The worst time to figure out how to compare job offers is after you’ve already signed one.

You’re PGY4. The offers are (or will be) coming. Salaries look huge compared to residency money. That’s exactly how people end up underpaid, stuck in bad call schedules, or trapped in RVU hell with “partnership” that mysteriously never materializes.

You need a timeline-driven system, not vibes. Month by month, what to look at, what to calculate, who to call, and when to walk away.

Below is your PGY4 month‑by‑month plan to compare lucrative job offers, with a bias toward the highest paid specialties (ortho, neurosurgery, cardiology, GI, radiology, EM, anesthesia, derm, etc.). Adjust exact months based on your specialty’s recruitment season, but keep the sequence.

Big Picture Timeline: From “I Should Start Looking” to Signed Contract

| Period | Event |

|---|---|

| Early PGY4 - Jul-Aug | Define priorities and money baseline |

| Early PGY4 - Sep-Oct | Start conversations and track opportunities |

| Mid PGY4 - Nov-Dec | Formal offers and detailed comparisons |

| Mid PGY4 - Jan-Feb | Negotiate contract terms |

| Late PGY4 - Mar-Apr | Final checks, sign, plan transition |

At each phase, your goal shifts:

- Early PGY4: Decide what “good” looks like for you, before recruiters do it for you.

- Mid PGY4: Collect hard numbers and put every offer on the same spreadsheet.

- Late PGY4: Negotiate, verify, and commit without getting guilted or rushed.

Let’s go month by month.

July–August (Early PGY4): Set Your Baseline Before Anyone Wows You

At this point you should define your goals and your floor. Before the first “We’re offering $600k and a sign-on” hits your inbox.

1. Decide your non‑negotiables (write them down)

Take one evening. No phone. Just a notebook or an empty doc.

List your top 5 priorities, ranked. For high‑paid specialties, typical categories:

- Total compensation (base + bonus + call + partnership)

- Schedule and call burden

- Geography and family needs

- Practice type (academic vs private vs employed)

- Path to partnership/equity

Force yourself to rank them. Not “all important.” What wins if two conflict?

Example ranking for an anesthesiologist:

- No more than 1:5 call

- Total comp ≥ $500k by year 3

- No mandatory post‑call clinic days

- Within 1 hour of major airport

- Group stability (no recent PE buyout)

You’ll compare offers against this list, not against each other.

2. Learn realistic compensation ranges for YOUR field

At this point you should know the numbers better than the recruiter. Use:

- MGMA, AMGA, Medscape, Doximity compensation reports

- Talk to alumni 2–5 years out in your specialty

- Your own attendings (the ones who will be honest with you)

Create a quick range table:

| Specialty | Low Start (Year 1) | Typical Start | High End by Year 3+ |

|---|---|---|---|

| Ortho Surgery | $450k | $550–650k | $800k+ |

| Cardiology | $400k | $500–600k | $750k+ |

| GI | $450k | $550–650k | $800k+ |

| Anesthesia | $350k | $450–550k | $650k+ |

| Radiology | $400k | $450–550k | $650k+ |

Do not obsess over exact numbers. Aim to know when something is clearly under market.

3. Build the comparison template BEFORE offers arrive

At this point you should set up your spreadsheet. Columns I insist on:

- Employer / Location

- Practice type (academic / PP / hospital employed / PE‑backed)

- Base salary, sign‑on bonus, relocation

- Productivity structure (RVU rate, targets, splits)

- Call frequency + call pay

- PTO + CME + parental leave

- Partnership track details (years, buy‑in, share of ancillaries)

- Non‑compete (radius, duration, covered locations)

- Benefits: retirement match, health premiums, disability, tail coverage

- Subjective: red flags (1–10), gut feeling (1–10)

You’re building the scoreboard now so you don’t move the goalposts later.

September–October: Start Conversations, Collect Data Points

At this point you should be talking, not signing.

1. Light networking and informational calls (not commitments)

- Respond to recruiter emails with:

“I’m PGY4 in [specialty], graduating [month/year]. I’m exploring options in [regions]. Can you send typical comp ranges and structure for new grads?” - Ask co‑residents where they’re interviewing and what numbers they’re hearing.

- Reach out to recent grads: “What do you wish you’d known before signing?”

Your goal: Build a mental “market map” for your specialty.

2. Start a “Lead Tracker”

Do not manage this chaos in your inbox. Create a simple tab in your spreadsheet:

Columns:

- Contact name / recruiter

- Organization & location

- Type (hospital, PP, academic, PE)

- Stage (initial call, site visit, verbal offer, written offer)

- Rough comp range mentioned

- Dealbreakers already visible? (e.g., 2‑year non‑compete; 1:2 call)

Update it weekly. If you’re serious about money, treat this like a second job for these months.

3. Ask the same early questions every time

Every first conversation, same script. That way, comparisons are clean.

- “What’s the typical year 1 total comp for a new grad in this role?”

- “What’s realistic by year 3?”

- “How is compensation structured? Base vs RVU vs collections vs partnership?”

- “What’s the call schedule right now for someone in this position?”

- “Any non‑compete? How broad and how long?”

If they dodge or get vague, you mark a red flag and move on.

November–December: Formal Interviews and First Written Offers

Now it gets real. At this point you should shift from exploring to evaluating.

1. On‑site visits: what to look for beyond the tour script

Everyone is nice on interview day. That’s useless. Look for:

- The hallway conversations:

- Residents saying, “We’ve had three people leave in the last year.”

- Attendings half‑joking about RVU quotas.

- Clinic/OR flow:

- Does the day feel like chaos or controlled busy?

- Are support staff actually present or “short‑staffed this week” (always this week)?

- Who’s burned out:

- Look at mid‑career folks, not just the partner telling the story.

Take notes same day. You’ll forget specifics by the third site visit.

2. Get offers in writing. Verbal is noise.

At this point you should not treat anything as real until you see a draft contract.

Insist on at least a written summary if the full contract is “still coming”:

- Base salary years 1–3

- Sign‑on, relocation, any loan repayment

- Bonus structure (RVU targets, quality bonuses, call pay)

- Partnership: timeline, buy‑in range, what you actually buy into (technical fees? ancillaries?)

- PTO, CME, retirement, tail coverage responsibility

Now you can start populating your comparison sheet with actual numbers.

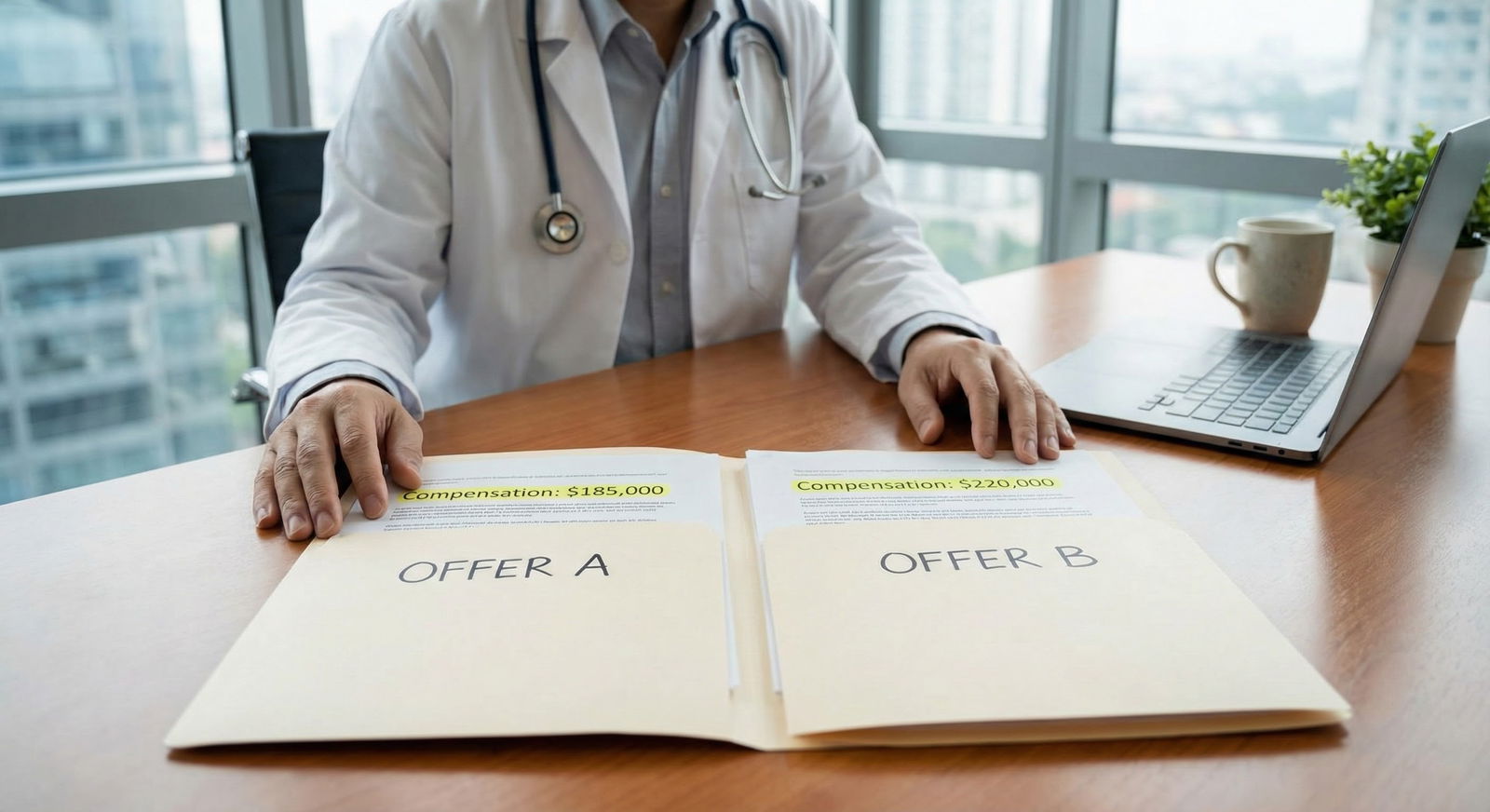

3. Normalize everything into annual “Effective Compensation”

This is where people mess up. A $550k job with brutal call is not automatically better than a $450k job with gentle call and shorter non‑compete.

Build an “effective annual value” estimate for each offer:

- Salary + guaranteed bonuses (year 1)

- Add sign‑on bonus spread over contract commitment (e.g., $60k over 3 years = $20k/yr)

- Estimate realistic productivity bonus using MGMA percentiles and what attendings there are actually hitting

- Add realistic call pay (average # call shifts x pay per shift)

- Subtract:

- Higher health premiums vs alternatives

- 401k match differences

- Extra unpaid call or uncompensated admin time

You want a single comparable number for “what this job probably pays each year in my first 3 years.”

| Category | Value |

|---|---|

| Job A | 480 |

| Job B | 520 |

| Job C | 455 |

Job B looks bigger. You still might prefer C if it has lighter call and no non‑compete. But at least you’re not tricked by sign‑on glitter.

January–February: Negotiate, Clarify, and Stress‑Test Each Offer

At this point you should stop collecting new offers and start deep‑diving on the serious ones. Usually 2–4.

1. Get a physician contract attorney involved

Yes, even if you “like” the group. Especially if you like them.

- Find someone who only or mostly does physician contracts. Not your friend’s dad who does real estate.

- Give them your spreadsheet and priorities.

- Ask them to flag:

- Non‑compete landmines

- Vague partnership language (“Typically partners make…”)

- Termination clauses (who can walk away and how fast?)

- Compensation that can be unilaterally changed

Best money you will spend this year. Period.

2. Re‑run your comparison at 3‑year and 5‑year marks

This is where “lucrative” actually lives. Many high‑paying specialties ramp up over a couple of years.

For each serious offer, sketch:

- Year 1: guarantee + reasonable bonus

- Year 3: partner track vs RVU increase vs higher base

- Year 5: full partner or mature production scenario

You’re not predicting the future. You’re checking whether the upside story matches the structure.

Example for GI job:

- Year 1: $525k base + $25k sign‑on

- Year 3: Expect $700k if hit average group RVU

- Year 5: Partners average $900k with ASC equity

Versus:

- Year 1: $600k base in hospital employed role

- Year 3: Base capped at $650k with strict RVU targets

- Year 5: No equity, comp aligned to MGMA 75th percentile

Which is more “lucrative”? Depends how much risk and ramp‑up you tolerate. Now you’re seeing that clearly.

3. Negotiate the right things, in the right order

At this point you should prioritize asks. Do not send a 20‑item wish list.

Common high‑impact negotiation levers:

- Base salary or guaranteed total comp year 1–2

- RVU rate or RVU thresholds

- Call frequency or call comp

- Non‑compete radius or duration

- Sign‑on distribution (paid early vs tied to long commitments)

- Tail coverage responsibility

Pick 3–5 items max. Lead with:

“After reviewing the offer and talking with my advisor, I’m very interested. There are a few areas that would make this a long‑term fit for me…”

Be specific. Example:

- “Base from $450k to $500k in year 1 and 2”

- “Non‑compete from 20 miles for 2 years down to 10 miles for 1 year”

- “Protected 8 weeks PTO including CME, consistent with your current partners”

If they can’t adjust money, push on schedule (fewer calls, flexible FTE) or non‑compete. Those often matter more long‑term than another $20k.

March–April: Final Checks, Gut Check, and Signing

At this point you should be choosing among 1–2 offers, not 5. Time to converge.

1. Reference checks you control, not theirs

Call:

- Recent departures (if you can find them). “Why did you leave? Would you go back?”

- Newer hires (1–3 years in). “Has the group done what they said they would for you?”

- Your own advisors: show them the offers side‑by‑side.

Questions to ask new hires:

- “How accurate were their year 1 and year 2 compensation promises?”

- “Any surprise changes to call or compensation formula since you joined?”

- “If you had to sign again, would you?”

If you start hearing, “Wellllll… it’s complicated,” pay attention.

2. Re‑score each job against your July priorities

Remember that list from early PGY4? Pull it out. For each offer, rate 1–10:

- Alignment with top 5 priorities

- Red flag level (non‑compete, instability, opaque partnership)

- Gut feeling

You should not accept a job that looks good on paper but torches your top 1–2 life priorities. That’s how you end up switching jobs in 18 months, which is expensive and miserable.

3. Decide your “walk away” threshold

Before you sign, define what would make you not sign:

- More than X change in offered terms at final contract

- Non‑compete clause not corrected as promised

- Call demands increasing before you even start

- Major leadership or ownership change announced

If any of those hit, you walk. No tortured re‑analysis. You already decided.

May–June: Transition Planning and Future‑You Protection

By this point you should be signed or about to sign. Last phase: execute smartly.

1. Lock in start date and onboarding support

Clarify:

- Exact start date

- Credentialing timeline (hospital, payors)

- Orientation / ramp‑up plan (how many clinics, OR days, cases early on)

- Mentorship: who’s actually responsible for helping you hit RVUs without drowning

Get it in writing where possible. Vague “we’ll take care of you” is worthless.

2. Protect yourself financially around the move

- Keep an emergency fund (you might get delayed by credentialing)

- Confirm sign‑on timing (on signing, on start date, or after X months)

- Understand clawbacks if you leave early

- Make sure disability and life insurance are in place before you start the new job

High income with no safety net is a trap, not a win.

3. Schedule a 12‑month “contract review” with yourself

Literally put it on your calendar for 12 months after you start:

“Review job vs contract and decide if renegotiation or exit planning needed.”

Look at:

- Actual vs promised compensation

- Actual vs promised call and schedule

- Culture and burnout level

If things are off‑track, you want to realize that in year 1 or 2, not year 7.

Quick Month‑by‑Month Snapshot

Here’s the compressed version you can screenshot:

| Months | Primary Focus | Key Actions |

|---|---|---|

| Jul–Aug | Define baseline & template | Priorities list, market ranges, spreadsheet |

| Sep–Oct | Explore & track leads | Networking, lead tracker, standard questions |

| Nov–Dec | Site visits & written offers | On‑site notes, normalize comp, early ranking |

| Jan–Feb | Deep comparison & negotiation | Attorney review, 3–5 year projections, asks |

| Mar–Apr | Final checks & decision | Reference checks, priority re‑score, sign |

| May–Jun | Transition planning | Start date, onboarding, financial safeguards |

Final Move: What You Should Do Today

Open a blank document and write your top 5 priorities for your first attending job, ranked. Then open a new spreadsheet and build the columns for your offer comparison template.

Do both before you reply to one more recruiter email.