Psychiatry is one of the most intellectually rich and personally rewarding specialties—but like all areas of medicine, it carries legal risk. Understanding malpractice insurance early in your training is essential to protecting yourself, your career, and your financial future.

This comprehensive guide is designed specifically for psychiatry students, applicants, and residents preparing for the psych match and beyond. You’ll learn what malpractice insurance is, why psychiatrists have unique liability risks, and how to navigate key decisions such as claims made vs occurrence coverage, policy limits, and tail coverage.

Understanding Malpractice Insurance in Psychiatry

Medical malpractice insurance is a type of medical liability insurance that protects you if a patient (or their family) alleges that your professional care caused harm. This includes claims of negligence, misdiagnosis, failure to prevent self-harm, boundary violations, or medication-related injury.

What Does Malpractice Insurance Cover?

While specific terms vary by policy, a typical malpractice policy for psychiatry may cover:

Defense costs

- Attorney fees

- Court costs

- Expert witness fees

- Investigation expenses

Settlements and judgments

- Money paid to a patient or family if you settle a case or lose at trial (up to your policy limits)

Board actions / licensing defense (sometimes)

- Legal representation if you are investigated by your state medical board

Additional endorsements (depending on policy)

- HIPAA/privacy breach defense

- Peer review representation

- Coverage for telepsychiatry and out-of-state practice (when properly licensed)

What it does not usually cover:

- Criminal acts (e.g., sexual assault)

- Intentional harm

- Practicing outside your scope or without proper licensure

- Work outside the policy’s defined scope (e.g., moonlighting not disclosed)

Always read your policy carefully and clarify what “professional services” and “covered activities” actually mean for you as a psychiatrist.

Why Psychiatrists Need to Take Malpractice Seriously

Psychiatry has an overall lower frequency of claims compared to high-risk specialties like OB/GYN or neurosurgery—but the patterns of risk are different and can be emotionally and professionally devastating if not anticipated.

Common areas of risk in psychiatry include:

- Suicide or self-harm

- Claims alleging failure to predict, prevent, or adequately respond to suicide risk

- Violence toward others

- Claims that a psychiatrist failed to assess or act on risk of harm to third parties

- Medication management

- Adverse effects, drug–drug interactions, metabolic complications of antipsychotics, lithium toxicity, etc.

- Involuntary treatment

- Allegations of wrongful detention or violation of patient rights

- Boundary and ethics violations

- Alleged inappropriate dual relationships, confidentiality breaches, or sexual misconduct

- Documentation issues

- Incomplete risk assessments

- No-shows not documented

- Lack of informed consent notes

Even if a claim is ultimately dismissed or you are found not liable, the process is stressful, time-consuming, and can affect your credentialing, hospital privileges, and future employment. Malpractice insurance is not just about money; it buys you legal defense and professional protection.

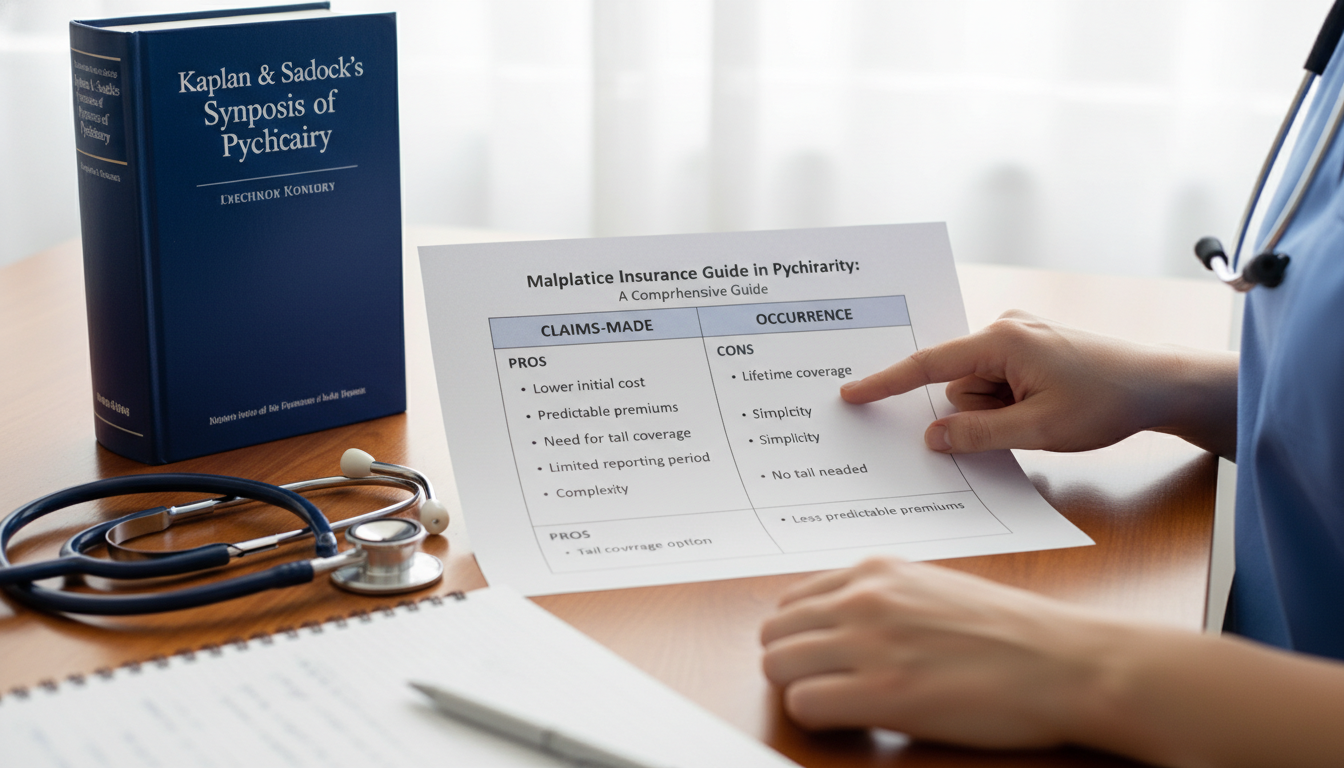

Key Policy Types: Claims-Made vs Occurrence

One of the most important decisions in choosing medical liability insurance is understanding claims made vs occurrence policies. This will affect your coverage now, during residency, and when you change jobs or states.

Occurrence Policies

Definition: Covers incidents that occur during the policy period, regardless of when the claim is filed.

- If your policy is active from 2025–2027:

- Any event during those years is covered, even if the lawsuit is filed years later (e.g., in 2030).

- Once the year has passed, that period’s coverage is “locked in” permanently.

Pros for psychiatrists:

- Long-term peace of mind: you don’t need tail coverage when you leave a job or state.

- Simpler when transitioning between positions or practice settings.

- Often easier to understand for trainees and early-career psychiatrists.

Cons:

- Typically more expensive than claims-made coverage in the early years.

- Not always offered by every employer or insurance carrier.

- Less common for group or large institutional contracts.

Claims-Made Policies

Definition: Covers claims that are both:

- Made (reported) during the policy period, and

- Arise from incidents that occurred after the policy’s retroactive date.

The retroactive date is the earliest date an incident can occur and still be covered.

Example:

- Claims-made policy active from July 1, 2025, retroactive date July 1, 2025.

- You see a patient in August 2025; they file a claim in 2028.

- If your policy is still active (or continuous with the same retroactive date), you’re covered.

- If the policy has ended and no tail coverage exists, you may not be covered.

Pros:

- Lower cost in the first years (premiums usually step up annually over 4–5 years).

- Very common in hospital-employed and large group settings.

- Employers often purchase and manage policies for you during residency and employment.

Cons:

- You may need to buy tail coverage when you leave the job or switch insurers.

- More complex to understand retroactive coverage and transitions.

- If tail is not arranged, you can be personally exposed for past care.

Tail Coverage and Nose Coverage

Tail coverage (Extended Reporting Endorsement):

- Applies to claims-made policies.

- Extends the time period during which you can report claims arising from care provided while the policy was active.

- Does not cover new care; only incidents that occurred during previous employment.

When is tail coverage needed for psychiatrists?

- Leaving a private group practice or independent contractor role with a claims-made policy.

- Changing employers when the new employer:

- Uses a different insurer, and

- Will not assume your prior acts coverage.

- Retiring from practice if you had claims-made coverage.

Nose coverage (Prior Acts Coverage):

- An alternative to tail; a new insurance carrier agrees to cover prior acts starting from your old retroactive date.

- Can be a negotiation point in employment contracts (“Will you cover my prior acts?”).

For residency and fellowship:

- Most psychiatry programs use institutional coverage.

- Tail is often handled by the program or not needed (depending on policy structure).

- Still, it is wise to ask explicitly:

“If I switch programs or finish training, who is responsible for tail coverage?”

Malpractice Insurance During Psychiatry Residency and the Psych Match

As you prepare for the psych match and start residency, you are almost always covered by your training institution. However, understanding the details can help you avoid unintentional gaps, especially if you moonlight or switch programs.

How Coverage Usually Works in Training

Most psychiatry residency programs provide:

- Institutional malpractice insurance

- You are covered as a “house officer” or trainee.

- Typically a claims-made policy with high institutional limits (e.g., $1 million per claim / $3 million aggregate or higher).

- Coverage for:

- Inpatient, outpatient, consult-liaison, emergency, and subspecialty rotations

- Supervised psychotherapy and medication management

- Teaching and some scholarly activities

Important: The coverage is generally limited to activities undertaken as part of your GME-approved training.

Ask These Questions During Interviews and Onboarding

When interviewing for psychiatry residency (or fellowship), you can ask program directors, chief residents, or GME offices:

- What type of malpractice insurance do residents have?

- Claims-made vs occurrence

- Policy limits

- Who holds the policy?

- Is it through the university, hospital, or a separate carrier?

- What specifically is covered?

- Rotations at outside sites or VA hospitals

- Telepsychiatry conducted during residency

- Supervised psychotherapy in training clinics

- Are moonlighting activities covered?

- If yes, under what conditions?

- If no, will the program assist in securing moonlighting coverage?

- What happens when I finish or leave the program?

- Is tail coverage required?

- If so, who pays for it?

These questions show professionalism and risk awareness—qualities program leadership typically respects.

Moonlighting and Malpractice

Moonlighting is common in psychiatry due to relatively flexible schedules and high demand. However, moonlighting is one of the highest-risk areas for residents from a malpractice standpoint.

Key considerations:

- Is moonlighting explicitly permitted by your program and GME office?

- You need written approval.

- Does your residency malpractice insurance cover moonlighting?

- Often, the answer is no unless the moonlighting is at an affiliated site under a specific agreement.

- If not covered:

- The moonlighting employer should provide malpractice insurance, or

- You may need to purchase an individual policy.

For any moonlighting contract, insist on written confirmation of:

- Who provides malpractice coverage

- Policy type (claims-made vs occurrence)

- Policy limits

- Whether tail is provided when you leave

If the employer expects you to buy and maintain your own coverage, factor that cost and administrative burden into your decision.

Policy Limits, Costs, and Coverage Details for Psychiatrists

Beyond policy type, you need to understand specific numbers and terms in your malpractice contract.

Typical Policy Limits

In many states, a common limit for psychiatrists is:

- $1,000,000 per claim / $3,000,000 aggregate per year

(“1/3 limits”), or - $1,000,000 / $5,000,000 depending on jurisdiction and employer.

“Per claim” = maximum the insurer will pay for a single patient’s lawsuit.

“Aggregate” = total maximum for all claims during the policy year.

Some factors may push you toward higher limits:

- Working in a litigation-prone region

- Doing higher-risk work (e.g., forensic psychiatry, emergency psychiatry, high-volume inpatient with acutely suicidal patients)

- Running an independent private practice

For residents and early attendings, your hospital or group will usually choose limits—learn them and understand whether they are standard for your state.

Cost Considerations (Especially Early Career)

For psychiatry, malpractice premiums are generally lower than many procedural specialties, but costs vary by:

- State and local legal climate

- Urban vs rural practice

- Outpatient vs inpatient focus

- Forensic work, addiction medicine, or high-risk populations

- Whether you practice telepsychiatry across state lines

As an approximate range (for awareness, not a quote):

- Early-career psychiatrist in a relatively low-risk state:

- Maybe a few thousand dollars per year for an individual policy.

- Higher-risk regions or forensic subspecialty:

- Premiums may be significantly higher.

Residents typically pay $0 directly, since coverage is institutional. But once you graduate, this becomes a key component of your personal financial planning.

What Psychiatry-Specific Coverage Features to Check

When you review a policy (or offer letter that includes coverage), pay attention to:

Scope of practice

- Explicitly covers:

- Medication management

- Psychotherapy (individual, group, family)

- Consultation-liaison in general medical settings

- Partial hospital / IOP settings

- If you practice in forensic psychiatry, confirm that evaluations for courts or legal referrals are included (sometimes they require an endorsement or higher premium).

- Explicitly covers:

Telepsychiatry coverage

- Does the policy cover care delivered via:

- Video?

- Phone?

- Asynchronous messaging (e.g., portals)?

- Are there restrictions based on:

- Which states patients are located in?

- Platforms used (HIPAA-compliant)?

- Does the policy cover care delivered via:

Boundary and ethics concerns

- While intentional misconduct is not covered, allegations sometimes arise in gray zones (e.g., misunderstandings about boundaries).

- Verify that you have defense coverage for allegations that you will contest as inaccurate.

Board and disciplinary proceedings

- Does your policy include:

- Legal defense for state licensure investigations?

- Representation for hospital or credentialing hearings?

- These can be critical in high-stakes psych cases (e.g., after a patient suicide).

- Does your policy include:

Practical Risk Management for Psychiatry Trainees and New Attendings

The best malpractice insurance strategy is to pair strong coverage with smart risk management. In psychiatry, that means meticulous documentation, thoughtful communication, and consistent boundaries.

Documentation Essentials for Psychiatry

Your notes are your first line of defense.

Prioritize careful documentation of:

- Risk assessments

- Suicide risk

- Homicide or violence risk

- Self-neglect and grave disability

- Clinical reasoning

- Why you chose (or did not choose) hospitalization

- Why you changed or maintained particular medications

- Safety planning

- Crisis plans

- Emergency contacts

- Means restriction conversations (e.g., firearms, medications)

- Informed consent

- Discussed medication risks/benefits/alternatives

- Off-label use, when applicable

- Side effects explained (e.g., metabolic risks, tardive dyskinesia)

- Follow-up and continuity

- No-shows and attempts to reach patient

- Referrals made and whether patient accepted/declined

- Discharge planning from inpatient or IOP settings

A well-written note tells the story of your clinical judgment. In a malpractice context, you are judged not only on outcomes but on whether your decision-making was reasonable and your documentation supports it.

Communication and Boundaries

Strong therapeutic relationships are protective—but only when grounded in clear boundaries:

- Set expectations early

- Availability between sessions

- Emergency vs non-emergency contact channels

- How medication refills and cancellations are handled

- Maintain professional boundaries

- Avoid dual relationships, social media contact, and role confusion.

- Document boundary-setting conversations when needed.

- Handle conflicts sensitively

- When terminating treatment, do so carefully and document:

- Notice given

- Referral options

- Emergency and crisis resources

- When terminating treatment, do so carefully and document:

Many psychiatric malpractice claims arise not purely from clinical decisions but from patients feeling abandoned, disrespected, or confused about their care. Proactive communication can prevent these situations.

Special Risk Areas in Psychiatry

Be extra cautious with:

- Patients with chronic suicidality

- Reassess risk regularly; avoid “copy-forward” notes that fail to reflect real-time thinking.

- Document your rationale when deviating from past plans (e.g., choosing outpatient instead of hospitalization).

- Involuntary holds and restraints

- Follow legal requirements precisely.

- Document criteria, alternatives attempted, and ongoing reassessment.

- Prescribing controlled substances

- Stimulants, benzodiazepines, and certain sleep medications carry diversion, misuse, and dependence risks.

- Use prescription monitoring programs and document risk–benefit analysis.

- Forensic evaluations

- Distinguish clearly between treatment and forensic roles.

- In forensic work, your “patient” may be the court, not the examinee; understand how this affects confidentiality and risk.

Transitioning from Residency to Practice: Avoiding Coverage Gaps

As you move from residency to attending practice—whether academic, community, or private—it is critical to ensure continuity in your malpractice protection.

Steps Before You Sign Your First Contract

When evaluating job offers, ask:

- Who provides malpractice insurance?

- Employer-paid vs self-paid

- What type of policy is it?

- Claims-made vs occurrence

- If claims-made, who pays for tail coverage when I leave?

- Employer, shared, or you alone?

- What are the limits of liability?

- Are they comparable to regional norms?

- Does the policy cover telepsychiatry and any forensic or specialty work I’ll perform?

Insist on having these terms in writing—either in the contract or in a signed addendum from HR or the group.

Common Early-Career Pitfalls to Avoid

- Assuming institutional coverage follows you

- Once you leave residency, that coverage usually applies only to your past training-related work (and often only via the institution).

- Switching jobs without confirming tail coverage

- Risk: a claim arises from your prior job, but your old policy is inactive and you have no tail.

- Doing side consulting, telepsychiatry, or expert witness work without confirming coverage

- Some activities may not be covered by employer policies; you might need an additional policy or rider.

If you are unsure, consider speaking with:

- Your institution’s risk management office

- A physician-focused insurance broker

- Senior psychiatrists or mentors familiar with your state’s environment

FAQs: Malpractice Insurance in Psychiatry

1. Do I need my own malpractice insurance as a psychiatry resident?

Usually, no—your residency program or hospital almost always provides malpractice insurance that covers your official training activities. However, if you engage in moonlighting or independent work outside the scope of your training program, you may need either:

- Employer-provided coverage at the moonlighting site, or

- An individual malpractice policy you purchase yourself.

Always confirm in writing whether your residency coverage extends to moonlighting and what conditions must be met.

2. What’s better for psychiatrists: claims-made vs occurrence policies?

Both can work well; the “better” option depends on your situation:

- Occurrence is simpler and often preferable for peace of mind, especially if you anticipate moving between jobs or states, because you don’t need tail coverage.

- Claims-made is more common in many employed positions and may be more economical for groups, but requires you to plan for tail coverage if not provided by the employer.

When starting your first attending job, the most important point is to clarify in writing who is responsible for tail coverage if you leave that employer.

3. What is malpractice “tail coverage,” and will I need it as a psychiatrist?

Tail coverage is an extension of a claims-made policy that allows you to report claims about care you provided in the past, even after the policy has ended. You may need tail coverage when:

- Leaving a job that provided a claims-made policy, and

- Your new job/insurer does not agree to cover your prior acts.

Many residency programs and some employers handle this automatically, but others specifically place the cost on the physician. Before signing a contract, ask: “If I leave, who pays for tail coverage?”

4. Does malpractice insurance cover board complaints or licensing investigations?

Some policies include professional board defense coverage, helping pay for legal representation if you’re investigated by a state medical board. Others do not, or they cap those benefits at a relatively low amount. Because psychiatric cases involving self-harm, boundary claims, or controlled substances may trigger board reviews, it’s wise to:

- Check whether your policy includes board defense coverage

- Consider additional legal defense coverage if your primary policy is limited

Understanding malpractice insurance early—before and during the psych match, through residency, and into your early attending years—equips you to practice with confidence. By combining appropriate medical liability insurance (claims-made or occurrence, with adequate limits and clear terms) with strong documentation, risk assessment, and professional boundaries, you protect not only yourself but also your ability to continue caring for patients over a long and meaningful psychiatric career.