Physician disability insurance is one of the most important—yet often least understood—parts of a doctor’s financial life. You can have excellent clinical skills, a strong contract, and a promising career path, but a single illness or injury can disrupt everything. Disability coverage is what protects your most valuable asset: your ability to earn an income.

This guide walks you through the key concepts, common pitfalls, and practical steps to secure the right coverage for where you are in training or practice. It’s especially relevant for medical students, residents, fellows, and early‑career attendings who are making long-term decisions for the first time.

Why Physician Disability Insurance Matters So Much

Physicians have a unique risk profile. You invest 7–15 years in training and often graduate with six-figure educational debt. Your income potential is high, but so is your vulnerability if you can’t work.

Your Income Is Your Biggest Asset

Most physicians will earn several million dollars over their careers. That future earning power dwarfs:

- Your current savings

- Your car or home value

- Your retirement accounts (especially early in your career)

Disability insurance exists to protect that future income stream. Without it, the financial consequences of a disabling illness or injury can be severe:

- Inability to pay student loans, mortgage, or childcare

- Forced lifestyle changes for you and your family

- Disrupted retirement planning and savings

- Need to depend on relatives or public assistance

Disability Is More Common Than You Think

Many physicians assume disability is unlikely unless there’s a catastrophic injury. In reality, most long-term disability claims come from:

- Musculoskeletal issues (e.g., chronic back/neck pain, joint problems)

- Cancer

- Mental health conditions (e.g., major depression, anxiety)

- Neurologic disorders (e.g., multiple sclerosis, stroke)

- Cardiac conditions

Physicians are particularly vulnerable to hand/arm problems, spine issues, or visual impairment that may not disable a layperson but can end a career in surgery, anesthesiology, or procedural specialties.

Why Residents and Fellows Should Care Now

Disability insurance for residents and fellows is often:

- Cheaper: You’re younger and generally healthier.

- More insurable: You’re less likely to have chronic conditions that lead to exclusions.

- Crucial leverage: You can lock in coverage and policy definitions now, then increase benefits later as an attending via future purchase options without medical re‑underwriting.

If you wait until you’re an attending—with higher income but also possibly more health issues—you may face:

- Higher premiums

- Policy exclusions (e.g., back, mental health, or joints)

- Declines or restrictions if you’ve developed significant conditions

That’s why disability insurance residents obtain during training can be one of the smartest long-term financial moves they make.

Key Concepts: Understanding How Disability Insurance Works

Before choosing a policy, you need to understand the building blocks of disability coverage. The contract language—especially how disability is defined—is more important than the company logo or the headline benefit amount.

Short-Term vs Long-Term Disability

Short-Term Disability

- Typically covers the first 3–6 months after disability

- Often provided by employers

- Helpful for pregnancy, minor injuries, or brief illnesses

- Not a substitute for long-term coverage

Long-Term Disability (LTD)

- Kicks in after a waiting (elimination) period—often 90 days, 180 days, or longer

- Can last years or even to age 65 or 67

- This is the core protection physicians need

Employer group LTD coverage is a start, but it’s rarely enough by itself—especially for high-income specialists.

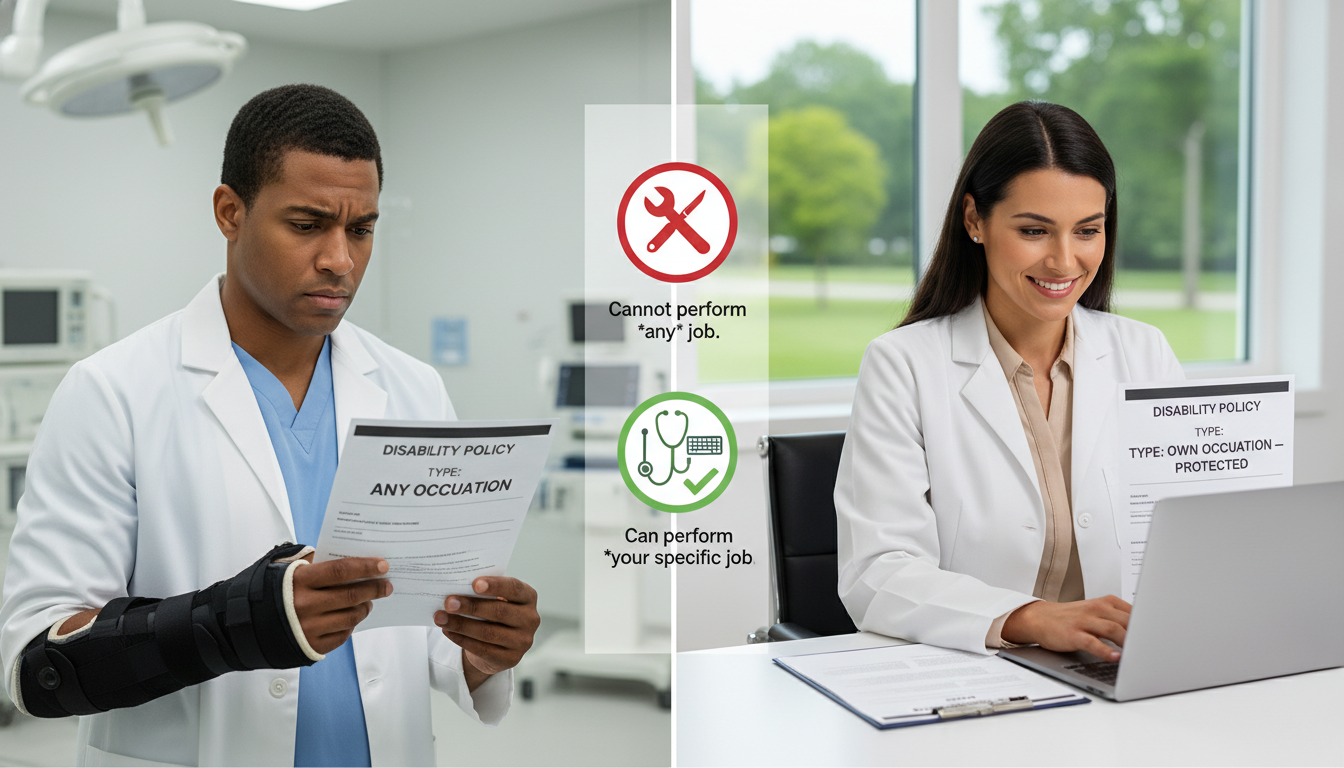

The Critical Concept: Own Occupation Disability

For physicians, own occupation disability is the central feature to understand.

A strong own-occupation definition typically means:

You are considered totally disabled if, due to illness or injury, you are unable to perform the material and substantial duties of your own occupation (e.g., orthopedic surgeon), even if you can work in another occupation and earn income there.

Why this matters:

- A surgeon who can no longer operate due to hand tremor, but can still teach, consult, or do telemedicine, should ideally:

- Receive full disability benefits, and

- Be free to earn additional income without losing those benefits.

This is fundamentally different from weaker definitions, like:

- Any occupation: You must be unable to work in any job consistent with your education, training, or experience.

- A disabled interventional cardiologist might be told they can do non‑procedural internal medicine, and therefore are not disabled under the policy.

- Modified own occupation or transitional own occupation: May reduce or phase out benefits depending on what you earn in another job.

For most physicians—especially in procedural specialties—having a true own occupation disability policy is crucial.

Core Components of an Individual Disability Policy

When you look at quotes or sample contracts, several key provisions determine how well you’re protected and what you’ll pay.

Benefit Amount and Benefit Period

- Monthly benefit:

- For residents/fellows: commonly $5,000–$7,500/month max without proof of income, sometimes more with special programs.

- For attendings: often 40–60% of gross income, sometimes higher with multiple policies.

- Benefit period: How long benefits can be paid:

- To age 65 or 67 (most common and recommended)

- 5 or 10 years

- Lifetime (rare and expensive)

For high-income physicians, benefit period to age 65/67 is usually the best balance of cost and protection.

Elimination (Waiting) Period

This is the time between disability onset and when benefits start.

Common options:

- 90 days (most typical)

- 180 days (cheaper, but more cash reserves needed)

- 30 or 60 days (more expensive)

For most physicians, a 90‑day elimination period is reasonable if you have a 3–6 month emergency fund.

Non-Cancellable and Guaranteed Renewable

- Non‑cancellable: The insurer cannot raise your premiums or reduce benefits as long as you pay on time, up to the policy’s end date.

- Guaranteed renewable: The insurer must renew your policy and cannot change it individually, but can change premiums by class (e.g., for your entire occupational class or state).

Ideally, you want a non‑cancellable, guaranteed renewable policy—this locks in your premium and benefits.

Residual/Partial Disability Rider

Total disability isn’t all-or-nothing. Many physicians suffer:

- A back injury that allows part-time work

- Chronic illness that reduces capacity

- Loss of call or procedures that cut income

A residual or partial disability rider:

- Pays benefits when you lose a certain percentage of income (e.g., 15–20%) due to illness or injury, even if you’re still working.

- Often includes recovery benefits that continue after you return to work if your income remains down.

For physicians, this rider is highly recommended.

Cost-of-Living Adjustment (COLA) Rider

The COLA rider:

- Increases your benefit annually while you’re on claim

- Helps benefits keep up with inflation

This is particularly important if:

- You’re younger (20s–40s)

- You may be disabled for many years

COLA adds to the cost, but for a resident or early attending planning decades of practice, it can be worth it.

Future Increase / Future Purchase Options

These riders allow you to:

- Increase your benefit in the future as your income rises

- Without new medical underwriting

- Often only financial underwriting (tax returns, W-2/1099)

This is critical for disability insurance residents and fellows purchase:

- You’re locking in insurability while healthy.

- Even if you later develop back pain, mental health conditions, or other issues, you can still increase coverage.

Never assume you can “just buy more later.” Health changes quickly during intense training and early practice years.

Special Considerations by Career Stage

Your needs, insurability, and options differ as you move from medical school to residency, fellowship, and independent practice.

Medical Students and New Graduates

You may be able to:

- Get a small individual disability policy in your final year of school or during internship.

- Access “new physician” programs with:

- Simplified underwriting

- Small but expandable benefits

- Future increase riders

Why consider starting early?

- You’re often in the best health of your life.

- You can lock in own occupation disability definitions before any issues arise.

- Even a modest benefit can be life-changing early on.

Residents and Fellows

This is often the most strategic time to purchase coverage.

Key points:

Specialty-Specific Own Occupation

- Make sure your policy defines your own occupation as your specific specialty (e.g., neurosurgery, OB/GYN, emergency medicine).

- If you’re in fellowship, clarify whether the policy will treat you as your fellowship specialty once completed.

Discounts and Training Program Deals

- Many insurers offer:

- Training-program discounts (10–40%)

- Unisex rates with female discounts (where available)

- These discounts usually follow you after graduation.

- Many insurers offer:

Balancing Cost and Benefits

- Start with a manageable base policy (e.g., $4,000–$5,000/month).

- Add a future purchase rider to scale up coverage as an attending.

- Consider:

- Non‑cancellable/guaranteed renewable

- Residual disability rider

- COLA if you’re early in training

Coordination with Employer or Hospital Coverage

- Many academic hospitals offer group LTD:

- Often 60% of salary, capped (e.g., $5,000–$10,000/month)

- Frequently taxable benefits (if employer-paid)

- Commonly weaker definitions (e.g., any occupation after a transition period)

- Use individual coverage to:

- Lock in own occupation

- Supplement group benefits

- Provide portable coverage if you move jobs

- Many academic hospitals offer group LTD:

Early-Career Attendings

Once you start your attending role:

Reassess Income and Needs

- Update coverage based on:

- Base salary and bonus

- Call pay, shift differentials, RVU or productivity income

- You may need:

- Higher monthly benefit

- Additional policies if your income is high and one contract’s cap is insufficient

- Update coverage based on:

Taxability of Benefits

- If you pay premiums with after-tax dollars:

- Benefits are typically tax-free

- If employer pays:

- Benefits are usually taxable as income

- This can dramatically affect how much you actually receive, so model your net benefit.

- If you pay premiums with after-tax dollars:

Private Practice and Partnership Track

- As a partner or business owner:

- Consider business overhead expense (BOE) coverage

- Evaluate key-person insurance if your disability would harm the group financially

- Ensure your personal disability insurance integrates well with any practice-provided coverage.

- As a partner or business owner:

Subspecialty and High-Risk Procedures

- Ensure your policy’s occupational class accurately reflects your risk and duties:

- A pain interventionalist doing heavy procedures is different from a purely outpatient neurologist.

- Be transparent about procedures you perform—failure to disclose can be grounds for denial later.

- Ensure your policy’s occupational class accurately reflects your risk and duties:

Evaluating Policies and Avoiding Common Pitfalls

Not all disability policies are created equal. Here’s how to compare them intelligently and avoid the mistakes physicians often make.

Step 1: Focus on the Definition of Disability

When comparing policies:

- Prioritize true own occupation disability over:

- “Any occupation”

- “Modified own occupation”

- Confirm it’s specialty-specific:

- The policy should treat your claim based on your actual, current specialty at the time of disability.

If you’re surgical or procedural, this is non-negotiable. For non-procedural specialties, it’s still strongly preferred.

Step 2: Scrutinize Exclusions and Limitations

Policies may have:

- Pre-existing condition exclusions (e.g., for back, joints, mental health)

- Mental/nervous limitations:

- Some limit mental health claims (depression, anxiety, substance use disorders) to 24 months.

- Subjective conditions limitations:

- Conditions like chronic pain, chronic fatigue, or fibromyalgia can be restricted in some contracts.

Ask directly:

- Are mental/nervous conditions covered to the full benefit period?

- Are there any specific exclusions on my policy?

- How are partial or subjective disability claims handled?

Step 3: Understand Riders and Optional Benefits

Common riders physicians should consider:

- Residual/partial disability – Highly recommended.

- Future increase/future purchase – Essential if you’re early in your career.

- COLA (cost-of-living) – Valuable if you’re young; consider cost vs benefit.

- Catastrophic disability rider – Additional benefit if you can’t perform basic activities of daily living.

- Student loan rider – Separate benefit to cover loans if disabled; useful if you have large educational debt and can get it at reasonable cost.

Step 4: Examine Cost vs Coverage

Premiums vary based on:

- Age and gender

- Specialty and occupational class

- Smoking status

- Benefit amount and period

- Riders chosen

- State of residence

To manage cost:

- Start with core features:

- Own occupation definition

- Non‑cancellable/guaranteed renewable

- Residual disability rider

- Then add:

- Future increase option

- COLA if affordable

- Consider:

- Longer elimination period (e.g., 180 days) if you have strong cash reserves and need to lower monthly premiums.

- Keeping benefit period to age 65 rather than lifetime.

Step 5: Work with an Independent Agent Who Knows Physicians

Because physician disability insurance is specialized:

- Look for an independent broker who:

- Works regularly with physicians

- Represents multiple top-tier carriers

- Can show you side-by-side comparisons

- Avoid:

- Relying solely on one company’s captive agent

- Buying a policy you don’t fully understand (especially from someone selling multiple products at once)

Ask the agent to walk you through a sample claim scenario in your specialty under each policy being considered.

Practical Action Plan: What to Do Next

Here’s a concrete, step-by-step approach you can follow regardless of your current stage.

1. Assess Your Current Situation

Make a quick inventory:

- Do you have any employer group disability coverage?

- What’s the percent and cap?

- Employer- or employee-paid?

- Any-occupation vs own-occupation?

- Do you have any individual disability policies already?

- Benefit amount?

- Riders?

- Own occupation language?

2. Determine How Much Coverage You Need

Guidelines:

- Residents/Fellows:

- Aim for the maximum you can reasonably afford (commonly $4,000–$5,000/month at minimum, often higher if allowed).

- Include a future purchase rider so you can reach your expected attending income.

- Attendings:

- Target replacement of at least 50–60% of gross income, more if possible (through multiple policies or layering with group LTD).

- Coordinate with your partner/spouse’s income, savings, and expenses.

3. Get Multiple Quotes

Ask an independent agent for:

- 3–5 quotes from major carriers who are strong in the physician market.

- Each quote should clearly list:

- Own occupation definition

- Benefit amount and period

- Elimination period

- Riders

- Premium (monthly or annual)

- Request any applicable:

- Residency program discounts

- Hospital or group discounts

- Female-to-unisex rate options where available

4. Decide on Riders Strategically

For most physicians:

- Must-have:

- Specialty-specific own occupation

- Non‑cancellable/guaranteed renewable

- Residual/partial disability

- Future increase/future purchase option (if not at peak income yet)

- Strongly consider:

- COLA rider (especially if under 45)

- Optional:

- Catastrophic benefit

- Student loan rider (if loans are large and rate is reasonable)

5. Apply Before Your Health Changes

Underwriting will include:

- Health questionnaire

- Possibly medical records

- Sometimes labs or a brief physical (depending on benefit amount/age)

Be honest and complete. Underwriters can access prescription databases and medical records; omissions can be grounds for denial later.

Apply before:

- A new diagnosis (e.g., chronic back pain, depression, migraines) appears

- You start high-risk hobbies (e.g., skydiving, scuba, mountaineering), which can impact underwriting

6. Review the Final Contract Carefully

When the policy is issued:

- Read the actual contract—not just the illustration.

- Confirm:

- Your name and specialty classification

- Benefit amount, period, and elimination period

- Riders and their terms

- Any exclusions or limitations

- Keep a digital and physical copy in a safe place, and tell a trusted spouse/partner where it is.

FAQs About Physician Disability Insurance

1. Isn’t my employer’s group disability insurance enough?

Usually not. Employer group LTD often:

- Replaces only 40–60% of base salary, with caps (e.g., $5,000–$10,000/month).

- Provides taxable benefits if employer-paid.

- May use weaker disability definitions (e.g., any occupation or limited own-occupation).

- Isn’t portable—you lose it when you change jobs.

Individual physician disability insurance with own occupation coverage supplements and improves on this baseline.

2. What’s the difference between “own occupation” and “any occupation” in real life?

- With own occupation disability, a disabled anesthesiologist who can no longer practice safely due to a neurologic issue can:

- Receive full disability benefits, and

- Work in another role (e.g., teaching, consulting) without losing those benefits (under a strong own-occupation contract).

- With any occupation, the insurer may argue that the physician can work as a hospitalist, telemedicine doctor, or in a non-clinical role and therefore is not disabled.

For physicians, own occupation—ideally specialty-specific—is far more protective.

3. When is the best time to buy disability insurance as a doctor?

The best time is as early as you can responsibly afford it, typically:

- Late medical school or early residency for first coverage

- During residency/fellowship using training discounts and future increase riders

- Before any significant health issues arise

Disability insurance residents purchase early in training often locks in better terms and lower premiums than waiting until they are attendings.

4. How much disability insurance do I really need?

As a rule of thumb:

- Aim to replace at least 50–60% of your gross income, accounting for whether benefits are taxable or tax-free.

- For residents/fellows:

- Get the maximum affordable level with strong future increase options.

- Consider fixed expenses:

- Student loans

- Rent/mortgage

- Childcare and family support

- Insurance, utilities, and basic living costs

You want enough that, if disabled, you can maintain a modest, sustainable lifestyle and continue saving at least minimally for retirement.

Securing the right physician disability insurance won’t make you money today, but it protects the years of sacrifice and training you’ve already invested—and the income you’re counting on for your future. Understanding own occupation disability, evaluating policy features, and acting early in your career are the keys to building a safety net that supports you, your family, and your patients—no matter what happens to your health.