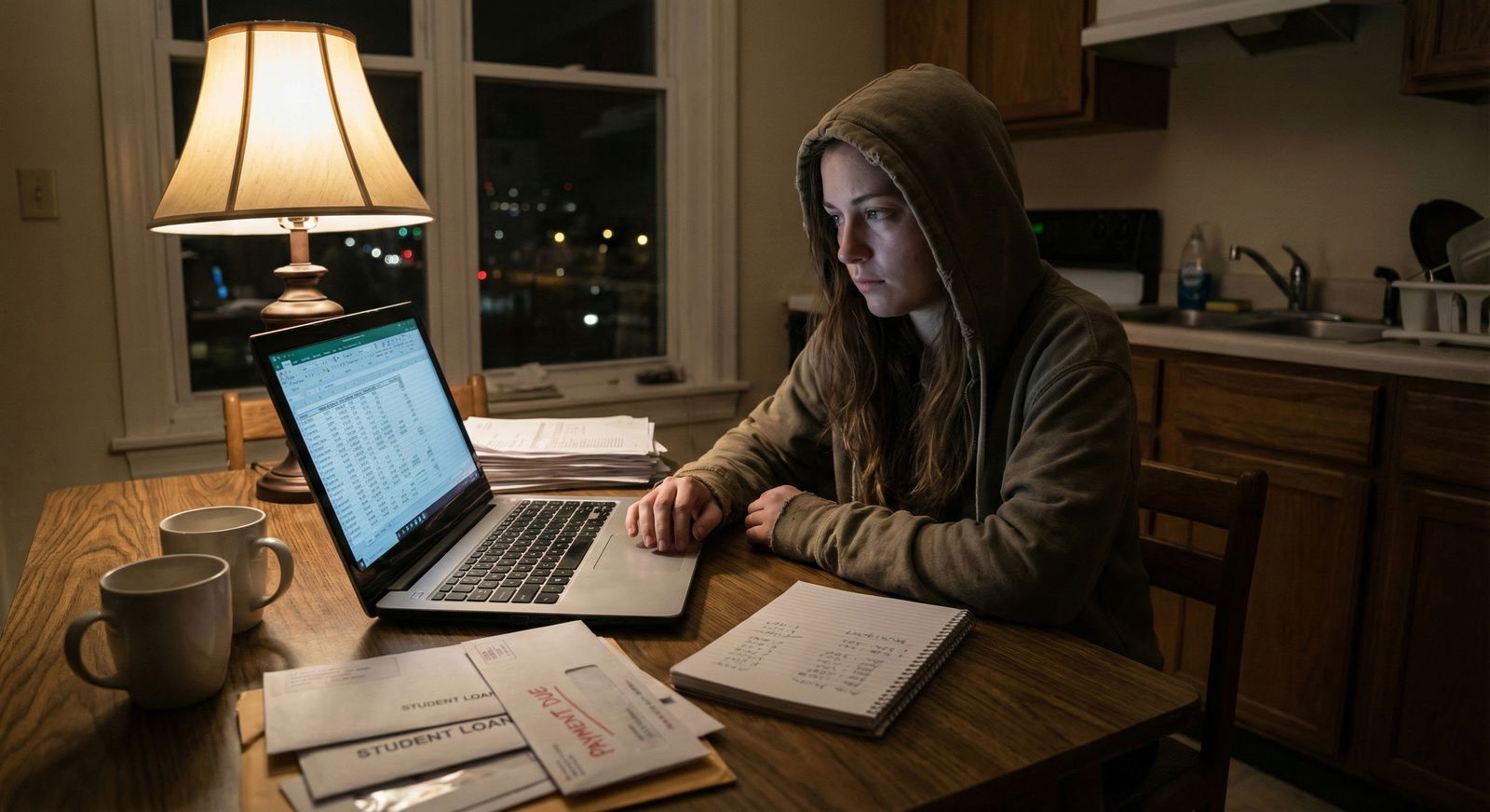

You close your Match results page, heart pounding, and it just says it: “You did not match.” Before the disappointment even lands, another thought slams in—“I have $300,000 in loans and no residency salary.” Now your inbox is full of “payment due” emails, and your parents are gently asking, “So… what’s the plan?”

This is where you are. You did not match, you’re staring down significant debt, and you cannot afford denial or magical thinking. You need a financial triage plan—something you can do this week, this month, this year—to keep your life from spinning out while you decide what’s next.

Let’s walk through it like a code. Stepwise, prioritized, no fluff.

Step 1: Stabilize Your Financial “Airway” (This Week)

You’re in acute phase right now. The goal is not optimizing your finances. It’s preventing immediate damage—missed payments, default, wrecked credit.

1. Stop Avoiding Your Loan Portals

Open every single loan account you have this week:

- Federal loans: studentaid.gov and your servicer (MOHELA, Nelnet, Aidvantage, etc.)

- Private loans: each lender’s site (Sallie Mae, SoFi, Discover, institutional loans, etc.)

- Any credit cards or personal loans you used during school

Create a one-page snapshot (yes, physically write or type it):

- Lender name

- Total balance

- Interest rate

- Type (federal Direct unsubsidized, Grad PLUS, private, etc.)

- Current status (in-school deferment, grace period, repayment, forbearance, delinquent)

You cannot triage what you cannot see. I’ve watched people ignore this for six months and then wake up to delinquency notices they could’ve easily avoided with a 20‑minute phone call.

| Lender/Servicer | Type | Balance | Rate | Status |

|---|---|---|---|---|

| MOHELA | Direct Unsub | $145k | 6.8% | Grace (ends 11/1) |

| MOHELA | Grad PLUS | $95k | 7.2% | Grace (ends 11/1) |

| Sallie Mae | Private | $40k | 9.5% | Payment due 9/15 |

| Chase | Credit Card | $6k | 24.9% | Minimum due 5/20 |

2. Call Your Lenders Before They Call You

Do not guess at your options. Call.

For federal loans, ask:

- When does my grace period end?

- What’s my earliest possible payment due date?

- What are my options if I do not have residency income this year?

(You’re looking for income-driven repayment and/or temporary forbearance.)

For private loans, ask:

- Do you offer economic hardship forbearance, reduced payment, or interest-only payment options?

- What exactly happens if I cannot make full payments—how fast does it hit my credit report?

Write down the answers and the name of the person you spoke to. Time and date. You’d be shocked how often you need to reference this later.

Step 2: Decide Your Immediate Repayment Strategy (Next 2–3 Weeks)

You are in a very specific situation: high debt, low or no income, and uncertain near‑term career trajectory. That changes which tools actually make sense.

Federal Loans: Almost Always Go Income-Driven

If you did not match and you’re not starting a residency salary July 1, you should almost certainly be on an income-driven repayment plan (IDR), not standard repayment.

The current main options you’ll likely see:

- SAVE (replaced REPAYE)

- PAYE (closing to new borrowers, but some still have it)

- Income‑based repayment (IBR)

Given your situation, SAVE is usually best. Why?

- Payments are based on your prior year’s AGI or your current income if you’ve had a drop and recertify with current proof.

- If your income is very low this year, your payment could be $0–$100/month. Legally. Not a gimmick.

- SAVE has interest subsidies—if your payment doesn’t cover all accrued interest, some or all of that unpaid interest won’t capitalize.

Action steps:

- Go to studentaid.gov → “Manage Loans” → “Apply for Income‑Driven Repayment.”

- Opt to use your most recent tax return. If last year you had $0 income while in school, your calculated payment may be $0.

- If you’ve started a job with income, you can upload paystubs instead.

If your grace period hasn’t ended yet, you can still set up IDR so you don’t roll straight into a huge standard payment.

Forbearance vs IDR: Do Not Default to the Wrong One

I see this mistake all the time: unmatched grads slam everything into forbearance because it feels like a safety blanket.

Forbearance:

- Pros: No payments required, extremely fast to set up

- Cons: Interest accrues on everything, often capitalizes, and you get no credit towards forgiveness programs

IDR with low or $0 payment:

- Pros: Keeps your loans in good standing, counts toward potential forgiveness (20–25 years), may have interest subsidies, looks better on your credit

- Cons: You have to actually set it up, and you’ll have to deal with yearly recertification

If you truly cannot get IDR in place before your first bill, use forbearance as a short bridge—1–3 months, not 18 months of “future me will figure this out.”

Step 3: Build a Bare-Bones Survival Budget (Next 1–2 Weeks)

You are not on a resident salary. You might be on minimum wage, part‑time scribe money, or living off family support. Your lifestyle has to match that reality, even if it hurts your pride.

1. Define Your Non-Negotiables

Start with these categories:

- Housing (rent, basic utilities, internet)

- Food (groceries, not restaurant therapy)

- Transportation (car payment/insurance or bus pass)

- Minimum loan/credit payments you cannot defer

- Health insurance (COBRA, marketplace plan, or parent plan if possible)

- Phone

Everything else is optional for now. Not forever. But right now.

| Category | Value |

|---|---|

| Rent/Utilities | 900 |

| Food | 300 |

| Transportation | 200 |

| Loans/CC | 150 |

| Health Insurance | 200 |

| Other | 150 |

If you don’t know what your numbers are, pull the last 2–3 months of bank statements and card transactions. Categorize them. Be honest about where the money went.

2. Decide Your Living Situation Strategically

This is where ego kills people.

If you can move home and your family is stable, not abusive, and it won’t derail your mental health, it’s often financially smart. Cutting $800–$1500 in rent per month gives you runway to survive a no‑match year without wrecking your credit or taking predatory loans.

If moving home is not a real option, then:

- Find roommates. Yes, even if you’re 28 and thought you were “done” with that.

- Consider relocating to a cheaper city if you’re only doing remote work or studying.

- Renegotiate your lease if your income situation just radically changed. Some landlords will work with you if you’re proactive.

Do not cling to a “doctor” lifestyle you have not actually earned yet.

Step 4: Prioritize Which Debts to Actually Pay Now

You won’t be able to pay everything aggressively this year. That’s fine. The priority is avoiding irreversible damage (default, collections, eviction).

Federal Loans

If you’re on IDR with a very low payment, just pay that. Don’t throw extra at federal loans while:

- You have high-interest credit card debt, or

- You’re not sure what your future earning trajectory is

Later, when you match or pivot into a stable income, you can reassess aggressive payoff vs forgiveness strategies.

Private Loans

These are more dangerous right now than federal loans:

- Fewer protections

- Limited forbearance

- Higher interest

- Quicker path to collections if you ghost them

Call and:

- Ask for interest-only payments or a temporary reduction based on hardship.

- If they refuse, at least confirm the minimum you must pay to avoid delinquency.

If you have to choose between a $0 IDR federal payment and making a private loan minimum, you usually prioritize the private loan to avoid collections.

Credit Cards

This is the fire you put out first after food and shelter.

You do not need to be paying these off aggressively right now unless you have extra income. But you absolutely need to make minimum payments on time to protect your credit score, because:

- You might need to rent an apartment.

- You may later want to refinance private loans.

- Some employers still run credit checks.

If your minimums are overwhelming, a nonprofit credit counseling agency is sometimes worth talking to (NOT random “debt relief” companies that blast ads). They can sometimes negotiate lower interest via a debt management plan.

Step 5: Income: You Need Cash Flow This Year

You’re probably emotionally drained, but the truth is simple: you need money coming in. Not for your “dream life”—just to keep your head above water and avoid digging the hole deeper.

Decide Your Main Track: Rematch vs Pivot

This isn’t a “forever” decision, but it changes how you spend the next 12 months.

- You plan to reapply next cycle.

- You’re seriously considering a different long‑term path (industry, non‑clinical work, different career).

Let’s assume you’re in group 1 first.

If You Plan to Reapply: Jobs That Fit the Mission

You want roles that:

- Pay something decent, and

- Look acceptable on a reapplication, and

- Leave you enough energy/time to improve your application (research, Step 3, new letters)

Examples I’ve seen work well:

- Hospitalist scribe or ED scribe (can double as networking time)

- Clinical research coordinator

- Telehealth scribe or virtual medical assistant

- Teaching assistant or adjunct for undergrad sciences

- Full-time job in a related field (quality improvement, data analyst for health system, etc.)

Night shift scribe jobs are common; some people pair that with daytime observerships or research. Just don’t kill yourself—burning out and failing Step 3 because you worked 80 hours/week of low‑pay jobs is dumb.

If You Might Pivot Out of Residency

Then broaden your search:

- Health tech or pharma (medical content writer, clinical specialist, medical affairs associate)

- Consulting firms that specifically like MDs/DOs

- Utilization review, chart review, or medico‑legal work (these usually want licensed docs, but some have roles for medically trained staff)

No, it’s not as simple as “just get a pharma job.” But if you’re seriously thinking of a non‑residency career, your job search shouldn’t be entirely in the $16/hour scribe bucket.

Step 6: Protect Your Credit and Mental Health (Ongoing)

This year is a stress test. Financially and mentally. The two are tightly linked.

Credit Protection Checklist

- Set every recurring bill you can to autopay minimums (you can always pay extra manually).

- Put payment due dates and recertification deadlines into a calendar with reminders.

- Check your credit report at annualcreditreport.com every few months for errors or forgotten accounts.

If something’s going to be late, call before it’s late. Lenders are far more flexible with people who are proactive and specific (“I can pay $50 this month, not $120”).

Mental Health: Acknowledge the Shame Spiral

I’ve watched unmatched grads shut down for months because they felt like failures. Money piles up, emails go unread, fees accrue. By the time they resurface, they’ve turned a 1‑year detour into a 5‑year disaster.

You are not the first person to:

- Not match

- Have $300k+ debt

- Panic

What matters is not the emotion; it’s whether you’re functional enough to take these unglamorous steps. If you’re paralyzed, get help—counseling, peer support, mentor, someone who will sit with you while you call MOHELA.

Step 7: Map Your Next 12 Months: Financial + Career Timeline

You need a rough timeline so you don’t drift.

| Period | Event |

|---|---|

| Month 1 - Confirm loan status | Calls to all lenders |

| Month 1 - Choose repayment plan | IDR or forbearance |

| Month 1 - Build bare-bones budget | Cut expenses |

| Months 2-3 - Secure income | Job search, accept position |

| Months 2-3 - Set autopays | Min payments, IDR |

| Months 2-3 - Start application fixes | Research, Step 3, LORs |

| Months 4-8 - Maintain income | Work consistently |

| Months 4-8 - Monitor loans | Recertify if needed |

| Months 4-8 - Save small cushion | Emergency fund |

| Months 9-12 - Reapply or pivot | Submit ERAS or new career apps |

| Months 9-12 - Reassess finances | Adjust budget to new plan |

Build a Tiny Emergency Cushion

Even $500–$1000 in a separate savings account is meaningful at your stage. Aim for:

- $50–$100/month automatically to savings, once your basic bills and minimums are under control.

- This prevents every flat tire or urgent care visit from going straight to a 25% APR card.

You’re not building full 6‑month emergency fund while unmatched. You’re buying a bit of breathing room.

Step 8: Do NOT Do These Financially Destructive Things

Some things I’ve watched unmatched grads do that made everything worse:

Putting entire loan balances into long forbearances without a plan

Then interest capitalizes, balance explodes, and they wake up 3 years later owing far more.Taking out new high-interest personal loans to make minimum payments

You don’t solve debt with worse debt.Ignoring mail and email from servicers

That “Important: Action Required” envelope might be the one chance to fix a problem before default.Refusing to adjust lifestyle at all

Keeping a solo $2,000/month apartment and Uber Eats daily on a $18/hour job is not brave. It’s denial.Quitting any job that feels “beneath me” because ‘I’m a doctor’

You have an MD/DO degree. You are not a licensed, board‑certified attending. Right now, you need cash flow and relevant experience, not prestige.

Quick Example: How This Actually Plays Out

Let’s say:

- You have $280k in federal loans and $40k in private loans.

- You didn’t match and moved back home.

- You get a full‑time ED scribe job paying $18/hour (~$2,800/month after taxes).

What a sane plan looks like:

- Federal loans: IDR on SAVE. Last year you had no income → payment calculates to $0–$50/month.

- Private loans: You negotiate interest‑only payments for 12 months at $200/month.

- Budget (rough):

- Parents charge you $400/month for room/board.

- Phone + internet contribution: $80.

- Transportation: $150 (gas, insurance share).

- Private loans: $200.

- Credit card minimums: $100.

- Miscellaneous/personal: $200.

- Savings: $100.

- Total fixed: ~ $1,230. You have some margin for variable stuff, but not much.

You survive the year, keep all loans current, and your credit report doesn’t take a beating. You reapply with new experience, hopefully match, and then revisit a more aggressive plan with a PGY‑1 salary.

Is it glamorous? No. Is it responsible and realistic? Yes.

When to Get a Professional

There are times you should not DIY this:

- You have a mix of federal, multiple private, and institutional loans and are already delinquent.

- You’re considering bankruptcy because of non‑student loan debt (credit cards, personal loans).

- You’re in a complicated situation with a spouse’s income and are trying to optimize IDR vs taxes.

Look for:

- A fee‑only financial planner with experience in physician or student loan planning.

- Or a reputable student loan consulting service that charges a flat fee to review and build a plan.

Do not sign up with random companies promising “student loan forgiveness” for a big upfront fee. Most of what they do, you can do yourself or with legitimate guidance.

Final Thoughts: The Triage Priorities

If you remember nothing else, remember this:

- Keep your loans in good standing using income-driven repayment and targeted negotiation, not denial.

- Build a bare-bones, realistic budget and secure some form of income—even if it bruises your ego.

- Make only the moves that buy you stability and options a year from now, not temporary relief that explodes later.

You didn’t match. That hurts. But financially, you’re not doomed unless you go dark and let chaos compound. Treat this year like a structured holding pattern, not a free fall.