Most clinicians doing telehealth across state lines are unintentionally underinsured.

Not because they are reckless. Because the way malpractice carriers treat multistate telehealth is fragmented, technical, and frankly, easy to get wrong—even if you are careful.

Let me break this down specifically, the way brokers explain it behind closed doors to groups and hospital systems, not in glossy marketing language.

1. The Fundamental Rule: Coverage Follows the Patient’s Location

Start here, or you will misunderstand everything else.

For medical malpractice purposes in the United States, the legally relevant place of care in telehealth is usually the patient’s location at the time of the encounter.

Insurers, licensing boards, and plaintiff attorneys all converge on this principle:

- A patient in Florida, seen by you via video while you sit in New York → clinically and legally, you are “practicing in Florida.”

- Claims, venue, and required coverage are driven by where the patient was, not where you sat, and not where your EMR server is.

Most malpractice policies now explicitly define “professional services” as occurring where the patient is located. If your policy does not, it often implies it through territorial or jurisdiction language.

This one rule has three immediate consequences:

- You must be licensed (or otherwise authorized) in the patient’s state.

- Your malpractice policy must extend coverage to that state.

- Any claim will typically be litigated under that state’s laws, damage caps, and standard of care expectations.

If your carrier only covers your “home state” and you are systematically seeing patients in multiple other states, you have a coverage problem, even if you pay your premium on time and never miss a CME.

2. Key Policy Structures: How Carriers Actually Treat Multistate Telehealth

Malpractice insurance is not one monolithic product. The way telehealth across state lines is insured depends heavily on how your policy is structured.

There are four dominant patterns. You need to know which one you are in.

2.1 Single-State Policy with “Incidental” Out-of-State Coverage

This used to be the default.

The carrier issues you a policy licensed and “admitted” in one state (say, Texas). The declarations page lists Texas as the state of practice. The policy then quietly includes a clause like:

“We will provide coverage for professional services rendered to patients temporarily located outside Texas, provided such services are incidental to your practice described in the application.”

Sounds generous. It is not.

“Incidental” usually means:

- Short-term travel or snowbirds.

- Rare, occasional consults.

- No intentional marketing or systematic presence in that other state.

What it does NOT typically cover:

- A structured telehealth program with substantial patient volume in other states.

- A clinic that lists “serving patients in 20+ states” on its website.

- Contracts with out-of-state employers to provide ongoing remote care.

I have seen claims where:

- A physician had 30–40% of their telehealth patients in a neighboring state.

- The carrier reviewed encounter volume and marketing materials.

- The carrier asserted: “This is not incidental out-of-state practice; it is a substantial practice in another jurisdiction that was not disclosed.”

- Coverage was contested or heavily limited.

If your telehealth practice across state lines is part of your business model (not a rare exception), you cannot rely on “incidental” clauses.

2.2 Multistate Endorsements on a Single Policy

This is the most common modern approach for individual clinicians or small groups doing telehealth in a handful of states.

Mechanics:

- The policy is issued through one carrier.

- Your main state is primary, but the carrier adds endorsements listing additional states where you are licensed and where patients are located.

- Premium is adjusted upward depending on:

- The number of added states.

- The legal risk profile of those states (e.g., New York, Florida, California usually cost more than, say, Iowa or Idaho).

- Your projected patient volume by state, if the underwriter is diligent.

You will see endorsements or territory language such as:

“Coverage is extended for professional services to patients located in: TX, OK, NM, CO, LA.”

or a territory provision like:

“This policy applies to claims arising from professional services provided in the United States, its territories, and possessions, provided the insured is duly licensed or otherwise authorized to provide such services in the jurisdiction where the patient is located.”

This sounds broad, but underwriters still expect you to disclose:

- Where you actively see patients.

- What volume or percentage of practice is in each jurisdiction.

If you add states without notifying them, you can run into “material misrepresentation” or “non-disclosure” issues on a claim.

2.3 Separate Policies in Multiple States

You see this more with:

- Larger groups.

- Institutions.

- Clinicians tied to different employers in different states.

Structure:

- Policy #1: Admitted in State A, covering services to patients in A (and sometimes neighboring states).

- Policy #2: Different carrier or same carrier but different admitted entity in State B.

- Sometimes with different limits, deductibles, or retro dates.

This can create:

- Gaps: If neither policy clearly covers telehealth to a third state.

- Conflicts: Disputes between carriers about who must defend a claim when patient location, provider location, and employer location conflict.

From a pure risk standpoint, multiple policies can be dangerous unless someone is carefully mapping:

- Which policy applies when you see a patient located in each state.

- How “other insurance” clauses interact.

2.4 Enterprise / National Telehealth Programs

Large telehealth platforms (Teladoc, Amwell, MDLive, etc.), big health systems, and some national concierge groups use:

- One primary malpractice program (often excess and surplus lines).

- National scope.

- Custom manuscript wording explicitly addressing telehealth and multistate coverage.

If you are an employed doc on such a platform, your malpractice may be:

- Fully employer-provided.

- Explicitly including multistate telehealth to any state where the company is operating and you are licensed.

Do not assume; get this in writing:

- Confirm which states are in-scope.

- Ask how coverage works if the company starts serving new states later.

- Understand whether coverage follows you for “moonlighting” telehealth outside the platform (usually it does not).

3. Licensing, Scope, and the “Illegal Practice of Medicine” Trap

Coverage is never just about insurance. Licensing and scope of practice are tied at the hip with malpractice for telehealth.

Most malpractice policies contain some version of:

“We will not be liable for claims arising from services rendered in violation of law or regulation, including practicing without a required license.”

This is where cross-state telehealth gets people into trouble.

3.1 Out-of-State Telehealth Without a License

Example:

- You are licensed in Illinois.

- You regularly see patients virtually in Missouri without a Missouri license.

- Your policy extends territorial coverage to “United States,” but requires you to be “duly licensed.”

If a Missouri patient sues, two layers of pain:

- Regulatory: Missouri board can pursue you for unlicensed practice (yes, even for telehealth).

- Insurance: Carrier can argue that services provided without appropriate licensure are outside policy scope.

Will they always deny? No. But they have a strong contractual argument to at least narrow or contest coverage.

Carriers are more aggressive with:

- Systemic, intentional practice in unauthorized states.

- Clear documentation (website, marketing) showing you advertised to out-of-state patients.

3.2 Special Regimes: Compacts, Exceptions, and Public Health Emergencies

You may be relying on one of:

- Interstate Medical Licensure Compact (IMLC) – faster licensing in multiple states, but still state-specific licenses.

- State-specific telehealth registration instead of full license (e.g., some states allow limited telehealth-only registration).

- Temporary waivers (COVID-era, now mostly expired).

From an insurance perspective:

- If you are lawfully authorized (by compact license, telehealth registration, or emergency waiver), you typically meet the “duly licensed” requirement.

- If you are relying on a waiver that expired last year and you never updated, you are back in the unlicensed zone.

Never assume your carrier is tracking this for you. They are not.

4. Claims Handling Across State Lines: How a Lawsuit Actually Plays Out

Let us walk through a real-world style scenario, with all the messy jurisdiction issues that matter for malpractice coverage.

4.1 A Typical Cross-State Claim Scenario

- You live and are licensed in Georgia.

- You are also licensed in Alabama and Florida.

- Your malpractice policy lists GA, AL, FL in the coverage endorsement.

- You work remotely from Atlanta for a telehealth group, seeing primarily GA and FL patients.

Case:

- You treat a Florida patient via video.

- Alleged missed diagnosis leads to harm.

- Plaintiff attorney files suit in Florida.

Here is what your carrier does:

- Confirms:

- Patient was in Florida at time of encounter.

- You were licensed in Florida on that date.

- Florida is an endorsed state under your policy.

- Assigns defense counsel admitted in Florida.

- Applies:

- Your policy limits and conditions.

- Florida tort law (standard of care, damage caps if any, pre-suit requirements).

- Florida’s statute of limitations for med mal.

Your physical presence in Georgia is almost irrelevant. The important facts, from the carrier’s standpoint: the patient and the lawsuit are in Florida, and your policy contemplates Florida practice.

4.2 The Multi-State Venue Tug-of-War

It gets trickier when:

- Patient in State A.

- Provider in State B.

- Employer incorporated in State C.

- Telehealth platform servers or headquarters elsewhere.

Plaintiff attorneys may:

- File in A (patient’s home).

- Try B or C if there are venue advantages (jury pool, damages, procedural rules).

Your carrier will:

- Evaluate whether the policy territory language permits claims arising from professional services in those states.

- Often still defend, but may reserve rights if a particular jurisdiction is outside the intended coverage.

This is where carefully negotiated territory clauses and multistate endorsements matter. Vague or restrictive language is a liability.

5. Coverage Nuances Specific to Telehealth

Telehealth is not just “office visits, but on video”. Carriers know that. They carve out specific telehealth issues in endorsements or internal underwriting guidelines.

5.1 Modality: Video vs. Phone vs. Asynchronous

Many policies historically assumed “face-to-face” care. Now they often say:

- Covered: Synchronous video, audio-only visits, secure messaging, e-consults.

- Sometimes limited: Asynchronous store-and-forward, algorithm-driven decision trees, or automated triage.

For cross-state practice, this can intersect weirdly:

- State A permits phone-only telehealth.

- State B restricts certain controlled substance prescribing without video.

- Your policy may be silent, but if you violate State B’s telehealth law, the “unlawful services” exclusion can be triggered.

You want written clarification from your carrier or broker that telehealth in all permitted modalities in each endorsed state is within your coverage scope.

5.2 Prescribing Across State Lines

Common litigation trigger:

- Controlled substances, especially for pain, psychiatry, ADHD.

- Tele-prescribing rules vary wildly by state (physical exam requirements, in-person visit rules, PDMP mandates).

Insurance angle:

- If a state deems your prescribing pattern unlawful, the malpractice claim may be tangled with criminal or administrative action.

- Many policies do not cover criminal defense or regulatory board actions (or cover them only with small sub-limits).

So even if your negligence claim is defended, you might be on your own for board proceedings in that patient’s state.

6. Financial Structure: Limits, Premiums, and State-by-State Risk

Cross-state telehealth is not just a licensing puzzle. It is a pricing and limits problem.

Carriers look at two main financial components:

- How much risk per claim (limits).

- How much risk per year (aggregate, exposure).

| Category | Value |

|---|---|

| California | 120 |

| Texas | 90 |

| New York | 150 |

| Florida | 160 |

| Iowa | 60 |

6.1 Limits and Aggregates

Typical physician limits remain:

- $1M per claim / $3M aggregate (annual) in many states.

- Some states or hospitals push for $2M / $4M or higher.

Cross-state factor:

- A single policy with $1M/$3M may now be covering:

- High-exposure states (Florida, New York).

- Lower-risk states.

- A couple of catastrophic telehealth claims in high-damages states can exhaust your aggregate quickly.

Groups that expand telehealth aggressively and keep the same limits they used for a single-state brick-and-mortar practice are playing with fire.

6.2 Premium Load for Multistate Telehealth

Underwriters adjust premiums based on:

- Number of states.

- Risk profile of those states (plaintiff-friendly vs. defense-friendly).

- Volume of visits per state.

- Mix of services: primary care vs. psych vs. urgent care vs. high-risk specialties.

Common patterns:

- Add a low-risk neighboring state with modest volume → small premium bump.

- Add CA, FL, NY with meaningful volume → noticeable (sometimes significant) increase.

You want your broker to show you:

- How each state’s exposure feeds into your overall premium.

- Whether your telehealth growth in particular high-risk states is being tracked and disclosed.

7. Employer, 1099, and “Side Gig” Telehealth: Whose Policy Responds?

This is where things often blow up in practice.

7.1 Employed Model

If you are a W-2 employed physician for a telehealth company:

- The company typically carries a malpractice policy covering:

- The corporate entity.

- Its employed clinicians.

- Multistate telehealth in all states where it operates and you are licensed.

Your main tasks:

- Confirm in writing that:

- You are a named or covered insured.

- All states where you see patients are contemplated.

- Understand if coverage is “claims-made” and whether tail is provided if you leave.

7.2 Independent Contractor (1099) Model

A lot of telehealth work is 1099.

There are three variants:

- Company provides malpractice that covers you as a contractor.

- Company requires you to carry your own policy.

- Hybrid: company policy primary, but requires you to maintain individual coverage too.

Red flags:

- Telehealth company says: “We cover you,” but the policy:

- Is limited to certain states.

- Does not list you by name.

- Has exclusions for certain services you routinely provide.

If you are 1099 and doing multistate telehealth, you need to:

- Obtain your own policy with explicit multistate telehealth coverage; or

- Get full documentation of your coverage as an additional insured on the company policy.

7.3 Side Gig Telehealth Outside Your Main Employer

If you are a hospital-employed physician in Ohio with employer-provided malpractice, and you pick up a weekend telehealth gig seeing patients in other states:

- Your hospital policy almost certainly does not cover that side work.

- Your telehealth platform may or may not provide adequate coverage.

- If the platform says, “You need your own policy,” that policy must be properly endorsed for:

- Telehealth.

- The states where those side-gig patients are located.

Never assume “I have malpractice at my main job, so I’m covered.” That assumption has ruined careers.

8. Practical Steps to Make Sure Your Cross-State Telehealth Is Actually Covered

Let me give you something tactical. If you are practicing telehealth across state lines, sit down with your policy and a broker and walk through this checklist.

| Step | Description |

|---|---|

| Step 1 | Start |

| Step 2 | List all states where patients are located |

| Step 3 | Confirm licenses or telehealth registrations |

| Step 4 | Review policy territory and state endorsements |

| Step 5 | Contact broker or carrier to add states |

| Step 6 | Review telehealth and modality language |

| Step 7 | Confirm employment vs 1099 coverage responsibilities |

| Step 8 | Document confirmation in writing |

| Step 9 | Reassess annually or when adding new states |

| Step 10 | All patient states listed or clearly included? |

Specific questions to ask (in writing, not just over the phone):

- “List all states in which this policy will defend and indemnify me for malpractice claims arising from telehealth visits when the patient is physically located in that state.”

- “Does coverage apply to synchronous video, audio-only, secure messaging, and asynchronous telehealth, as long as they are lawful in the patient’s state?”

- “Are there any states that are excluded from coverage, even if I am licensed there?”

- “How does the policy treat services rendered under temporary waivers, compacts, or telehealth registrations rather than full licenses?”

- “If I add a new state later, what is the process to ensure coverage extends to that state before I see patients there?”

Also, create a simple internal map:

| State | Licensed? | Patients Seen? | Covered by Which Policy? |

|---|---|---|---|

| Texas | Yes | Yes | Individual Policy |

| Florida | Yes | Yes | Individual Policy |

| New York | No | No | N/A |

| California | Yes | No (yet) | Add before starting |

You would be surprised how many physicians cannot answer “Which policy covers me for my Florida telehealth patients?” without digging through emails for 30 minutes.

9. Special Case: Cross-State Tele-Psychiatry and High-Risk Domains

Tele-psychiatry, tele-OB, and tele-ICU raise the stakes.

9.1 Tele-Psych Across State Lines

High risk because:

- Chronic conditions.

- Controlled substances.

- Suicide and self-harm risk.

- Frequent long-term follow-up, often with fragile documentation trails.

Many carriers:

- Underwrite tele-psych separately.

- Charge higher premiums.

- Scrutinize state mix and tele-prescribing compliance.

If you are seeing psych patients across state lines:

- Confirm that psych services are explicitly covered, not silently excluded as “high-risk behavior modification” or similar nonsense language.

- Understand how your carrier views suicide/self-harm claims in different states. Some have specific case law around “duty to warn” that varies by jurisdiction.

9.2 Tele-OB, Tele-ICU, and High-Acuity Teleconsults

Some insurers:

- Treat low-acuity telehealth (urgent care, primary care follow-up) as relatively standard.

- Treat high-acuity remote consults (OB triage, ICU management) as higher risk categories.

Ask specifically:

- Whether acute teleconsults to out-of-state hospitals are covered.

- Whether the receiving institution’s location or your own location is controlling for coverage purposes (in practice, both matter).

10. Tail Coverage and the Time Bomb of Claims-Made Policies

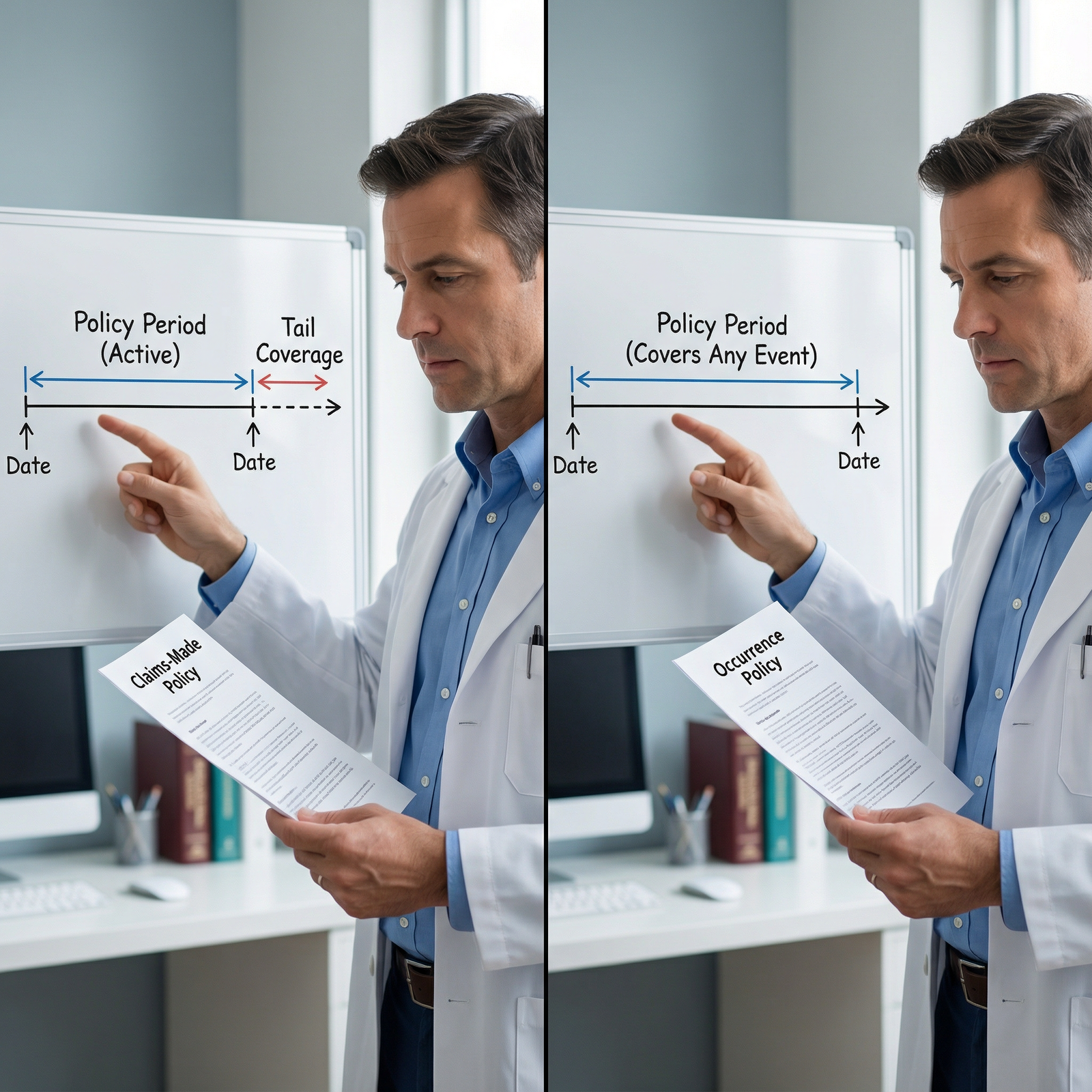

One more layer that gets nasty when you cross state lines: claims-made vs. occurrence.

Most physician malpractice today is claims-made:

- You are covered if:

- The incident occurred after the retroactive date, and

- The claim is made while the policy is active.

If you:

- Do telehealth in five states under a claims-made policy.

- Then change carriers or employers.

You must consider:

- Tail coverage that explicitly covers prior acts in all those states.

- Whether the new carrier is providing “prior acts” coverage for your multistate telehealth practice.

If your old policy only had GA and FL endorsed when you started, and you later added CA and TX but never updated endorsements properly, tail coverage can be patchy.

You will not discover this until someone files a claim from that early-period California telehealth visit. Then everyone is pointing at everyone else.

What This All Means for You

Telehealth across state lines is not exotic anymore. It is mainstream medicine. But malpractice insurance is still catching up, and many clinicians are stuck in a single-state mental model that does not match reality.

The core truths:

- The legal “place” of telehealth is the patient’s state.

- Your policy must explicitly contemplate every state where your patients sit.

- Licensing, telehealth modality laws, and prescribing rules in each state are not just regulatory trivia; they can affect whether your insurer defends you.

- Multistate practice changes your financial risk profile, and your limits and premiums should reflect that change.

You do not need to become an insurance lawyer. You do need to be the one person in your practice who can clearly answer:

- “Which states do we see patients in?”

- “What policies cover which states?”

- “Are we licensed and compliant in each of those jurisdictions?”

Once you can answer those without hesitation, then you are ready to think about more advanced issues: corporate structuring across states, self-insurance layers, and negotiating manuscript policy language. But that is another level—and another conversation.

For now, fix your map, your licenses, and your policy endorsements. That is the foundation.

FAQ (Exactly 4 Questions)

1. If my malpractice policy says it covers the ‘United States,’ does that automatically mean I am covered for telehealth in every state?

No. “United States” territorial language sounds broad, but carriers still expect that you are lawfully licensed and that your intended practice states were disclosed in underwriting. If you quietly start seeing large volumes of patients in a high-risk state that was never discussed, the carrier can argue misrepresentation or at least push back hard on a claim. You want explicit confirmation—ideally via endorsements—of the states where you are actively practicing telehealth.

2. I am covered by my hospital for malpractice. Does that cover my separate telehealth work in other states?

Almost certainly not. Employer-provided coverage is usually restricted to services within the scope of that employment. Side telehealth work, especially across state lines, is typically outside that scope. You must either verify that your hospital policy explicitly includes this secondary work (rare) or purchase your own malpractice policy tailored to your telehealth practice and the states where those patients are located.

3. Can I rely on temporary COVID-era telehealth waivers and still be covered now?

In most states, no. Many emergency waivers that allowed cross-state telehealth without full licensure have expired. If you continue to see patients based on an expired waiver, you are effectively unlicensed in that state. Malpractice policies almost always require that you be duly licensed in the jurisdiction where the patient is located. Practicing without that license can jeopardize coverage and expose you to regulatory sanctions.

4. How many states can I safely add before my malpractice premium becomes unreasonable?

There is no magic number. It depends entirely on which states, what specialty, and what volume of patients you see in each. Adding two low-risk neighboring states for occasional telehealth may barely move your premium. Adding California, Florida, and New York with substantial volume can increase it dramatically. The right approach is not to guess; it is to work with a broker who can model premium impact and help you prioritize which states justify the additional risk and cost.