Understanding Malpractice Insurance in Your Preliminary Medicine Year

Your preliminary medicine year (prelim IM) is often the busiest, steepest learning curve of your training—and it’s also the first time you’re exposed to real legal risk as a practicing physician. Knowing how malpractice insurance works during internship is essential for protecting yourself and your future career.

This guide walks you through what malpractice insurance is, how it applies to preliminary medicine positions, and what you should confirm with programs before ranking and before you start. It is written specifically for students entering a preliminary medicine year, whether you’re headed to neurology, anesthesiology, radiology, dermatology, PM&R, or another advanced specialty.

1. Malpractice Insurance Basics for Preliminary Medicine Residents

What is malpractice insurance?

Medical malpractice insurance (a form of medical liability insurance) protects you financially if you are accused of negligence or error in the care you provide. In simple terms, it:

- Pays for your legal defense (lawyers, depositions, experts)

- Pays settlements or judgments (up to your policy limits)

- Often covers licensing board complaints and sometimes peer review issues

- Provides access to risk management resources and legal advice

As an intern, you’ll be writing orders, admitting patients, documenting, and sometimes performing procedures. Even when under supervision, you can be named in lawsuits. Good malpractice coverage during your prelim IM year is non‑negotiable.

Why it matters during a preliminary year (even if it’s “only” one year)

Some applicants mistakenly assume a one‑year prelim spot is “low risk” because they are supervised and will move on quickly. That’s incorrect for several reasons:

- You can still be personally named in a lawsuit, even as an intern.

- Claims can arise years later (long after you’ve left the prelim institution).

- A poorly handled claim can:

- Affect future credentialing and hospital privileges

- Complicate state medical licensure applications

- Impact your ability to obtain future malpractice coverage

- Your future attending or fellowship positions may ask about any prior claims or suits.

Even if you never pay out of pocket, having a claim in your history can follow you for your entire career. That’s why understanding your malpractice coverage during your preliminary medicine year matters as much as in any other phase of training.

2. Key Features of Malpractice Coverage for Prelim IM Residents

Most ACGME‑accredited preliminary medicine residencies provide malpractice coverage under a group policy purchased by the hospital or sponsoring institution. However, the specifics vary. You should understand these key components:

2.1 Who is covered? (“Named insured” and scope of practice)

Your policy should clearly state that it covers:

- Resident physicians employed or appointed by the institution

- Services within the scope of your training program

- Activities performed under the supervision and policies of the hospital

Important pitfalls to watch for:

- Moonlighting: Many resident policies exclude outside clinical work. If you plan to moonlight (where allowed), you may need:

- Written permission from your program director

- Separate malpractice insurance through the moonlighting site or an individual policy

- Off‑site rotations: Ensure coverage extends to:

- Affiliated VA hospitals

- Community clinics or private practice sites

- Nursing homes or rehab centers, if part of required rotations

This is usually covered via institutional agreements but is worth confirming.

2.2 Policy limits: How much coverage do residents usually have?

Typical resident coverage limits in the U.S. are:

- Per claim (per occurrence): $1 million

- Aggregate (per year): $3 million

Some states or institutions may use different limits (e.g., $500,000 / $1.5 million or $2 million / $4 million). Higher limits provide more protection, but even standard resident limits are usually adequate because:

- You’re part of a larger care team (attendings, hospital) that shares liability.

- The hospital often has excess/umbrella coverage beyond the basic limits.

When reviewing benefits, look for language like “professional liability coverage of $1M/$3M provided.”

2.3 Defense costs and legal support

A strong malpractice insurance policy for residents should:

- Provide legal defense at no cost to you

- Appoint an attorney who specializes in medical malpractice

- Cover:

- Court costs

- Attorney fees

- Expert witness fees

- Settlement negotiations

- Provide support if you are:

- Deposed as a witness

- Named in a lawsuit

- Subject to a licensing board complaint (in some policies)

You should not have to pay for your own lawyer or legal bills related to care you provided in the scope of your prelim IM duties.

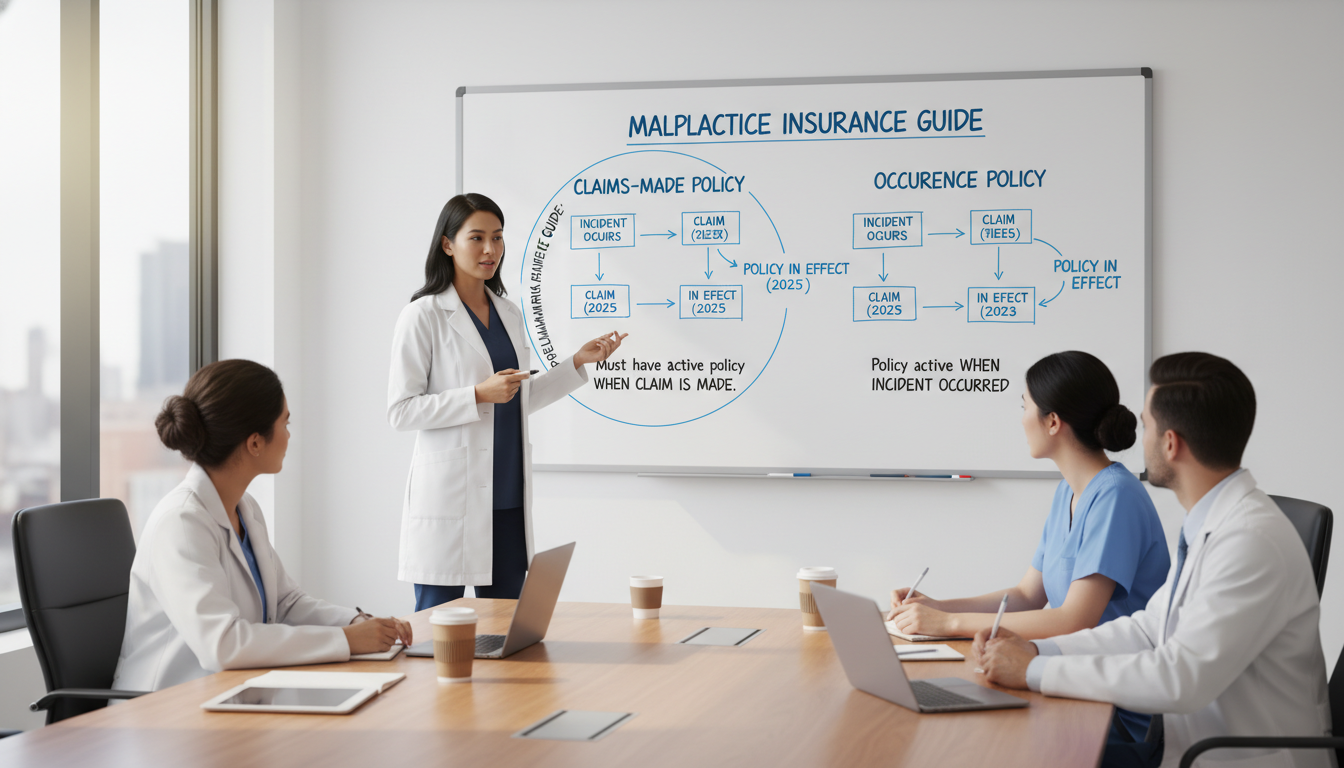

3. “Claims Made vs Occurrence”: What Prelim Residents Must Know

One of the most confusing—but critical—issues in medical liability insurance is the difference between claims made vs occurrence policies. This distinction has big implications when you leave your preliminary medicine year and move to your advanced program or attendingship.

3.1 Occurrence policies

An occurrence policy covers you for any incident that happened during the time the policy was in force, regardless of when the patient files the claim.

- If the incident occurred in 2026 while you were a prelim resident…

- And the patient sues in 2031…

- An occurrence policy that covered you in 2026 still applies, even if the policy ended years ago.

Key point: No tail coverage needed when you leave, because the coverage is tied to the date of the incident, not the date of the claim.

3.2 Claims‑made policies

A claims‑made policy only covers you if:

- The incident happened during the time the policy was active, and

- The claim is filed while the policy (or its extension) is still active.

That means if:

- The incident occurs in your prelim year (2026)

- The policy ends when you leave the program in 2027

- The patient sues in 2030

You are not covered unless someone has arranged ongoing coverage for those prior acts—usually through tail coverage (also called extended reporting endorsement).

This is why “claims made vs occurrence” is such an important question to ask as you evaluate prelim IM programs.

3.3 Tail coverage: Why it matters when you leave your prelim year

Tail coverage extends a claims‑made policy so that claims filed in the future for past acts are still covered. Key details:

- Tail coverage is a one‑time purchase that can be quite expensive in the attending world (often 150–250% of the annual premium).

- For residents, tail coverage is typically:

- Negotiated and paid by the training institution, or

- Included automatically in the resident group policy.

In the context of your preliminary medicine year, the critical question is:

“If the hospital’s malpractice coverage is claims‑made, does the institution fully provide and pay for tail coverage for residents after they complete or leave the program?”

You should not be paying for your own tail coverage at the end of a one‑year prelim IM position.

3.4 How this plays out in real life: A sample timeline

Imagine:

- 2026–2027: You complete a preliminary medicine year at Hospital A.

- Policy type: Claims‑made with institutional tail coverage.

- 2027–2030: You complete your neurology residency at Hospital B.

- 2031: A patient from 2026 files a lawsuit alleging an error while you were an intern.

If Hospital A:

- Has a claims‑made policy with institution‑funded tail coverage, you remain protected.

- Had a claims‑made policy without tail coverage and didn’t buy it for you, you may be personally vulnerable and might need complex legal help to sort out coverage.

Understanding the structure upfront helps you choose programs wisely and avoid future headaches.

4. What Your Program Typically Provides (and What to Confirm)

4.1 Typical malpractice insurance arrangements for residents

Most U.S. teaching hospitals and academic centers provide malpractice coverage to residents with:

- Automatic enrollment—no separate application needed

- Coverage limited to:

- Duties as a resident in that program

- Required rotations at affiliated institutions

- No premium cost to the resident

- Institutional responsibility for tail coverage, if applicable

However, do not assume this. You should verify the specifics using:

- The Resident/Fellowship Benefits section on the program’s website

- The Graduate Medical Education (GME) Office materials

- The resident contract (offer letter or appointment letter)

- Direct questions via email to the program coordinator or GME office

4.2 Questions to ask programs as a preliminary medicine applicant

Here are concrete, non‑confrontational questions you can ask programs:

- Type of coverage

- “Is the malpractice coverage for residents occurrence‑based or claims‑made?”

- Policy limits

- “What are the malpractice coverage limits for residents (per claim and aggregate)?”

- Tail coverage

- “If the policy is claims‑made, does the institution provide and pay for tail coverage for residents who complete or separate from the program?”

- Scope of coverage

- “Does the policy cover all required training sites, including off‑site rotations?”

- “Are moonlighting activities covered? If not, is separate coverage arranged?”

- Licensing board and disciplinary matters

- “Does the malpractice policy provide any support for state licensing board complaints related to patient care during residency?”

These questions are professional and reasonable, and experienced programs will be used to answering them.

4.3 Where to find this information in writing

Before you start your preliminary medicine year, obtain and save:

- Your resident employment contract or GME offer letter

- The GME handbook or resident manual

- Any summary of benefits that describes malpractice coverage

- If possible, a certificate of insurance or written confirmation from risk management

Save these documents permanently (cloud + physical backup). If a claim arises 5–10 years later, you’ll be glad you have proof of the coverage that was in place while you were a prelim IM intern.

4.4 Special considerations for international medical graduates (IMGs)

If you are an IMG:

- Your visa status (J‑1, H‑1B) typically does not change malpractice coverage; residents are usually covered equally.

- However, disciplinary issues, board complaints, or lawsuits may have immigration implications, so having robust institutional legal defense is particularly important.

- Ask your program whether malpractice coverage includes any immigration‑related legal support (usually it does not; that’s separate).

5. Practical Risk Management During Your Preliminary IM Year

Even with strong malpractice insurance, the best protection is preventing claims in the first place. Your preliminary medicine year is an ideal time to build risk‑reduction habits that will serve you throughout your career.

5.1 Documentation: Your most powerful defense

Key principles:

- Be timely: Complete notes the same day whenever possible.

- Be specific: Avoid vague terms like “patient doing okay.” Instead:

- Describe symptoms, exam findings, vitals, and reasoning.

- Demonstrate clinical reasoning:

- Document differential diagnoses and why some were ruled out.

- Record discussions with attendings and consultants:

- “Discussed with cardiology attending, Dr. X, who agrees with the plan to…”

- Clarify shared decision‑making:

- Note that you discussed risks, benefits, and alternatives with the patient/family.

- Avoid judgmental language:

- Don’t label patients as “noncompliant.” Use neutral, descriptive phrases (e.g., “Patient reports difficulty affording medications.”)

In a malpractice claim, your chart often becomes the central evidence. Good documentation can make the difference between a defensible case and a difficult one.

5.2 Communication and professionalism

Common sources of malpractice claims are not purely medical errors but communication breakdowns. Focus on:

- Clear, empathetic communication with patients and families.

- Proactive explanation when there are delays, complications, or changes in plan.

- Returning calls and pages from nursing staff promptly and respectfully.

- Clear handoffs using standardized tools (e.g., I‑PASS).

Patients and families who feel listened to and respected are less likely to pursue litigation even when complications occur.

5.3 Supervision and asking for help

As a prelim IM resident, one of your strongest protections is appropriate supervision:

- Know your program’s supervision policies—what requires direct attending presence, what can be done with indirect supervision.

- When in doubt:

- Call your senior resident.

- Call your attending.

- Document supervisory communications:

- “Case discussed with senior resident, Dr. Y, and attending, Dr. Z; they concur with plan.”

- Never let fear of “bothering” someone keep you from escalating care when needed.

From a malpractice perspective, a resident who appropriately seeks supervision and documents it is usually well protected.

5.4 Handling adverse events

If an adverse event occurs:

- Prioritize patient safety first

- Stabilize the patient.

- Involve the rapid response team or ICU if necessary.

- Notify your chain of command

- Senior resident, attending, nursing leadership.

- Participate in event reporting

- Use your institution’s internal incident reporting system.

- Be cautious about written communications

- Avoid speculating about fault or blaming others in the medical record or emails.

- Save detailed reflection for confidential quality improvement or morbidity and mortality (M&M) discussions as allowed by your institution.

- Seek support

- Adverse events can be emotionally draining; use wellness resources, peer support, or employee assistance programs.

If a patient or family raises the possibility of legal action, alert risk management immediately. Do not discuss the legal aspects independently or attempt to negotiate on your own; that’s what malpractice coverage and institutional attorneys are for.

6. Transitioning From Prelim IM to Your Advanced Residency: Coverage Checklist

Your preliminary medicine year is only 12 months, but liability for care you provided can extend for many years. As you prepare to transition to your advanced specialty, take time to review your malpractice coverage.

6.1 End‑of‑year malpractice checklist

Before you leave your prelim program:

- Request written confirmation of coverage

- Ask the GME office or risk management for:

- A certificate of insurance listing you as a covered resident.

- Confirmation of coverage dates (start and end).

- Ask the GME office or risk management for:

- Clarify “claims made vs occurrence” one more time

- If claims‑made:

- Ask: “Is tail coverage automatically provided for all residents?”

- Request this in writing (email is fine).

- If claims‑made:

- Save all documents

- Contract, handbooks, certificate of insurance, email confirmations.

- Store in at least two formats (local and cloud).

6.2 Communicating with your advanced program

Your advanced program (neurology, anesthesiology, etc.) may ask:

- Whether you’ve ever been involved in a malpractice claim.

- Whether you are currently named in any suits.

- To provide proof of prior coverage, especially if you moonlighted.

Be prepared to answer:

- Accurately but briefly about any claims or suits.

- With documentation that you were covered during your prelim year.

6.3 What if you receive a claim notice later?

If you receive a letter, subpoena, or notice about an incident from your prelim year:

- Do not ignore it.

- Immediately contact:

- The risk management or legal office at your former prelim institution.

- The GME office (they can direct you).

- Notify your current malpractice carrier (if required by your current employer).

- Do not independently contact the patient, family, or plaintiff’s attorney about the legal aspects.

- Preserve all records you have related to the incident (but do not alter anything).

Your former institution’s malpractice insurer should appoint an attorney to represent you and guide you through the process.

FAQs: Malpractice Insurance and the Preliminary Medicine Year

1. Do I need to buy my own malpractice insurance for my preliminary medicine year?

In almost all ACGME‑accredited prelim IM programs, no. Malpractice insurance is typically provided and paid for by the institution that employs you. You may need your own policy only if:

- You are doing unauthorized outside clinical work (strongly discouraged).

- You take on independent moonlighting that is not covered by your hospital’s group policy.

Always confirm with your program and the moonlighting site before starting any outside work.

2. What happens if I’m named in a malpractice lawsuit from my prelim year after I’ve moved to a different residency?

You should still be covered by the malpractice policy of the institution where the care was delivered, provided that:

- They used an occurrence policy, or

- They used a claims‑made policy and arranged tail coverage that includes residents.

When you receive notice of a lawsuit, immediately contact the risk management office of your former prelim program and follow their instructions. Also inform your current program’s risk management office.

3. How can I tell if my coverage is claims‑made vs occurrence?

Look for this information in:

- The GME handbook or benefits summary.

- The certificate of insurance (often labeled “claims‑made policy” or “occurrence policy”).

- Written responses from the GME or risk management office.

If it’s not clear, email the GME office with a direct question:

“Could you please confirm whether resident malpractice coverage is provided on a claims‑made or occurrence basis, and whether tail coverage is provided for residents after they leave the program?”

4. Will a malpractice claim from my prelim IM year affect my future career?

It can, but not always negatively. Many physicians are sued at some point, and one claim does not automatically damage your career. Potential impacts include:

- Additional questions during credentialing and licensure.

- Requirement to provide details of the claim and its outcome.

- Scrutiny from future employers or insurers if there are multiple claims or serious findings.

Strong institutional support, good documentation, and appropriate legal defense can help achieve a favorable resolution—and your role as a supervised intern is relevant context. The most important thing is to respond appropriately to any claim and to maintain high‑quality, patient‑centered care throughout your training.

By understanding how malpractice insurance works—especially the differences between claims made vs occurrence coverage, the importance of tail coverage, and your institution’s responsibilities—you can navigate your preliminary medicine year with greater confidence. Treat this year not only as a clinical apprenticeship, but also as your introduction to the professional and legal realities of medical practice.