Understanding Malpractice Insurance in Medicine-Pediatrics

As a Medicine-Pediatrics (Med-Peds) physician, you occupy a uniquely broad clinical space—caring for patients from birth through adulthood, often with complex chronic conditions that transition between pediatric and adult systems. That breadth brings extraordinary rewards, but it also means you face a wide spectrum of medico-legal risk. A clear understanding of malpractice insurance is therefore essential for every stage of your career—from the medicine pediatrics match through fellowship or early attending life, and into mature practice.

This guide will walk you through the fundamentals of malpractice insurance tailored to Med-Peds, including how policies work, key decisions like claims made vs occurrence coverage, what’s usually covered during residency versus attending practice, and how to evaluate offers in employment contracts.

Throughout, keep in mind: this is educational information, not legal advice. Always review your specific situation with your institution’s risk management office, a qualified attorney, or an insurance professional.

1. Why Med-Peds Residents and Attendings Need to Think About Malpractice Early

Med-Peds: A Broader Risk Profile

Med-Peds physicians practice at the intersection of internal medicine and pediatrics, which can mean:

- Caring for vulnerable populations (neonates, children, the elderly, complex chronic patients)

- Managing high-acuity conditions across age groups (sepsis, respiratory failure, diabetic ketoacidosis)

- Navigating complex transitions of care (pediatric to adult providers, inpatient to outpatient, subspecialty coordination)

- Potentially working in multiple practice settings (hospitalist, outpatient clinic, urgent care, continuity clinic, subspecialty co-management)

These factors don’t automatically mean higher risk than other specialties, but they do mean diverse risk. A miscommunication during a transition of care, a missed diagnosis in a young adult with congenital disease, or a dosing error in a pediatric patient can all be fertile ground for malpractice allegations.

Malpractice Insurance Basics: What It Actually Covers

At its core, malpractice insurance is a specific type of medical liability insurance that:

- Pays for legal defense costs if you are sued for professional negligence

- Pays damages or settlements up to the policy limits, if you are found liable or choose to settle

- May cover certain board complaints or licensing matters, depending on the policy

It typically does not cover:

- Criminal acts or intentional harm

- Sexual misconduct

- Practicing outside your scope or license

- Activities explicitly excluded by the policy (e.g., volunteering not covered by your residency policy, cosmetic procedures outside your employment contract)

For Med-Peds residents, malpractice coverage is usually provided by the hospital or training institution. Once you move into attending roles, the picture becomes more complex—and your decisions can have long-term financial consequences.

Why Think About It Before the Medicine Pediatrics Match?

Even at the medicine pediatrics match stage, you should be aware of:

- How residency programs structure malpractice coverage

- Whether moonlighting is allowed and covered

- Whether tail coverage is provided if you leave or transfer

You do not typically choose your own liability carrier in residency, but you do choose the environment you’ll be working in. Programs vary in how they handle issues like moonlighting and legal support for residents.

Actionable tip for applicants:

During interviews or second looks, politely ask program leadership:

- “Can you walk me through the malpractice insurance coverage for residents, including limits and whether it’s claims-made or occurrence?”

- “Is moonlighting allowed, and if so, is it covered under the residency’s malpractice insurance or do residents need separate coverage?”

These questions signal maturity and professionalism, not mistrust.

2. Key Malpractice Insurance Concepts Every Med-Peds Physician Should Know

Policy Limits: How Much Coverage Do You Really Have?

Most residency programs and many employers use policies stated like:

- $1 million / $3 million

- $1 million: maximum the insurer will pay per claim

- $3 million: maximum the insurer will pay in total for all claims in a single policy year

Other common structures include $1M/$5M or $2M/$4M.

For most Med-Peds physicians:

- Standard limits are usually sufficient when working within a hospital system or large group

- Very high-risk procedures (e.g., certain invasive or surgical procedures) might warrant higher limits, but these are less common in general Med-Peds practice

Actionable tip:

When reviewing an employment contract, confirm:

- The exact limits (per claim / aggregate)

- Whether the limits are shared among a group or unique to you

- If there are different limits for different practice sites (e.g., hospital vs clinic vs telemedicine)

Deductibles and Defense Costs

In many hospital- or group-employed positions, you do not pay a deductible yourself. The employer or practice absorbs that cost.

Important distinctions in policy design:

- Defense costs inside limits: Legal fees reduce the total available for settlement or judgment

- Defense costs outside limits: Legal fees are paid in addition to the coverage limit

For example, with a $1M per-claim limit:

- If defense costs are inside limits:

- $300,000 on defense, $700,000 left for settlement/judgment

- If defense costs are outside limits:

- $1M still available for settlement/judgment, plus defense costs paid separately

Most residents cannot change these details, but attendings reviewing offers should ask which structure is used.

Scope of Coverage: Where and What Are You Covered For?

Med-Peds physicians often work in more than one location or role:

- Hospital inpatient service (adult and pediatric)

- Outpatient continuity clinic

- Newborn nursery

- Urgent care

- Telemedicine follow-up visits

- Moonlighting at an outside facility

You need clarity on exactly which activities and locations are covered. Common issues:

- Telemedicine crossing state lines (licensure and coverage may differ by state)

- Volunteer or global health work not associated with your employer

- Locum tenens or side clinical work

Actionable tip:

Ask your risk management office or HR:

- “Does my malpractice coverage apply to all clinical activities I perform for the organization, including telemedicine and off-site clinics?”

- “What about volunteer, global health, or outside moonlighting work?”

If it’s not explicitly covered, you may need a separate policy (often called “part-time” or “moonlighting” coverage).

3. Claims Made vs Occurrence: The Crucial Coverage Decision

Understanding claims made vs occurrence policies is one of the most important malpractice insurance lessons you will ever learn. It affects:

- How long you’re protected

- Whether you need tail coverage

- How much your coverage will cost over time

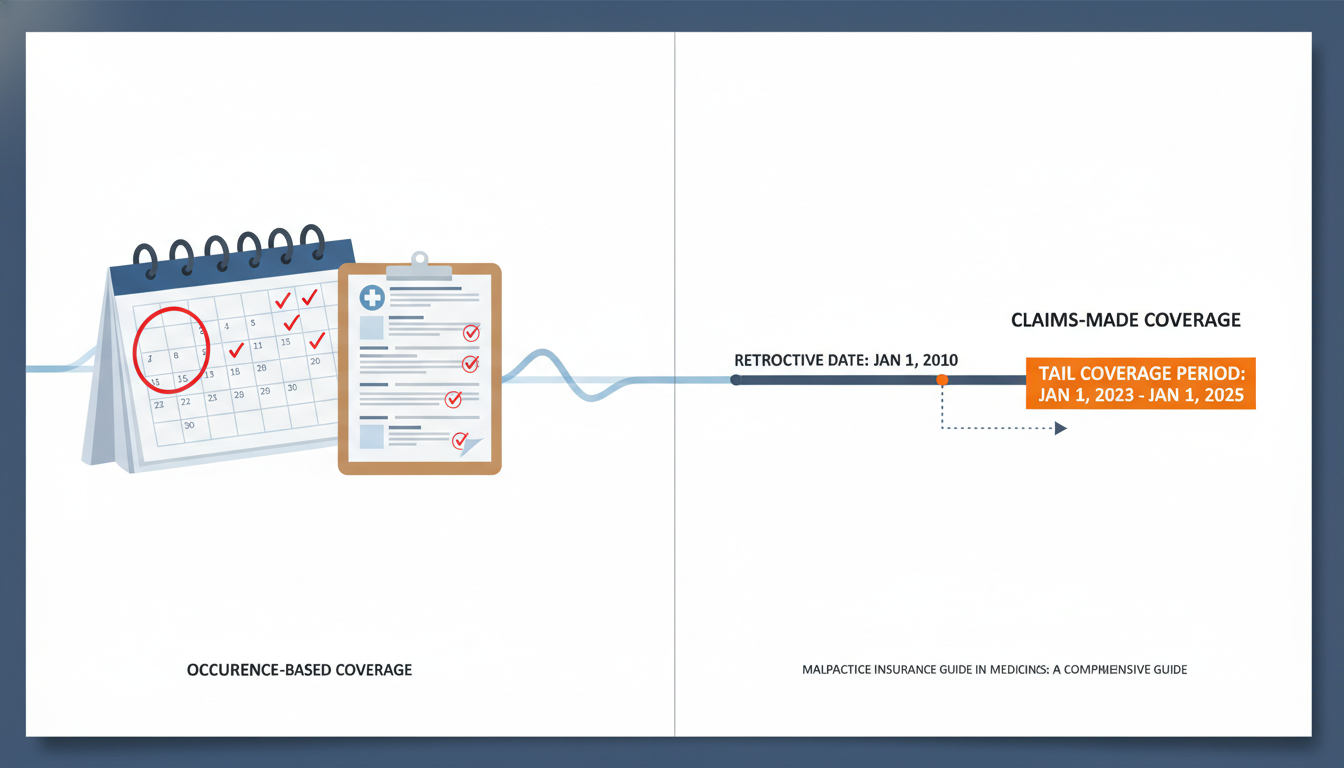

Occurrence Policies

An occurrence policy covers you for any incident that occurred while the policy was in force, no matter when the claim is filed.

- If you had occurrence coverage from 2025–2027:

- A patient treated in 2026 sues in 2030 → The 2026 occurrence policy responds

- When you leave that job or stop paying premiums, you are still covered for incidents that occurred while it was active

- No tail coverage is usually needed

Pros for Med-Peds physicians:

- Simpler to understand

- No need to worry about buying tail when you leave

- Good for people who anticipate multiple job changes early in their career

Cons:

- Premiums are typically higher up front than claims-made

- Not as commonly offered in some markets or employer structures

Claims-Made Policies

A claims-made policy only covers claims that are:

- Based on an incident that occurred after the retroactive date, and

- Reported (filed) while the policy is active

Key terms:

- Retroactive date: The earliest date from which incidents are covered under the policy

- Tail coverage (extended reporting endorsement): Extends the time to report a claim after the policy ends, for incidents that occurred while the policy was active

Example for a Med-Peds hospitalist:

- Start job: July 1, 2025. Claims-made policy with retroactive date of 7/1/2025.

- Leave job: June 30, 2029. Policy ends.

- A patient you treated in 2027 sues you in 2031.

Without tail coverage:

- Policy ended in 2029 → Claim reported in 2031 → No coverage

With tail coverage:

- Tail extends reporting window beyond 2029 → Claim reported in 2031 is covered, as long as the tail is in force.

Pros:

- Lower initial premiums, especially early in practice

- Common in group and private practice arrangements

Cons:

- You may be responsible for purchasing expensive tail coverage when you leave

- Requires careful contract negotiation and planning

4. Tail Coverage, Job Changes, and Contract Negotiations in Med-Peds

What Is Tail Coverage and Why Does It Matter So Much?

Tail coverage (also called an “extended reporting endorsement”) is an add-on to a claims-made policy that:

- Allows you to report claims after the original policy ends

- Covers incidents that happened during the original policy period

This is crucial for Med-Peds physicians because:

- Many claims—especially in pediatrics—are filed years after the care occurred

- Statutes of limitation for children can extend to adulthood in some states

- Your risk doesn’t vanish just because you change jobs or stop practicing

For example, if you misdiagnosed a congenital heart condition in a 10-year-old patient, the consequences may not become evident until the patient is older. Without tail coverage, a lawsuit filed years later for that earlier care might not be covered.

How Much Does Tail Cost?

Typical tail coverage costs:

- Roughly 150–250% of your final year’s premium

- Paid as a one-time upfront amount

For an early-career Med-Peds physician whose premium might be $12,000–$20,000 annually as an attending, tail could cost $18,000–$50,000 or more, depending on specialty risk, limits, and region.

This is why it’s critical to understand who pays for tail in your contract.

Who Should Pay for Tail? Negotiation Strategies

Common arrangements:

Employer pays 100% of tail

- Most favorable to you

- Often seen in large health systems, academic centers, or highly competitive markets

Physician pays 100% of tail

- Less favorable

- More common in smaller groups or private practices

Shared or conditional agreements, such as:

- Employer pays if you stay a certain number of years

- Employer pays if they terminate you without cause

- You pay if you leave before a specified time frame

- Cost split by a percentage (e.g., 50/50)

Actionable tips for Med-Peds physicians reviewing contracts:

- Look for an explicit clause about:

- Type of coverage (claims-made vs occurrence)

- Responsibility for tail coverage

- Ask:

- “If I leave the practice or the contract ends, who is responsible for purchasing tail coverage?”

- “Under what circumstances would the employer cover tail—termination without cause, retirement, disability?”

If the contract is silent, request clarification in writing before signing. In some cases, negotiating for occurrence coverage (even with slightly higher premiums) might be worth it for the peace of mind, especially early in your career.

5. Residency, Moonlighting, and Early-Career Insurance Practicalities

Coverage During Med-Peds Residency

Most ACGME-accredited Med-Peds programs provide:

- Malpractice insurance at no cost to residents

- Coverage that extends to:

- Clinical activities mandated by the residency (inpatient, outpatient, electives)

- Many program-approved off-site rotations

Key questions to clarify as a resident:

- Is coverage claims-made or occurrence?

- What are the policy limits?

- Does the institution provide tail coverage automatically if a resident leaves or graduates?

- Many academic centers do

- Are research-related clinical activities covered?

For most residents, the coverage structure chosen by the institution is non-negotiable. Your key responsibility is to understand the policy’s boundaries, especially if you take on additional work.

Moonlighting: A Common Pitfall

Med-Peds residents frequently moonlight as:

- Hospitalists (adult or pediatric)

- Urgent care physicians

- Telemedicine providers

- Nocturnists in community facilities

Moonlighting may or may not be covered by your residency program’s malpractice insurance. Often:

- Internal moonlighting (within the same system) is covered under the institutional policy, but confirm the details

- External moonlighting (at another hospital or clinic) generally requires the moonlighting site to provide coverage, or you to obtain your own individual policy

Actionable steps:

- Check your program’s written moonlighting policy.

- For each moonlighting opportunity, ask:

- “Is malpractice insurance provided?”

- “What are the policy limits?”

- “Is this coverage separate from my residency policy?”

- Get the answers in writing or email, not just verbal assurances.

Never assume that your residency malpractice policy automatically follows you to an outside site.

Transitioning to Fellowship or Attending Practice

When you complete your Med-Peds residency, consider:

- Does your residency program’s malpractice policy include tail coverage when you graduate?

- Many institutional occurrence policies inherently do; claims-made policies may have institutional tail that you don’t have to pay for

- If you did independent moonlighting under a separate claims-made policy, does that policy require tail?

When joining a new employer:

- Confirm their malpractice structure before you sign:

- Claims-made vs occurrence

- Retroactive date (if they’re picking up prior acts)

- Who pays for tail at the end of your employment

If moving directly into fellowship within the same system, coverage is often continuous and simple. If you’re changing institutions or starting as an attending, the details matter much more.

6. Risk Management for Med-Peds: Reducing Your Exposure

Even the best medical liability insurance is a safety net, not a primary strategy. Strong clinical practice and risk management can reduce the likelihood of claims and improve outcomes.

High-Risk Areas in Med-Peds

Transition of Care Errors

- Poor communication between pediatric and adult services

- Inadequate medication reconciliation

- Lost follow-up of complex congenital or chronic disease patients

Diagnostic Delays or Missed Diagnoses

- Subtle presentations in adolescents or young adults

- Vague symptoms in children leading to delayed diagnoses of serious illness

Medication Dosing Errors

- Weight-based pediatric dosing

- Renal or hepatic adjustment in adults with chronic disease

Informed Consent and Communication Failures

- Inadequate discussion of risks and benefits

- Compassion fatigue impacting bedside communication

Practical Risk-Reduction Strategies

Document thoroughly and clearly

- Rationale for decisions (why you did or didn’t order a test)

- Shared decision-making discussions

- Patient or family’s understanding and questions

Use checklists and clinical decision support where available

- For pediatric dosing

- For preventive care in adolescents and young adults

- For transitional care plans

Close the loop on follow-up

- Lab and imaging result tracking systems

- Clear instructions to patients about what to do if symptoms change

- Explicit documentation when patients decline recommended care

Communicate proactively across care teams

- Handoff templates between pediatric and adult services

- Clear assignment of who is “captain of the ship” for complex patients

These practices not only improve patient care but also create strong documentation that can be protective if a claim arises.

FAQs: Malpractice Insurance for Med-Peds Physicians

1. Are Med-Peds residents personally liable if they’re sued, or does the hospital take care of everything?

You can be named personally in a lawsuit alongside the hospital and supervising physicians. However, in almost all residency situations, the hospital’s malpractice insurance covers your legal defense and any settlement or judgment, up to the policy limits, for activities within the scope of your training. Confirm with your GME office and review the policy summary, but residents rarely need their own additional malpractice coverage for program-sanctioned clinical work.

2. For the medicine pediatrics match, should I prioritize programs based on their malpractice insurance details?

Malpractice specifics shouldn’t be the sole deciding factor, but they are worth understanding. Among otherwise comparable programs, it can be a plus if:

- Coverage limits are robust

- Tail coverage is clearly provided at graduation

- Internal moonlighting is covered under the institutional policy

Focus your rank list primarily on training quality, culture, and fit, but use malpractice coverage as a secondary differentiator if needed.

3. As a new Med-Peds attending, is it better to choose a job with occurrence coverage or a higher salary with claims-made coverage?

It depends on your risk tolerance, job stability, and local market. Occurrence coverage is simpler and avoids future tail costs but often comes with higher premiums (which may indirectly affect your salary). Claims-made coverage can be financially attractive short-term, if:

- The employer pays for tail when you leave, or

- You anticipate long-term stability with that employer

When comparing offers, factor in who pays for tail coverage and what that tail might cost. A higher salary that leaves you on the hook for a $30,000–$50,000 tail in a few years may not be as attractive as it looks.

4. I want to do part-time telemedicine as a Med-Peds physician. How do I make sure I’m covered?

Telemedicine adds layers of complexity—state licensure, cross-border practice, and varied insurer rules. To stay protected:

- Confirm whether your primary employer’s malpractice insurance covers telemedicine, and in which states.

- If working for a separate telemedicine company:

- Ask if they provide malpractice insurance and get details (claims-made vs occurrence, limits, tail).

- If needed, purchase an individual policy specifically covering telemedicine in all states where you’re licensed and see patients.

Never assume your core policy automatically covers telemedicine, especially across state lines.

Malpractice insurance—and broader medical liability insurance concepts—may feel abstract when you’re busy with exams, the medicine pediatrics match, or starting your first attending role. Yet the decisions you make about claims made vs occurrence policies, tail coverage, and contract terms can shape your financial and professional security for decades. Take the time to learn the basics now, ask clear questions, and seek expert advice when needed. Your future self will be grateful.