Why “Max Your 401(k) and You’re Set” Fails High‑Earning Physicians

What actually happens if you do everything “right” financially as a physician—max the 401(k), avoid debt disasters, buy the house—and still end up with a tax bill that feels like a second student loan?

That’s the problem with the lazy advice you hear from generic financial blogs and more than a few hospital HR talks: “Just max your 401(k) and you’ll be set.”

For a high‑earning physician, that line is not just incomplete. It is dangerously misleading.

The 401(k) Myth: Why It Sounds Good and Fails You

Let me be blunt: the 401(k) is not bad. It’s just massively overrated as a complete plan for someone making $350k–$800k in a progressive tax system.

You’ve heard some version of this script during benefits orientation:

“Contribute up to the match, then work toward maxing your 401(k). With tax‑deferred growth you’ll be in great shape for retirement.”

That script was written for W‑2 employees making $80k, not an orthopedic surgeon with a $650k AGI and moonlighting income.

Here’s the real math problem.

| Item | Amount (Approx 2025) |

|---|---|

| Employee 401(k)/403(b) limit | $23,000 |

| 50+ catch-up contribution | $7,500 |

| Max employer + employee total | $69,000 |

| Typical attending income (W‑2) | $300,000–$600,000 |

| Combined dual‑physician income | $500,000–$1,000,000+ |

If you’re a 42‑year‑old cardiologist making $550k:

- Even if you max your $23k employee deferral and your employer is generous, 401(k) space is a small slice of your taxable pie.

- The rest of your income is getting hammered at 35–37% federal, plus state, plus NIIT, plus payroll taxes where applicable.

And the standard pitch—“you’ll be in a lower bracket in retirement”—is often wrong for physicians who actually save and invest well.

You think you’ll magically end up in the 12% bracket living off $60k? If your 401(k) does what you hope, your RMDs, Social Security, maybe some rental income, and a spouse’s accounts will push you right back into a meaningful bracket. Especially if tax rates rise from here, which is not exactly a wild conspiracy theory.

The net effect: you defer at high brackets now, only to withdraw at brackets that are not as low as promised later, with less flexibility because every dollar coming out is ordinary income.

The problem is not that the 401(k) is useless. The problem is that it is treated as the plan instead of one tool.

What the Data Actually Shows for High‑Earning Physicians

Let’s move from theory to what happens on real returns and real tax bills.

You’re top‑heavy in tax‑deferred accounts

Most mid‑career physicians I’ve seen who “did everything right” have a balance sheet that looks like this:

- 80–90% of investable assets in tax‑deferred accounts (401(k), 403(b), 457, traditional IRA).

- A tiny taxable brokerage account.

- House equity.

- Maybe a 529.

That allocation boxes you in later. Every withdrawal is taxed as ordinary income. No long‑term capital gains rates. No qualified dividends break. No way to selectively harvest gains or losses.

And if you overshoot your savings (which is actually the good problem), you’ll be forced to take Required Minimum Distributions (RMDs) later that you do not need, at whatever tax regime exists at the time.

“Max the 401(k)” completely ignores how physicians actually get paid

You’re not a salary‑only engineer. Your income streams are messy:

- W‑2 hospital pay.

- 1099 moonlighting.

- Call stipends.

- Maybe some consulting, expert witness work, or partnership distributions.

Treating all of that like generic W‑2 income and just dumping into one employer plan ignores half the tax planning playbook available to you.

For example, a physician with $400k W‑2 and $150k 1099 income who only maxes the hospital 401(k) is leaving a small fortune on the table: no solo 401(k), no defined benefit plan potential, no entity planning, no Augusta rule, no business deductions.

That is not a strategy. That’s inertia.

Your real risk is future tax law, not just market returns

Everyone obsesses over their investment mix: 70/30 vs 80/20, US vs international, and so on.

The bigger risk for a 35‑year‑old physician? Future tax brackets and policy. You’re playing a 40‑50 year game.

If Congress decides:

- RMD ages change again.

- Roth rules adjust.

- Brackets creep up.

- Step‑up in basis is limited.

Then having everything jammed in pre‑tax accounts with no flexibility is precisely the wrong position.

You want tax diversification at least as much as asset diversification. That requires more than maxing a 401(k).

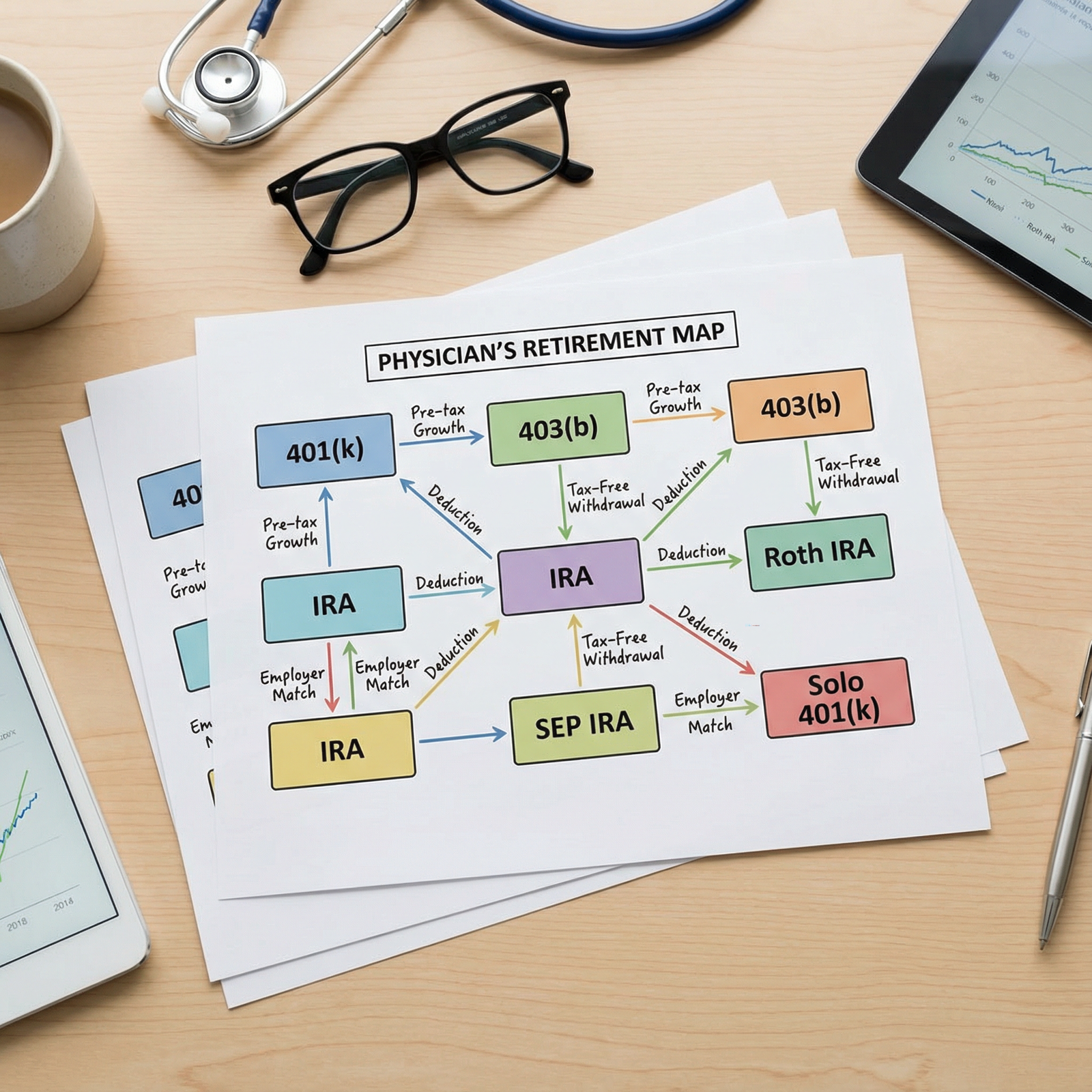

The Real Levers: Beyond the 401(k)

Let’s go through the tools almost never mentioned in the “just max your 401(k)” script—but that actually move the needle for high‑earning physicians.

1. Roth space and backdoor Roths (yes, even for you)

The high‑income version of the Roth conversation is not “I make too much for Roth.” That line is for people who stopped reading the instructions.

Your Roth options usually include:

- Backdoor Roth IRA (non‑deductible IRA contribution + Roth conversion).

- Mega backdoor Roth via after‑tax 401(k) contributions, if your plan allows them.

- Roth 401(k) employee contributions when it makes sense (younger, lower bracket, or expecting higher future rates).

The key benefits are predictable:

- Tax‑free growth for decades.

- No RMDs on Roth IRAs (current law).

- Enormously better for heirs than a gigantic pre‑tax account.

But I’ve seen attending physicians in their late 40s who have never done a backdoor Roth because someone in HR said, “you’re over the income limit.” That’s malpractice-level advice.

2. Solo 401(k) or defined benefit plan for 1099 income

If you have any meaningful 1099 income and you’re not using a separate retirement structure, you’re donating money to the IRS.

For a physician with $100k–$300k of side 1099 income, a properly structured entity and retirement plan can:

- Add another $20k–$60k of tax‑advantaged space annually with a solo 401(k).

- In some cases, add six figures of deductible contributions via a cash balance (defined benefit) plan, if the income is stable and you’re older.

| Category | Value |

|---|---|

| No 1099 Plan | 0 |

| Solo 401(k) | 35000 |

| Solo 401(k) + DB Plan | 120000 |

You can’t do this if your only philosophy is “max the 401(k) at the hospital and call it a day.”

3. Taxable accounts: not a failure, a feature

Here’s a weird myth: “If you’re investing in a taxable brokerage account, you’re behind.”

No. If you’ve maxed available tax‑advantaged space and you still have free cash to invest, that’s not a failure, that’s exactly what high‑income planning looks like.

Taxable accounts give you:

- Long‑term capital gains rates (usually better than your ordinary income rate).

- Step‑up in basis at death under current law.

- The ability to harvest tax losses in down markets.

- Flexibility to access funds before age 59½ without acrobatics.

The mistake physicians make is filling taxable accounts with tax‑inefficient investments—like actively managed funds kicking off short‑term gains or frequent trading.

Use low‑turnover index funds, ETFs, or direct indexing. Accept that some of your wealth belongs there and design for tax‑efficiency, instead of pretending the 401(k) can absorb everything.

4. HSAs, 457(b)s, and other “small” levers that compound

Everyone fixates on the 401(k) limits and ignores the “side doors” that are often just sitting there.

- Health Savings Account (HSA): triple tax advantaged if used correctly (deductible in, grows tax‑deferred, tax‑free for qualified medical expenses). Many physicians pay medical costs out of pocket and let the HSA grow as a stealth retirement account.

- 457(b): particularly for academic or non‑profit physicians. Some of these plans are solid; some are landmines due to employer bankruptcy risk. But when good, they effectively double your deferral space alongside a 403(b)/401(k).

These won’t transform your life in a single year. But over 15–25 years of consistent use? They matter. A lot.

Physicians’ Real Weak Spot: Lack of Tax Planning, Not Lack of Savings

Most high‑earning physicians are not bad savers. You survived med school and residency on peanuts. You know how to live below your means.

Your weak spot is structure, not discipline.

You save plenty. You just save in the wrong way, in the wrong accounts, with no coordinated tax plan.

I’ve seen this repeatedly:

- Couple in their early 50s, combined income $900k.

- Both maxing 401(k)/403(b), decent home equity, some 529s.

- Tax bill every April feels obscene.

- They assume the only answer is “save more” or find “better investments”.

Wrong question. The real question: “What’s the least amount of lifetime tax we can legally pay, while hitting your goals?”

That’s a planning question, not a “which fund is better” question.

And the 401(k) is, at best, one chapter in that plan.

Where the Myth Really Hurts You: Lifetime Taxes, Not Just This Year

The “max your 401(k) and you’re set” line frames tax as a year‑by‑year problem.

High‑earning physicians need to think in lifetime terms.

That means:

- Maybe you do Roth 401(k) contributions early in your career when you’re “only” making $250k and in a lower bracket than you will be at peak.

- Maybe you intentionally convert pre‑tax IRA/401(k) money to Roth in low‑income years (sabbatical, part‑time, early retirement gap years) and pay tax strategically at 22–24% instead of 35%.

- Maybe you diversify across pre‑tax, Roth, and taxable so that at 65 you can “dial in” exactly how much taxable income you recognize each year.

| Category | Value |

|---|---|

| All Pre-Tax | 20 |

| Mixed (Pre-Tax/Roth/Taxable) | 80 |

You don’t get that flexibility if you blindly shove everything into pre‑tax 401(k) space until mandatory withdrawals start dictating your bracket.

What a Saner Framework Looks Like for Physicians

Here’s the grown‑up version of the retirement conversation for a high‑earning physician:

- Yes, take the 401(k)/403(b) match. That’s free money.

- Use backdoor Roth IRAs every year unless there’s a very specific reason not to.

- Evaluate Roth vs traditional 401(k) contributions given your actual bracket now and realistic expectations about the future.

- If you have 1099 income, strongly consider a solo 401(k) and possibly a defined benefit plan once the income is stable.

- Fund an HSA if you have a qualifying plan and treat it as long‑term money, not a checking account.

- Build a sizable, tax‑efficient taxable account with index funds/ETFs.

- Periodically project your future RMDs and tax brackets rather than assuming you’ll be “poor in retirement.”

This is the kind of planning that actually matches how physicians earn, save, and get taxed.

Not the “just max your 401(k)” one‑liner designed for HR slides.

| Step | Description |

|---|---|

| Step 1 | Physician Income |

| Step 2 | Use Employer Plan |

| Step 3 | Add Solo 401k or DB Plan |

| Step 4 | Backdoor Roth |

| Step 5 | HSA and 457 if Available |

| Step 6 | Build Taxable Account |

| Step 7 | Plan Roth Conversions and RMDs |

| Step 8 | W2 Only or W2 + 1099 |

Notice what’s missing from that flowchart: the idea that the 401(k) is the finish line.

It’s one gate in the process, not the whole race.

The Bottom Line: Why the 401(k) Myth Needs to Die for Physicians

Let me wrap this up without sugarcoating.

“Max your 401(k) and you’re set” fails high‑earning physicians for three main reasons:

- The numbers do not work. 401(k) limits are small relative to your income. You will have a huge taxable base no matter what. Pretending the 401(k) solves your tax problem is delusional.

- It ignores your actual income structure. W‑2 plus 1099, variable comp, side gigs, and delayed peak earning years require entity planning, additional retirement structures, and conscious tax diversification.

- It locks you into future inflexibility. Overloading pre‑tax accounts without building Roth and taxable assets leaves you at the mercy of whatever Congress feels like doing to high earners 20–40 years from now.

Use the 401(k). Max it if it fits your overall plan. But stop confusing “using a tool” with “having a strategy.”

Physicians need a tax plan, not just a contribution habit.