It is 11:45 p.m. You just signed out of your last moonlighting shift at the community hospital across town. You are bleary, you smell like chlorhexidine and burnt coffee, and your phone just buzzed with the deposit notification: $1,300 for tonight.

And you know exactly what will happen if you do nothing.

That money will sit in checking “for now,” then leak out over two weeks into DoorDash, an upgraded vacation, replacing your aging MacBook, and paying down whatever random bill screams loudest. By next month, you will barely remember this shift.

This is why most physicians moonlight for years and still feel broke.

Let me give you a protocol so that never happens again.

You are not just “making extra money.” You are running a micro-business on top of your job. The only way this pays off is if you turn each shift into something durable:

- Debt gone.

- Real investments.

- Tax-optimized accounts.

- A snowball big enough that you can stop moonlighting when you want to, not when you burn out.

Here is the Moonlighting Money Protocol. Step-by-step. No fluff.

Step 1: Define the Mission of Your Moonlighting

Before we touch any spreadsheets or accounts, you need one clear sentence:

“I moonlight to _______ by ________.”

For example:

- “I moonlight to eliminate my $180k student loans in 4 years.”

- “I moonlight to build a $500k taxable portfolio by end of fellowship.”

- “I moonlight to fund a 20% down payment on a $900k house in 3 years.”

If your answer is “to have more money,” that is not a mission. That is lifestyle creep bait.

Pick one primary goal and one secondary at most. Then attach numbers and dates to it. Example:

- Primary: “Pay off $180k loans at 5.5% in 4 years.”

- Secondary: “Fully fund Roth IRA every year.”

This does two things:

- It tells you how much to work.

- It tells you exactly where each dollar goes.

Otherwise, you will just chase every $150/hr offer until you hate everyone.

Step 2: Separate Moonlighting Money From Your Main Income

If you do not wall this money off, it will disappear into the same sludge as your main paycheck. You need a separate pipe.

Here is the structure that works:

- Open a separate checking account dedicated to moonlighting.

- Direct all moonlighting income into that account only.

- From that account, set up:

- Automatic transfers to investment / debt paydown.

- Tax savings bucket.

- A small “burnout relief” bucket if you want (more on that later).

Treat this like a side practice. It has its own P&L.

| Account Type | Purpose |

|---|---|

| Moonlighting Checking | All moonlighting deposits |

| Tax Savings Account | Federal, state, self-employment |

| Investment Account | Brokerage / IRA / 401(k) |

| Loan Servicer | Extra principal payments |

You never, ever spend from the moonlighting account directly on lifestyle unless it is a deliberate transfer to your main checking as part of your written plan.

Step 3: Understand Your Real Hourly Rate After Everything

That $150/hr shift is not $150/hr. You know that intellectually. But most doctors still behave like it is.

You need a rough but realistic after-tax, after-expense rate. Do this once, then update annually.

A. Account for taxes

If you are getting a 1099 for moonlighting, you are on the hook for:

- Federal income tax

- State income tax (if applicable)

- Self-employment tax (Social Security + Medicare) on net income

Simplified, for most attendings and late residents, your combined marginal rate on this extra income is typically:

- 30–45% depending on state and bracket.

Be conservative. Assume 40–45% total burden on that moonlighting income unless you have specific numbers.

So:

- $150/hr → after tax ~ $82–90/hr.

- $250/hr → after tax ~ $138–150/hr.

B. Subtract true work-related costs

These are the costs nobody counts:

- Commute (gas, tolls, parking).

- Extra childcare.

- Hospital parking.

- Medical license/state licenses just to qualify for this gig.

- Malpractice if not covered.

- Disability/term life you should have because you are working more.

Estimate a per-shift overhead and convert to hourly.

Example:

- Extra childcare: $80 per shift.

- Gas/parking: $20 per shift.

- Licensing (amortized): $2,000 per year / 80 shifts = $25 per shift.

Total: $125 per shift. On an 8-hour shift → ~$16/hr of friction.

So your $150/hr becomes:

- $150 − $16 = $134 gross “real”

- After tax at 40% → $80/hr.

C. Put it in writing

You should end up with a one-liner:

“My real, after-tax, after-overhead moonlighting rate is about $80/hr.”

Now you can make sober decisions:

- Is a post-call 8-hour shift for $640 actually worth how you feel the next day?

- Is working 4 extra shifts a month truly moving the needle or just making you tired?

| Category | Value |

|---|---|

| Taxes | 40 |

| Debt Paydown | 30 |

| Investments | 25 |

| Lifestyle Reserve | 5 |

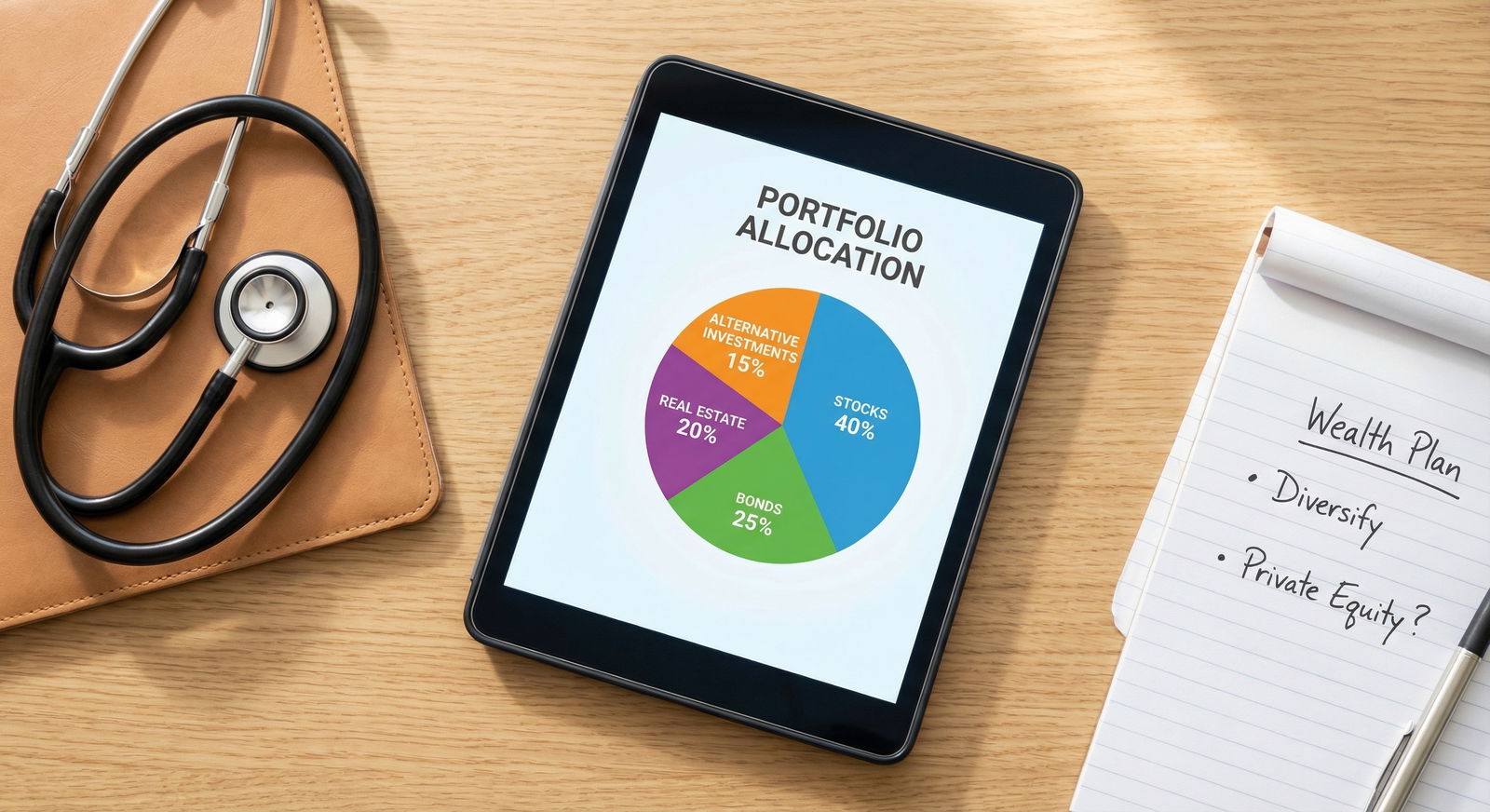

Step 4: The Allocation Protocol – Every Dollar Has a Job

Here is where it becomes a protocol instead of vibes.

Your moonlighting allocation should be pre-decided, automated, and boring. Emotionless.

A clean starting framework:

- 40% → Taxes

- 30–40% → Primary goal (debt OR investments OR down payment)

- 10–20% → Secondary goal (usually retirement accounts)

- 0–10% → “Burnout reserve” (fun, travel, childcare, outsourcing chores)

You can tweak the percentages, but lock them in for 12 months. Do not change the plan every time you feel rich or tired.

A. Taxes: do not play games here

If you are 1099:

- Open a “Moonlighting Tax Savings” high-yield savings account.

- Every time you get paid:

- Transfer 35–40% of the gross into that account.

- Pay quarterly estimates to IRS and state from that account.

If you end up over-saving, great. That “refund” becomes a lump-sum investment or extra loan payment.

B. Debt vs Investing: a sane decision tree

Everyone gets tangled up here. Use this simple rule:

- Bad debt (credit cards, personal loans, 8%+ interest)

- Moonlighting money should smash this first. Aggressively.

- Student loans 5–8%

- If not eligible for meaningful forgiveness:

- Lean toward accelerated payoff.

- Especially if you hate them and they limit career choices.

- If not eligible for meaningful forgiveness:

- Student loans <5% and you are disciplined

- Split:

- 50–60% to investments.

- 40–50% to loans.

- Split:

- Low-rate mortgage or 0% promo debt

- Minimal moonlighting money to this.

- Focus on higher-return uses.

If you want a hard stance:

For most physicians with federal loans at 6–7%, directing the majority of moonlighting toward loan payoff is rational, unless you have ironclad PSLF trajectory in an academic or non-profit job.

Step 5: Choose the Right Investment Buckets for Moonlighting Money

You are not day-trading with moonlighting cash. You are using boring, tax-efficient vehicles. Here is how to prioritize, assuming you have already done basic due diligence on your main job’s 401(k)/403(b).

Priority order for moonlighting money (attending or senior resident)

Make sure you get all employer matches (main job)

If you are leaving match money on the table, fix that first with your regular income. Moonlighting money can backfill your budget.Roth IRA / Backdoor Roth IRA

- 2024 limit: $7,000 ($8,000 if 50+; adjust for current year when you read this).

- If your income is too high:

- Do a backdoor Roth properly:

- Contribute to traditional IRA (nondeductible).

- Convert to Roth.

- Avoid pre-tax money in other traditional IRAs to avoid pro-rata mess.

- Do a backdoor Roth properly:

HSA (if you have a high-deductible health plan)

- Triple tax advantage.

- Use moonlighting money to pay current medical expenses out-of-pocket and let HSA grow.

Solo 401(k) (for 1099 moonlighting docs)

If you have no other self-employed retirement plan, this is huge.Solo 401(k) basics:

- You can contribute as:

- “Employee” deferral (shared across all jobs).

- “Employer” profit-sharing from 1099 income.

- Great if your primary W-2 job’s plan is weak or you are under the combined limits.

This requires setup through a custodian (Fidelity, Vanguard, etc.) and you need to understand the coordination rules with your primary plan. Worth it for many high-volume moonlighters.

- You can contribute as:

Taxable brokerage account

- This is your flexible, medium-to-long-term wealth engine.

- Ideal for:

- House down payment 5+ years out.

- Early financial independence.

- Use low-cost index funds or ETFs.

What to actually buy

You do not need creativity here.

- Total US stock market index fund (VTI / FSKAX / similar).

- Total international stock index (VXUS / FTIHX).

- Maybe a bond fund if you are more conservative or closer to needing the money.

Allocation example for a long time horizon (10+ years):

- 70–80% US total stock.

- 20–30% international stock.

If down payment money is <5 years away:

- Keep at least half in high-yield savings or short-term Treasury/bond fund.

- The rest in conservative index funds if the timeline is flexible.

Step 6: Legal and Contract Pitfalls You Cannot Ignore

Here is where many physicians step on landmines. Moonlighting is not just “extra work.” It has legal consequences.

1. Check your primary employment contract

Look for:

Exclusivity clauses

Some contracts explicitly restrict outside clinical work or require written permission.Non-compete / geographic restrictions

Your contract may prohibit working in competing hospitals or within X miles in the same specialty.Malpractice coverage restrictions

Your main job’s malpractice almost never covers outside work. Do not assume it does.

If you cannot parse your contract, pay a physician contract attorney once. That bill is cheaper than a lawsuit or termination.

2. Malpractice coverage for moonlighting

Ask directly, in writing:

- Who provides malpractice coverage for this moonlighting role?

- Is it claims-made or occurrence?

- What are the limits (e.g., $1M/$3M)?

- If claims-made, who pays for tail coverage when you leave?

If you are 1099, you may need to:

- Buy your own malpractice (which hits your real hourly rate).

- Or negotiate higher rates to compensate.

Skipping this is reckless. I have seen physicians assuming they were covered, then discovering the coverage applied only to “house staff duties” not independent shifts.

3. Licensing, credentialing, and scope

Do not stretch your license or training:

- Make sure your moonlighting scope matches your actual competence and coverage.

- If you are an internal medicine resident doing “ICU moonlighting,” be very sure:

- You are properly privileged.

- There are clear escalation pathways.

- You are not functioning as a solo intensivist beyond your training.

Boards and lawyers are not forgiving.

4. Tax structure: W-2 vs 1099 vs entity

Most moonlighting is:

W-2 (employed by the hospital group)

- Taxes withheld.

- Limited deductions.

- Simpler.

1099 (independent contractor)

- No tax withholding by default.

- You are responsible for quarterly estimates.

- You can deduct legitimate business expenses.

- You may set up a solo 401(k).

Entity (LLC/S-corp) questions:

- For small moonlighting amounts (e.g., under $50–75k/yr), forming an S-corp rarely justifies the admin load.

- For large recurring 1099 income, talk to a CPA about whether:

- An S-corp could reduce self-employment taxes.

- An LLC for liability clarity is reasonable.

But do not start here. Get the protocol working first. Then optimize.

| Step | Description |

|---|---|

| Step 1 | Moonlighting Shift Completed |

| Step 2 | Income Deposited to Moonlighting Account |

| Step 3 | Allocate to Tax Savings 35-40 percent |

| Step 4 | Allocate to Primary Goal |

| Step 5 | Allocate to Secondary Goal |

| Step 6 | Optional Burnout Reserve |

| Step 7 | Quarterly Estimated Tax Payments |

| Step 8 | Debt Paydown or Investment Account |

| Step 9 | Roth IRA or Solo 401k |

| Step 10 | Planned Lifestyle Spending |

Step 7: A Simple Tracking System That Takes 10 Minutes a Month

You do not need a full bookkeeping setup. But you do need to see the effect of your shifts, or motivation will die.

Set up a small spreadsheet or note with:

- Columns:

- Date

- Site / hospital

- Hours

- Gross pay

- Tax allocation

- Debt / investment amount

- “Net wealth created” (debt down + investments up)

Example:

- January:

- 4 shifts → $5,200 gross.

- Taxes bucket: $2,000.

- Loans extra: $2,000.

- Investments: $1,000.

- Net wealth created: $3,000.

End of year:

- 48 shifts.

- $62,400 gross.

- $37,000+ in real net worth movement.

You will quickly see which sites are worth the pain and which are not.

| Category | Value |

|---|---|

| Shifts 12 | 8000 |

| Shifts 24 | 16000 |

| Shifts 36 | 24000 |

| Shifts 48 | 32000 |

(Assuming ~$675 net wealth per shift after tax and allocation.)

Step 8: Protect Your Time and Sanity – Avoid the Burnout Trap

This part gets ignored in every “maximize your moonlighting” pep talk. I have watched residents stack shifts to the point of being unsafe zombies on their main job.

Protocol rule: Moonlighting is optional. Your core job performance and health are not.

A. Hard caps

Set explicit caps before the checks start feeling good:

- Max shifts per month (e.g., 4–6).

- No post-24h-call moonlighting.

- Minimum 1 full day off weekly with no clinical work.

Write them down. Tell your spouse/partner or a trusted colleague. Ask them to call you out.

B. Build a “quit number”

Decide now:

“Once my student loans are under $X or my investments reach $Y, I cut moonlighting by Z%.”

Example:

- When loans < $80k, drop from 4 shifts/month to 2.

- When taxable portfolio hits $200k, stop moonlighting entirely for 12 months.

Moonlighting is supposed to be a lever, not a permanent second job you resent.

C. Burnout reserve done right

I am not naive. Sometimes what keeps you going is knowing that some of this cash buys relief today.

If you want that:

- Allocate 5–10% of moonlighting income to a labeled “burnout reserve.”

- Use it for:

- Housecleaning or laundry service.

- Meal delivery.

- Babysitting so you can sleep or go out.

- Actual decompression travel.

Not random Amazon crap.

This way even your “fun money” is aligned with keeping you in the game, not numbing you.

Step 9: Example Protocols for Common Scenarios

Theory is fine. Let me show you how this looks in real life.

Scenario 1: PGY-3 IM resident with $210k loans, PSLF uncertain

- Moonlighting rate: $120/hr, 2 shifts/month, 8 hours each.

- Gross: ~$1,920/month, $23k/year.

Protocol:

- 40% → Tax: $770/month.

- 40% → Loan paydown: $770/month extra to loans.

- 20% → Roth IRA: $380/month until $7k max reached, then:

- Reallocate to loans.

Result:

- Extra $9,240/year to loans.

- Roth fully funded.

- You have a clear exit point:

- Once attending job is secure and PSLF either confirmed or discarded, adjust.

Scenario 2: Early-career hospitalist, $350k loans at 6.5%, wants out in 7 years

- Moonlighting: $160/hr, 3 shifts/month, 10 hours each.

- Gross: $4,800/month, $57,600/year.

Protocol:

- 40% → Tax: $1,920/month (quarterly estimates).

- 40% → Loan paydown: $1,920/month.

- 15% → Taxable investments: $720/month.

- 5% → Burnout reserve: $240/month.

Impact:

- Extra loan payments: $23k/year.

- Investments: ~$8,600/year.

- Realistically, you cut years off your payoff timeline and build a meaningful side portfolio without completely sacrificing quality of life.

Scenario 3: Attending EM physician, no debt, wants $1M taxable in 8 years

- Moonlighting: $220/hr, 2 shifts/month, 10 hours.

- Gross: $4,400/month, $52,800/year.

Protocol:

- 40% → Tax: $1,760/month.

- 60% → Investments: $2,640/month into taxable index fund portfolio.

Projection (basic, no promises, but directionally accurate):

- $2,640/month at 7% annualized ≈ $310k in 8 years from moonlighting alone.

- If you occasionally bump to 3 shifts/month or increase contributions with raises, $500k–600k from moonlighting is realistic.

The point: a small, disciplined protocol beats chaotic grind every single time.

Step 10: Systematize and Review Once a Year

You do not need to think about this weekly. You do need to revisit it annually.

Annual review checklist:

- Did your contract change? Any new restrictions or competing clauses?

- Has your tax situation changed? Different bracket? Move states?

- Are your goals the same? Loans shrinking? Down payment target met?

- Is your moonlighting rate still worth it after burnout, family impact, and taxes?

- Are your investments on autopilot and low-fee?

If you are ahead of your goals, consider:

- Reducing shifts.

- Redirecting more to taxable accounts.

- Building a larger safety cushion (6–12 months expenses).

If you are behind, do a serious check:

- Are you sticking to allocations?

- Did lifestyle creep eat into your moonlighting account?

- Is the work still safe, legal, and sustainable?

Then adjust your protocol, not your impulses.

The Core of the Moonlighting Money Protocol

You are trading sleep, time, and bandwidth for cash. That is fine, temporarily. But only if the money does something durable for you.

Keep these three points straight:

Separate and automate

Moonlighting income goes to its own account. From there, fixed percentages go to taxes, debt, investments, and (optionally) burnout relief. No winging it.Know your real hourly rate and your exit plan

After tax, overhead, and fatigue, what is that shift really worth? Decide up front how much is enough and when you start cutting back. Moonlighting is a lever, not a lifestyle.Tie every shift to a specific, measurable goal

“This month’s four shifts knocked $2,000 off my loans and bought $1,000 of VTI.” Clear, tangible progress. That is how you turn extra shifts into real investments instead of just extra exhaustion.