What happens if you finally start making attending money… and then realize you hate your specialty but feel completely stuck because of your lifestyle and loans?

That’s the nightmare, right?

Not just failing to match. Not just burning out in residency.

The deep, quiet fear that you’ll “make it”… into a cage you built yourself.

The classic golden handcuffs story: you pick a high‑paying specialty to “keep doors open,” your lifestyle creeps up, your identity wraps around the paycheck, and suddenly switching fields or cutting back hours feels impossible. Even if you’re miserable.

Let’s talk about how to not end up there. Or at least how to massively lower the odds.

Because this fear? It’s rational. But it’s also manageable if you stop pretending it’ll magically sort itself out “once I’m making real money.”

What Golden Handcuffs Actually Look Like in Medicine

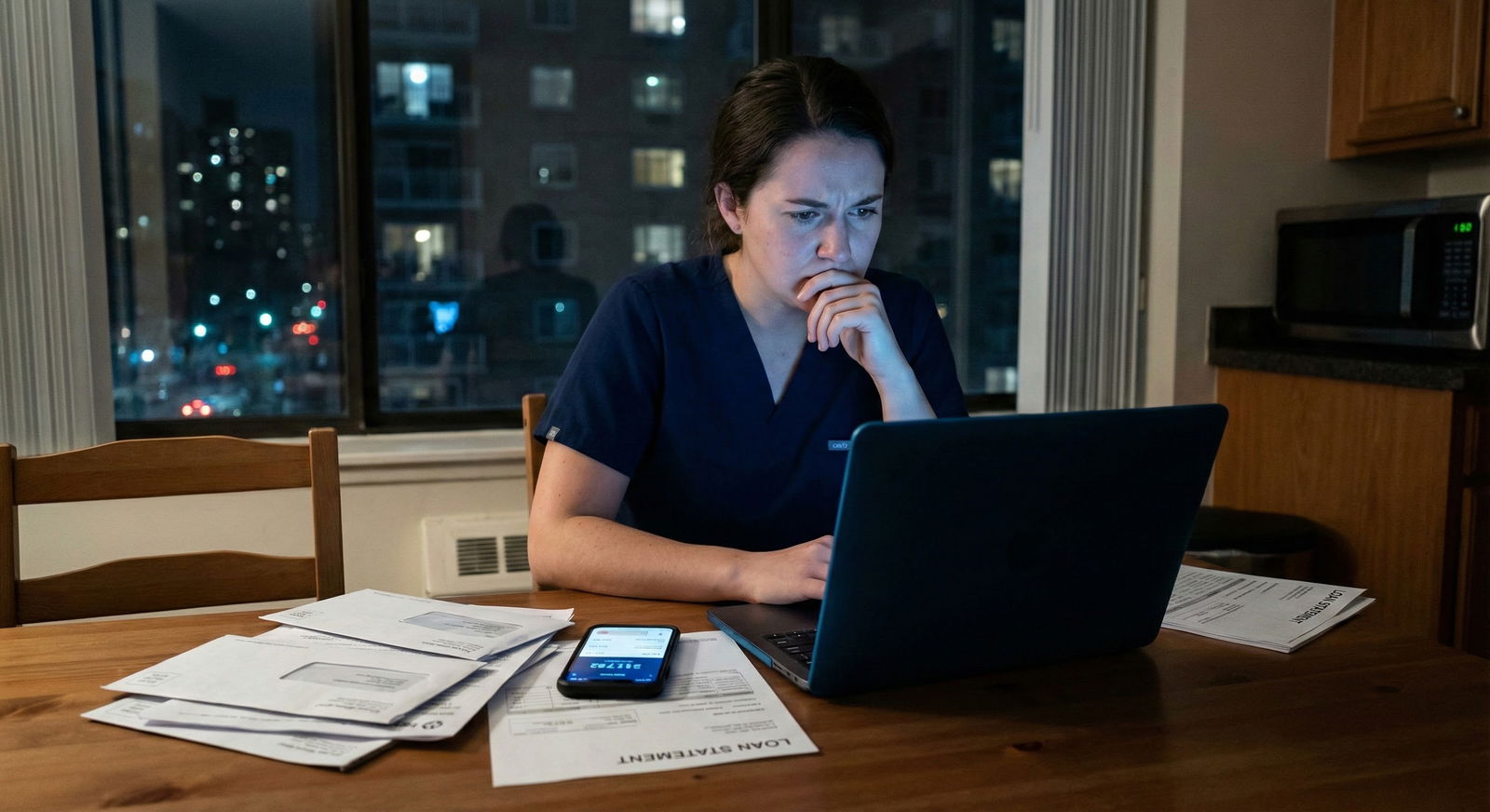

I’ve watched this play out with real people, not just Reddit horror stories.

The interventional cardiology fellow who said, “I can’t leave — my mortgage is built on my future attending salary.”

The plastics attending who whispered, “I’d rather do primary care half‑time and see my kids… but we bought the house, the second car, the private school. My spouse’s not on board with a pay cut now.”

The orthopedic surgeon with $500k loans who swore, “I’ll just do this for 10 years and then go part‑time,” but now has 3 kids, aging parents, and a practice structured around him being there 60 hours a week.

Golden handcuffs in real life usually look like:

You could change specialties, move to a lower-paying job, or cut your hours…

but the math and your commitments make it feel impossible.You could say no to one more call shift…

but the RVU bonus and lifestyle you’ve already built rely on that extra income.You could move to a lower cost-of-living area…

but your entire social life, kids’ schools, and home equity are tied to your current city.

The trap isn’t just money. It’s identity + debt + other people’s expectations + lifestyle creep, all stacked on top of each other.

And you’re feeling it before you even match. Which honestly might be the best time to feel it, because you still have leverage.

Are You Picking a Specialty or Picking a Prison?

Let me be blunt: some specialties are more “golden-handcuff-prone” than others. Not because they’re evil. Just because the gap between training life and attending income is so big that it invites lifestyle inflation.

| Specialty | Typical Income Tier | Handcuff Risk* |

|---|---|---|

| Orthopedic Surgery | Very High | High |

| Plastic Surgery | Very High | High |

| Dermatology | Very High | Medium-High |

| Interventional Cards | Very High | High |

| Radiology | High | Medium |

| Anesthesiology | High | Medium |

*Handcuff risk = how easy it is to build a lifestyle that’s hard to walk away from

You’re probably thinking some version of:

- “If I go low‑paying, the loans will crush me.”

- “If I go high‑paying, I’ll trap myself and never be able to pivot.”

- “What if I get into ortho/derm/IR and realize I hate it, but by then my whole life depends on that salary?”

So, what do you do when every path feels like a trap?

You stop pretending specialty choice is just about prestige and “fit,” and you start treating it like a long game:

What life do you want to be able to say yes and no to at 35, 45, 55?

Not which specialty will give you the highest W‑2 in your early 30s.

The Money Reality: You’re Not as Stuck as Your Brain Says You Are

Let’s tackle the ugliest thought:

“If I don’t pick a top‑paying specialty, I’ll never dig out of this debt.”

That thought alone has pushed way too many people into fields they tolerate rather than fields they actually like.

Here’s the uncomfortable truth: as a physician, you have an absurd amount of financial optionality compared to almost any other profession. Even in “lower-paid” specialties.

Look at rough ballparks (yes, it varies; yes, markets change; no, this isn’t eternal gospel):

| Category | Example Fields | Typical Range (USD) |

|---|---|---|

| Highest Paid | Ortho, Plastics, Derm | $500k–$900k+ |

| High | Cards, GI, Rad, Anes | $400k–$700k |

| Mid | IM, Peds subs, Psych | $220k–$400k |

| Primary Care | FM, Gen IM, Peds | $200k–$300k+ |

| Category | Value |

|---|---|

| Primary Care | 250 |

| Mid | 325 |

| High | 525 |

| Highest Paid | 700 |

Here’s the part programs and mentors rarely say out loud:

A primary care doc who lives like a resident for 5–7 years after training and aggressively pays down loans can end up more financially free than a high‑paid subspecialist who immediately buys the doctor house, doctor car, and private school X3.

A psychiatrist making $280k who keeps expenses at $120k doesn’t feel trapped.

An ortho making $800k with $700k in annual commitments absolutely does.

The handcuffs aren’t your specialty income bracket.

They’re the gap between what you earn and how hard you work to spend nearly all of it.

And that’s where you actually have massive control.

How People Accidentally Lock the Cuffs Tight (And How You Don’t)

Nobody wakes up one day and says, “I’d like to become fully dependent on this miserable job.”

It happens in a thousand small, “reasonable” decisions.

You finish fellowship after a decade of being broke. You’re exhausted. You want to feel like it was all worth it. So the thought creeps in: “I deserve this.”

You’re not wrong. You do deserve nice, safe, comfortable things. But here’s how it turns into a trap:

- You set your life up assuming your maximum attending income is permanent and guaranteed.

- You commit to fixed costs that bake in that number: house, car leases, private school, vacation home, etc.

- You emotionally fuse your self‑worth to being “the doctor” who can provide at that level.

Then if you want to cut back, or switch to a less lucrative practice model (academics, non‑RVU job, half‑time clinic)… it doesn’t feel like a choice. It feels like collapse.

The move is to intentionally build slack into your financial life. From the very beginning:

Don’t peg your fixed expenses above what a less intense job could support.

For example: if your specialty can make $600k full bore, build your life as if you earned $350–400k. That way you can actually downshift someday.Plan like you might switch jobs or styles.

Because you might. Obvious cases: high‑acuity ED docs who later switch to urgent care, IR who later moves to more diagnostic, surgeons who cut OR time in their 50s.Make your “doctor upgrade” slow and deliberate, not one massive lifestyle explosion the first year as an attending.

This is how you keep the key to the cuffs in your pocket.

Specific Fears You Probably Have (And What to Do About Them)

Let’s call out the big ones directly.

“If I choose a high-paid specialty, I’ll never be able to leave.”

You might not want to leave. That’s worth acknowledging. A lot of people actually like their high‑earning fields enough to stay. The disaster scenario you’re picturing is: hate job + love income.

The defense against that isn’t avoiding every high‑paying field. It’s:

- Being brutally honest about what you actually enjoy in rotations, not just what looks good on paper or pays a lot.

- Building a life that doesn’t require your top‑end salary to be sustainable.

- Keeping a modest baseline lifestyle for the first 3–5 attending years so you can nuke loans early and build flexibility.

If you do those three, and you still end up desperate to leave? You’ll have the financial runway to do it.

“If I choose a lower-paid specialty, I’ll be financially doomed.”

No. You’ll be forced to be intentional. Which, ironically, is exactly what saves you from golden handcuffs.

Lower-income relative to ortho doesn’t mean “poor.” It means “less margin if you let lifestyle expand mindlessly.”

Every doc I’ve seen who did the following in a primary care or mid‑paid field ended up fine:

- Picked a reasonable cost-of-living area (not the priciest coastal city)

- Lived like a resident for 2–5 years after training

- Attacked loans as if they were a hair-on-fire emergency

- Avoided anchoring their self‑image on material flexes

You don’t need $900k/year to be free. You need a healthy gap between income and expenses, and time.

“What if my spouse/partner expects the ‘doctor lifestyle’?”

This one’s real and messy.

You need to have that conversation early. Not after you’ve signed the attending contract and started touring seven‑figure houses.

Try being stupidly direct:

“I’m scared of golden handcuffs. I don’t want us to build a life where I’m forced to stay in a job I hate just to keep up with our bills. Can we agree that, for the first few years, we’ll live below what the bank says we can afford so we have options later?”

If they’re not on board at all, that’s not a money problem. That’s a values problem.

Concrete Moves You Can Actually Make Now (Even as a Student/Resident)

You don’t have to wait to be an attending to start protecting yourself.

1. Be honest in your specialty ranking: Would you still pick this if it paid half?

Not zero. Half.

If ortho paid like primary care, would it still be on your list?

If derm paid like psych, would you still want it?

If the answer is “absolutely yes,” golden handcuffs risk is lower.

If the answer is “ehhh, probably not,” that doesn’t mean you shouldn’t do it — but it means you really need a plan for financial flexibility so you’re not trapped.

2. Start learning basic personal finance like it’s another required rotation

Not crypto. Not day trading. Boring stuff.

Honestly, a simple mental model is enough:

- Make a plan for loans (PSLF, refinancing, or aggressive payoff)

- Understand your likely after-tax attending income by specialty

- Decide ahead of time how long you’ll “live like a resident”

- Choose a rough target for how big you’ll let your fixed expenses get

That’s it. That’s the backbone of staying free.

| Period | Event |

|---|---|

| Training - Med school | Loans accumulate |

| Training - Residency | Low pay, habits form |

| Early attending - Years 1-3 | Live like resident, pay debt |

| Early attending - Years 3-7 | Build savings, keep lifestyle modest |

| Flexibility - Year 7+ | Option to cut hours or change jobs |

3. Decide your “non‑negotiables” that matter more than peak income

Stuff like:

- I want the option to work 0.7 FTE when I have kids

- I don’t want to be on overnight call past age 50

- I want the ability to move states without blowing up my finances

- I want to be able to switch to a more academic or teaching role later

If those are truly important, they have to show up in both your specialty choice and your lifestyle design. Not just in your “someday” fantasy.

A Quiet Truth: You Can Redefine “Success” Mid‑Career

This is the part nobody tells you during M3:

A lot of attendings quietly recalibrate what “success” means around age 35–45.

The surgeon who once cared about being “the best” starts caring about being home for dinner.

The derm attending who built a crazy busy cosmetic practice starts burning out and cuts back to three days a week.

The cardiologist gives up some cath lab time for a more clinic‑heavy schedule.

This is normal.

But whether you can act on that shift in values depends on how tight those golden handcuffs are.

If you’ve designed your entire financial life assuming you’ll always be on max grind mode… it’s going to hurt.

If you’ve kept some space — lived under your means, avoided turning every raise into lifestyle, stayed away from debt beyond your student loans and a sane mortgage — then you can actually listen to yourself when your priorities change.

You don’t have to get this perfect. You just have to avoid the most common trap: believing attending money will solve everything and then architecting a life that depends on never stepping off the gas.

The Bottom Line If You’re Panicking About This

You’re not crazy for being afraid of golden handcuffs. If anything, you’re ahead of the game for thinking about it now instead of in your 40s with a $1.8M house and kids in private school.

Here’s what actually matters:

| Category | Value |

|---|---|

| Specialty Choice | 60 |

| Lifestyle Creep | 90 |

| Debt Strategy | 80 |

| Cost of Living | 75 |

| Partner Expectations | 85 |

You control most of these levers more than it feels like.

And yeah, there will always be risk. You might choose a high‑paid specialty and later want out. You might pick something you love and still feel financial pressure. There’s no path with zero anxiety.

But you can do this in a way where you’re not captive to your paycheck.

If you strip it down, avoiding golden handcuffs comes down to three things:

- Pick a specialty you can at least tolerate even if the money wasn’t insane.

- Refuse to let your lifestyle expand to wherever your income tops out.

- Design your early attending years around buying freedom, not flex.

You don’t have to live like a monk forever. You just have to delay building a cage long enough to decide what kind of life you actually want.