Understanding Why Malpractice Insurance Matters in Radiation Oncology

Radiation oncology is one of the most technologically complex specialties in medicine. You work with high‑energy radiation, sophisticated planning systems, and multidisciplinary teams. That combination makes radiation oncology incredibly rewarding—but it also creates unique medicolegal risks.

For residency applicants and residents, malpractice insurance can feel abstract, something “attendings worry about later.” In reality, you’ll be covered by malpractice insurance from day one of residency, and understanding the basics now will help you:

- Evaluate residency contracts and benefits more intelligently

- Ask the right questions before signing attending contracts

- Protect your career and financial future in a high‑risk specialty

In this guide, we’ll focus on what residents and early‑career physicians in radiation oncology need to know about malpractice insurance, with special attention to common policy types, risk scenarios in rad onc, and what to look for at each stage of training and practice.

Core Concepts: Malpractice and Medical Liability Insurance 101

What is malpractice insurance?

Malpractice insurance—more formally, professional medical liability insurance—is a policy that covers you if a patient (or their family) alleges that your professional negligence caused harm. In radiation oncology, that might include:

- Mistargeted radiation leading to severe toxicity

- Under‑dosing or geographic miss resulting in disease progression

- Failure to obtain informed consent for risks of radiation

- Delays in starting radiation due to miscommunication or planning errors

Your insurer typically provides:

Defense coverage

- Pays for legal counsel, expert witnesses, court costs

- Provides attorneys specialized in medical malpractice defense

Indemnity coverage

- Pays settlements or court judgments (up to policy limits)

Support through claim process

- Assistance with documentation, depositions, court appearances

Who is covered in residency?

During residency, your malpractice insurance is almost always provided by your training institution. Common features:

- You are covered while acting within the scope of your training

- Coverage typically applies during:

- Clinical duties in the hospital and affiliated clinics

- Certain rotations at partner institutions (per affiliation agreements)

- Moonlighting may or may not be covered (often it is not—more on this later)

It’s essential to assume that you personally are always named in any lawsuit linked to your care, even though the hospital and attending physicians may also be named. That’s why adequate coverage limits and policy structure matter.

Limits of liability

Most policies have per‑claim and annual aggregate limits, for example:

- $1 million / $3 million

- Up to $1M for any single claim

- Up to $3M total payments in a policy year

For residents, limits are set by the institution. For attendings, you may negotiate or choose limits, often guided by:

- State norms

- Payer/hospital credentialing requirements

- Specialty risk profile (rad onc is moderate‑to‑high due to high‑severity potential, even if claims frequency is relatively low)

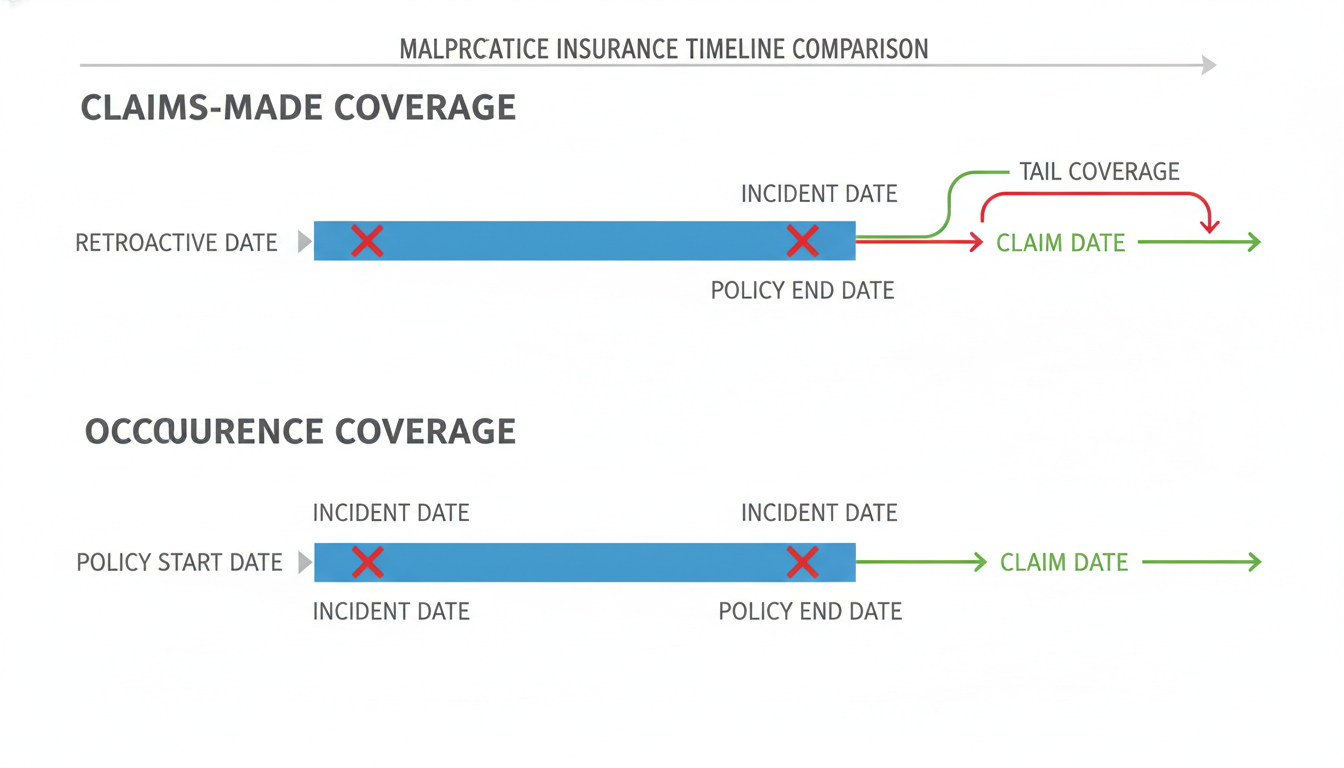

Claims-Made vs Occurrence Policies: What Radiation Oncologists Must Know

One of the most important concepts in malpractice insurance is the difference between claims made vs occurrence coverage. This impacts what happens if a lawsuit is filed years after the clinical care.

Occurrence policies

Occurrence coverage protects you based on when the incident happened, regardless of when the claim is filed.

- If you had an occurrence policy covering you in 2025 and a patient sues in 2030 for care rendered in 2025, that 2025 policy will respond.

- You do not need to keep purchasing coverage after leaving the job to protect against past acts.

Pros for physicians:

- Simpler when changing jobs—no need for “tail” coverage

- Long‑term peace of mind

Cons:

- Can be more expensive per year

- Less common in certain states and among larger groups

Claims-made policies

Claims‑made coverage protects you based on when the claim is made and reported, as long as:

- The clinical care occurred after the policy’s retroactive date, and

- The claim is filed while the policy is in force (or under tail coverage)

Example for a radiation oncology attending:

- You start a job in 2025 with a claims‑made policy.

- Retroactive date: July 1, 2025.

- You leave in 2029 and the policy terminates.

- In 2032, a patient sues for a 2027 brachytherapy case.

- Without tail coverage, you may have no protection—because the claim is being made after the policy ended.

Pros for physicians:

- Typically lower premiums in early years

- Widely available and commonly used

Cons:

- Requires tail coverage when you leave or change carriers

- Potentially large one‑time tail cost (often 150–250% of last year’s premium)

Tail coverage (extended reporting endorsement)

Tail coverage is an add‑on for claims‑made policies that allows you to report claims for incidents that occurred during the policy period, even after the policy expires.

In rad onc, the need for tail coverage is especially important because:

- Radiotherapy complications and failures may appear years later

- Long latency for certain radiation‑induced effects (e.g., secondary malignancies)

- Long survival in many cancers, leading to delayed discovery of alleged errors

Key points about tail coverage:

- It does not cover new acts going forward—only claims arising from care provided while the original policy was active.

- It is often a one‑time purchase at the time you leave the job.

- Some employers:

- Pay tail in full (ideal)

- Require you to pay (less favorable)

- Split cost or structure vesting schedules (e.g., employer pays 25% per completed year)

Nose coverage (prior acts coverage)

Nose coverage is the opposite: when you start with a new insurer, they may offer to cover prior acts under their policy, effectively replacing the need to buy tail from your old carrier.

For radiation oncology, this might be attractive if:

- You are early in your attending career and your prior exposure is small

- The new employer negotiates group coverage that includes prior acts

Always confirm in writing whether:

- Tail is required by your prior contract

- Nose coverage is actually in place, including the retroactive date

Unique Risk Profile: Why Radiation Oncology Has Distinct Malpractice Issues

Radiation oncology has a different risk profile from many other specialties, driven by technology, dose, and long‑term follow‑up. Understanding these risks helps you appreciate why malpractice insurance is structured the way it is—and how to lower your exposure.

Common malpractice themes in radiation oncology

Targeting and planning errors

- Incorrect contouring of tumor or organs at risk

- Wrong laterality or incorrect simulation setup

- Failure to adjust plan after new imaging or clinical changes

Dose and fractionation errors

- Wrong total dose or fraction size entered or delivered

- Applying the wrong protocol to the wrong diagnosis site

- Failing to account for prior radiotherapy exposure

Communication and coordination failures

- Lack of clear communication with medical oncology or surgery

- Lost follow‑ups or missed imaging leading to delayed salvage treatment

- Ambiguous documentation about intent (curative vs palliative)

Informed consent issues

- Inadequate explanation of risks (e.g., spinal cord injury, infertility, secondary malignancies)

- Incomplete documentation of patient understanding and agreement

Technology and QA failures

- Brachytherapy source misplacement or miscalculation

- IGRT setup errors not caught by image review

- Inadequate QA processes or failure to follow them

Why claims may arise years later

Radiation harm or failure is often delayed:

- Secondary cancers may manifest >10 years after radiation

- Organ dysfunction (e.g., cardiac, pulmonary, endocrinologic) may appear years later

- Local recurrence might be detected long after completing therapy

This long tail of risk makes the claims made vs occurrence distinction particularly important for rad onc, and emphasizes the importance of robust documentation and long‑term follow‑up policies.

Risk mitigation as a resident

During radiation oncology residency, you can significantly reduce your personal risk by:

Following established protocols religiously for simulation, planning, and QA

Always confirming:

- Patient identity

- Site and laterality

- Dose and fractionation

- Prior radiation history

Documenting key discussions:

- Goals of treatment

- Risks and alternatives

- Patient questions and your responses

Speaking up in the treatment planning process if something looks off:

- Unexpected OAR doses

- Unusually small or large target volumes

- Inconsistent prescriptions

Learning from QA conference and incident reports:

- Many departments have morbidity and mortality (M&M) or QI meetings

- Pay attention to patterns—these are exactly what become malpractice cases if repeated

Malpractice Insurance Across the Career Spectrum: From Rad Onc Match to Attending

During the rad onc match and residency applications

When evaluating programs during the rad onc match process, malpractice insurance is not usually the deciding factor—but it’s still useful to understand:

- Virtually all ACGME‑accredited programs provide malpractice insurance for residents.

- It’s usually:

- A claims‑made policy with the institution carrying tail obligations, or

- A broad coverage structure where residents are protected as long as the incident occurred during training

Questions you can appropriately ask as an applicant (especially on second looks or via email to program coordinators):

- “Is malpractice insurance provided for residents, and are there any coverage limits we should be aware of?”

- “Are residents covered for off‑site rotations and away electives?”

- “Is resident moonlighting ever allowed, and if so, is it covered under the institutional malpractice policy?”

You do not need to negotiate malpractice terms as a resident applicant; focus is mainly on clarity rather than contract leverage.

During residency

Residents should be aware of:

Scope of coverage

- Confirm whether:

- Internal moonlighting is covered

- External moonlighting requires separate malpractice insurance

- Never assume coverage for outside work without written confirmation.

- Confirm whether:

Policy type

- Typically, the institution’s insurance and legal department handle tail and transitions, so you rarely purchase individual coverage during residency.

- Still, it’s useful to know whether the hospital’s policy is claims‑made vs occurrence.

Documentation and professionalism

- Even as a trainee, your name may appear on lawsuits years later. Your notes, emails, and orders at the time of care are your best defense.

Incident reporting

- If you are involved in or aware of a near‑miss or error, follow institutional incident reporting policies.

- Timely reporting can:

- Improve patient safety

- Strengthen your defense if a claim eventually arises

Transition to Attending: Contract Details and Negotiation Points

The biggest malpractice insurance decisions arise when you finish residency and sign your first attending contract.

Key questions to ask prospective employers

When interviewing for a radiation oncology job, explicitly ask:

What type of malpractice insurance is provided?

- Claims‑made vs occurrence

- If claims‑made, ask:

- Who pays for tail coverage if/when I leave?

- Are there any vesting schedules or conditions?

What are the policy limits?

- Typical: $1M/$3M or higher

- Clarify:

- Are limits per physician, or shared across a group?

- Are there separate limits for defense costs or included within the cap?

Is coverage through a commercial carrier or a hospital self‑insured plan?

- Academic centers often use self‑insured or captive arrangements.

- Private groups may use standard commercial carriers.

What is the retroactive date for coverage?

- Especially important if prior acts will be covered (nose coverage).

Does the policy include coverage for:

- Administrative hearings (state medical board actions)?

- Deposition-only situations (e.g., being deposed because you were consulted)?

- Telemedicine across state lines, if relevant?

Tail coverage: non-negotiable to understand

For a claims‑made policy in radiation oncology, tail coverage is not optional—it is essential. Situations to watch:

Private practice group offers claims‑made coverage but requires you to buy your own tail when you leave.

- Tail can be extremely expensive (tens of thousands of dollars or more), particularly later in your career.

- Factor this into the overall compensation package.

Employer pays tail only if you stay a minimum number of years.

- Example:

- 0–2 years: you pay 100% of tail

- 3 years: employer pays 50%

- 5+ years: employer pays 100%

- This is common; understand the exact terms.

- Example:

Leaving for another job with nose coverage.

- Confirm that the new employer’s policy:

- Sets the retroactive date to your initial start date at the prior job

- Explicitly covers all prior acts while insured at the old job

- Confirm that the new employer’s policy:

Choosing appropriate limits as a radiation oncologist

As an attending, you’ll typically be offered standard limits. Factors to consider:

State norms and requirements

Some states or hospitals mandate minimum coverage to maintain privileges.Practice setting

- High‑risk or high‑complexity practices (e.g., prostate brachytherapy, SBRT, pediatric radiation) may warrant higher limits.

- Solo or small group practices might prefer higher limits for personal protection.

Employer structure

- In some groups, you may be personally responsible for any award exceeding policy limits (“excess coverage risk”). Understand this possibility clearly.

Practical Strategies to Reduce Malpractice Risk in Radiation Oncology

Insurance is the safety net; prevention is your real shield. As a rad onc trainee or young attending, cultivate habits that both protect patients and minimize legal exposure.

1. Robust informed consent

Radiation oncology consent should be detailed but understandable:

Explain:

- Purpose of radiation (curative, adjuvant, palliative)

- Realistic benefits and anticipated outcomes

- Common side effects and serious but rare risks

- Alternatives including no treatment

Use visual aids when helpful (e.g., diagrams of organs at risk, potential side effect regions).

Document:

- Discussion points (especially serious risks)

- Patient questions and your answers

- Patient’s expressed understanding

Courts often focus on whether a reasonable patient would have wanted to know a particular risk before consenting.

2. Careful documentation

Your note may someday be read to a jury. Good documentation in rad onc:

Clarifies:

- Intent of therapy

- Rationale for target selection

- Basis of dose/fractionation choice

Includes:

- Prior radiation history check (when applicable)

- Comorbid conditions that influence risk

- Discussions with other specialists (tumor board, curbside consults)

If something goes wrong (e.g., unexpected toxicity), document:

- Clinical findings

- Steps taken to evaluate/mitigate

- Communication with the patient and family

Avoid retroactive changes to notes; instead, use addenda clearly stating date and purpose.

3. Adherence to QA processes

Radiation oncology QA exists because small errors can cause major harm. Protect yourself by:

- Double‑checking plan parameters against the prescription

- Participating actively in chart checks and peer review of contours

- Immediately addressing any physics or therapist concerns

If an error is discovered:

- Follow institutional protocols for disclosure and remediation.

- Early, transparent disclosure and corrective action often reduce both harm and legal risk.

4. Professional communication and follow-up

Miscommunication is a leading root cause of malpractice claims.

Return calls and messages promptly, especially about:

- New symptoms

- Imaging suggesting complications or progression

Clearly arrange:

- Follow‑up intervals

- Responsibility for post‑treatment surveillance (you vs medical oncology vs primary care)

Document attempts to contact patients if they miss appointments or imaging.

Frequently Asked Questions (FAQ)

1. As a radiation oncology resident, do I need to buy my own malpractice insurance?

Almost always no. Your residency program or teaching hospital provides malpractice insurance that covers you for activities within your training scope. Exceptions might include:

- External moonlighting at unaffiliated sites

- Certain volunteer or global health activities

If you’re planning to work outside institutional duties, confirm with:

- Your program director

- GME office

- Risk management or legal counsel

You may need to purchase individual policies for those activities.

2. For attendings, is a claims-made or occurrence policy better in radiation oncology?

Neither is universally “better”; each has trade‑offs:

Occurrence:

- Simpler, no tail needed when you leave

- Often higher annual premium

- Less common in some markets

Claims-made:

- Lower initial premiums, widely used

- Requires tail coverage (or nose coverage with a new employer)

- More moving parts during job transitions

Given radiation oncology’s long latency risks, both policy types can work well if tail or prior‑acts coverage is properly managed. Focus less on the label and more on:

- Who pays for tail

- Retroactive date and continuity of coverage

- Policy limits and exclusions

3. What happens if I’m named in a lawsuit years after I finished residency?

If the suit involves care you provided as a resident, you are typically covered under your training institution’s policy as long as:

- The incident occurred while you were a resident

- The institution’s policy included you as an insured party

Hospitals often maintain coverage and defense for past trainees for many years. If you receive legal documents:

- Contact your residency program’s GME office and risk management (even if you’ve graduated)

- Notify your current malpractice carrier

- Do not contact the patient or family directly about the case

Your former institution’s insurer typically appoints counsel for you.

4. How much malpractice insurance coverage do I need as a radiation oncologist attending?

Most rad onc attendings carry at least $1M/$3M or $2M/$4M in coverage, driven by:

- State requirements

- Hospital credentialing standards

- Group norms

Higher limits may be appropriate if you:

- Work in a high‑severity risk environment (e.g., pediatrics, frequent SBRT, complex brachytherapy)

- Have substantial personal assets to protect

Discuss appropriate limits with:

- Your employer’s risk management team

- An independent malpractice insurance broker familiar with your state and specialty

Malpractice insurance in radiation oncology is not just legal fine print—it’s a core component of your professional safety net. From the rad onc match through your first attending job and beyond, understanding medical liability insurance, especially claims made vs occurrence coverage and the role of tail protection, will help you make informed, career‑wise decisions while focusing on what truly matters: delivering safe, high‑quality care to your patients.