Retirement planning is one of the most powerful ways physicians can turn high, often volatile income into lasting financial security. Between long training, delayed earning years, and large student debt loads, physicians must be especially intentional with how they save and how they use available tax benefits.

This guide walks through the major retirement account options, the tax advantages of each, and how to build a practical, stage-appropriate strategy from residency through your peak earning years and into retirement. The focus is on Retirement Planning, Physician Finance, Tax Benefits, and Investment Strategies that support long-term Financial Security.

Introduction to Retirement Accounts and Physician Tax Planning

Physicians occupy a unique financial position:

- Earnings are often delayed until early or mid-30s

- Income can rise rapidly after training

- Tax brackets are usually high during attending years

- Many physicians have a mix of W‑2 and 1099 income

- Clinical burnout makes early or flexible retirement appealing for many

Retirement accounts are one of the most efficient tools to:

- Lower current tax bills

- Grow wealth in a tax-advantaged way

- Build future flexibility to cut back or stop clinical work

- Protect assets from creditors in many states

Understanding which accounts exist, how they’re taxed, and how to prioritize them at each career stage can dramatically improve long-term outcomes.

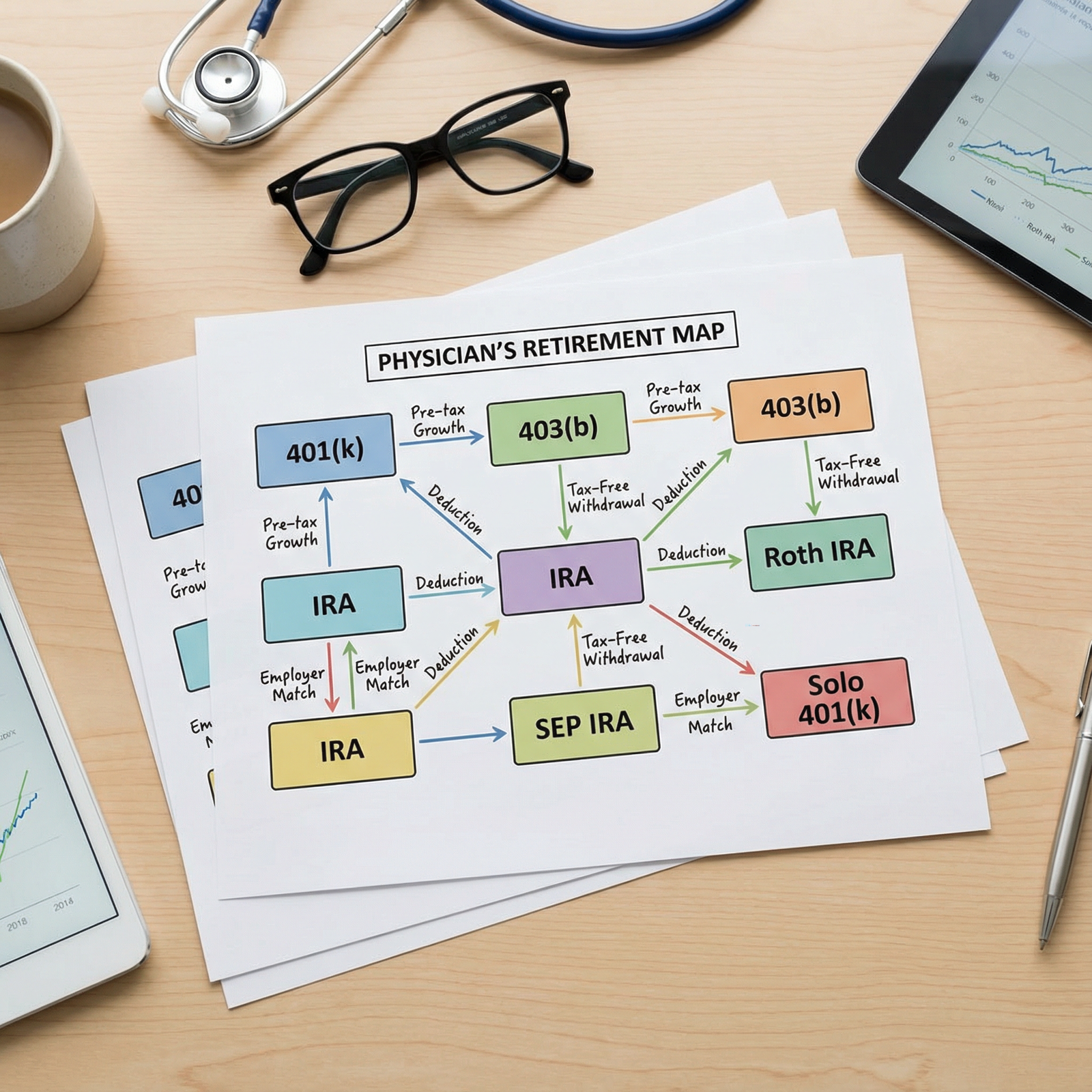

Types of Retirement Accounts for Physicians

Most physicians will encounter several different retirement accounts over their careers. The optimal mix depends on your employment status (W‑2 employee vs 1099/owner), practice setting, and income level.

Traditional IRAs

A Traditional IRA (Individual Retirement Account) allows you to save for retirement with pre-tax or partially pre-tax dollars, depending on your income and whether you’re covered by a workplace plan.

Key features (using 2024-style limits conceptually; always check current IRS limits):

- Contribution limit: Typically in the range of $6,500–$7,000 per year

- Catch-up contribution: Additional amount (e.g., $1,000) for age 50+

- Tax treatment:

- Contributions may be tax-deductible (subject to income and coverage rules)

- Investments grow tax-deferred

- Withdrawals in retirement are taxed as ordinary income

For high-income physicians who are active participants in an employer plan, contributions to a Traditional IRA are often not deductible. However, a non-deductible Traditional IRA can still be used as the first step of a backdoor Roth IRA strategy (more on this later).

Roth IRAs

A Roth IRA flips the Traditional IRA tax treatment:

- Contributions are made with after-tax dollars

- Qualified withdrawals in retirement (after age 59½ and a 5-year holding period) are 100% tax-free, including earnings

- No Required Minimum Distributions (RMDs) during the original owner’s lifetime, which provides excellent flexibility

Income limits:

High-earning physicians often phase out of direct Roth IRA eligibility. That’s why so many attendings use the backdoor Roth IRA route:

- Contribute to a non-deductible Traditional IRA

- Convert those funds to a Roth IRA shortly afterward

This allows high-income physicians to keep building tax-free assets even when they exceed Roth income limits.

Roth IRAs are particularly powerful for:

- Residents and fellows in relatively low tax brackets

- Early-career attendings before income fully ramps up

- Physicians who expect higher tax rates in the future

- Those who value flexibility and potential early retirement

401(k) and 403(b) Plans

Most physicians encounter at least one of these during their careers:

- 401(k): Employer-sponsored plan in for-profit entities (private practices, corporate employers)

- 403(b): Employer-sponsored plan in non-profits (academic centers, hospitals, universities)

Key features:

- Employee contribution limit: Typically in the ~$22,500+ range, with extra catch-up for 50+

- Employer contributions: Often match a portion of your contribution or provide a fixed contribution

- Total contribution limit (employee + employer): Much higher than the employee-only limit, often in the $66,000+ range

Tax options:

- Traditional 401(k)/403(b): Pre-tax contributions, tax-deferred growth, fully taxable withdrawals

- Roth 401(k)/403(b): After-tax contributions, tax-free qualified withdrawals

Many hospital systems now offer both Traditional and Roth options within the same plan. High-income physicians often use Traditional to reduce current taxes, but there are strategic reasons to use or blend Roth contributions (e.g., expected higher future tax rates, desire for more tax diversification).

SEP IRAs (for Self-Employed Physicians)

A SEP IRA (Simplified Employee Pension) is designed for:

- Independent contractors (locum tenens physicians, telemedicine, moonlighting)

- Small practice owners with few employees

Key features:

- Contributions are made by the employer (including you as your own employer if self-employed)

- Contribution limit: Up to 25% of compensation, capped at an annual limit (often around $66,000)

- Contributions are tax-deductible to the practice or self-employed individual

- Investments grow tax-deferred

Important consideration:

If you have employees, SEP IRAs typically require proportional contributions for them as well, which may become costly. In those cases, a Solo 401(k) or custom profit-sharing plan might be more flexible.

Profit-Sharing Plans

A Profit-Sharing Plan is an employer-sponsored retirement plan that allows the employer to make discretionary contributions based on business profits.

For physician practice owners, especially in group practices:

- Can be combined with a 401(k) to significantly increase total retirement contributions

- Allows flexibility to adjust contributions each year based on cash flow

- Employer contributions are tax-deductible to the practice

- Contributions grow tax-deferred for the physicians

Profit-sharing plans can be designed with sophisticated allocation formulas (e.g., age-weighted or new comparability) that may favor higher-earning or older partners—this is often valuable for senior physicians nearing retirement.

Other High-Impact Accounts to Know

Solo 401(k)

For physicians with 1099 income and no employees (other than a spouse):

- Combines features of a 401(k) and profit-sharing plan in one

- Allows both employee and employer contributions

- Often enables higher contributions at lower income levels than a SEP IRA

- May allow Roth and mega-backdoor Roth options, depending on the provider

Cash Balance / Defined Benefit Plans

For high-earning practice owners:

- These “pension-style” plans allow very large tax-deductible contributions, especially for older physicians

- Contributions are based on actuarial calculations and are typically higher for older partners

- Can dramatically reduce taxable income in peak years

These are more complex and require specialized professional guidance but can be extremely effective in late-career Retirement Planning and Tax Benefits optimization.

Tax Benefits of Major Retirement Accounts

Understanding the tax mechanics is key to smart Physician Finance decisions. Here’s how each of the main account types helps reduce taxes and build Financial Security.

Tax Benefits of Traditional IRAs

- Immediate tax deduction (when eligible):

- Reduces your adjusted gross income (AGI)

- Directly lowers your current-year income tax bill

- Tax-deferred growth:

- Dividends, interest, and capital gains are not taxed annually

- Compounding can be significantly faster compared to a taxable brokerage account

- Potentially lower tax rate in retirement:

- Withdrawals may occur when you are in a lower tax bracket, particularly if you reduce clinical work or retire early

Caution:

High-income physicians frequently cannot deduct Traditional IRA contributions if covered by a workplace plan. In that case, the Traditional IRA becomes primarily a backdoor Roth conduit.

Tax Benefits of Roth IRAs

- Tax-free growth and withdrawals:

- No tax on qualified distributions of contributions or earnings

- Invaluable during retirement when other sources of income may push you into higher brackets

- No RMDs for original owner:

- You are not forced to take money out at any age

- Allows better control of your taxable income in retirement and supports legacy planning

- Flexibility for early retirees:

- Contributions (not earnings) can be withdrawn at any time tax- and penalty-free

- With planning (e.g., Roth conversion ladders), Roth accounts can support early retirement before Social Security or pensions kick in

For physicians worried about future tax increases or aiming for long-term Financial Security, Roth assets provide valuable tax diversification.

Tax Benefits of 401(k) and 403(b) Plans

- Substantial tax deferral:

- Pre-tax contributions reduce taxable income dollar-for-dollar

- For a physician in a high marginal bracket, every $10,000 contributed can save several thousand dollars in current-year taxes

- Employer match = guaranteed return:

- A 50% match on the first 6% of pay is like an instant 50% return, before market growth

- Tax-deferred investment growth:

- Like other tax-advantaged accounts, returns are not taxed annually

Roth 401(k)/403(b) options:

- Tax-free withdrawals later, but no deduction now

- May be ideal for:

- Residents and fellows

- Early-career attendings in lower tax brackets

- Those anticipating significantly higher income later

Tax Benefits of SEP IRAs and Profit-Sharing Plans

For self-employed physicians and practice owners, these plans are powerful Tax Benefits tools:

- Large tax-deductible contributions:

- Contributions directly reduce business income

- Can move tens of thousands of dollars from taxable income to a tax-deferred environment

- Tax-deferred compounding:

- Similar to other pre-tax accounts, growth isn’t taxed yearly

In group practices, thoughtful design of profit-sharing and companion plans can:

- Favor older/high-earning partners (within legal limits)

- Enable aggressive Retirement Planning during high-earning years

- Support phased or early retirement with robust, tax-advantaged balances

How to Choose the Right Retirement Accounts as a Physician

Choosing “the right” retirement account is rarely about a single choice. Most physicians benefit from a multi-account, multi-tax-bucket approach over time.

Step 1: Understand Your Employment Status

Your options differ depending on whether you are:

- A W‑2 employed physician (hospital, health system, academic center)

- A 1099 independent contractor (locums, telemedicine, side gigs)

- A practice owner or partner

- Some combination of the above

Each role may open access to different plans (403(b), 401(k), SEP IRA, Solo 401(k), profit-sharing, cash balance plans).

Step 2: Match Account Types to Your Tax Bracket

As a rule of thumb:

- Lower tax bracket (typical for residents/fellows):

- Favor Roth contributions (Roth IRA, Roth 401(k)/403(b))

- High tax bracket (typical for most attendings):

- Prioritize pre-tax contributions (Traditional 401(k)/403(b), SEP, profit-sharing)

- Add Roth via backdoor methods for tax diversification

Step 3: Prioritization Order for Most Physicians

A common priority order (generalized; individual situations vary):

- Employer match in 401(k)/403(b): Always capture 100% of available match

- Backdoor Roth IRA (if eligible and appropriate): Builds tax-free assets

- Maximize 401(k)/403(b) contributions (pre-tax or Roth depending on situation)

- Solo 401(k) or SEP IRA for 1099 income (if applicable)

- Taxable brokerage account for additional flexible investing

- Advanced plans (cash balance, defined benefit, etc.) for high earners/practice owners

Step 4: Seek Specialized Advice

Physician finances can be complex:

- Mixed W‑2/1099 income

- Complex benefit packages

- Rapid changes in income

- State-specific tax issues

Working with a fee-only financial planner or tax professional experienced with physicians can help integrate Retirement Planning, Investment Strategies, and tax law efficiently.

Retirement Strategies for Each Physician Career Stage

A successful plan looks different for a resident than for a partner nearing retirement. Below are practical, stage-specific approaches.

Early Career: Medical School, Residency, and Fellowship

In training, income is modest and tax rates are usually low. That makes it an ideal time to favor Roth strategies.

Key Priorities

- Build an emergency fund (at least 3–6 months of living expenses)

- Pay minimums on student loans while exploring loan forgiveness or repayment options

- Begin Retirement Planning with modest, consistent contributions

Actionable Strategies

- Contribute to a Roth IRA (if possible):

Even small monthly contributions can grow substantially over decades.- If cash flow is tight, even $100–$200/month is valuable.

- Use Roth options in employer plans:

- If your institution offers a 403(b) with a Roth option, strongly consider it during training years.

- Capture any employer match:

- Some training programs provide modest retirement matches—never leave matched money on the table.

Mid-Career: Early Attending Years to Peak Earnings

This is where most Physician Finance and Investment Strategies decisions have the largest impact. Income is high, student loans may still be present, and lifestyle inflation can be tempting.

Key Priorities

- Aggressive, tax-efficient retirement saving

- Thoughtful Retirement Planning for medium- and long-term goals

- Avoiding unsustainable lifestyle creep

Actionable Strategies

- Maximize employer retirement plans:

- Aim to reach the full employee contribution limit in your 401(k)/403(b)

- Typically favor pre-tax (Traditional) in high tax brackets

- Backdoor Roth IRA annually:

- Maintain a habit of funding your backdoor Roth every year

- This steadily builds a tax-free bucket for retirement

- Use 1099 income strategically:

- If you have side 1099 income (locums, consulting, telehealth), consider a Solo 401(k) to defer additional income

- Coordinate with your spouse’s accounts (if applicable):

- Married physicians often have multiple plans between partners; coordinate contributions and asset allocation as a household.

Late Career: Pre-Retirement and Transition Years

As retirement (or partial retirement) approaches, priorities shift toward:

- Maximizing contributions during final high-income years

- Reducing future tax burdens on withdrawals

- Planning for Required Minimum Distributions (RMDs)

- Preserving and distributing wealth efficiently

Key Priorities

- Catch-up contributions

- Strategic Roth conversions

- RMD planning and Social Security integration

Actionable Strategies

- Use catch-up contributions:

- After age 50, increase contributions to 401(k)/403(b) and IRAs using catch-up provisions.

- Evaluate Roth conversions:

- In low-income years (e.g., after partial retirement but before RMDs and Social Security), consider converting some pre-tax assets to Roth at favorable tax rates.

- Coordinate RMDs and withdrawal strategy:

- Decide which accounts to tap first: tax-deferred, taxable, or Roth

- This can materially affect lifetime tax paid and portfolio longevity.

- Consider advanced plans:

- High-income practice owners may use cash balance or defined benefit plans for a last push of large tax-deductible contributions.

Building a Tax-Diversified Retirement Portfolio

One of the most powerful Investment Strategies for long-term Financial Security is tax diversification—spreading assets across:

- Tax-deferred accounts: Traditional 401(k)/403(b), SEP, profit-sharing

- Tax-free accounts: Roth IRAs, Roth 401(k)/403(b)

- Taxable accounts: Individual or joint brokerage accounts

Benefits include:

- Flexibility to manage tax brackets in retirement

- Ability to respond to future tax law changes

- Optimization of specific withdrawal strategies (e.g., harvesting capital gains at favorable rates, Roth withdrawals in high-tax years)

A typical balanced approach for high-income physicians might be:

- Maximize pre-tax contributions to lower current taxes

- Add annual backdoor Roth IRA contributions

- Invest any surplus in a taxable account with tax-efficient index funds

- Consider Roth conversions during lower-income years (e.g., sabbaticals, early retirement, gap years)

FAQs: Physician Retirement Accounts and Tax Planning

1. What is the 401(k)/403(b) contribution limit for physicians, and does it differ by specialty?

The IRS sets a uniform annual employee contribution limit for 401(k) and 403(b) plans that does not vary by specialty or profession. Physicians are subject to the same limits as other workers. However, total contributions (employee + employer) can be much higher, and some physician groups or practices design plans to allow large employer and profit-sharing contributions up to that total limit.

Always verify the current year’s IRS limits, as they are adjusted periodically for inflation.

2. Can a physician have a 403(b), a 401(k), and a SEP or Solo 401(k) in the same year?

Yes, in many cases you can participate in multiple plans if they are sponsored by unrelated employers. However:

- Your employee deferral limit (the basic 401(k)/403(b) contribution) is shared across all 401(k)/403(b) plans in a year.

- Employer contributions (e.g., SEP or profit-sharing) have separate limits based on each unrelated employer and overall IRS total limits.

This can get complex quickly. Physicians with both W‑2 and 1099 income should coordinate with a knowledgeable accountant or planner to avoid excess contributions and to maximize available Tax Benefits.

3. Are backdoor Roth IRA contributions legal, and what are the main pitfalls?

Yes, the backdoor Roth IRA is legal under current law and widely used by high-income professionals, including physicians. The main pitfalls:

- Pro-rata rule: If you have other pre-tax money in Traditional IRAs, SEP IRAs, or SIMPLE IRAs, the IRS treats any Roth conversion as partly taxable based on the ratio of pre-tax to after-tax dollars across all IRAs.

- To avoid messy tax situations, many physicians:

- Roll existing pre-tax IRAs into an employer’s 401(k) (if allowed) before using the backdoor Roth, or

- Coordinate with a tax professional to handle the pro-rata calculations.

Accurate reporting on IRS Form 8606 is essential.

4. How are withdrawals from retirement accounts taxed in retirement?

For most physicians:

- Traditional 401(k)/403(b), Traditional IRA, SEP IRA, profit-sharing plans:

- Withdrawals are taxed as ordinary income at your marginal tax rate in retirement.

- Roth IRA and Roth 401(k)/403(b):

- Qualified withdrawals (after age 59½ and meeting the five-year rule) are tax-free.

- Taxable brokerage accounts:

- Interest and non-qualified dividends are taxed at ordinary income rates

- Qualified dividends and long-term capital gains are taxed at capital gains rates, often lower than ordinary income rates.

A smart withdrawal strategy blends these sources to control your tax bracket over time.

5. What should physicians focus on if they feel “behind” on retirement savings?

If you feel behind—common among physicians due to long training—focus on:

- Maximizing tax-advantaged accounts:

- Fully fund 401(k)/403(b), backdoor Roth IRAs, and any available profit-sharing or cash balance plans.

- Controlling lifestyle inflation:

- Keep fixed expenses in check to free up more for savings.

- Building a written plan:

- Clarify your target retirement age, desired lifestyle, and required savings rate.

- Using catch-up contributions (age 50+):

- Take full advantage of increased contribution limits.

Even a late start can still produce robust Financial Security with high, consistent savings rates and disciplined Investment Strategies.

Thoughtful use of retirement accounts is one of the most reliable ways for physicians to convert demanding careers into long-term financial independence. By understanding your account options, leveraging the right Tax Benefits at each career stage, and maintaining a clear, flexible Retirement Planning strategy, you can build the freedom to practice medicine on your own terms—and eventually retire with confidence.