The RVU compensation model is not “too complicated to understand”—that lie is exactly how physicians get underpaid for years.

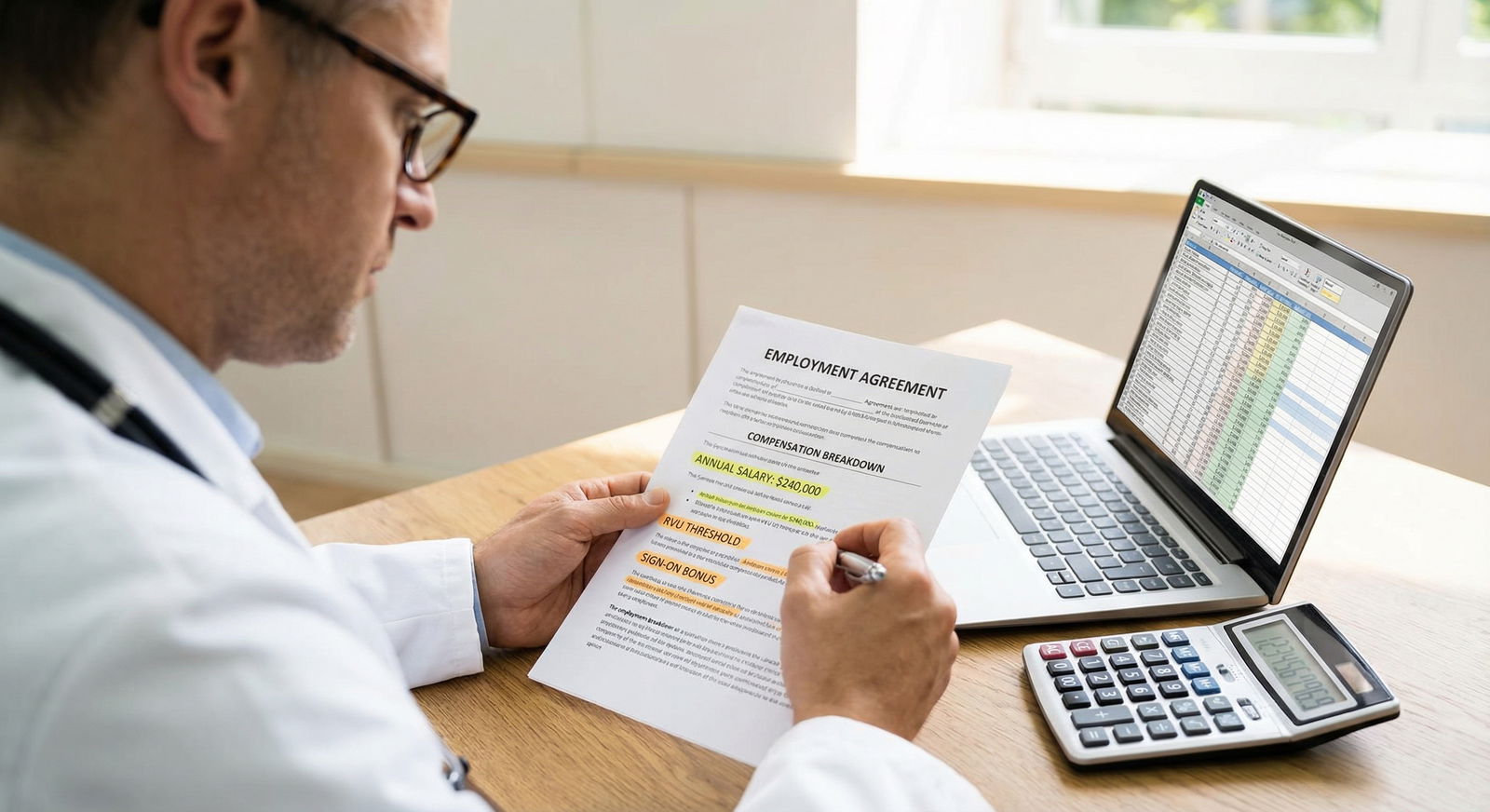

You’re about to read your first attending offer. You see RVUs, conversion factors, thresholds, wRVU bonuses. Your brain says, “This looks fine, my co-resident signed something similar.” That’s the mistake.

I’ve watched brand‑new attendings lock in 3–5 years of underpayment because they didn’t understand a single table in their contract.

Let’s fix that.

1. The First Deadly Mistake: Confusing “RVUs” With “Money”

Residents often assume: “Higher RVUs = higher pay.” Not necessarily. The only number that actually turns your work into money is the wRVU conversion factor.

If you do not know your conversion factor, you do not know your salary. Period.

What you’re usually shown

You’ll see some version of:

- Base salary: $260,000

- wRVU target: 5,000/year

- wRVU bonus: $45 per wRVU over 5,000

You think, “Sounds pretty good. My PD said $40–$50 per wRVU is normal.”

But then you miss the trap: What is that base salary actually paying you for?

| Scenario | Base Salary | Included wRVUs | Extra wRVU Rate | Effective $/wRVU (first 6,000) |

|---|---|---|---|---|

| A | $260,000 | 5,000 | $45 | ~$43 |

| B | $260,000 | 7,000 | $45 | ~$37 |

| C | $260,000 | 8,000 | $45 | ~$34 |

Same “$45 per wRVU” bonus, totally different reality.

The common misunderstandings

Residents routinely:

- Compare base salaries between offers but ignore RVU expectations.

- Quote colleagues’ bonus rates ($45/wRVU!) without asking how many RVUs are baked into base.

- Celebrate “high RVU potential” while walking into unachievable targets for their specialty and setting.

The question you should actually ask:

“What’s my effective dollars per wRVU when I hit a realistic volume for this job?”

If the recruiter can’t answer that cleanly, pause. That’s not a small detail. That’s your life.

2. Not Knowing What a Realistic wRVU Number Looks Like

The second big mistake: agreeing to targets you’ve never sanity‑checked.

I’ve seen hospitalists handed 6,000 wRVU “targets” that would require them to live in the hospital. I’ve seen outpatient IM offers with 8,000 wRVU “high performers” where nobody in the group has ever broken 6,000.

You sign it because: “I don’t know, this feels like how attending jobs work?”

You must benchmark. Even roughly.

Every specialty has a range of reasonable annual wRVUs. There are outliers, sure. But if you’re 30–40% above normal, something’s off.

| Category | Value |

|---|---|

| Outpatient IM | 4500 |

| Hospitalist | 4500 |

| Outpatient Cards | 8000 |

| General Surgery | 7000 |

| Outpatient Psych | 3500 |

Those numbers aren’t gospel. They move with practice style, procedures, and region. But if you’re offered:

- Outpatient IM: 8,000 wRVU “target”

- Psych: 6,000 wRVU “median expectations”

- Hospitalist: 7,500 wRVU “standard”

You aren’t being “challenged.” You’re being set up.

How residents screw this up

They never ask what current docs produce.

The easiest sanity check, and almost nobody asks:- “What did your median physician produce in wRVUs last year?”

- “What did the 25th and 75th percentile produce?”

They don’t ask for data by FTE.

A 0.8 FTE being compared to a 1.2 FTE is meaningless. You want:- “wRVUs per 1.0 FTE physician in this group.”

They trust vague language.

Phrases like:- “Most of our docs hit this bonus.”

- “High earners are in the $400–$450K range.”

These mean nothing without actual numbers.

You’re not being rude by asking. You’re protecting your future.

3. Ignoring How wRVUs Are Actually Generated (and Lost)

Another classic resident mistake: assuming the RVUs magically appear because you worked.

They don’t. RVUs are billed based on:

- CPT codes

- Documentation quality

- Coder interpretation

- Billing policies (especially with time‑based codes and split/shared visits)

If your contract pays you based on wRVUs, you’ve basically partnered with the billing department. Without ever meeting them.

Common traps you don’t see coming

No guarantee on who gets the wRVU credit.

- Are APP visits credited to you? To them? Split?

- What about shared visits in hospital?

- What about procedures done by you but “billed under” someone else?

If it’s not spelled out, assume the worst.

Crippling template and compliance policies.

I’ve watched new attendings lose 20–30% of potential wRVUs because:- They were forced to adopt ultra-short note templates.

- Leadership banned certain time-based codes “for compliance safety.”

- Admin asked them not to bill higher-level visits “so patients do not complain about their bill.”

That’s fine—if you’re on straight salary. It’s theft if your pay is RVU-based.

Bad coder alignment.

If your coders default to:- Downcoding anything ambiguous

- Refusing to bill prolonged or complex visits

- Rejecting add-on codes because “we don’t usually use that”

Then your “high RVU job” might quietly become a mid-tier salary.

You must ask: “Will I get regular reports of billed and collected wRVUs by CPT code?”

If they say, “We don’t really break it down like that,” that’s not a minor inconvenience. That’s a visibility blackout.

4. Letting the Employer Define the Benchmark… and Keep It Secret

Residents love the MGMA/AMGA/PCR data game—because employers use those words and it sounds official.

The mistake is thinking “MGMA median” is a fixed, universal truth. It’s not. It’s a data set with:

- Wide ranges

- Regional breakdowns

- Different practice types

- Different reporting methods

And you almost never see the page they’re quoting from.

| Category | Value |

|---|---|

| Offer A | 4500,260000 |

| Offer B | 5500,280000 |

| Offer C | 7000,320000 |

| Your Goal | 5000,300000 |

| Local Median | 4800,290000 |

How you get played with benchmarks

Common employer lines:

- “We’re paying you at the 65th percentile for your specialty.”

- “Your target wRVUs are at the 50th percentile only.”

- “Our comp plan is based on national benchmarks.”

Sounds reassuring. But residents rarely ask:

- “Which survey? Which year?”

- “Show me the table where those numbers are listed.”

- “Is that 65th percentile for total comp or dollars per wRVU?”

- “Is the RVU benchmark academic, private, employed?”

If they won’t show you the actual page or PDF, assume they’re cherry-picking in their favor.

The more subtle benchmark trap

I’ve seen offers where:

- RVU targets are set at 75th percentile productivity

- Dollars per RVU is set at 25th–35th percentile compensation

Translation: You have to work like a monster just to be paid like an average physician.

You think, “But they said it’s aligned with MGMA.”

Yeah. In two completely different columns.

5. Not Understanding the Base + RVU “Blended” Trap

This one nails almost every first-time attending:

You see:

- Base salary: $300,000

- wRVU target: 6,000

- Bonus: $50/wRVU over 6,000

You compare that to:

- Straight RVU pay: $60/wRVU, no base guarantee

You instantly prefer the “safe” base + bonus. Especially with student loans breathing down your neck.

Here’s the problem: the base is not free money. It’s a prepayment for your first block of RVUs.

| Offer | wRVU Rate | Target | Base Pay | Extra wRVU Rate | Total at 7,000 wRVU |

|---|---|---|---|---|---|

| Straight RVU | $60 | 0 | $0 | $60 | $420,000 |

| Base + Bonus | ~$50 | 6,000 | $300,000 | $50 | $350,000 |

Same workload (7,000 wRVU). $70,000 difference. Over a 3-year contract, that’s $210,000 you never see.

Where residents get burned

- They never calculate total compensation at multiple RVU levels (4k, 5k, 6k, 7k).

- They ignore what happens after the guarantee period (year 2–3).

- They don’t ask if the base resets to a lower amount when “the ramp” is over.

You must act like an attending, not a trainee. That means doing the math.

Literally get a spreadsheet or a napkin and write:

- If I produce 4,000 wRVUs → what’s my pay?

- 5,000? 6,000? 7,000?

If the slope of that line is weak, the job is weak. Even if the base looks “secure.”

6. Ignoring Call, Procedures, and “Non-Productive” Time

Another resident move: assuming all your work contributes to your RVUs.

It doesn’t. The nastiest RVU contracts sneak in a ton of uncompensated work:

- Mandatory unpaid call

- Diktat-level admin time

- Teaching expectations (without RVU credit or stipend)

- Committee work, quality projects, leadership “opportunities”

Specific mistakes to watch for

Call pay black holes.

Some RVU contracts:- Provide no extra pay for call

- Or give a tiny stipend “for availability” but pay only RVUs for any work performed

If your call is heavy and the payer mix is bad, your nights and weekends may be nearly free labor.

Procedures that don’t belong to you.

Especially in hospital-employed models:- You might do procedures, but the RVUs go to a “service line” or another department

- In some places, APPs get the credit; you get “supervisory” headaches

Expected admin/teaching time without compensation.

If your contract says:- “Approx. 20% of time for admin, meetings, and teaching”—and

- “Compensation is productivity-based”

Then 1 day a week is dead from a wRVU perspective.

Ask directly:

- “Is call compensated separately from the RVU structure? How?”

- “Does procedure work generate RVUs credited to me?”

- “Is there protected non-clinical time, and is that built into base comp or not?”

If they dodge or handwave these answers, assume that time is free to them.

7. Not Demanding Transparent wRVU Reporting and Reconciliation

Big one. Residents assume the hospital will just “pay what’s owed.” That’s not how this game works.

When your income depends on wRVUs, the data feed is your lifeline. And yet:

- Many new attendings never see monthly wRVU reports.

- Or they get a useless PDF summary with one line: “Total wRVUs: 523 this month.”

- Or they see their numbers only after annual “true-up”—when it’s too late to fix anything.

| Category | Value |

|---|---|

| Jan | 380 |

| Feb | 420 |

| Mar | 450 |

| Apr | 410 |

| May | 395 |

| Jun | 430 |

You need line-item transparency

What you should be able to get (easily):

- wRVUs by date and CPT code

- Total wRVUs by location and payer

- Attribution (who got the credit) when APPs or other physicians are involved

- Comparison vs target year-to-date

If the employer’s system “doesn’t really do that,” they are not ready to run an honest RVU plan. You will be the one who pays for that sloppiness.

Also: ask when reconciliation happens.

- Quarterly? Annually?

- If you leave mid-year, do they reconcile what you’ve earned? Or do you forfeit threshold-based bonuses?

If your bonus is calculated only once a year and you leave in October, you can easily walk away from tens of thousands of dollars in “not yet reconciled” RVUs.

8. Underestimating How Fast RVU Terms Can Be Changed

Final mistake: acting like the RVU plan in your offer is carved in stone.

It’s not. Unless your contract explicitly locks in:

- The conversion factor

- The threshold

- The formula

- The definition of RVUs (e.g., CMS wRVU schedule for a specific year)

…then they can move the goalposts.

| Step | Description |

|---|---|

| Step 1 | Year 1 Contract Signed |

| Step 2 | High Base + Reasonable Target |

| Step 3 | Year 2 Group Meeting |

| Step 4 | Lower Base Salary |

| Step 5 | Higher RVU Threshold |

| Step 6 | Lower $ per RVU |

| Step 7 | Same Work, Lower Pay |

| Step 8 | Admin says plan unsustainable |

I’ve seen this sequence play out in community hospitals, large systems, even academics.

“We’re moving to a ‘more sustainable’ model.”

“We’re aligning with updated benchmarks.”

“We’re standardizing across departments.”

Translation: We’re going to cut your effective comp, and the math will be just confusing enough that half of you won’t fight it.

What to insist on

- A clearly defined conversion factor for a set period (e.g., “$52 per wRVU, guaranteed years 1–2”).

- Clear language about how and when the plan can change.

- The right to terminate the contract without penalty if compensation is materially altered.

You’re not being dramatic. You’re avoiding the trap of being locked into a 3-year restrictive covenant while they slash your pay in year 2.

9. Letting Non-Competes and Penalties Neutralize Your RVU Leverage

Last ugly piece: all the RVU sophistication in the world is useless if you can’t leave.

Residents often:

- Focus entirely on salary and RVUs

- Give five seconds of attention to non-competes, buyouts, tail coverage

- Assume, “If it’s really bad, I’ll just leave”

Not if:

- You owe a huge sign-on bonus clawback

- Your tail coverage is $60,000 and you’re on the hook

- Your non-compete blocks you from working anywhere nearby

The RVU plan gives you leverage only if you can credibly say, “If this doesn’t work, I can walk.”

If walking costs you $150,000 and forces a cross-country move, you don’t have leverage. You have golden handcuffs.

Ask directly:

- “What happens financially if I leave in year 1? Year 2?”

- “What is the exact non-compete radius and duration?”

- “Who pays for malpractice tail if I leave or they terminate me without cause?”

You don’t have to solve all of this alone. This is exactly where a physician-friendly contract attorney earns their fee many times over.

10. A Simple Checklist to Avoid the RVU Traps

If you remember nothing else, at least don’t sign a wRVU-based offer until you can answer these cleanly:

- What’s my effective dollars per wRVU at 4k, 5k, 6k, 7k wRVUs?

- What do current physicians in this exact role produce in wRVUs (25th/50th/75th percentile)?

- Which MGMA/AMGA/etc. table is this offer supposedly aligned with—and can I see it?

- Who gets credit for APP work, shared visits, and procedures? In writing.

- How is call paid? Is any part of it RVU-invisible?

- How often do I get detailed wRVU reports and when is reconciliation done?

- Is the conversion factor guaranteed, and for how long? How can the plan be changed?

- What are the non-compete, clawback, and tail obligations if I walk?

If an employer becomes vague, impatient, or defensive when you ask these, that is your red flag. Competent, honest groups are used to smart physicians asking smart questions.

Bottom Line

- RVUs are not magic or mysterious; they’re math. The biggest mistake residents make is signing RVU deals they do not fully calculate.

- Targets, conversion factors, call, and non-competes all interact. Looking at any of them in isolation is how you get trapped in years of underpaid overwork.

- If the numbers or terms do not make clear sense to you, do not sign. Get the data, run the math, and, if necessary, pay a physician contract lawyer before you pay for a bad decision with your career.