What if the “retirement number” you are chasing is the very thing that steals the years you were trying to protect?

Let me be blunt: more people ruin their retirement by working too long than by quitting a little “too early.”

Not because the money runs out. Because health, energy, and relationships run out first.

You are surrounded by messages that scream: “Seven-figure portfolio or you are not safe,” “Work until 70 for maximum Social Security,” “Just a few more years to be sure.” Hidden behind that is the mistake I see over and over: smart people chasing the wrong number so relentlessly that they miss the window when retirement would have actually meant something.

This is for you if you keep saying:

- “I will retire when I hit $X.”

- “I just want a bigger cushion.”

- “I will know it when I feel ready.”

You will not “just know.” You will rationalize. You will move the goalposts. And if you are not careful, you will wake up with the money and without the time, health, or desire to use it.

Let’s walk through the warning signs that you are on that path.

The Fantasy Number Trap: When “Enough” Never Arrives

The most common mistake: treating retirement like a math puzzle with a single magical answer.

“I need $2 million.”

“Once we hit $3 million, we’re done.”

“I will stop when my net worth hits eight figures.”

Sounds disciplined. It is usually avoidance dressed up as discipline.

Here is the problem: that number almost always moves. Because you are not really chasing a financial target. You are chasing a feeling: safety.

Safety does not live in a number. It lives in your spending, flexibility, and expectations.

| Category | Value |

|---|---|

| Fear of outliving money | 30 |

| Fear of market crashes | 25 |

| Not trusting own math | 20 |

| Lifestyle expectations | 15 |

| Healthcare costs | 10 |

The fantasy-number mistakes I see constantly:

Your number is not based on your actual spending

You picked it from:- An article headline (“You need $1.5M to retire comfortably in America”)

- A friend’s situation (“My colleague retired with $2M, so that must be the bar”)

- A round number that “feels” big enough

If you cannot say, “We spend about $X after tax each year, so with Y% safe withdrawal we need about $Z,” you are not planning. You are guessing.

You ignore guaranteed income

Having:- Social Security

- A pension

- An annuity

means your necessary investment number may be much lower than you think. I have watched people with $50,000 per year from pensions and Social Security, plus a paid‑off home, insist they “need” $2 million. For what? Ego?

You never update the assumptions

If you set your “number” at 50 and you are now 63, but you are still using the same spending, inflation, and return assumptions, you are lying to yourself. Markets have changed. Your lifestyle has changed. Your runway has shrunk.

Warning sign:

Every time you get close to your “retirement number,” you raise it. That is not good planning. That is fear.

Health and Time: The Decay You Pretend Will Not Happen

I see people ruin this part more than any other.

They assume their 60s and 70s will feel like their late 50s. That is fantasy. If you are lucky, you have maybe a 10–15 year window of truly active retirement: travel without mobility aids, hiking, grandkids on the floor instead of on FaceTime because your back cannot take it.

| Category | Value |

|---|---|

| Retire at 60 | 18 |

| Retire at 65 | 13 |

| Retire at 70 | 8 |

(Think “years of relatively high physical ability” before major limitations become common. Yes, it varies. No, you are not the exception just because you “feel young.”)

Common health‑time mistakes:

You overvalue one extra year of salary and undervalue one extra year of mobility

I have literally heard: “If I work two more years, I can get the kitchen exactly how we want it.” Two years of your healthiest remaining life for nicer countertops. That trade is insane when you say it out loud.You assume you will travel “later”

I have seen dozens of versions of this story:

Couple works until 68 “for safety.” He retires. Within a year: heart failure, hip replacement, cancer diagnosis. The bucket‑list trip to Italy? Gone. Now everything is about managing medications and stairs.You ignore your current trajectory

If at 62 you already:- Avoid stairs

- Have chronic joint pain

- Are exhausted after a normal workday

what do you think 70 looks like? Pushing retirement later compresses your years of freedom at the exact time your body starts failing you more often.

Warning sign:

You talk a lot about things you “want to do in retirement,” but you keep postponing the start of that window into years when you are statistically less likely to be able to do them.

Lifestyle Creep: The Silent Saboteur of “Enough”

Here is a trap that professionals and high earners fall into all the time: you do not retire because your lifestyle keeps inflating to justify continued work.

Every raise, bonus, or promotion should bring you closer to retirement. For many, it does the opposite.

New car. Nicer vacations. Second home. Expensive hobbies that only exist because you are trying to reward yourself for enduring a job you dislike.

Suddenly your “required” annual spending is $200k instead of $90k. And guess what? Now your “retirement number” doubles. And retirement drifts another 5–7 years down the road.

Signs lifestyle creep is pushing your retirement too far out:

You call expenses “fixed” that are actually optional

$1,200/month car leases. $300/month cable and streaming. Eating out 5 times a week. These are choices, not fixed obligations.You measure status by income, not freedom

If you catch yourself saying, “I cannot retire, I am used to making $350k,” you just admitted the problem. You are attached to the identity and status of income, not to what it actually buys you.You pretend your current spending is the baseline you must maintain forever

“We cannot live on less than $15,000/month.” Really? Or are you simply unwilling to examine trade‑offs?

Warning sign:

Your retirement keeps getting delayed while your house, cars, travel, and “standard” vacations get more expensive every few years. You are literally buying a fancier version of the years you are too busy to enjoy.

Emotional Red Flags: When Work Has Become a Crutch

This is uncomfortable, but I will say it.

Some people chase a bigger retirement number because they are scared to be without work. So they hide that fear under “just being prudent.”

Here is how to know if that is you:

You have no non‑work identity

If you left your job tomorrow, could you answer, “What do you do?” without referencing your former title? If the answer is no, of course retirement feels terrifying.Your social life is almost entirely work‑based

You go to lunch with colleagues, happy hour with the team, conferences with your industry. You have not meaningfully built friendships outside of that circle. Retirement, for you, feels like a social amputation.You keep saying you will “figure out” retirement later

Translation: you are using the false security of a bigger number to avoid the emotional work of designing a life without your job.

Warning sign:

You obsess over future withdrawal rates and market crashes but have barely spent an hour sketching a realistic week in retirement: where you wake up, what you do, who you see, what gives you purpose.

That is backward. Money should serve the life plan, not replace the life plan.

The Legal and Financial “Fine Print” That Punishes Late Retirees

You are in the “Financial and Legal Aspects” phase. Let’s talk about the less glamorous, more technical ways working too long can backfire.

| Age | Critical Issue |

|---|---|

| 59½ | Withdraw from IRAs/401(k)s w/o 10% penalty |

| 62 | Earliest Social Security (reduced) |

| 65 | Medicare eligibility starts |

| 67 | Full retirement age for many |

| 73 | Required minimum distributions |

Mistakes that show up here:

1. Losing the tax‑planning sweet spot

The ideal retirement window for many people is between stopping work and taking Social Security / RMDs. Those years often have much lower income, which can be a gift if you use it:

- Roth conversions at lower rates

- Long‑term capital gains at favorable brackets

- Drawing down pre‑tax accounts strategically

If you insist on working until 70 “for safety,” you may compress or eliminate this window. Suddenly:

- Social Security + RMDs + portfolio income push you into higher brackets

- Roth conversions become much more expensive

- You lose flexibility to smooth taxes over more years

You kept working for “more net,” and then handed a big chunk of it to the IRS because you delayed the smart planning years.

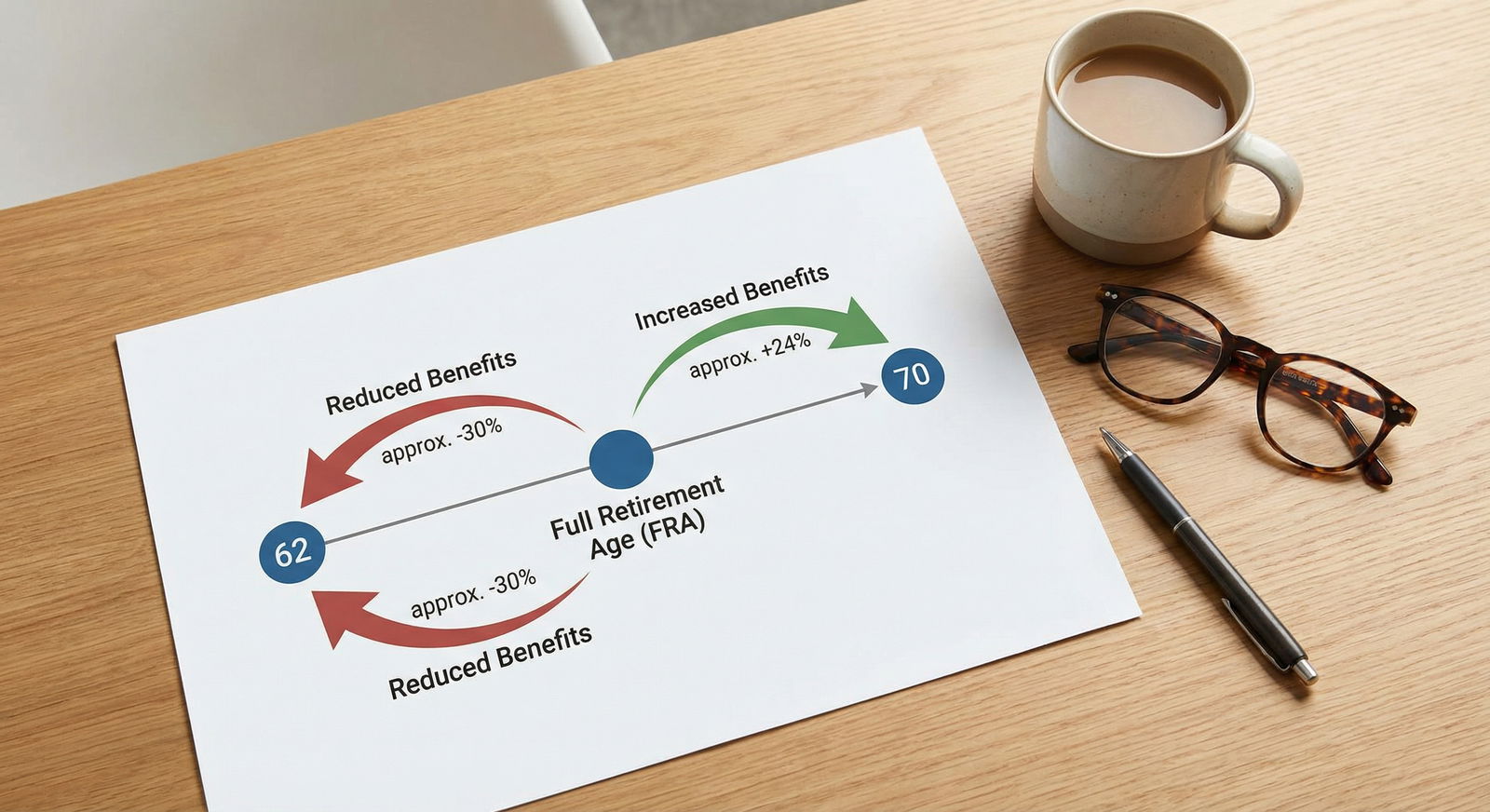

2. Mishandling Social Security

A lot of people justify working longer with, “I want the higher Social Security benefit at 70.” That can be a good move. It can also be pointless.

Common errors:

- Ignoring spousal benefits and survivor benefits

- Failing to consider your own life expectancy realistically

- Focusing on the monthly check instead of lifetime total and when you need income

If you have strong health issues or a family history that screams “shorter lifespan,” working extra years just to maximize a benefit you may not live to use is a special kind of tragic.

3. Underestimating healthcare transitions

Working longer for the health insurance is a real factor. But people regularly misjudge:

- The cost and quality of COBRA

- The true cost of Medicare plus supplemental coverage

- How long they actually have to stay employed to bridge gaps

If your plan is “I will work until Medicare at 65,” but your job burns you out at 62, you may have backed yourself into an expensive corner. Or you stay at a toxic job three extra years purely out of fear, when a properly priced ACA plan or part‑time work could have bridged the gap.

4. Estate and incapacity risk

The later you push retirement, the higher the odds you:

- Suffer a cognitive decline while still managing complex finances

- Have an incapacitating event before you ever get to the life stage you are “saving for”

If you are working into your late 60s or 70s and:

- Do not have updated powers of attorney

- Do not have clear beneficiary designations

- Do not have a simple, understandable plan your spouse or partner can follow

you are playing with fire. I have seen surviving spouses buried in accounts, passwords, and half‑baked strategies that made sense only in the head of the still‑working partner who suddenly was not there.

Warning sign:

You keep saying, “I will update the estate plan / POAs / account structure when I finally retire,” while simultaneously pushing retirement further out.

The Math You Actually Need (And the Questions You’re Avoiding)

Let me strip the noise and give you a practical, non‑fantasy framework.

You can retire when:

You have a clear picture of your annual spending

Not “I think we spend about $100k.” I mean:- Your current annual spending

- What realistically changes in retirement (commuting, mortgage, kids, healthcare)

You can fund that spending with a reasonable withdrawal rate

Reasonable usually means 3–4% of investable assets if you want a very high probability of not running out of money over 30+ years. Not a guarantee. But very defensible.You have evaluated your guaranteed income

Social Security, pensions, annuity income. Subtract those from your spending need. The shortfall is what your portfolio has to cover.You have a plan for:

- Healthcare (pre‑ and post‑65)

- Debt (ideally minimal or gone)

- Tax strategy over the next 10–20 years

If you can say, on paper, “Between Social Security and a 3.5% withdrawal rate, we can cover what we actually spend plus a margin,” you are probably closer to “enough” than your fear wants to admit.

The harder questions are not about spreadsheets. They are about you:

- If you do not retire in the next 3–5 years, what exactly are you buying with those extra years of work?

- Are those purchases better than 3–5 more years of your healthiest, freest time?

- If you got a serious diagnosis tomorrow, would you regret not having retired already?

You do not need more hypothetical safe‑withdrawal debates. You need to stop lying to yourself about what you are trading away.

How to Know You’re Chasing the Wrong Number: A Quick Diagnostic

If 3 or more of these are true, you are probably working too long for the wrong reasons:

- You change your “retirement number” every time you get close to it

- You feel more anxiety looking at retirement calculators than clarity

- You routinely say, “Just a few more years,” but cannot define what changes then

- Your health has declined in the last 5 years, but your retirement date moved later, not earlier

- Your partner is ready (or at least open) to retiring, but you keep blocking the decision

- You fear boredom or loss of identity more than you fear running out of money

- You have never written down a specific first‑year retirement budget and plan

If that stings, good. That means there is still time to correct course.

FAQs

1. How do I know if my retirement number is truly realistic?

Start from spending, not from a target portfolio value. Pull 12 months of bank and credit‑card statements. Categorize them roughly: housing, food, transportation, healthcare, discretionary. Add in irregular but predictable costs (home repairs, car replacements). Then:

- Subtract expenses that will drop in retirement (commuting, work clothes, payroll taxes if income falls)

- Add likely increases (healthcare, travel, hobbies)

Now you have a realistic annual spending need. Compare that to:

- Social Security / pensions / other guaranteed income

- What a 3–4% withdrawal rate from your portfolio can reasonably cover

If your plan “works” only by assuming 7–8% annual returns forever or ignoring healthcare, your number is not realistic. Fix the assumptions before moving the goalposts.

2. Is it always a mistake to work past 65 or 70?

No. Working longer can be smart if:

- You genuinely enjoy your work

- It is not destroying your health

- You are using the extra income to de‑risk your life (pay off debt, diversify investments, fund long‑term care coverage)

- You have a clear, conscious reason, not just vague fear

It becomes a mistake when you are miserable, your health is sliding, your relationships are strained, and the only justification is “more is safer” without any concrete plan for how those extra dollars change your life.

3. What if the market crashes right before or after I retire?

Sequence‑of‑returns risk is real. The mistake is assuming the only defense is “work longer.” Better defenses:

- Hold 1–3 years of living expenses in cash or very short‑term bonds

- Keep necessary spending lower than your maximum possible withdrawal

- Have flexibility: be willing to trim travel or big discretionary expenses in down markets

- Use a dynamic withdrawal strategy (not a rigid fixed percentage no matter what)

Yes, if you are 100% in stocks and retire right before a 40% crash with no cushion, that is a problem. No, the solution is not necessarily “work until you die.”

4. My spouse wants to retire; I do not. Who is right?

The bigger mistake is forcing both of you to follow one person’s fear. You can:

- Retire at different times

- Move one partner to part‑time or consulting

- Run the numbers together with a third party (advisor, planner)

What you must not do is dismiss your partner’s readiness because you are chasing an arbitrary number they never agreed to. If one partner keeps unilaterally pushing retirement out, resentment tends to follow. And I promise you: an extra $500k does not fix a damaged marriage.

5. What is one practical step to avoid retiring too late?

Write down, on a single sheet of paper:

- Your age

- Your current target retirement age

- Your realistic annual retirement spending

- Your guaranteed income projections (Social Security, pensions)

- Your current portfolio value

- A 3–4% withdrawal from that portfolio

If that math already supports your spending with some margin, circle your retirement age and ask yourself one hard question: “What exactly am I buying by working longer?” If you cannot answer in specific, life‑changing terms, not vague “security” language, you are probably chasing the wrong number.

Open your latest retirement statement and your last three months of bank transactions today. Do not just glance at the balance. Calculate your actual annual spending and compare it to a 3–4% withdrawal plus your estimated Social Security. Then write, in ink, the earliest age you could retire safely—and put a question mark next to your current target. If those two numbers are far apart, you have a decision to make, not a spreadsheet problem to solve.