentation (technique, laterality, imaging guidance, complications).

- Clear follow-up and emergency instructions.

Prescribing Opioids and Controlled Substances

- Allegations of overprescribing, dependency, or insufficient monitoring.

- Strategies:

- Use standardized opioid agreements, PDMP checks, and risk assessments.

- Document rationale when continuing or tapering opioids.

- Partner with multidisciplinary teams (psychology, PT, addiction medicine).

Rehabilitation Discharge Decisions

- Allegations of premature discharge or inadequate rehab intensity.

- Strategies:

- Team-based decision-making with documented multidisciplinary notes.

- Clear documentation of functional gains, plateau, or medical limitations.

- Patient/family discussions recorded in detail, including their understanding and preferences.

Disability and Work Capacity Determinations

- High potential for litigation exposure (workers’ comp, personal injury).

- Strategies:

- Stick to objective findings and functional assessments.

- Avoid speculative statements about causation when evidence is unclear.

- Clarify the limits of your role (treatment vs independent evaluation).

When a Claim or Complaint Arises

If you receive any notice of a potential claim:

Notify your insurer or risk management immediately.

- Do not wait for a formal lawsuit; many policies require notification of “incidents.”

Do not alter the medical record.

- Never add or change documentation after learning of a potential claim.

- If a legitimate late entry is needed, clearly date and mark it as such.

Do not contact the patient or family about the claim without legal guidance.

- Communication programs exist in some institutions, but follow structured processes.

Cooperate with appointed defense counsel.

- Provide requested information promptly.

- Prepare thoroughly for depositions or testimony.

Your malpractice insurance typically covers not only payout amounts but also defense costs, which can be substantial—even for claims that ultimately settle in your favor or are dropped.

Action Steps for PM&R Residents and Early-Career Physicians

To translate this information into practical steps:

During Residency/Fellowship

- Ask your GME office:

- Type of coverage (claims-made vs occurrence).

- Coverage limits.

- Moonlighting coverage rules.

- Obtain:

- Annual proof of coverage or a final certificate when you graduate.

Before Ranking Programs in the Physiatry Match

- During interviews or follow-ups (where appropriate), ask:

- How are residents/fellows covered for procedures like EMG, injections, and interventional spine (if available)?

- What is the policy on internal vs external moonlighting?

While malpractice coverage details may not be the deciding factor in ranking, serious red flags (e.g., no coverage for core training activities) should prompt caution.

When Reviewing Your First Job Contract

Request the actual malpractice policy summary or at least a written outline that specifies:

- Claims-made vs occurrence

- Limits (per claim/aggregate)

- Tail coverage responsibility and estimated cost

- Scope of covered procedures and activities

Consider consulting:

- A physician-focused contract attorney.

- Senior PM&R mentors who understand regional norms in your subspecialty.

If You Plan Locums or Multiple Part-Time Roles

- Clarify whether each site provides coverage.

- If not, consider a personal malpractice policy that:

- Covers part-time or locums work.

- Includes all relevant PM&R procedures you perform.

Frequently Asked Questions (FAQ)

1. As a PM&R resident, do I need to buy my own malpractice insurance?

In most ACGME-accredited PM&R residency programs, you do not need to buy your own malpractice coverage for your core training activities—the institution provides it. However:

- External moonlighting is often not covered under your residency policy.

- If you do external moonlighting, you may need:

- Employer-provided malpractice coverage from the moonlighting site, or

- Your own policy (less common but sometimes necessary).

Always verify with your GME office before starting any moonlighting work.

2. How big of a deal is tail coverage when taking my first attending job?

Tail coverage is extremely important if your job uses a claims-made malpractice policy. Without tail coverage, you could be personally responsible for legal defense and payouts for future claims related to your past work.

When comparing offers:

- Ask who pays for tail and under what conditions (e.g., length of employment, type of termination).

- Rough cost estimate: often 150–250% of your last year’s premium.

- Employer-paid tail can be worth tens of thousands of dollars.

It should be a major factor in evaluating total compensation and long-term financial risk.

3. I’m an interventional spine/pain-focused physiatrist. Do I need special malpractice insurance?

You don’t necessarily need a “special” policy, but you must confirm that:

- All interventional procedures you perform (e.g., epidurals, RF ablation, SCS management) are explicitly covered.

- Coverage limits are appropriate for your risk profile and local environment.

- Your carrier is comfortable with your procedure mix and practice setting (e.g., office-based vs ASC vs hospital).

Often, large pain groups and academic centers negotiate robust coverage packages for interventional PM&R, but you should still confirm scope and ask for written confirmation.

4. If I change jobs, will my new malpractice policy cover my past work?

Not automatically. For past work, you need:

- Tail coverage on your old claims-made policy, or

- Nose (prior acts) coverage from your new insurer that covers your prior practice back to your original retroactive date.

Occurrence policies, by contrast, continue to cover past incidents even after you leave, so you don’t need tail for those years. When changing jobs, always clarify what will protect you for care already provided under your prior employer.

Understanding malpractice insurance is a critical, often overlooked part of building a sustainable career in Physical Medicine & Rehabilitation. As you move from the physiatry match through residency, fellowship, and your first attending role, proactively engaging with these concepts—claims-made vs occurrence, tail coverage, scope of practice, and risk management—will help you protect your license, your finances, and your future in PM&R.