The fastest way for a physician to blow up years of careful work is to misunderstand claims-made vs occurrence coverage.

Not burnout. Not a bad investment. A coverage gap you do not discover until there’s a lawsuit with your name on it.

Let me be blunt: insurers, brokers, even some hospital HR departments will happily let you sign policies you don’t really understand. And the mistake almost always boils down to this:

You thought you were covered because you had insurance when you treated the patient…

but you actually needed coverage when the claim was filed.

That difference is claims-made vs occurrence. Get it wrong, and it will haunt you long after you’ve left a job, a state, or even medicine entirely.

The Core Trap: You’re Thinking Like a Clinician, Not Like an Underwriter

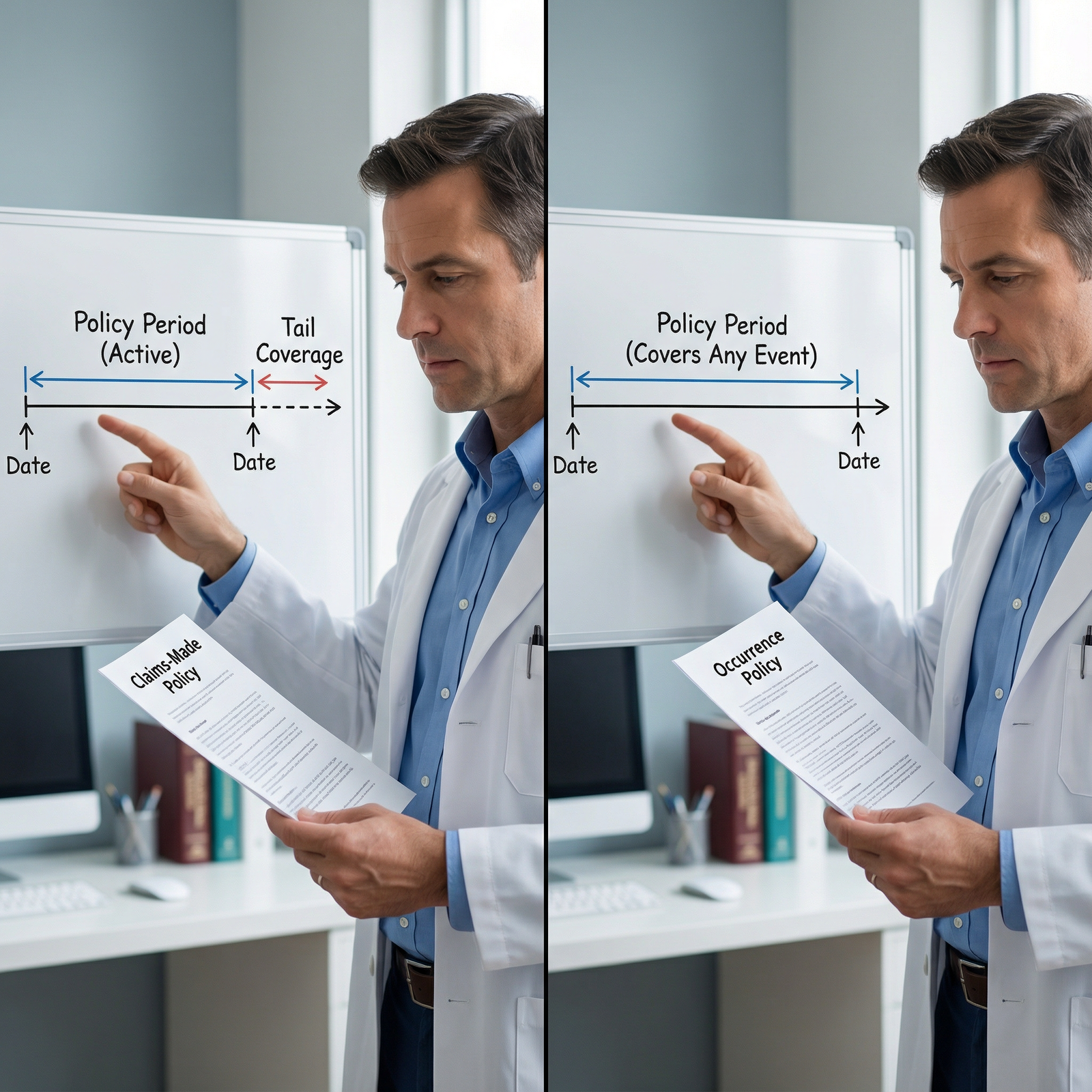

You’re wired to think chronologically:

- I saw the patient in 2019

- Something allegedly went wrong in 2019

- I had malpractice insurance in 2019

- So I’m covered, right?

With occurrence coverage, yes.

With claims-made, not necessarily.

Here’s the nasty surprise: with a pure claims-made policy, what matters is:

- Was the policy active when the claim was made (filed)?

- Was the incident within the policy’s retroactive date?

If the answer to either is no, you can be standing completely naked in front of a plaintiff’s attorney… even if you were fully insured when you saw the patient.

| Category | Value |

|---|---|

| Within 1 year | 15 |

| 1-3 years | 45 |

| 3-5 years | 25 |

| 5+ years | 15 |

That gap between treatment and claim is exactly where physicians get killed financially.

Quick Definitions (That Actually Matter in Real Life)

Forget the textbook fluff. Here’s all you actually need to understand:

Occurrence policy

- Covers you if the incident occurred while the policy was in force

- The claim can be filed years later—still covered

- Once the year is done and paid for, that coverage is locked in forever for incidents in that year

Claims-made policy

- Covers you if:

- the incident happened after the retroactive date, and

- the claim is made while the policy is active (or during an extended reporting period / tail)

- When you leave or switch policies, past years become exposed unless you:

- buy tail coverage, or

- get nose/prior acts coverage from the new carrier

- Covers you if:

Read that again: with claims-made, coverage can evaporate for past care unless you do something proactive when you change jobs or policies. That’s the mistake zone.

The Most Expensive Error: Walking Away Without Tail

This is the big one. I’ve watched this destroy people.

You’re leaving a job. The contract is annoying, the schedule is brutal, and they just offered you more money across town. You’re rushing through onboarding paperwork and someone casually says:

“Your new malpractice starts on your first day. You’ll be covered.”

You sign. You leave. You never think about it again.

Two years later: certified letter. A claim from a patient you saw at the old job.

You assume your new coverage will handle it. Or the old employer will. Why wouldn’t they?

Because:

- Your old claims-made policy ended when you left

- You did not buy tail coverage from that old policy

- Your new policy’s retroactive date starts on your new job start date

- Result: that older incident is in no-man’s-land

You are now personally exposed.

| Step | Description |

|---|---|

| Step 1 | Old Job - Claims-made Policy Active |

| Step 2 | Leave Job |

| Step 3 | Covered for Old Incidents |

| Step 4 | Coverage Gap |

| Step 5 | Claim Filed from Old Care |

| Step 6 | Personal Exposure |

| Step 7 | Tail Purchased |

Why tail coverage hurts (and why people skip it)

- Tail can cost 150–250% of your last annual premium

- Many physicians see that number and think, “This feels like a scam. I’ll be fine.”

- Or they assume their new employer’s policy automatically covers prior acts. Wrong assumption.

You don’t skip tail because it’s cheap. You skip it because it’s painfully expensive exactly at the worst time—when you’re moving, maybe buying a house, maybe paying off loans.

But skipping it is like canceling your fire insurance the day after a wiring job you’re not sure about.

Claims-Made vs Occurrence: The Trade-offs No One Explains Straight

Most people hear: “Occurrence is better but more expensive.” That’s lazy half-truth.

Here’s a cleaner comparison.

| Feature | Claims-Made | Occurrence |

|---|---|---|

| What must be true? | Claim made during coverage + after retro date | Incident occurred during policy year |

| Need tail when leaving? | Yes, usually | No |

| First-year premium | Lower | Higher |

| Long-term cost | Often similar after tail | Higher annually, no tail |

| Complexity when changing jobs | High | Low |

The seductive trap

Claims-made looks attractive early on:

- Lower first-year premiums

- Common in group and private practice settings

- Employers like it because they can shift tail responsibility to you in the contract

Occurrence looks expensive but clean:

- You pay more every year

- No tail coverage needed

- If you’re doing lots of job changes, locums, or 1099 work, occurrence often saves your sanity (and sometimes money)

The mistake physicians make is not choosing one over the other. The mistake is thinking “I have insurance so I’m fine” without asking:

“What happens to my coverage when I leave?”

Hidden Contract Landmines: Who Pays For Tail?

Your employment contract is where a lot of your future stress (or safety) is baked in.

Here are the three most dangerous setups I see:

“Physician responsible for all tail coverage.”

Translation: your employer saves money up front; you get a five-figure bill the day you resign or get terminated. If you don’t negotiate this, you’re volunteering for that bill.“Tail covered only if terminated without cause after X years.”

Sounds reasonable until:- You leave voluntarily for a better job

- You’re “with cause” terminated over something debatable

- You leave before the magic number of years

Vague or missing tail language.

“Malpractice coverage will be provided during employment.” Full stop. That’s not enough. That says nothing about what happens after.

If your contract:

- Doesn’t mention who pays for tail, or

- Uses hand-wavy language like “industry standard,” or

- Says “to be determined”

…assume you’re on the hook unless you fight for clarity.

Specific Selection Errors That Come Back Years Later

Let me run through the common screwups I’ve seen repeatedly.

1. Choosing claims-made solely because it’s cheaper this year

You’re starting your first job. The broker shows you:

- Occurrence: $22,000/year

- Claims-made: $14,000 first year

You’re thinking about your loans, not lawsuits. You pick the cheaper one. What you didn’t factor in:

- Year 1: low claims-made premium

- Year 2–5: step-up premiums that approach or match occurrence

- End of job: tail of $30–50k (easily)

Over 5–7 years, that “cheaper” option often isn’t cheaper. But by then you’re trapped—you need the tail.

2. Assuming hospital coverage means you’re globally safe

Hospital-employed physicians love to say, “I’m covered by the hospital.” Ok. For what exactly?

Typical problems:

- The hospital’s policy might be claims-made

- They might only cover acts within defined scope:

- On their premises

- For scheduled duties

- Within your specific department

If you:

- See someone curbside and document it

- Help a colleague’s patient unofficially

- Do locums on the side

- Moonlight in an urgent care

…those might not be covered under the hospital’s umbrella.

You need to know:

- Is the hospital policy claims-made or occurrence?

- If claims-made, who buys tail when you leave?

- Are your side gigs explicitly covered or excluded?

3. Switching carriers without protecting your retro date

Classic scenario:

- You’re with Carrier A (claims-made) for 4 years

- New employer uses Carrier B

- You let Carrier A policy lapse when you leave

- You don’t buy tail from A

- Carrier B policy starts with a retroactive date equal to your start date with new employer

Years 1–4 of practice are now exposed. That entire block of time exists with no active coverage once claims arise.

The right move is one of:

- Buy tail from Carrier A

- Or negotiate prior acts/nose coverage from Carrier B with your original retro date

Letting the retro date reset is how you erase years of protection in a single signature.

Specialty-Specific Risk: Some Fields Can’t Afford Sloppiness

If you’re doing anything where bad outcomes show up late, you have less room for error.

Think:

- OB/GYN – claims can arise years after delivery

- Peds – long latency between care and discovery

- Surgery – complications discovered much later

- Radiology / Pathology – missed diagnosis realized years down the line

| Category | Value |

|---|---|

| OB/GYN | 95 |

| Neurosurgery | 90 |

| Pediatrics | 80 |

| Internal Med | 60 |

| Psychiatry | 40 |

If you’re in one of these high-tail-risk specialties, going claims-made without crystal clarity about tail is reckless. That’s not harsh; that’s just actuarial reality.

Common Myths That Will Get You Burned

Let’s clear out the garbage I hear all the time.

“If I had coverage at the time of treatment, I’m fine.”

Not necessarily.

- True – if your coverage was occurrence

- False – if your coverage was claims-made and you didn’t maintain the policy or tail

You must know which type you have. Guessing is not a strategy.

“My new job’s policy will cover old claims.”

Only if:

- They explicitly provide prior acts coverage, and

- The retroactive date includes your prior practice period

Most do not automatically do this. Many won’t, especially if they don’t want to inherit your unknown risk.

“I’ll just get tail later if I need it.”

Wrong direction in time.

- Tail must typically be purchased immediately after the claims-made policy ends

- If you let that window close, getting coverage for that period afterward is extremely difficult or impossible

Tail is like COBRA for malpractice: once you pass the window, you’re done.

How to Choose Without Shooting Yourself in the Foot

You don’t need to become an insurance expert. You do need a checklist.

Step 1: Identify what you have (or are being offered)

Ask explicitly:

- “Is this claims-made or occurrence?”

- “If claims-made, what is the retroactive date?”

- “If I leave, who is contractually responsible for tail?”

If anyone dodges those questions, treat it as a red flag.

Step 2: Match the policy type to your reality

You should lean toward:

Occurrence if:

- You expect multiple job changes

- You do locums or 1099 work

- You want simplicity and are okay with higher annual premiums

Claims-made if:

- Employer pays full premium and guarantees tail in writing

- You’re likely to stay long-term and can negotiate tail-friendly terms

- You’re comfortable actively managing tail every time you change roles

Step 3: Attack the contract, not the brochure

Do not trust:

- Verbal reassurances

- Marketing one-pagers

- “Standard policy for all our physicians”

You care about what is in your signed agreement, specifically:

- Who pays tail on resignation?

- Who pays tail on termination with cause?

- What if the group dissolves or is acquired?

- Do you owe any portion of tail if you leave before X years?

If it’s not spelled out, ask for the clause to be added. Employers expect this from savvy physicians. The ones who don’t ask are exactly the ones who get stuck.

Key Red Flags to Watch For

If you see any of these, pause:

- Contract says: “Claims-made coverage will be provided” and nothing about tail

- HR says: “We’ve never had a problem; no one else has asked about that”

- Broker cannot explain retroactive date without reading a script

- New carrier retro date doesn’t match your actual first practice date

- You’re told: “Tail is your responsibility” with no mention of typical cost ranges

| Category | Value |

|---|---|

| Annual Salary | 250000 |

| Typical Tail Cost | 40000 |

| Other Moving Costs | 10000 |

That $40k tail isn’t hypothetical. I’ve seen worse. Especially for high-risk specialties or long practice periods.

A Simple Mental Model: Think in “Coverage Blocks”

Stop thinking “I have insurance.” Start thinking in blocks of exposure:

- When did I start practicing clinically?

- For every year since then, which policy covers that year’s incidents now?

- If I quit tomorrow, which years would instantly become uncovered?

If you cannot map every year of your practice to a policy (or tail) that would respond today if a claim came in, you have a problem.

| Period | Event |

|---|---|

| Early Career - 2016-2018 | Claims-made with Carrier A |

| Mid Career - 2019-2021 | Claims-made with Carrier B with prior acts |

| Current - 2022-2025 | Occurrence policy with Carrier C |

In that example, Carrier B’s prior acts and Carrier C’s occurrence fill in the gaps. Remove B’s prior acts, or drop A without tail, and the early years are hanging out to dry.

What To Do Today (Not “Someday”)

Here’s the part most people skip: actually checking.

Today, not next month:

Pull your current malpractice declarations page.

- Find: type (claims-made vs occurrence), limits, retroactive date.

Pull your employment contract.

- Read the malpractice section. Find the words “tail,” “extended reporting,” or “claims-made.”

Write down:

- Policy type

- Retroactive date

- Who pays tail if you leave

- Whether any old coverage had tail or prior acts

If you can’t answer those clearly, that’s your warning siren.

FAQ: Claims-Made vs Occurrence Malpractice Insurance

1. I’m switching jobs soon and currently have claims-made coverage. What’s the one thing I must not forget?

Do not let your current policy end without either:

- Buying tail coverage from your existing carrier, or

- Securing prior acts/nose coverage from your new carrier with a retroactive date that reaches back to your original practice start date.

If you skip both, every patient you treated under that old policy becomes a ticking financial bomb.

2. How can I estimate what tail coverage will cost before I sign an employment contract?

Ask directly for a written estimate range from either:

- The practice’s broker, or

- The insurance carrier itself.

As a rough (and uncomfortable) rule of thumb, expect 150–250% of your final annual premium. If your last-year premium is $20k, tail can easily be $30–50k. You should use those numbers in negotiation, not find out at resignation.

3. Is it ever smart to insist on occurrence coverage even if everyone else in the group uses claims-made?

Yes. Especially if:

- You expect to move often (early career, dual-career household, visa issues),

- You are doing side gigs or locums, or

- Your group refuses to share tail costs under any circumstances.

You may pay more each year, but you avoid having your future held hostage by a single giant tail bill when you want to leave.

Open your latest malpractice declarations page right now and find one line: “Policy Type: Claims-Made or Occurrence.” If you cannot see it—or cannot explain how your past five years are covered—fix that before you sign anything else.