Introduction: Why Smart Tax Planning Matters for Physicians

Physicians often appear financially secure from the outside—high salaries, stable employment, and strong long‑term earning potential. Yet many doctors feel constant financial pressure due to high student loans, practice expenses, and an often-overlooked factor: taxes.

Because physicians typically fall into higher tax brackets, inefficient tax management can quietly erode a significant portion of their income every year. Thoughtful Tax Planning is not about “gaming the system”; it’s about legally using available Financial Strategies to keep more of what you earn, build wealth, and reduce stress.

This guide walks through practical, physician-focused strategies for Income Optimization and Deductions—applicable to residents, attendings, and practice owners. You’ll learn how to structure your income, use tax‑advantaged accounts, and coordinate your financial decisions to minimize avoidable taxes while still complying fully with the law.

Understanding the Tax Landscape for Physicians

Before applying specific tax moves, physicians need a working understanding of how the U.S. tax system interacts with high physician income. A few key concepts drive most advanced tax strategies.

Progressive Tax System and Marginal Rates

The U.S. tax system is progressive: as your taxable income increases, the last dollar you earn is taxed at a higher rate than the first dollar. This is your marginal tax rate.

For example, suppose a physician has:

- Salary: $400,000

- Filing Status: Married Filing Jointly

Their income is taxed in layers (brackets). A portion is taxed at lower rates, and only the top slice hits the highest bracket they qualify for. This matters because:

- Every deduction reduces income taxed at your top marginal rate.

- Deciding when to realize income or gains (this year vs. next year) can change what bracket they land in.

Understanding your marginal rate helps you evaluate how valuable each tax strategy really is.

Deductions vs. Credits: Know the Difference

- Deductions (e.g., retirement contributions, some practice expenses) reduce your taxable income. If you’re in a 35% bracket, a $10,000 deduction may save you about $3,500 in federal tax.

- Tax credits (e.g., some education credits, child tax credit) reduce your tax bill dollar-for-dollar. A $2,000 credit reduces your tax liability by $2,000.

Physicians should prioritize high‑impact Deductions and be aware of credits they may lose as their income rises above phase‑out thresholds.

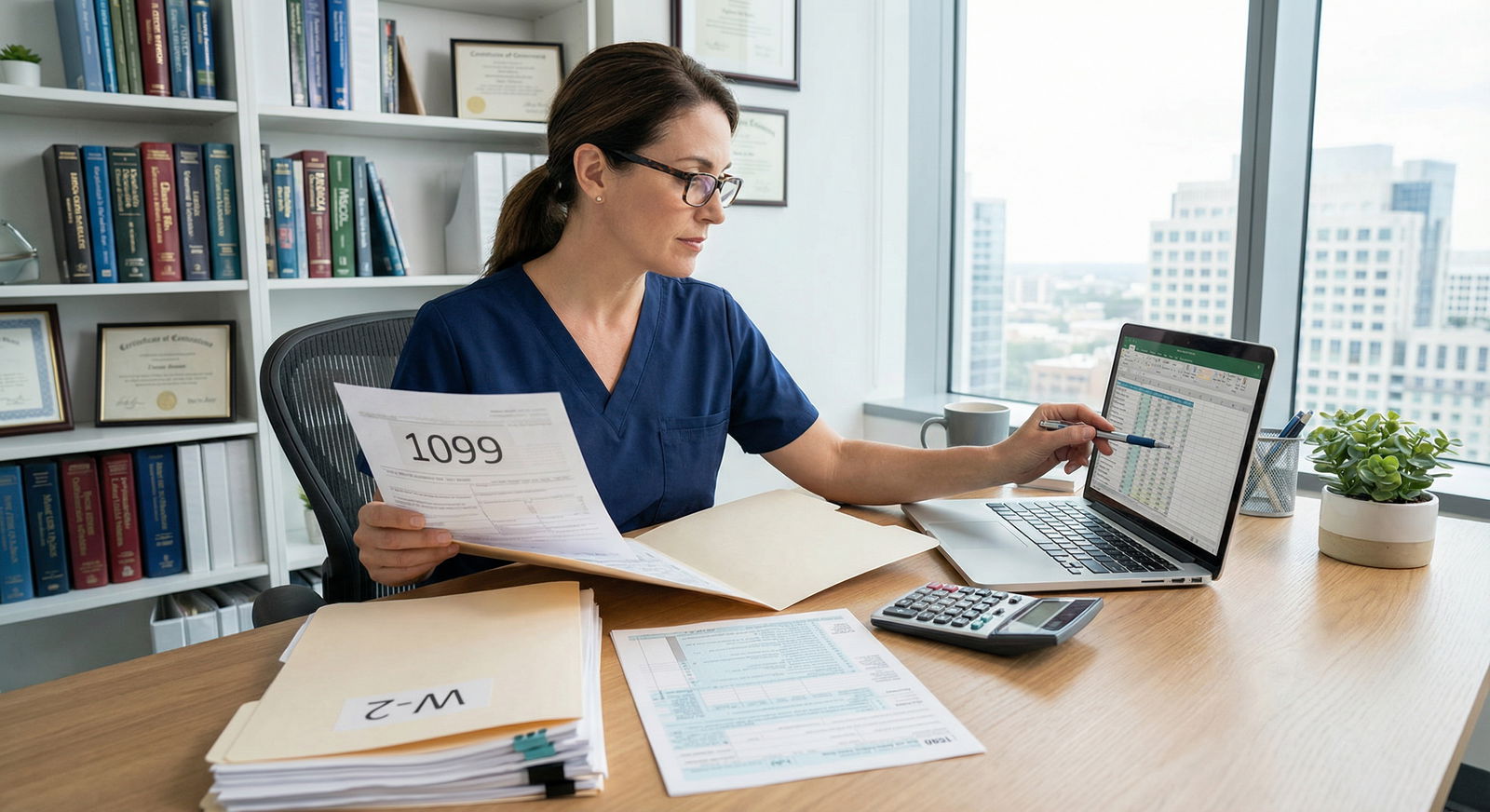

W‑2 vs. 1099 Physician Income

Your tax opportunities depend heavily on how you’re paid:

W‑2 income (employee):

- Taxes are withheld by your employer.

- Fewer business expense deductions are available personally.

- Best strategies typically focus on employer retirement plans, HSAs, and careful itemized deductions.

1099 income (independent contractor or practice owner):

- You’re considered self‑employed or a business owner.

- Broader range of deductible business expenses.

- Ability to choose business entity type (e.g., LLC taxed as S Corp) and potentially use the Qualified Business Income deduction and more flexible retirement plan structures.

Many physicians now have a mix of W‑2 and 1099 income (e.g., main job plus moonlighting). Each stream may require different planning.

Core Tax-Optimizing Strategies for Physicians

1. Use Health Savings Accounts (HSAs) as “Stealth IRAs”

For physicians covered by a High Deductible Health Plan (HDHP), a Health Savings Account (HSA) is one of the most powerful tax tools available.

Triple Tax Advantage

HSAs offer three layers of benefit:

- Tax-deductible contributions (or pre‑tax via payroll):

- Reduces your taxable income in the year of contribution.

- Tax-free growth:

- Interest and investment returns inside the HSA are not taxed.

- Tax-free withdrawals for qualified medical expenses.

In 2025 (verify current limits each year), contribution limits are typically around:

- Individual coverage: in the mid‑$4,000s

- Family coverage: in the mid‑$8,000s

- Additional catch‑up contributions allowed for age 55+

Advanced HSA Strategy for Physicians

Many high‑earning physicians can afford to pay current medical expenses out of pocket. One powerful strategy is:

- Pay medical costs with after‑tax dollars now,

- Save and invest your HSA contributions aggressively, and

- Keep receipts for all qualified medical expenses.

You can later reimburse yourself from the HSA years or decades later—tax‑free—as long as you have documentation. This effectively turns the HSA into an additional retirement account with tax‑free distributions.

2. Maximize Retirement Contributions for Income Optimization

Retirement accounts are central to Tax Planning for Physicians. Contributions can dramatically reduce taxable income while funding your future.

Employer-Sponsored Plans: 401(k) and 403(b)

Most employed physicians have access to:

- 401(k) plans (private practices, for‑profit employers)

- 403(b) plans (hospitals, academic centers, non‑profits)

Key features:

- Pre‑tax contributions reduce your taxable income now; investments grow tax‑deferred until withdrawn.

- Some plans also offer Roth 401(k)/403(b) options: no immediate deduction, but tax‑free withdrawals in retirement.

Contribution limits (check annually for updates) are generally:

- Employee elective deferral: around $23,000+

- Catch‑up (age 50+): additional ~$7,500

If your employer offers a match, always contribute at least enough to receive the full match—it’s effectively a guaranteed return.

Individual Retirement Accounts (IRAs)

Even high‑income physicians should understand IRAs:

Traditional IRA:

- Contributions may be deductible depending on your income and retirement plan coverage.

- For many attending physicians with high W‑2 income, contributions are non‑deductible but still useful for a Backdoor Roth IRA strategy.

Roth IRA:

- Direct contributions are phased out at higher incomes.

- Backdoor Roth (non‑deductible traditional IRA → Roth conversion) is often a core tool for physicians; the pro‑rata rule must be considered if you have pre‑tax IRA balances.

SEP IRA and Solo 401(k) for Self-Employed Physicians

For physicians with 1099 income (locums, moonlighting, consulting, telemedicine):

SEP IRA:

- Employer contribution only (no employee deferral).

- Contribution up to ~25% of net earnings from self‑employment, up to an annual maximum (around $69,000—but verify current year limits).

Solo 401(k):

- Allows both employee and employer contributions from 1099 income.

- Often preferred for Backdoor Roth users because you can avoid large pre‑tax IRA balances.

Careful coordination between W‑2 and 1099 plan contributions is needed to avoid exceeding annual limits.

3. Optimize Itemized Deductions and Work-Related Expenses

Since the Tax Cuts and Jobs Act (TCJA), many physicians take the standard deduction because certain unreimbursed employee expenses are no longer deductible. Still, itemizing may be beneficial in specific situations.

Common Itemized Deductions

- Mortgage interest (on qualifying home loans)

- State and local taxes (SALT):

- Capped at $10,000 per return (subject to legislative changes).

- Charitable contributions:

- Cash and appreciated securities (donating appreciated stock can be particularly tax‑efficient).

Physicians with significant charitable intent may especially benefit from donor-advised funds (DAFs)—bunching several years of giving into one tax year to clear the standard deduction and maximize tax savings.

Work-Related and Professional Expenses (Business Owners)

If you are an independent contractor or practice owner (1099 income), many expenses may be deductible as business expenses, such as:

- Continuing Medical Education (CME):

Conferences, courses, online subscriptions, board prep (if clearly related to your current specialty/practice). - Malpractice insurance premiums

- Licensing fees and DEA registration

- Professional society membership dues

- Scrubs, lab coats, and certain uniforms (if required and not suitable for everyday wear)

- Equipment and technology:

Laptops, tablets, medical devices used in practice, EHR subscriptions. - Home office (if you regularly and exclusively use part of your home for administrative or telehealth business).

Maintaining detailed records and separating personal vs. business use is crucial for audit protection.

4. Consider Entity Structure: PC, PLLC, and S Corporation

Many physicians begin as sole proprietors by default when doing 1099 work. As your earnings increase, the right business entity can create meaningful tax savings.

Why Form a Professional Corporation or PLLC?

- Liability protection (governed by state law; malpractice is usually covered by insurance, not entity structure).

- Professional image and easier separation of personal and business finances.

- Access to retirement plan options and potentially better employment/contracting arrangements.

S Corporation for Physicians: Pros and Cons

If your practice or 1099 work generates significant profit beyond a reasonable salary, you may elect S Corporation taxation:

Potential benefits:

- Part of your profits can be taken as distributions rather than wages.

- Distributions are not subject to Self‑Employment Tax / Medicare portion of FICA (though the rules and exact savings depend on current law).

- Flexibility in designing retirement plans and benefits.

Key considerations:

- You must pay yourself a “reasonable salary” for your role and work level.

- Additional payroll, accounting, and compliance costs.

- The S Corporation structure interacts with the Qualified Business Income (QBI) deduction in complex ways—especially because many physician practices are considered “specified service trades or businesses” (SSTBs).

Always work with a CPA or tax attorney experienced with physician practices before electing S Corporation status.

5. Understanding and Leveraging the Qualified Business Income (QBI) Deduction

The QBI deduction (Section 199A) allows eligible pass‑through business owners to deduct up to 20% of qualified business income. For physicians, this can be powerful but is heavily limited by income level and profession type.

Physicians and QBI: Income Limits Matter

Most physician practices are classified as Specified Service Trades or Businesses (SSTBs). For SSTBs:

- Above certain taxable income thresholds (which adjust annually), the QBI deduction is phased out or fully eliminated.

- For physicians with moderate income (e.g., early in career, part-time, or with significant deductions), there may still be QBI benefit.

- For high‑earning attendings, careful planning around:

- Entity structure,

- Retirement contributions,

- HSA contributions,

- and timing of income

may help keep income within ranges where some QBI is still allowed.

Because the rules are technical and frequently updated, collaboration with a tax professional is essential.

6. Tax-Deferred and Tax-Efficient Investments

Beyond standard retirement accounts, physicians can use other vehicles to optimize investment taxation.

529 Plans for Education Savings

If you anticipate funding your children’s (or grandchildren’s) education:

- Contributions to 529 plans are not deductible for federal income tax, but:

- Many states offer state tax deductions or credits for contributions.

- Growth is tax‑deferred, and withdrawals for qualified education expenses are tax‑free.

- 529s can also serve as a long‑term family planning tool (beneficiary can sometimes be changed to another relative).

Real Estate and REITs

Physicians often diversify into real estate—either directly or through Real Estate Investment Trusts (REITs):

- Direct real estate can offer:

- Depreciation deductions

- Potential for 1031 exchanges to defer capital gains.

- REITs:

- Typically distribute taxable dividends.

- Held in tax‑advantaged accounts (IRA, 401(k)) can be more tax‑efficient.

Always consider risk, liquidity, and portfolio balance—not just tax benefits.

Tax-Efficient Investing in Brokerage Accounts

For taxable (non‑retirement) accounts:

- Prioritize index funds and ETFs with low turnover to minimize yearly taxable distributions.

- Place tax‑inefficient assets (REITs, high‑yield bonds) inside tax‑advantaged accounts when possible.

- Use tax‑loss harvesting:

- Realize losses to offset current or future capital gains.

- Up to $3,000 of net losses per year can offset ordinary income.

7. Planning for Capital Gains and Losses

As your portfolio grows, capital gains can become a major tax consideration.

Long-Term vs. Short-Term Capital Gains

- Short-term capital gains (assets held ≤ 1 year) are taxed at your ordinary income rate—which for physicians can be quite high.

- Long-term capital gains (assets held > 1 year) are taxed at preferential rates (0%, 15%, or 20%, plus possible NIIT for high earners).

Practical implications for physicians:

- Avoid excessively frequent trading in taxable accounts.

- Plan the timing of major asset sales—for instance, selling in a sabbatical or lower‑income year may reduce your effective tax rate.

Coordinating Capital Gains With Other Income

If you expect a spike in income (e.g., partnership buy‑in bonus, large side contract, or practice sale), it may be wise to delay some capital gains or accelerate deductions to smooth your taxable income over several years.

8. Optimizing 1099 Income, Contracts, and Referral Arrangements

Many physicians have additional income streams beyond their primary job:

- Locums or moonlighting

- Telemedicine services

- Expert witness work

- Consulting or speaking

- Surgical or specialty referral arrangements (where legal and compliant with anti‑kickback laws)

Structuring Independent Contractor Income

When you earn 1099 income:

- Consider operating through a single‑member LLC or professional corporation for administrative and potential tax benefits.

- Deduct legitimate business expenses against this income:

- CME, travel, technology, home office, and a portion of phone/internet used for business.

Always ensure that any referral or revenue-sharing arrangements comply with federal and state regulations (e.g., Stark Law, Anti-Kickback Statute). Tax savings are never worth legal or licensing risks.

9. Travel, Meals, and Other Work-Related Deductions

For physicians who travel for work, conferences, or cross‑facility coverage, careful documentation can lead to valid Deductions.

Travel and Lodging

- Trips primarily for business may have deductible airfare, hotel, and ground transport.

- Keep receipts, itineraries, and agendas for CME and business-related travel.

- If you extend a trip for personal reasons, only the business portion is deductible.

Meals

- Business meals with colleagues, partners, or at conferences can often be 50% deductible (rules vary by year and context).

- Maintain a log:

- Date, location, attendees, business purpose.

The key principle: to be deductible, expenses must be ordinary and necessary for your trade or business and well-documented.

10. Working With a Tax Professional Who Understands Physicians

While self‑education is valuable, physicians’ tax situations often become complex quickly—especially with multiple income sources, practice ownership, and high marginal rates.

Why Specialized Tax Help Is Worth It

A CPA or tax advisor experienced with healthcare professionals can:

- Identify missed Deductions specific to physicians and practices.

- Determine the optimal entity structure (sole proprietor vs. S Corp, etc.).

- Model scenarios (e.g., buying into a practice, relocating to a low‑tax state, or selling your practice).

- Keep you compliant with ever-changing rules and deadlines.

The cost of a high‑quality professional is often small compared to annual tax savings and reduced audit risk.

How to Choose the Right Advisor

Look for professionals who:

- Work regularly with physicians or other high‑income professionals.

- Can explain strategies clearly and transparently.

- Are proactive—bringing strategies to you rather than just filing forms.

- Coordinate with your financial planner, especially around investment and retirement decisions.

FAQs: Tax Planning and Income Optimization for Physicians

1. How early in my career should I start tax planning as a physician?

Tax planning should begin as soon as you have any meaningful income—ideally during residency. Even residents can:

- Contribute to Roth IRAs (often at lower tax rates).

- Start understanding 401(k)/403(b) options.

- Deduct eligible CME or licensing costs if they have 1099 income.

Establishing good habits early—tracking expenses, understanding your marginal rate, and using tax‑advantaged accounts—makes it easier to scale strategies as your income grows.

2. What is the best way to maximize my retirement contributions as a high-earning physician?

For most attending physicians, a sequence like this is effective:

- Contribute enough to your 401(k)/403(b to get the full employer match.

- Max out your employee contribution to 401(k)/403(b.

- Use the Backdoor Roth IRA (if appropriate) each year.

- If you have 1099 income, add a Solo 401(k) or SEP IRA for additional contributions.

- Consider additional investing in a taxable brokerage account using tax‑efficient funds.

Confirm annual limits and coordinate across all plans with a tax professional or financial planner.

3. Are CME and board exam expenses still deductible for physicians?

It depends on how you’re paid:

- W‑2 employees: After TCJA, most unreimbursed employee business expenses, including CME, are not deductible on your personal return. However, some employers offer CME stipends or reimbursement programs—always use those first.

- 1099 independent contractors or practice owners: CME, board exam fees (for your current field), licensing, and some professional development costs can often be deducted as business expenses, reducing your taxable business income.

Always keep receipts, agendas, and proof that expenses relate to maintaining or improving skills in your current role.

4. How can I legally lower my taxable income as a physician without aggressive or risky strategies?

There are several well‑accepted, low‑risk approaches:

- Maximize pre‑tax retirement contributions (401(k), 403(b), SEP IRA, Solo 401(k)).

- Use HSAs if eligible.

- Contribute to 529 plans if your state offers tax benefits.

- Itemize when appropriate—especially mortgage interest and charitable giving.

- For 1099 income, carefully deduct legitimate business expenses (CME, malpractice, office supplies, etc.).

- Consider entity structuring (e.g., S Corporation) with help from a knowledgeable CPA.

These are mainstream Financial Strategies that focus on using existing tax law, not exploiting gray areas.

5. Why should I hire a tax advisor if I already use tax software?

Tax software is useful for filing forms, but it cannot:

- Proactively design a multi‑year tax plan around your career trajectory.

- Advise on practice buy‑ins/buy‑outs, entity choice, or complex compensation.

- Integrate your tax situation with investment, debt repayment, and retirement planning.

- Represent you effectively in the event of an audit.

For physicians with high and growing incomes, a tax advisor is less about filling out returns and more about strategic planning that can save tens of thousands of dollars over a career.

Thoughtful Tax Planning is an essential component of financial wellness for Physicians. By understanding how the tax system works, strategically using retirement and health accounts, selecting the right business structure, and coordinating your investments for tax efficiency, you can significantly increase your after‑tax income and accelerate your path to financial independence.