Financial Survival Guide for Residents: Smart Budgeting for Your Stipend

Transitioning from medical school to residency is one of the biggest shifts you’ll experience in your professional and personal life. Your clinical responsibilities grow dramatically, your schedule becomes less predictable, and for many, it’s the first time receiving a consistent salary rather than loans or small stipends.

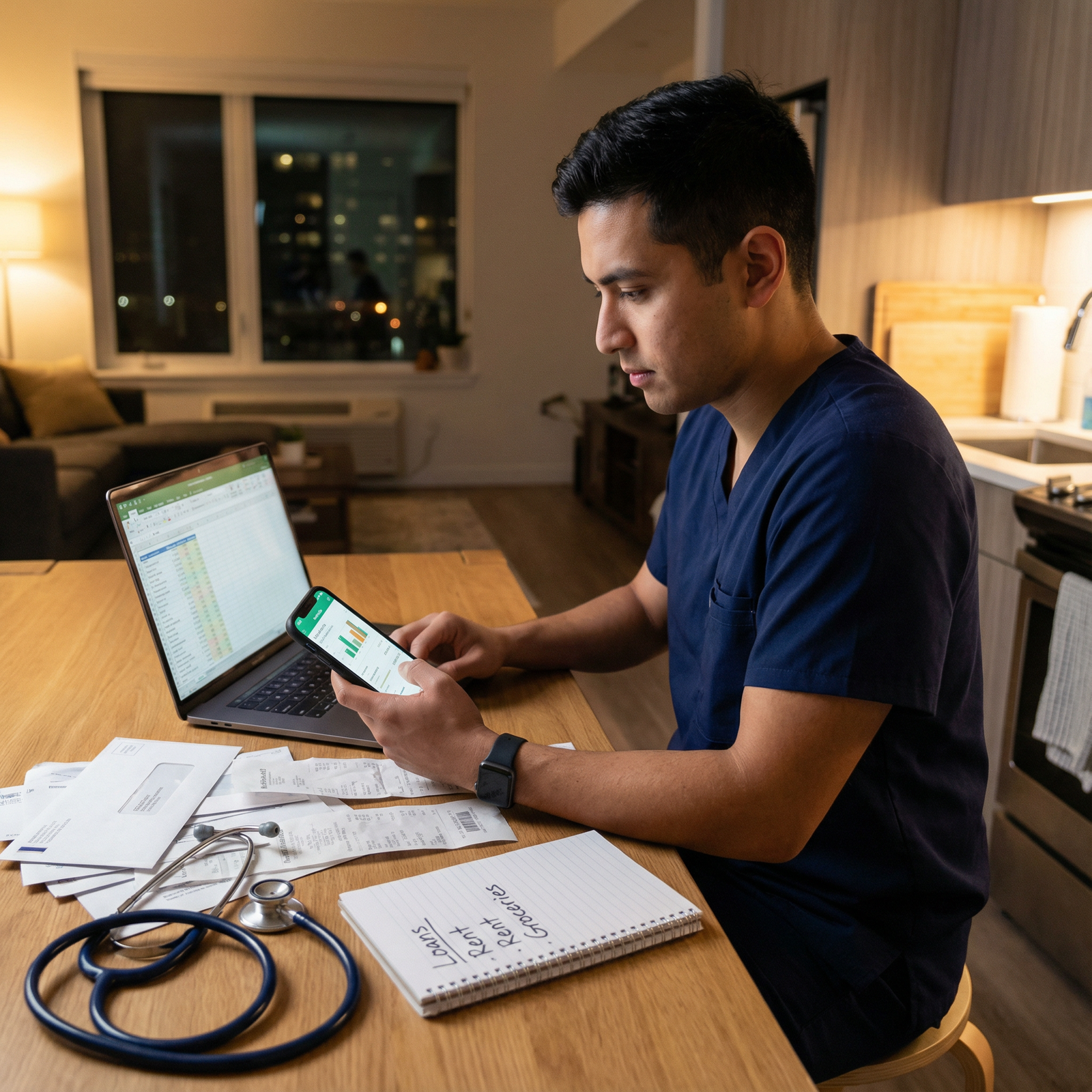

Yet for all the long hours and responsibility, residency income often feels tight—especially when you factor in student loans, high cost-of-living areas, and the temptation to “finally live a little” after years of sacrifice. This is where a strategic Residency Finance plan and practical medical budgeting become essential.

This guide walks you through a realistic, residency-focused Financial Survival Guide: how to understand your pay, build a practical budget, prioritize savings and debt, avoid common money traps, and make your stipend management work for you—not against you.

Understanding Residency Compensation and Your Real Take-Home Pay

Before you can create a realistic budget, you need to understand what you’re really earning—not just your “salary number.”

Typical Residency Pay: What to Expect

In the U.S., the annual stipend for a PGY-1 resident typically falls between $55,000 and $70,000, depending on:

- Geographic region (major cities and coasts often pay more, but also cost more)

- Hospital system and program size

- Specialty and post-graduate year (PGY-1 vs PGY-3, etc.)

While this may seem like a significant jump compared to medical school, it must cover:

- Housing (rent or mortgage)

- Utilities and internet

- Food and essentials

- Transportation (car, gas, insurance, parking, public transit)

- Health, disability, and sometimes life insurance

- Student loan payments or other educational debt

- Licensing, exam, and board preparation costs

- Professional expenses (scrubs, white coats, books, apps, conferences)

- Miscellaneous costs (phone, clothing, entertainment, travel, family expenses)

Crucially, residents are usually salaried, so you don’t get typical overtime pay—despite working far beyond a standard 40-hour week. The hourly breakdown of your stipend is often much lower than it appears.

Gross vs Net Income: Why Your Paycheck Feels Smaller

The number your program quotes is your gross income. What you can actually spend is your net (take-home) income after:

- Federal income tax

- State and local income tax (where applicable)

- Social Security and Medicare

- Health, dental, and vision insurance premiums

- Retirement contributions (if you opt in)

- Union dues or other required deductions

Example: Realistic Take-Home Pay for a Resident

- Gross Salary: $60,000/year

- Estimated withholding and deductions:

- Federal and state taxes: ~$9,000–$11,000

- Social Security and Medicare: ~$4,600

- Health insurance and other benefits: ~$1,500–$2,500

Approximate Net Income: $42,000–$45,000/year

That’s roughly $3,500–$3,750 per month before you pay rent, loans, food, or anything else.

This net amount is the foundation of your Residency Finance plan. Every good resident budget starts by accepting this reality—then working backward.

Why Budgeting is Non-Negotiable in Residency

Having a written or digital budget allows you to:

- See where your money goes instead of wondering where it went

- Reduce financial anxiety, especially during demanding rotations

- Plan for predictable big-ticket items (board exams, moving, weddings, children)

- Build an emergency buffer for unexpected events

- Avoid accumulating high-interest debt that can haunt you as an attending

- Align your money with your goals, like aggressive loan payoff, early investing, or saving for a house

In residency, your mental bandwidth is limited. A clear budget acts like a standing order for your money—so you’re not making stressful decisions every payday.

Building a Practical Resident Budget Step-by-Step

Effective Budgeting Tips for residents are not about perfection—they’re about survival, control, and gradual improvement. Think of it as clinical management: assess, diagnose, plan, and adjust.

1. Start With Your Monthly Net Income

Use your actual pay stubs to find your true monthly net pay. If you’re paid biweekly, multiply one paycheck by 26 and divide by 12 to estimate monthly income.

Example:

- Biweekly take-home: $1,650

- Annual net: $1,650 × 26 = $42,900

- Monthly net: ~$3,575

This is the real number you can assign to expenses, savings, and debt every month.

2. Identify Your Fixed vs Variable Expenses

Separate your spending into fixed and variable categories. This helps you see what is “non-negotiable” and where you can adjust.

Fixed Expenses (stable month to month):

- Rent or mortgage

- Renter’s insurance

- Utilities (sometimes variable but predictable)

- Internet and phone bill

- Minimum student loan payments (if not in deferment or IDR)

- Car payment and auto insurance

- Health, disability, and life insurance (if not deducted from paycheck)

- Childcare or support obligations

Variable Expenses (fluctuate and are adjustable):

- Groceries and household supplies

- Eating out and coffee runs

- Gas/transportation and rideshares

- Clothing and personal care

- Streaming services, apps, subscriptions

- Entertainment, hobbies, vacations

- Gifts and social events

Sample Resident Budget Breakdown

| Category | Monthly Estimate |

|---|---|

| Rent and renters insurance | $1,500 |

| Utilities & internet | $200 |

| Phone | $60 |

| Health/other insurance (if not payroll) | $200 |

| Transportation (gas, parking, insurance) | $350 |

| Student loan payments (IDR) | $300 |

| Groceries | $350 |

| Eating out & coffee | $150 |

| Subscriptions & streaming | $40 |

| Misc. personal (clothes, household, etc.) | $200 |

| Professional (exam fees, apps averaged) | $150 |

| Savings/emergency fund | $200 |

| Total | $3,700 |

If your take-home is $3,575/month, this budget is $125 over—so you’d need to adjust categories (cheaper housing, fewer dining out expenses, lower transportation costs, etc.).

This is the core of medical budgeting in residency: seeing the mismatch early and tweaking intentionally.

3. Prioritize an Emergency Fund—Even if It’s Small

Saving during residency feels counterintuitive, but even a small buffer significantly reduces stress. Aim for:

- Initial target: $500–$1,000 for a basic buffer

- Intermediate goal: 1 month of essential expenses

- Long-term goal: 3–6 months of expenses (this may extend into early attending years)

Set up an automatic transfer on payday—even $50–$100/month is a strong start. Treat this as a non-negotiable line item, just like rent.

4. Use Budgeting Tools That Fit Your Style

You’re already juggling multiple tools for clinical work; choose financial tools that simplify your life, not complicate it.

Popular options for residents:

- Mint: Free, good for tracking and basic budgeting

- YNAB (You Need A Budget): Excellent for proactive, envelope-style budgeting and planning for irregular expenses

- EveryDollar: Simple zero-based budgeting, helpful for beginners

- Spreadsheet (Google Sheets/Excel): Fully customizable, good if you like control and visibility

Whichever you choose, the key is consistency. Check in at least once or twice per month—more often if you’re just getting started.

5. Plan for Irregular but Predictable Expenses

Residency is full of “surprise” expenses that are actually predictable if you step back:

- USMLE Step 3 or COMLEX Level 3 fees

- Licensing and DEA registration

- Board review courses or question banks

- Conference travel

- Moving costs for fellowship or first attending job

- Holiday travel

Create mini “sinking funds” in your budget for these:

- Example: If Step 3 and associated costs will total $1,000 in 10 months, save $100/month toward that goal.

- Label it clearly in your budgeting app or spreadsheet.

Doing this turns future financial stress into a series of small, manageable monthly actions.

6. Revisit and Adjust Your Budget Regularly

Your schedule—and sometimes your pay—will change across PGY years and rotations. Reassess whenever:

- You move or change rent

- Your student loan status changes (e.g., leaving deferment)

- You start or stop moonlighting

- You add major expenses (marriage, children, car, etc.)

Think of your budget as a living document—like a treatment plan you continuously refine.

Smart Ways to Stretch Your Resident Stipend

A solid Financial Survival Guide doesn’t just tell you to “spend less.” It gives practical methods to make your income go further without burning out.

Housing: Your Biggest Lever

Housing is often your largest expense and your greatest opportunity for savings.

Options to explore:

- Live with roommates: Even sharing with one person can cut costs by $400–$800/month in many cities.

- Choose proximity strategically: Living closer to the hospital may reduce transportation costs and on-call fatigue.

- Avoid high-end complexes: Luxury amenities are rarely worth hundreds more per month during residency.

- Negotiate rent when feasible: Longer lease terms or off-season moves can sometimes lower rates.

A difference of $300–$500/month in rent can completely change your budget flexibility.

Food and Daily Living

Residency makes you time-poor, which drives impulse spending on takeout and delivery.

Consider:

- Meal prepping 1–2 times per week (even simple meals: rice, frozen vegetables, rotisserie chicken)

- Bringing snacks from home to avoid vending machines and cafeteria runs

- Choosing coffee at home or hospital rather than daily café purchases

- Buying non-perishable essentials in bulk (toilet paper, cleaning supplies, canned goods)

If you reduce eating out by $100–$150/month, that’s $1,200–$1,800/year—enough to fund an emergency fund or Step exam costs.

Transportation and Commuting

- Consider a used, reliable car instead of a new one to avoid large payments and rapid depreciation

- Ask your program about parking, public transit discounts, or shuttle options

- Carpool with co-residents when possible

- Compare insurance rates yearly—many residents overpay

Even small changes—like dropping a car payment from $400 to $250 by buying used—can free up vital cash.

Finding Additional Income Without Burning Out

Some residents supplement their stipend with side income, but this must be handled carefully. Your primary job is to learn, stay safe, and care for patients.

Possible Side Gigs for Residents

Depending on your schedule, contract, and licensing status, options may include:

- Moonlighting (when allowed):

- Inpatient or outpatient shifts in your specialty

- Nocturnist or urgent care work

- Telemedicine:

- Telehealth consults (if appropriately licensed and credentialed)

- Medical tutoring and teaching:

- USMLE/COMLEX tutoring

- Teaching medical students or premeds

- Freelance medical writing or editing:

- CME content, patient education materials, blog posts, or clinical summaries

- Paid survey or expert network work (often intermittent and modest)

Always confirm:

- Your program’s policy on outside work

- Malpractice coverage and licensing requirements

- Duty hour rules and wellness considerations

If a side gig adds significant stress or cuts into sleep and study time, it may not be worth the extra income.

When Additional Income Makes Sense

Consider looking for extra income if:

- You consistently cannot cover basic expenses despite a lean budget

- You’re trying to avoid or pay down high-interest debt (e.g., credit cards)

- You’re close to a financial goal (e.g., exam fees, moving costs)

Avoid it if:

- Your performance or wellness are suffering

- You’re using extra income primarily to support lifestyle inflation

Remember: your long-term earning potential as an attending is substantial. Protect that by not burning out during residency.

Common Financial Pitfalls During Residency—and How to Avoid Them

Knowing what to avoid is as important as knowing what to do in any Residency Finance plan.

1. Lifestyle Inflation and “Deserved” Spending

After years of living on loans and stipends, it’s natural to want nicer housing, a better car, or more travel. The problem is when spending rises to match (or exceed) your income.

What to do instead:

- Give yourself small, planned rewards—like a monthly “fun money” category

- Delay major upgrades (car, high-end apartment, designer wardrobe) until attending income

- Ask: “If I were an attending, would I still be happy I bought this now?”

2. Ignoring or Mismanaging Student Loans

For many residents, student loans are six figures or more. Avoid:

- Ignoring your loans entirely for years (interest may balloon)

- Choosing a repayment plan that is unaffordable

- Failing to explore Income-Driven Repayment (IDR) or Public Service Loan Forgiveness (PSLF) options

Action steps:

- Inventory all your loans, interest rates, and servicers

- Review IDR options (SAVE, PAYE, IBR, etc.) and calculate payments based on your income

- If interested in PSLF, ensure you’re with a qualifying employer and repayment plan

A brief meeting with a student loan–savvy financial advisor can be worth its cost early in residency.

3. Underestimating Healthcare and Disability Risks

You are your greatest financial asset. If illness or injury prevents you from working, the impact can be devastating.

Consider:

- Ensuring you understand your health insurance deductible, co-pays, and out-of-pocket maximums

- Carrying own-occupation disability insurance if feasible (sometimes available at discounted rates through professional organizations)

- Budgeting a small monthly amount for medical and dental expenses

4. Over-Reliance on Credit Cards

Credit cards are useful tools—when paid in full each month. They become dangerous when:

- You carry balances at high double-digit interest rates

- You use them to fill structural budget gaps month after month

- You open multiple cards without a payoff plan

If you must carry a balance temporarily:

- Prioritize paying down the highest-interest debt first

- Avoid adding new discretionary purchases to that card

- Consider a low-interest balance transfer only if you’re committed to a payoff timeline

Long-Term Financial Foundations You Can Build During Residency

Even with a tight budget, you can lay groundwork for long-term stability.

Start (or Maintain) Small Retirement Contributions

If your program offers a 401(k) or 403(b):

- Contribute enough to receive any employer match (if offered)

- Even 3–5% of your income can grow significantly over decades

- If no match and money is extremely tight, it’s reasonable to focus on emergency savings and debt first

Learn Basic Investing and Financial Literacy

You don’t need to become a finance expert in residency, but understanding:

- The difference between tax-advantaged accounts (401(k), 403(b), IRA)

- The basics of index funds and diversification

- The impact of high-interest debt vs expected investment returns

…will make your transition to attending life much smoother.

Protect Your Credit Score

Your credit score affects:

- Apartment approval

- Car loan rates

- Potentially even job offers in some institutions

Good habits:

- Pay every bill on time (set up autopay when possible)

- Keep credit utilization low (ideally under 30% of total available credit)

- Avoid frequent unnecessary credit applications

Frequently Asked Questions: Residency Finance and Budgeting Tips

How much should I realistically aim to save each month during residency?

It depends on your cost of living, debt load, and family situation, but a common target is 5–10% of your net income if possible. For many, this may start as low as $50–$150/month, focused first on building an emergency fund. Increase the amount whenever you get a raise, finish paying off a debt, or reduce an expense (like moving to cheaper housing).

Is it better to pay down student loans aggressively or save/invest during residency?

For most residents, the priority order is usually:

- Build a basic emergency fund (at least $500–$1,000)

- Avoid high-interest credit card debt

- Enroll in an appropriate student loan repayment plan (often IDR)

- Contribute enough to retirement to get any employer match (if feasible)

- Then weigh extra loan payments vs additional investing

If you’re pursuing PSLF, aggressive early payoff generally doesn’t make sense. If not, and your interest rates are high, modest extra payments may be worthwhile—even $50–$100/month can reduce long-term interest significantly.

What if my budget doesn’t balance, even after cutting back?

If you’ve trimmed non-essential expenses and still can’t cover basics:

- Re-evaluate your largest costs first—especially housing and transportation

- Check whether you’re on the most appropriate student loan repayment plan

- Consider controlled, temporary side income (moonlighting, tutoring, writing), ensuring it doesn’t compromise your training or wellness

- Look for community or institutional resources: resident emergency funds, financial counseling, or hardship assistance

If you’re consistently short, you don’t have a personal failure—you have a math problem that needs structural changes.

Are there any “must-have” insurances for residents?

Key types to consider:

- Health insurance: Usually through your employer—understand your coverage, deductibles, and out-of-pocket maximums.

- Disability insurance: Essential for protecting your future earnings if you become unable to practice. Many residents opt for at least a basic policy, ideally with an own-occupation definition.

- Renter’s insurance: Inexpensive and protects your belongings and liability.

- Life insurance: Important if you have dependents or someone relying on your income. A simple term policy is usually sufficient.

Can I start investing in a taxable brokerage account during residency?

You can, but it should be lower on your priority list than:

- Emergency savings

- High-interest debt payoff

- Appropriate student loan management

- Capturing any employer retirement match

If those bases are covered and you still have surplus, starting a small, automated investment in a low-cost index fund can be reasonable. Keep it simple, and do not invest money you may need in the short term.

Managing money during residency is challenging, but it’s also one of the most impactful skills you can develop. By understanding your pay, creating a realistic budget, avoiding common pitfalls, and taking small but consistent steps toward savings and debt management, you can navigate residency with far less financial stress—and set the stage for lasting stability once you become an attending.