Choosing malpractice coverage is rarely discussed openly on the interview trail, yet as a preliminary surgery resident you are already practicing high‑risk medicine. Understanding malpractice insurance isn’t just “for attendings later”—it directly affects your protection, future career options, and even your wallet during and after residency.

This guide explains how malpractice insurance works specifically for a preliminary surgery year or prelim surgery residency, how it is usually handled by training programs, what questions you should ask, and how to protect yourself when you switch programs or specialties.

Understanding Malpractice Insurance in Preliminary Surgery

Malpractice insurance—often called medical liability insurance—protects you if a patient alleges that your care fell below the standard and caused harm. It typically covers:

- Legal defense costs

- Settlements or judgments (up to policy limits)

- Certain associated fees and expenses

In a preliminary surgery residency, your situation is unique:

- You are doing procedural and operative work under supervision, which is inherently higher risk than many non-surgical fields.

- Your position is often one-year and non-renewable, and you may move into a categorical surgery spot, another specialty, or a non-clinical path afterward.

- Because of this mobility, coverage continuity and understanding “tail issues” become more important than many residents expect.

Key Concepts for Residents

You don’t need to become an insurance expert, but you should be comfortable with these core ideas:

- Policy holder – For residents, your employer (hospital or GME consortium) almost always holds the policy; you are a covered insured individual.

- Limits of liability – The maximum the insurer will pay per claim and in total per policy year (e.g., $1M per claim / $3M aggregate).

- Defense inside vs outside limits – Whether legal expenses reduce the amount left to pay a judgment or are paid on top.

- Policy type: claims-made vs occurrence – The biggest factor for residents who move between institutions.

We’ll focus next on that last concept, because it drives tail coverage questions and transitions between your prelim year and your next position.

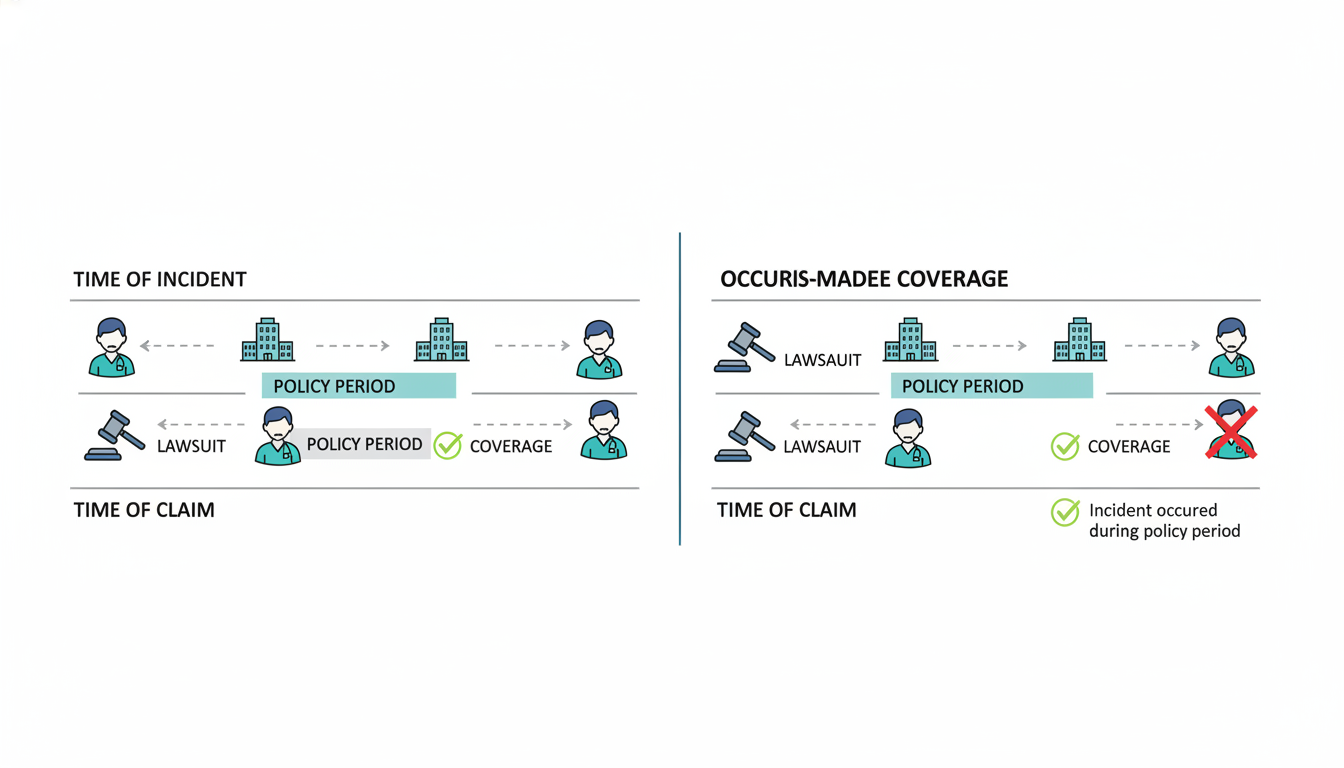

Claims-Made vs Occurrence: What It Means for Your Prelim Year

When residents start reading about malpractice coverage, the phrase “claims made vs occurrence” shows up everywhere. These are the two main policy structures used in medical liability insurance, and understanding the difference helps you ask smart questions of your GME office.

Occurrence Policies

Occurrence coverage protects you for any incident that occurs during the policy period, regardless of when the claim is actually filed.

- If you performed a procedure in March 2026, and a claim is filed in 2030, your 2026 occurrence policy responds—even if you have moved to another hospital and have completely different insurance.

- You typically do not need tail coverage with pure occurrence policies because the coverage is inherently tied to when the incident took place.

In modern U.S. residency training:

- Large academic centers and GME consortia often use claims-made, but some still use occurrence-based or hybrid structures, especially in certain states or systems that self-insure.

- Occurrence policies are simpler for residents, but often more expensive for hospitals, so they are less common as stand-alone commercial products.

Claims-Made Policies

With claims-made malpractice insurance, the policy only covers claims that:

- Arise from incidents that happened after the retroactive date, and

- Are reported (claimed) while the policy is active.

If your prelim surgery program’s coverage is claims-made:

- It will protect you for care you provided during your prelim surgery year, as long as the claim is made before the policy ends or you have tail coverage extending the reporting period.

- When you leave that hospital at the end of the year, the policy typically stops covering new claims unless:

- The hospital or GME program purchases tail coverage for you, or

- The next employer’s policy provides prior-acts coverage (sometimes called “nose coverage”) that backdates your protection.

For residents, the key question is:

“If a patient files a claim 2–3 years after my preliminary surgery year, who covers that—my old program, my new program, or no one?”

The answer depends entirely on how your institution handles tail and prior-acts coverage for trainees.

How Malpractice Insurance Works for Prelim Surgery Residents

While details vary by institution, there are common patterns in how malpractice is structured for residents in a prelim surgery residency.

Who Usually Provides the Coverage?

Almost universally in U.S. residency programs:

- Your employer—the hospital, health system, or sponsoring institution—purchases malpractice insurance for all residents and fellows.

- This coverage is typically automatic and free to you as part of your employment; you do not pay separate premiums during residency.

You are usually covered when:

- Providing patient care within the scope of your training,

- At hospitals or clinics affiliated with your program,

- During approved moonlighting activities if explicitly included in the policy (always confirm this in writing).

Important: Never assume outside moonlighting or volunteer work is covered. Ask specifically.

Typical Coverage Limits

Common liability limits for residents are in the range of:

- $1 million per claim / $3 million aggregate per policy year, or

- $2 million / $4 million, depending on state and institution.

Most trainees cannot negotiate these numbers; they are set at the institutional level. But you should know what they are, because some fellowship applications, state licensure forms, and future employers will ask.

Tail Coverage During and After Your Prelim Year

For a preliminary surgery year, the biggest practical issue is what happens after you leave:

- You may move into:

- A categorical surgery spot at the same institution

- A categorical surgery spot at a different institution

- A different specialty (anesthesia, radiology, emergency medicine, etc.)

- A research year or non-clinical position

For each scenario, you need to know:

- Does my prelim program’s policy include tail coverage for residents by default?

- If not, does my next program provide prior-acts coverage for my prelim year?

- Am I ever responsible for buying my own tail insurance as a resident?

Most well-structured academic programs:

- Provide automatic tail coverage for residents when they complete training or leave in good standing.

- Or they maintain a self-insured trust that continues to handle claims from prior years, so the concept of tail is managed internally rather than by individual policies.

However, in community or hybrid settings, particularly in high-risk states, the arrangements can be more complex. You should never assume; always clarify.

Practical Questions to Ask About Malpractice as a Prelim Surgery Applicant

As a residency applicant or incoming preliminary surgery resident, you don’t need to interrogate every program about actuarial details—but you should ask a few targeted questions to protect your future self.

1. What Type of Policy Does the Program Use?

Phrase it like this:

“For residents, is your malpractice coverage structured as claims-made or occurrence?”

Why it matters:

- If occurrence, tail coverage after graduation is usually a non-issue.

- If claims-made, you need to ask follow-up questions about tail coverage and retroactive dates.

2. Is Tail Coverage Provided Automatically for Residents?

Recommended question:

“When residents complete training or leave the program—especially prelim residents after one year—does the institution provide tail coverage, or is any tail the resident’s responsibility?”

Desired answer (paraphrased):

- “Yes, the institution fully covers tail for residents and fellows; you are never responsible for purchasing your own tail when you leave.”

If the program cannot clearly answer this or suggests residents might pay, that’s a red flag you should factor into ranking decisions.

3. What Are the Coverage Limits and Scope?

You can ask:

“What malpractice limits are provided for residents, and are we covered at all affiliated training sites?”

Key points you want to hear:

- Clear limits (e.g., “$1M/$3M”)

- Coverage at all rotation sites, including VA hospitals or private facilities

- Confirmation of coverage for in-hospital procedures and clinics

4. How Is Moonlighting Handled?

This is particularly important for surgical prelims if you consider moonlighting in the ED, ICU, or minor procedures.

Ask:

“Does the residency malpractice insurance cover any moonlighting, or would separate coverage be required?”

Typical scenarios:

- Most common: Internal moonlighting (within your own system) is covered, but only with explicit approval; external moonlighting is not.

- Some institutions categorically forbid moonlighting during a preliminary surgery year due to workload or accreditation rules.

5. What Happens if I Change Programs or Specialties After My Prelim Year?

Because many prelim residents transition to other fields, you should understand:

“If I complete a preliminary surgery year here and then move to another institution, how is malpractice coverage handled for any future claims arising from my time here?”

Look for:

- Assurance that your current institution’s coverage follows you for past acts, or

- Clear explanation that the receiving institution’s policy includes prior-acts coverage or that tail is handled automatically by the prelim program.

Common Pitfalls and How to Protect Yourself

Even though most residents are well protected by their employers, several risks pop up repeatedly—especially in the unique context of a preliminary surgery year.

Pitfall 1: Assuming All Moonlighting Is Covered

Moonlighting without explicit, documented coverage can expose you personally if a claim arises.

Protection strategies:

- Obtain written confirmation (even an email from GME or risk management) that your malpractice policy covers a specific moonlighting activity.

- If it is not covered, either:

- Decline the opportunity, or

- Obtain a separate moonlighting malpractice policy (often relatively inexpensive for low-volume work, but still a real cost and complexity).

Pitfall 2: Misunderstanding Tail Responsibilities

A common misunderstanding is that tail coverage is “an attending issue.” But for some residents—especially prelims leaving midstream or at a non-academic site—tail matters.

Protection strategies:

- Clarify tail policies before you sign your contract or certainly before you start moonlighting or clinical research involving direct patient care.

- Keep a personal record of:

- Where you trained

- Dates of service

- Policy type and limits

- Statements or documents confirming tail or continuation of coverage

This documentation will help you later for credentialing, licensure, or if a claim arises years down the line.

Pitfall 3: Working Outside the Scope of Training

You are covered as a resident, not as an independent surgeon. If you:

- Perform procedures beyond your level of training

- Provide unsupervised care in settings that are not part of your program

- Represent yourself as an attending

…you may run into coverage disputes.

Protection strategies:

- Follow institutional policies on supervision and attending presence in the operating room and procedural areas.

- Use your correct title (“PGY-1 preliminary surgery resident”).

- Decline responsibilities that clearly exceed your training if supervision is not available, and document your concerns through the appropriate chain if needed.

Pitfall 4: Not Realizing You Are Named in a Lawsuit

Residents can be individually named when malpractice suits are filed, typically along with attendings and institutions.

What you should know:

- Being named does not mean you did anything wrong; it is common in complex cases.

- Your institution’s malpractice insurer will typically appoint defense counsel for all named providers.

- You must cooperate with the defense process—providing statements, records, and testimony as requested.

Protection strategies:

- Immediately notify your program director and risk management office if you receive any legal paperwork or contact from a plaintiff attorney.

- Do not discuss case details with anyone outside your defense team and relevant institutional representatives.

- Do not alter the medical record after the fact; corrections or addenda should follow institutional policies and only be made if genuinely needed and properly dated.

Strategic Considerations: How Malpractice Fits into Your Career Path

While malpractice insurance should not be the primary factor in choosing a prelim surgery residency, it can be a meaningful tiebreaker and an indicator of how well an institution supports its trainees.

Weighing Programs During Applications and Ranking

You might favor programs that:

- Clearly explain their malpractice structure, including tail coverage.

- Offer comprehensive risk management training, such as workshops on documentation, informed consent, and disclosure.

- Have a stable institutional history and long-standing residency programs, suggesting mature systems for handling claims.

A program that is transparent and protective about malpractice issues often treats residents well in other ways too (scheduling, wellness, educational support).

Building Good Habits That Reduce Malpractice Risk

Your prelim year is an ideal time to develop risk-reducing habits that will pay dividends for the rest of your career, regardless of specialty:

- Meticulous documentation:

- Timely notes, clear rationale for decisions, legible orders, and explicit communication of abnormal results.

- Effective handoffs:

- Use structured tools (e.g., I-PASS) and ensure critical information is passed on and documented.

- Informed consent:

- For procedures, make sure risks, benefits, and alternatives are discussed and documented at your level of responsibility.

- Communication after complications:

- Participate appropriately in disclosure discussions with patients/families under attending guidance.

These practices not only lower your malpractice risk but also improve patient safety and your reputation as a thoughtful, reliable clinician.

FAQs: Malpractice Insurance in a Preliminary Surgery Year

1. Do I need to buy my own malpractice insurance during a preliminary surgery residency?

In nearly all ACGME-accredited programs in the U.S., you do not need to buy your own primary malpractice policy for your core residency duties. Your employer (hospital or sponsoring institution) provides coverage automatically as part of your residency contract.

Exceptions where you might need separate coverage:

- External moonlighting that is not covered by your employer’s policy

- Rare cases in which a non-traditional training position or out-of-country rotation requires you to secure your own coverage

Always verify coverage with your GME office before you start any clinical activity outside your core program.

2. Could I personally be sued as a prelim surgery resident?

Yes. Residents are often named individually in malpractice suits related to cases in which they provided care, especially in surgical and ICU settings. However:

- Your institution’s malpractice policy typically defends and indemnifies you.

- The hospital’s legal team and insurer manage the case; you are not left alone.

- Being named in a lawsuit does not automatically mean your personal finances are at risk, as long as you were acting within the scope of your employment and coverage.

You are expected to cooperate with the defense, follow institutional legal guidance, and avoid independent communication with the plaintiff or their attorney.

3. What happens to my coverage when I finish my preliminary surgery year and switch specialties?

If your program uses occurrence coverage, you remain protected for incidents that occurred during your prelim year, regardless of where you go next.

If your program uses claims-made, one of three things usually happens:

- The institution provides tail coverage for graduating or departing residents, so you remain protected for future claims related to that year.

- Your new program provides prior-acts coverage back to your prelim start date.

- In poorly structured or unusual cases, neither provides coverage and you might be asked to purchase your own tail—this is uncommon and a red flag.

To avoid gaps, ask your prelim program and your future program to clarify in writing how coverage for your prelim year will be handled.

4. Should malpractice insurance affect how I rank preliminary surgery programs?

It should rarely be the primary deciding factor, but it can influence your ranking in close calls. Consider giving preference to programs that:

- Provide clear, written information on malpractice and tail coverage for residents

- Explicitly state that residents are not responsible for purchasing tail

- Have robust systems for risk management and resident education on documentation and communication

Combined with surgical case volume, educational quality, and mentorship, a strong malpractice framework signals a program that takes long-term resident welfare seriously.

Understanding malpractice insurance during your preliminary surgery year may feel like one more administrative detail in a busy phase of life, but it’s part of your foundation as a physician. By learning the basics of claims-made vs occurrence, asking a few targeted questions about tail coverage, and practicing sound risk management habits, you can enter residency—and whatever comes after your prelim year—with both eyes open and your professional future better protected.