Introduction: Why Financial Planning Matters for IMG Residency Applicants

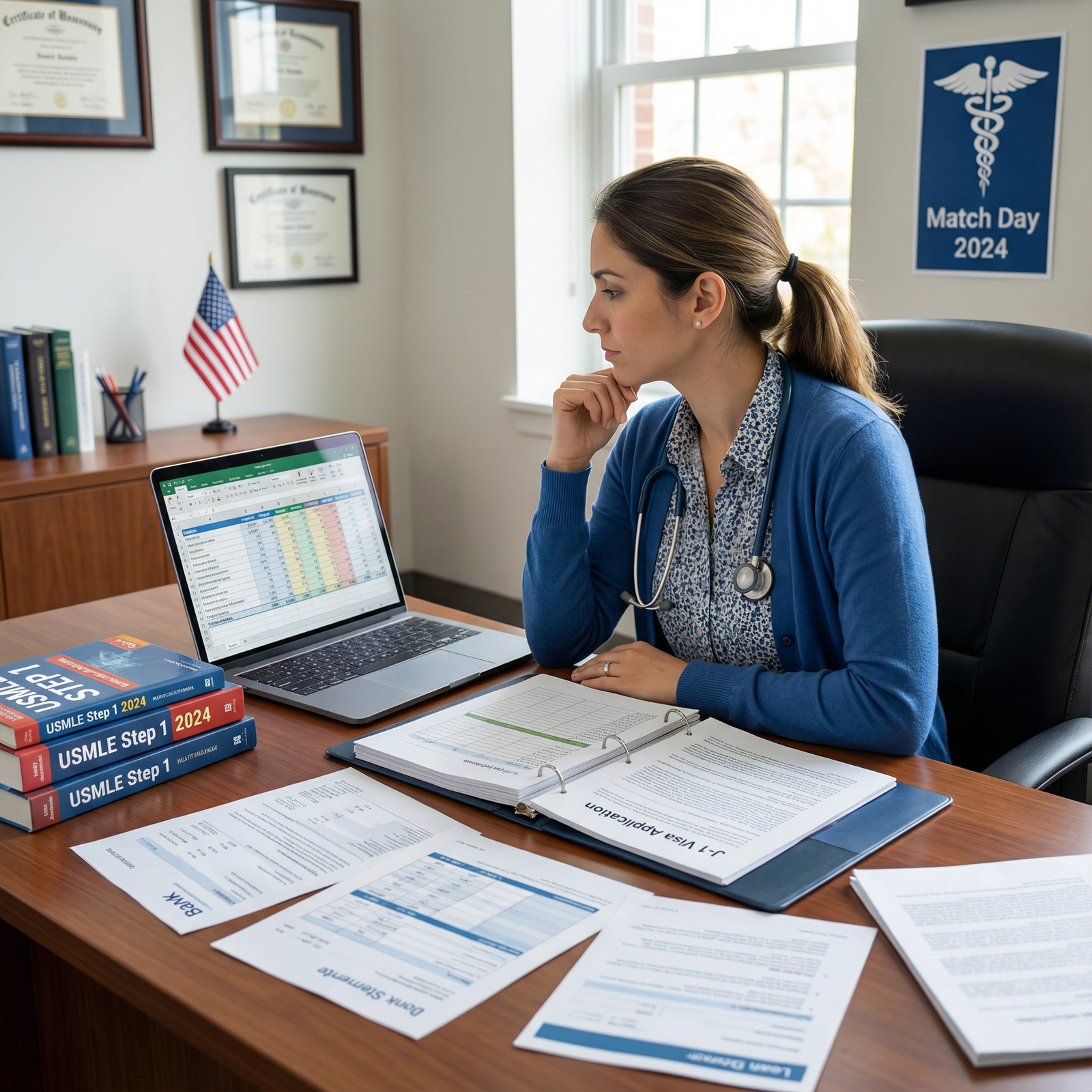

Pursuing a medical career in the United States as an International Medical Graduate (IMG) is both inspiring and expensive. Beyond the years you have already invested in medical school, the residency application process itself requires a major financial commitment—often at a time when savings are limited and income is modest or nonexistent.

Many IMGs underestimate the total cost of applying to U.S. residency programs: USMLE exam fees, application fees, observerships, travel for interviews, visa and immigration expenses, and the cost of simply living in a new country while you train. At the same time, access to traditional Financial Aid pathways and Medical School Funding—especially federal Student Loans—is often more limited for non–U.S. citizens.

This guide explains the biggest financial hurdles faced by IMG applicants and outlines practical, step‑by‑step strategies to secure Scholarships, grants, loans, and other resources. It is written for international medical graduates at different stages—whether you are still a student abroad, in a U.S. observership, or preparing to apply for the Match in the next 1–2 cycles.

Major Financial Hurdles for International Medical Graduates

Understanding where the money goes is the first step to building a realistic funding plan. For IMGs, the costs span several phases: pre‑residency preparation, the residency application cycle, and immigration/logistical expenses.

1. Tuition, Pre‑Residency Training, and Living Expenses

Many IMGs do not pay U.S. medical school tuition but still encounter significant education‑related costs.

A. Tuition and Training-Related Costs

Common scenarios for IMGs include:

U.S. Medical School Enrollment

- If you are an international student in a U.S. MD or DO program, tuition can easily exceed USD $40,000–$65,000 per year, excluding fees and living expenses.

- Additional costs:

- Health insurance (USD $2,000–$5,000+ per year)

- Textbooks, online resources, and question banks (USD $1,000–$2,500 per year)

- Clinical supplies (stethoscope, white coat, scrubs, etc.)

Caribbean or International Schools with a U.S. Clinical Component

- While base tuition is paid in your country or region, clinical rotations in the U.S. often come with:

- Clinical site fees

- Housing and transportation near rotation sites

- Higher cost of living relative to your home country

- While base tuition is paid in your country or region, clinical rotations in the U.S. often come with:

USMLE Preparation Courses

- Dedicated prep courses or subscriptions to large question banks can cost several hundred to several thousand dollars per exam cycle.

B. Cost of Living in High-Expense Cities

If you are doing observerships, research, or clinical electives in major U.S. cities, monthly living costs can be substantial:

- Rent in cities like New York, San Francisco, Boston, or Los Angeles can range from USD $1,200–$2,500+ for a shared or studio apartment.

- Add:

- Utilities, phone, and internet

- Food and transportation

- Health insurance if you are not covered by an institution

For IMGs self‑funding their time in the U.S. for clinical experience, budgeting accurately for 6–12 months of living costs is critical.

2. USMLE Exams, ECFMG Certification, and Application Fees

The exam and application portion of the IMG journey is a major line item.

A. USMLE and ECFMG Fees

While exact amounts change periodically, IMGs should budget for:

USMLE Step 1 & Step 2 CK

- Each exam: roughly USD $1,000+ for IMGs (including international testing surcharges where applicable)

- Step 3 (often taken during residency, but some IMGs complete it earlier) is an additional cost.

ECFMG Certification Fees

- Application and certification fees

- Form submission and document verification charges

Study Materials

- Comprehensive question banks, review books, and online courses can total:

- USD $500–$1,500+ per exam

- Many IMGs invest in multiple resources for competitive scores.

- Comprehensive question banks, review books, and online courses can total:

B. ERAS and NRMP Fees

Applying to residency programs also involves multiple fee layers:

ERAS (Electronic Residency Application Service)

- Application fees increase with the number of programs:

- Many IMGs apply broadly (often 80–150+ programs) to improve their matching chances, which can cost several hundred to over USD $2,000.

- Application fees increase with the number of programs:

NRMP (National Resident Matching Program)

- Separate registration fee for participating in the Match.

Optional Expenses

- Professional photo for ERAS

- Transcript and MSPE transmission fees from your medical school

When combined, exam and application fees alone can easily reach several thousand U.S. dollars.

3. Visa, Immigration, and Relocation Costs

Visa and immigration factors are unique and often unpredictable expenses for IMGs.

A. Visa Application and Legal Fees

Depending on your situation and the visa type (commonly J‑1 or H‑1B for residency):

- Visa application and SEVIS fees

- Consular interview costs

- Travel to the U.S. embassy/consulate

- Possible attorney or legal service fees, especially in complex cases

Some training institutions cover part of these costs, but many IMGs must budget for several hundred to a few thousand dollars in total immigration-related expenses.

B. Relocation to the U.S. for Residency

Once matched, IMGs need to finance:

- One‑way international flight

- Initial housing deposits and first month’s rent

- Basic furniture, clothing, and professional attire

- Licensing and initial onboarding fees for the residency program or state medical board

These upfront costs often appear at a time when you have not yet received your first resident paycheck.

4. Limited Access to Traditional Financial Aid and Student Loans

Traditional U.S. Financial Aid structures are designed primarily for citizens and permanent residents.

A. Federal Student Loans and IMGs

- Federal Direct Loans and PLUS Loans are generally available only to:

- U.S. citizens

- U.S. permanent residents

- Certain eligible non‑citizens (e.g., some refugees, asylees)

- Most IMGs do not qualify for these core federal Student Loan programs, which typically offer:

- Lower fixed interest rates

- Income‑driven repayment options

- Forgiveness or public service programs

B. Institutional and Private Aid Limitations

Some U.S. medical schools and teaching hospitals offer:

- Institutional scholarships

- Need-based grants

- Institutional loans

However, competition is intense, and funding for international students is usually more limited.

Private Student Loans are sometimes available to IMGs, but:

- Often require a U.S. citizen or permanent resident co‑signer

- May have higher interest rates and less flexible repayment terms than federal loans

Strategies to Secure Funding and Resources as an IMG

Despite these challenges, many IMGs successfully fund their residency application journey with a mix of scholarships, grants, loans, employment, and community support. Planning early and combining multiple strategies is usually most effective.

1. Scholarships and Grants for International Medical Graduates

Scholarships and grants—money you do not need to repay—are the most valuable funding sources.

A. Types of Scholarships Available

- Merit-Based Scholarships

- Awarded based on academic performance, USMLE scores, research involvement, leadership, or community service.

- Need-Based Grants

- Based on financial need and available through some medical schools, universities, private foundations, and international organizations.

- Country- or Region-Specific Awards

- Some governments or NGOs fund students who commit to returning home to practice after training.

- Field- or Specialty-Specific Scholarships

- Organizations focusing on primary care, global health, rural medicine, or specific specialties may offer support to trainees.

B. Examples and Starting Points

While availability changes over time, examples and categories to research include:

- Fulbright Foreign Student Program

- Supports graduate study and research in the U.S.; some tracks support health sciences.

- AAMC and Specialty Societies

- The Association of American Medical Colleges and many specialty societies (e.g., American College of Physicians, American Academy of Family Physicians) list scholarships and awards that may be open to IMGs.

- Private Foundations and NGOs

- Foundations focusing on education, minority advancement, or global health often fund health professional students.

C. How to Maximize Scholarship Success

Start Early

- Many applications open 6–12 months before funds are disbursed.

- Track deadlines in a dedicated spreadsheet.

Prepare Core Documents

- Updated CV and personal statement

- Transcripts and USMLE score reports

- Letters of recommendation

- Proof of financial need (when applicable)

Tell a Compelling Story

- Highlight:

- Your journey as an IMG

- Unique barriers you’ve overcome

- Your long‑term impact on patient care and your community

- Highlight:

Apply Broadly

- Treat scholarship applications like a second Match: cast a wide net.

- Even small awards (USD $500–$1,000) can collectively cover exam or application fees.

2. Understanding and Accessing Student Loans as an IMG

While options are more restricted, loans remain a key part of Medical School Funding and pre‑residency financing for many IMGs.

A. Federal Loans (If You Are Eligible)

If you are an IMG who is also:

- A U.S. citizen, dual citizen, permanent resident, or an eligible non‑citizen:

Then you may access:

- Direct Unsubsidized Loans

- Fixed interest rate, annual and lifetime borrowing limits.

- Direct PLUS Loans (Graduate)

- Higher borrowing limit; can cover remaining costs of attendance.

These loans are accessed through your institution’s financial aid office via the FAFSA (Free Application for Federal Student Aid).

B. Private Educational Loans

For IMGs who are not eligible for federal loans:

Lenders That Serve International Students

- Some private lenders and fintech companies specifically target international students in health professions.

- Many require:

- A strong creditworthy U.S. co‑signer, or

- Enrollment at a partner school.

Comparing Options

- Interest rate (fixed vs variable)

- Repayment start date (in school vs after graduation)

- Grace periods and deferment options

- Fees and prepayment penalties

Use comparison platforms (e.g., Credible‑like aggregators or regional equivalents) to view multiple loan offers, but always verify:

- Eligibility for non‑U.S. citizens

- Co‑signer requirements

- School-specific restrictions

C. Responsible Borrowing Tips

- Borrow only what you need to cover essential expenses.

- Estimate your future resident salary and potential debt‑to‑income ratio.

- Consider currency exchange risk if you plan to repay loans in your home country’s currency.

3. Crowdfunding, Community Support, and Creative Fundraising

Crowdfunding can be a powerful bridge when traditional Financial Aid falls short.

A. Crowdfunding Platforms

Common platforms include:

- GoFundMe

- Indiegogo

- Region‑specific platforms popular in your home country

These allow you to share your story publicly and receive support from family, friends, community members, and even strangers.

B. Best Practices for a Successful Campaign

- Tell Your Story with Clarity

- Explain who you are, where you trained, what exams you have passed, and your career goals.

- Be Transparent About Costs

- Break down your budget: exam fees, ERAS/NRMP, visa, travel, living expenses.

- Share Progress Updates

- Post when you pass exams, receive interviews, or match—this builds trust and encourages ongoing support.

- Leverage Your Network

- Share via social media, alumni organizations, religious communities, or local NGOs.

Combine crowdfunding with direct outreach to potential donors (e.g., former employers, community leaders) for better results.

4. Employer Sponsorship, Government Support, and Bonded Programs

Some IMGs can obtain partial or full funding through employers or government programs in their home countries.

A. Employer or Institutional Sponsorship

Potential sources:

- Hospitals or clinics in your home country that need specialists

- Universities or teaching institutions

- NGOs or faith‑based medical missions

These sponsors may:

- Pay for exams, travel, or tuition

- Require a service commitment (e.g., return to work for 3–5 years after training)

Before accepting, clarify:

- Exact benefits (amount, duration, covered expenses)

- Service obligation length and location

- Penalties for not fulfilling the agreement

B. Government and Ministry of Health Programs

Some countries offer:

- Scholarships or stipends for physicians to train abroad in needed specialties

- Financial support conditioned on returning to serve in public sector roles

Check with:

- Ministry of Health

- National medical councils

- Government scholarship agencies

5. Maximizing Personal Savings, Part-Time Work, and Side Income

Personal financial discipline can significantly reduce reliance on loans or external aid.

A. Building Savings Before the Application Phase

If you are still in medical school or early in your career:

- Set a monthly savings goal specifically for USMLE and Match costs.

- Use:

- A dedicated savings account

- Simple budgeting tools or apps

- Target at least:

- USMLE Step exam fees

- One full application cycle of ERAS and NRMP fees

- Several months of living expenses if planning U.S. observerships

B. Working Legally While Preparing

In Your Home Country

- Part‑time clinical work, teaching, or research assistant roles.

- Telemedicine (if licensed and allowed) to generate flexible income.

In the U.S. (If Visa Permits)

- Some visas allow limited on‑campus or authorized work.

- Non‑clinical jobs (administration, tutoring) can help without interfering with licensing rules.

Always check visa regulations carefully to avoid jeopardizing your immigration status.

C. Side Projects Aligned with Your Medical Skills

- Medical content writing or editing

- USMLE tutoring or mentoring junior students

- Paid participation in research projects (where ethical and permitted)

These side roles can enhance your CV while helping fund your goals.

6. Leveraging Networking, Mentorship, and IMG Communities

Financial strategies are easier to implement when you are not working in isolation.

A. Finding Mentors Who Understand the IMG Journey

Look for:

- Senior residents or attendings who were IMGs

- Faculty in your specialty of interest with experience training IMGs

- Alumni from your medical school who matched in the U.S.

Mentors can share:

- Realistic budget estimates

- Which costs are essential vs optional

- Which funding options worked for them (and which to avoid)

B. Joining IMG and Resident Organizations

- Online forums and social media groups for IMGs

- National specialty organizations with IMG sections

- Local resident physician associations once you are in the U.S.

These communities often share up‑to‑date information on:

- Scholarship calls and deadlines

- Affordable housing and shared accommodation

- Observerships or research positions with stipends

7. Using Financial Planning Tools and Professional Advice

Finally, treat your finances as systematically as you treat your exam preparation.

A. Budgeting and Tracking

Create a comprehensive financial plan that covers:

- All expected exam and application fees

- Estimated living expenses for each phase (home country vs U.S.)

- Travel, visa, and relocation costs

- Emergency buffer (ideally 1–3 months of essential expenses)

Tools:

- Simple spreadsheets (Google Sheets/Excel)

- Budgeting apps that allow multi‑currency tracking if needed

B. Educational Debt Resources

Look for resources specific to medical trainees, such as:

- Online tools that calculate total medical education debt and repayment scenarios

- Guides on loan repayment strategies for residents and fellows

- Webinars provided by medical associations on financial literacy

C. When to Consult a Professional

Consider speaking with:

- A financial planner familiar with international professionals

- A student financial services officer at your institution

- A legal advisor for complex sponsorship or loan contracts

These experts can help you avoid common pitfalls such as predatory loan terms or unsustainable debt.

FAQ: Financial Aid and Funding for IMG Residency Applicants

Q1: Are there scholarships specifically for International Medical Graduates?

Yes. While not as numerous as scholarships for domestic students, several types of scholarships and grants are open to IMGs:

- Institution‑specific scholarships at some U.S. medical schools and teaching hospitals

- International programs (e.g., Fulbright) that may support health professionals

- Country‑specific or government‑sponsored awards for physicians training abroad

- Specialty society or foundation grants for research, global health, or primary care

Because eligibility criteria vary widely, invest time in researching:

- Your home country’s government scholarship portal

- Medical associations in your target specialty

- Educational foundations that support international students in health fields

Apply early, and do not overlook smaller awards—they can collectively cover key costs like exam or application fees.

Q2: Can IMGs apply for U.S. federal student loans?

Only some IMGs are eligible for U.S. federal student loans. To qualify, you generally must be:

- A U.S. citizen or national

- A U.S. permanent resident (green card holder)

- Or an “eligible non‑citizen” as defined by the U.S. Department of Education

Most IMGs on student, exchange, or temporary professional visas do not qualify. If you are unsure, speak with your school’s financial aid office and review your status under FAFSA guidelines. If you are ineligible, you will likely need to explore private loans, institutional aid, or funding from your home country.

Q3: What are realistic total costs for an IMG to apply for U.S. residency?

Exact costs vary widely, but many IMGs report spending several thousand to over USD $10,000 across the entire pre‑residency process, including:

- USMLE exams and preparation materials

- ECFMG certification and document verification

- ERAS and NRMP fees for a broad application strategy

- Observerships or U.S. clinical experience (including travel and housing)

- Visa, immigration, and relocation expenses

- Travel and accommodation for in‑person interviews (if applicable)

Creating a detailed budget early—ideally at least 12–18 months before your planned application cycle—can help you phase these expenses and pursue targeted funding sources for each category.

Q4: How can I find ethical and safe private loan options as an IMG?

To identify safe and appropriate private Student Loans:

Start with your institution

- Ask if your medical school or teaching hospital maintains a list of vetted lenders who work with international students.

Compare multiple offers

- Use reputable loan comparison platforms, but always verify details directly with the lender.

Check for red flags

- Extremely high interest rates

- Mandatory large upfront fees

- No clear information about repayment terms or penalties

- Pressure tactics or predatory marketing

Read the fine print

- Confirm:

- Whether a U.S. co‑signer is required

- When repayment begins

- Options if you fail to match, change visa status, or leave the U.S.

- Confirm:

Whenever possible, consult with a financial aid officer or an independent financial advisor before signing.

Q5: Is it realistic to work part‑time while preparing for exams or applying to residency?

It can be realistic, but it depends on your situation:

In your home country, many IMGs successfully combine:

- Part‑time clinical work

- Teaching or tutoring

- Research assistantships

with exam preparation and application tasks, as long as they maintain a disciplined schedule.

In the U.S., work options are tightly regulated by visa type. Unauthorized work can jeopardize your immigration status and future residency prospects. Always verify with your international office or an immigration attorney before accepting any job.

For most IMGs, part‑time work should be viewed as a way to supplement (not completely fund) the process, and it should not compromise exam performance or application quality.

By understanding the full landscape of financial hurdles and proactively combining multiple funding strategies—Scholarships and grants, loans where appropriate, savings, part‑time work, and community support—International Medical Graduates can navigate the U.S. residency application process in a financially informed and sustainable way. Thoughtful planning now will reduce stress during crucial periods like exam preparation and interview season, allowing you to focus on what matters most: demonstrating your potential as a future physician in the U.S. healthcare system.