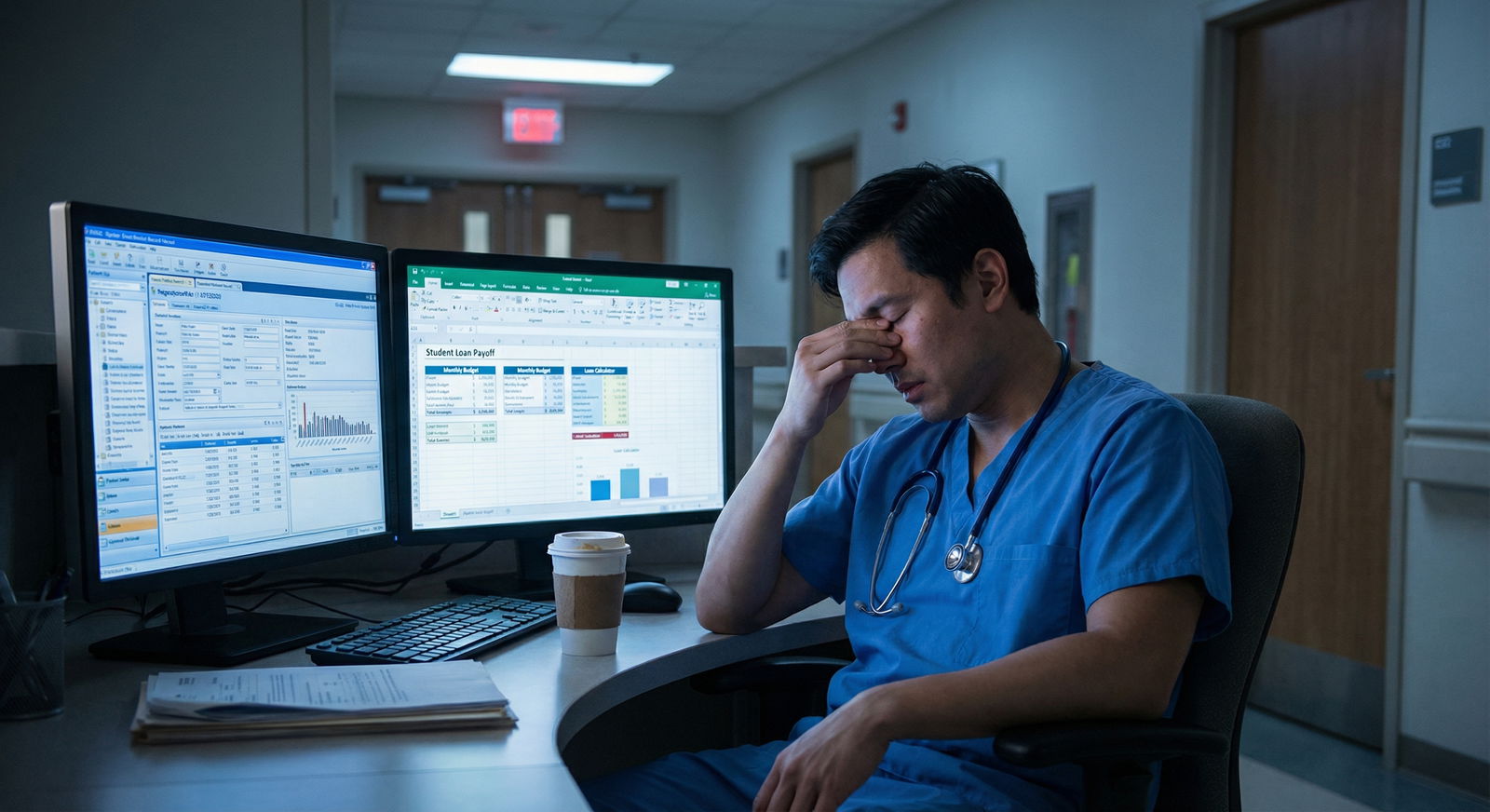

It is July 1st. You just started your final year of residency. Everyone around you is talking about boards, fellowship applications, chief year drama. You are quietly thinking about something else:

“I am about to go from $70K to $350K+. I have no idea how to not screw this up.”

Good. That means you are ahead of most of your co-residents.

Here is the blunt truth: your very first attending contract can set your financial trajectory for a decade. Not just the base salary. The structure. The non-compete. The RVU targets. The call pay. The tail coverage. The little clauses you skim because you are post-call and exhausted.

You want a clear, month‑by‑month plan from now (12 months before you start) to the end of your first attending year that maximizes your salary, protects you legally, and keeps the door open for better jobs later.

That is what this is.

The Core Strategy: 3 Phases Over 12 Months

You have three distinct phases:

Months −12 to −6 (Preparation & Positioning)

Build leverage before you ever speak to a recruiter.Months −6 to 0 (Search, Negotiate, Sign)

Maximize your first contract and avoid expensive legal traps.Months 0 to +12 (Execution & Optimization)

Crush your first year metrics, hit bonuses, and quietly prepare your next move.

We will walk through each phase with specific actions, timelines, and scripts you can actually use.

Phase 1 (Months −12 to −6): Preparation and Positioning

You are still a resident. You do not feel powerful. But this is exactly when you start creating leverage, because once you are desperate for a job, your options shrink.

Step 1: Get brutally clear on your market value

Stop guessing. Look at real data.

Collect numbers from:

- MGMA or AMGA data (via your program, faculty, or state medical society)

- Specialty societies (e.g., ACEP, ACR, AAFP often publish ranges)

- Doximity, Medscape, and compensation surveys by specialty

- Senior residents and recent grads from your program — what are they actually getting?

Build a simple range for your specialty + your region:

| Specialty | Region | Typical Base Range | Total Comp Range (Year 1) |

|---|---|---|---|

| Hospitalist | Midwest | $240K–$280K | $260K–$320K |

| EM | Southeast | $210–$250/hour | $350K–$450K |

| Gen Surgery | South | $350K–$425K | $400K–$550K |

| Cards (non-int) | Northeast | $400K–$500K | $450K–$650K |

| Outpt Psych | West Coast | $260K–$320K | $280K–$380K |

You want:

- Base expectations (low, median, high)

- Productivity models: wRVU rate, thresholds

- Bonus structures: sign‑on, relocation, quality, call, nocturnist differentials

If you do not have at least three concrete data points for your specialty and region, you are guessing. And guessing gets you underpaid.

Step 2: Decide your “musts” vs “nice-to-haves”

You maximize salary by knowing what you can flex on.

Write two lists:

Non‑negotiable (you walk if these are bad):

- Minimum total compensation (e.g., “Not less than $320K all‑in year 1”)

- Location radius or specific cities

- Call burden (e.g., “No more than Q4 home call, no uncompensated call”)

- Non‑compete limits (distance, duration, scope)

- Visa sponsorship, if relevant

Flexible:

- Academic vs community

- Teaching opportunities

- Research time

- Start date

- Exact wRVU threshold, if comp above market

This gives you a framework to negotiate without getting emotionally spun around by a recruiter’s “this is standard.”

Step 3: Build your “value story”

You want to be the candidate that justifies top‑quartile pay.

Draft a one‑page summary (not a CV, you already have that) that highlights:

- Procedure volume (“Logged 350+ colonoscopies with independent call coverage”)

- Productivity (“Average 10–12 new patients per clinic day, 6–8 follow‑ups”)

- Leadership (“Chief resident, led quality project reducing ED boarding by 20%”)

- Niche skills that make money (“TTE/TEE certified”, “Point‑of‑care ultrasound instructor”, “Advanced endoscopy”, “Obstetric ultrasound”, “Buprenorphine waiver”)

You will use this language over and over:

- In emails to recruiters

- In interviews

- As justification for compensation

Step 4: Clean up your legal and financial foundation

Maximizing salary is useless if you leak money everywhere else.

By month −9 or so:

- Pull your credit report (all three bureaus)

- List your student loans with interest rates, servicers, and total

- Get disability insurance quotes as a resident (cheaper now, especially own‑occupation policies)

- Decide: PSLF or not? If you are going PSLF, your job search changes.

Phase 2 (Months −6 to 0): Search, Negotiate, Sign

This is where money is made or lost.

Month −6 to −4: Start the search strategically

Do not “see what is out there.” That is how you wind up with lowball offers and rushed decisions.

Use a deliberate approach:

- Tap program alumni first. Ask:

- “If you were me, which groups or systems would you avoid?”

- “Any practices hiring in [X city] that actually treat physicians well?”

- Use specialty‑specific recruiters you trust. Some are vultures; some actually know the good groups.

- Check hospital system job boards directly for W‑2 employed roles.

Keep a simple spreadsheet with:

- Organization / practice

- Location

- Contact person

- Comp model (base, RVU, hybrid)

- Call expectations

- Non‑compete

- Notes: red flags, culture, “everyone is leaving”

This keeps you out of the “I do not remember which one had the crazy non‑compete” trap.

How to talk money early without looking greedy

You need ranges before you waste time traveling and interviewing.

Use language like:

“To be respectful of everyone’s time, can you share the typical total compensation range for a new hire in this role, including base, productivity, and any bonuses?”

If they will not answer in at least rough numbers up front, that is a data point. Usually not a good one.

Understanding and attacking the comp structure

You must know how the money is made in each offer. The base number is not the whole story.

Common setups:

Pure base salary (academic, some hospital employed)

Simple, but often lower. Look hard at:- Protected time vs clinically productive time

- Promotion pathways and raises (or lack of them)

Base + wRVU bonus (very common)

Key variables:- Base salary (guaranteed vs time‑limited)

- wRVU rate ($ per wRVU)

- Threshold (when bonus kicks in)

- Historical wRVU numbers of current docs

Straight RVU/production (more private groups)

Higher upside, higher risk. You need:- Payer mix

- New patient volume and referral sources

- Partner track transparency

- Buy‑in costs

Here is why this matters so much:

| Category | Value |

|---|---|

| $40/wRVU | 40000 |

| $45/wRVU | 60000 |

| $50/wRVU | 80000 |

Same work. Same wRVUs. Different rate. Your annual bonus swings by tens of thousands.

If you do not understand wRVUs, fix that now. Ask your billing office, senior attendings, or look at your residency’s billable logs.

Step‑by‑step: How to negotiate your first contract

Here is the playbook.

1. Get multiple offers if at all possible

Even if you are 95% sure of one job, having another written offer changes the conversation.

You can literally say:

“I like your group and feel this would be a good fit. I do have another offer at $X base with a wRVU rate of $Y. If you could match something in that range, I would be comfortable moving forward.”

You are not threatening. You are presenting facts.

2. Do not negotiate verbally only

When they send a “summary of terms” email or letter of intent, push to get specifics in writing:

- Base salary and duration of guarantee

- wRVU rate and thresholds

- Call requirements and compensation

- PTO / CME days and dollars

- Sign‑on, relocation, retention bonuses

- Non‑compete terms

- Malpractice: occurrence vs claims‑made, tail coverage

You cannot negotiate what you cannot see.

3. Hire a contract review attorney. Not optional.

You want a physician contract lawyer who:

- Works in the state where you will practice

- Reviews dozens of contracts per month

- Has seen your specialty contracts before

They will catch:

- Non‑competes that effectively lock you out of the entire metro area

- RVU targets that nobody in the group is actually hitting

- Termination clauses that leave you stuck with tail coverage

- Ridiculous repayment provisions on sign‑on bonuses

Pay the $500–$1,500. You will make it back many times over.

| Step | Description |

|---|---|

| Step 1 | Receive Draft Contract |

| Step 2 | Initial Read Through |

| Step 3 | List Questions and Concerns |

| Step 4 | Send to Physician Contract Attorney |

| Step 5 | Attorney Review and Summary Call |

| Step 6 | Prioritize Changes |

| Step 7 | Negotiate with Employer |

| Step 8 | Final Legal Check |

| Step 9 | Sign or Walk Away |

What to push on (and what to let go)

You do not need to “win” every point. You need to move the financially meaningful levers and remove landmines.

High‑impact items to negotiate:

- Base salary (especially in first 1–2 years)

- wRVU rate and threshold

- Call pay and structure (is it mandatory? how is it valued?)

- Sign‑on bonus vs relocation (taxed differently, sometimes structured differently)

- Non‑compete radius and duration

- Who pays for tail coverage on termination (you vs employer, without cause vs with cause)

Lower‑impact / often symbolic:

- CME allowance variance within a few hundred dollars

- One extra PTO day

- Titles like “Assistant Professor” if the pay is unchanged

You are not there to win trivia points. You are there to increase total comp and reduce future risk.

Non‑competes, malpractice, and other legal traps

If you ignore anything in your contract, do not let it be these three:

Non‑compete

- Distance: 10 vs 50 miles is life‑changing in some regions

- Duration: 1 year is common; 2–3 years is aggressive

- Scope: specialty‑specific or “any practice of medicine”?

Malpractice (and tail)

- Occurrence: best, more expensive for employer, no tail needed

- Claims‑made: cheaper, requires tail when you leave

- Tail cost: often 1.5–2.5x annual premium (think $30–$100K+)

Your goal: employer pays tail if they terminate without cause or if the contract expires.

Termination clause

- Without cause termination: 60–90 days notice is standard. Less than 60 is unpleasant.

- With cause: make sure reasons are narrow and clearly defined, not “any reason we decide.”

Do not be shy about asking your attorney to translate any legalese into plain language. If you do not understand it, it is dangerous.

Phase 3 (Months 0 to +12): Execution and Optimization

You signed. You are now an attending. The goal shifts from “negotiate good terms” to “hit the numbers and set up leverage for your next contract.”

Month 0–1: Onboarding with a compensation lens

Day one, you should know:

- Your wRVU or productivity targets for year 1

- How wRVUs are credited (same‑day vs lag, how procedures vs visits are counted)

- How to see your own data (dashboard, monthly reports, who to email)

Schedule a 30‑minute meeting with:

- Practice manager

- Or the person who runs billing/coding/finance

Ask very specific questions:

- “How do I access my monthly RVU and collections reports?”

- “What were the last 12 months of RVUs for the median physician in our group?”

- “Are there any bottlenecks in scheduling or referrals I should know about?”

You are signaling: I care about productivity and transparency. That usually gets you more support.

Months 1–3: Fix your clinical workflow to match your comp model

You maximize salary by aligning your daily work with how you are paid.

Some examples:

RVU‑based outpatient IM:

- Optimize your template: more new patients and complex visits instead of being crushed by 15 low‑level follow‑ups.

- Use pre‑visit planning so chronic issues can be billed appropriately as level 4 visits when justified.

Procedure‑driven fields (GI, Cards, Ortho, Anesthesia):

- Get on the procedure schedule early and often.

- Say “yes” to add‑on cases you can safely handle, especially when there is extra pay or RVU volume.

Hospitalist:

- Know which diagnoses and services are under‑coded most often.

- Avoid doing hours of non‑billable admin work that should be on the system, not you.

If your job is pure salary and not volume‑based, maximize:

- Visibility (committees, leadership, teaching)

- Quality metrics tied to future raises or bonuses

But do not fall into the trap of “hero work” that does not show up anywhere in your evaluations or pay.

Track your numbers. Religiously.

Physicians who earn more do one simple thing differently: they know their data.

Once a month, on a recurring calendar reminder:

- Pull your wRVU report

- Compare:

- wRVUs this month vs target

- wRVUs this month vs group median

- Cumulative YTD vs bonus thresholds

If numbers are off, identify where:

- Low volume? Talk to scheduling about new patient slots, referral relationships, template design.

- Low RVUs per encounter? Get coding feedback; consider a quick chart audit.

- Bottlenecks? Limited OR time, insufficient support staff, EMR issues.

You are not whining. You are troubleshooting your small business.

Months 3–6: Tuning for bonuses and retention leverage

By now, you should see if the contract’s promises match reality. This is your mid‑year course correction window.

Actions to take:

Meet with a senior partner or department chair to review your progress. Ask:

- “Based on my first few months, what would you focus on to hit or exceed our productivity benchmarks?”

- “Are there growth areas the group wants to expand where I could help?”

If you are far above RVU targets and clearly profitable to the group, document it. You will use this later for:

- Early comp adjustment discussions

- Future contract renegotiation

- Outside job offers (if needed)

If you are far below, you do not panic. You diagnose. New attendings commonly need 6–12 months to ramp up. But do not wait until your annual review to realize you missed the bonus threshold by 200 RVUs.

Non‑salary levers that still increase effective pay

Your W‑2 number is not the only thing that matters. Structure matters.

Look at:

Retirement match:

- Maximize any 401(k)/403(b) match — that is guaranteed immediate return.

- Ask about 457(b), cash balance plans, or defined benefit options if available.

Tax‑advantaged accounts:

- HSA if you have a high‑deductible plan

- Dependent care FSA if applicable

CME and professional expenses:

- Use them fully. Go to conferences that matter for your career and networking.

Call structure:

- If call is underpaid or unpaid, your effective hourly rate is lower than it looks on paper. This is a key negotiation lever at contract renewal.

Months 6–12: Prepare your next move before you need it

You might stay. You might leave. Either way, you want leverage.

Around month 9:

- Ask for a copy of your full productivity and quality metrics YTD.

- Ask your practice manager or chair:

- “If I keep performing at this level, what does the next contract typically look like?”

- “What is the usual time frame for compensation review?”

Then quietly:

- Update your CV with hard numbers: RVUs, volumes, leadership roles.

- Reconnect with alumni and colleagues in other systems:

- “Just finished my first year as an attending. Curious what your group’s comp and call setup looks like these days.”

If your current job is great, this information still matters. You can sit down at renewal and say:

“Here are my numbers: I am in the top quartile of productivity for our group and above MGMA median for new attendings in this specialty. Based on that, I would like to discuss aligning my compensation closer to that benchmark.”

If your job is not great, you are already halfway ready to move. That alone increases your bargaining power.

Watch the lifestyle creep

Maximizing salary is useless if every raise disappears into car leases and pointless upgrades.

In your first attending year:

Lock in a basic written plan:

- X% to retirement

- Y% to loans or investments

- Z% to “fun”

Delay major purchases (house, luxury car) until:

- You are sure you like the job and location

- You have at least 3–6 months of expenses in cash

- You understand your true after‑tax income and call schedule

Plenty of physicians are “high income, broke.” Do not join them.

A Simple 12-Month Timeline You Can Follow

Here is an at‑a‑glance view. Adapt the exact months to your training end date.

| Category | Value |

|---|---|

| -12 | 10 |

| -9 | 25 |

| -6 | 45 |

| -3 | 70 |

| 0 | 80 |

| +3 | 85 |

| +6 | 90 |

| +9 | 95 |

| +12 | 100 |

Think of that as your “percentage ready” if you follow through:

- Month −12 to −9: Research your market, define must‑haves, start disability insurance.

- Month −9 to −6: Build your value story, network with alumni, start low‑pressure job conversations.

- Month −6 to −3: Actively interview, compare offers, bring in contract attorney.

- Month −3 to 0: Negotiate final contract, finalize moving/financial logistics.

- Month 0 to +3: Onboard, learn comp system, start tracking your numbers.

- Month +3 to +6: Optimize workflow, meet or beat productivity expectations.

- Month +6 to +12: Prepare for contract review or next move with solid data in hand.

Your Next Step Today

Do one concrete thing now:

Open a blank document and create three headings:

- “My Market Range”

- “My Non‑Negotiables”

- “My Value Story”

Under “My Market Range,” write your specialty and the region you are most likely to work in. Then, before you go to bed tonight, find and write down three real compensation data points from surveys, recent grads, or recruiters.

Once you have those numbers on paper, you are no longer guessing. You are planning.

From there, you execute the rest of the 12‑month plan. Step by step.