The usual advice about malpractice insurance reviews—“just check it at renewal”—is lazy and wrong.

If you’re a practicing physician, reviewing your malpractice policy once a year and forgetting about it the rest of the time is how you end up uninsured for a new procedure, underinsured for a lawsuit, or personally on the hook because you misunderstood tail coverage.

Here’s the real answer, with numbers and concrete triggers.

How Often Should Physicians Review Their Malpractice Policy?

Let me be precise:

- At minimum: a full, intentional review once a year

- Plus: a focused review any time you have a material change in your practice

What counts as a “material change”? At least these:

- You change employers or groups

- You change practice locations or states

- You add or drop procedures (e.g., start doing injections, procedures, or telemedicine)

- You change your FTE status (0.5 → 1.0, or retire to part-time/locums)

- You change your legal structure (W‑2 → 1099, solo practice, new LLC/PC)

- Your patient population or scope shifts meaningfully (e.g., adding OB, high‑risk surgery, pain procedures)

Routine “set it and forget it” is how physicians accidentally practice uninsured. I’ve seen people:

- Start doing telemedicine across state lines…with zero coverage in those states

- Move from occurrence to claims‑made without understanding they’ll need to pay for tail later

- Assume their new employer “handles everything” and never verify retro dates or limits

You do not need to obsess over your policy monthly. But you absolutely should treat your malpractice policy like a living document, not a one‑time form you filed three jobs ago.

The Core Review Schedule: What To Do and When

Here’s the cadence I recommend for most physicians, attendings and advanced residents/fellows included.

| Review Type | Frequency |

|---|---|

| Full policy review | Annually |

| Quick check | At each renewal |

| Change-triggered | Before changes |

| Post-claim review | After any claim |

1. Annual Deep Review (Non‑Negotiable)

Once a year, sit down for 30–60 minutes and go through the full policy or summary. Not a skim. A real review.

At a minimum, verify:

- Policy type – Claims‑made vs occurrence. If you cannot answer this in one sentence, you haven’t reviewed enough.

- Limits of liability – Standard often 1M/3M or 2M/4M depending on state/market. Are you still appropriate relative to your specialty and risk?

- Retroactive date (for claims‑made policies) – That date is your coverage start line. Claims from before it are not covered.

- Named insured and entities – You personally? Your LLC or PC? Your group? Are all entities you use to bill and practice actually named?

- Covered locations – Every clinic, hospital, surgery center, telemedicine location, and state where you practice.

- Scope of practice – Are all procedures and services you actually provide listed and not excluded?

- Exclusions and endorsements – Things specifically excluded (e.g., cosmetic injectables, OB coverage carve‑outs, tech/AI services) and any riders you added.

Annual review is also when you:

- Check whether your limits are still adequate for your specialty and region

- Consider umbrella coverage or employer add‑ons if you’ve had growth in income or exposure

- Confirm who pays for tail if/when you leave (especially if employed)

If you’re in a high‑risk specialty (OB, neurosurgery, ortho, anesthesia, ED, pain), treat the annual review as mandatory risk management, not optional admin.

2. Renewal Review (Quick but Focused)

Every renewal cycle (usually annually, sometimes semi‑annual or custom for groups), you should at least:

- Compare the new declarations page to the prior one

- Confirm that limits, retro date, and entities have not been quietly changed

- Review any premium changes and why:

- Did your risk class change?

- Did an insurer apply a surcharge or remove a discount?

- Did they add an exclusion you weren’t told about?

You don’t need a 1‑hour deep dive every renewal if you already did the annual review recently, but you do need a defensive scan. Insurers and employers change carriers, modify coverage, and “standardize” policies all the time. Those changes can leave you under‑protected.

3. Change‑Triggered Reviews (Where Most People Get Burned)

The most critical reviews are not time‑based. They’re event‑based.

Here are the big life/career events that should trigger a policy review before you sign anything:

Changing Jobs or Employers

New hospital system. New group. New private practice. Locums gig.

You must pin down:

- Is coverage claims‑made or occurrence at the new job?

- Who pays for tail coverage on your current policy when you leave? You, the old employer, or the new one? Is that written in your contract?

- What’s the retroactive date on the new policy, and does it cover all past work that needs coverage?

- Are your side gigs and moonlighting covered, or only work billed under the employer’s tax ID?

I’ve seen physicians accept new jobs assuming “they said they provide malpractice,” then discover:

- The new coverage is future‑only; old employer expects them to buy their own tail (tens of thousands of dollars)

- Side telemedicine or urgent care moonlighting is completely uninsured

You don’t let that happen if you review your policy each time you move.

Changing States or Adding Telemedicine

Malpractice is state‑specific. Policy that fully covers you in Texas does not magically follow you to New York.

Before you:

- Add telehealth to a new state

- Move practices across state lines

- Start cross‑border outreach clinics

…you need carrier confirmation in writing that:

- They cover that state

- Your limits and scope apply in that jurisdiction

- Any special state requirements (patient compensation funds, state funds, minimum limits) are being met

Telemedicine is especially easy to get wrong. Many physicians start video visits to other states under the same entity, never telling their insurer. Claim arises. Insurer points to the policy: “Only covers practice in State A.” You’re exposed.

Expanding Scope: New Procedures, New Risk

If you:

- Start doing office‑based surgery or sedation

- Add OB coverage

- Start cosmetic procedures, injections, or pain interventions

- Launch a concierge program or subscription‑style care

- Participate in AI‑aided diagnostics or tech pilots through your own entity

You need to confirm that:

- The new procedures are not excluded

- Any required credentials or site certifications are clear and documented

- The carrier knows about the new services and has rated your premium accordingly

Insurers love to argue “material misrepresentation” if you never told them about a higher‑risk service you later get sued over. Do not give them that opening.

4. Post‑Claim Review (After You Get Sued or a Claim is Filed)

Any time there’s:

- A demand letter

- A formal claim

- A lawsuit

…you should:

- Pull out your policy and re‑read:

- Notice requirements (how fast you must notify the carrier)

- Defense and consent‑to‑settle provisions

- Coverage limits and aggregates (how much is left if this is not the first claim)

- Ask your carrier or broker directly:

- How this claim affects my future premiums

- Whether there’s a risk of non‑renewal

- What you can do to mitigate (risk management courses, credential updates, documentation changes)

Post‑claim is also a good time to reassess whether your current insurer is the right fit. Some are aggressive in defending physicians, others fold fast and settle. That culture matters, and you usually only see the truth when a claim hits.

Key Elements to Check Every Time You Review

Frequency is one piece. Knowing what to look at is just as crucial.

| Category | Value |

|---|---|

| Tail coverage | 85 |

| Telemedicine states | 70 |

| Scope/procedures | 65 |

| Entity names | 50 |

| Limits too low | 45 |

Here’s where physicians most often get into trouble:

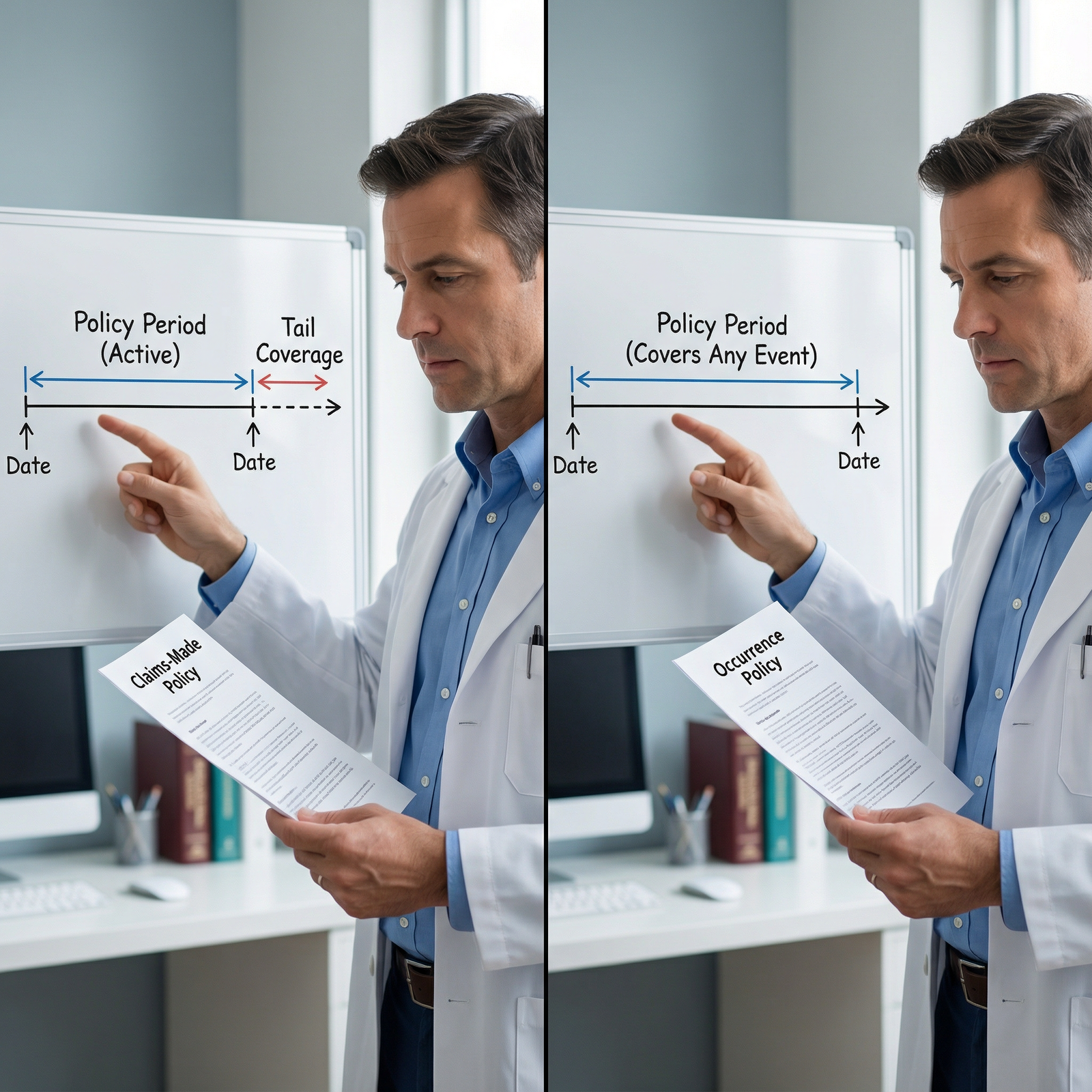

1. Claims‑Made vs Occurrence

- Occurrence – Covers incidents that occur during the policy period, regardless of when the claim is filed. No tail needed if you stop. Usually more expensive annually.

- Claims‑made – Covers claims filed while the policy is active, for incidents on or after the retro date. When you leave or switch, you usually need tail or “nose” coverage.

You should know:

- Exactly which type you have today

- If claims‑made: the retro date; this is a line in the sand you care about

- Who is contractually responsible for tail when you leave

If your employment contract and your malpractice policy disagree, you’re the one stuck in the middle.

2. Limits of Liability

Common structure: per-claim / annual aggregate. Example: 1M/3M.

- In some states and specialties, 1M/3M is bare minimum and borderline low

- For high‑risk specialties, you may want higher limits or excess/umbrella coverage

- Group policies may share aggregates across multiple physicians, which can be a nasty surprise after a big group claim

During your annual review, ask yourself:

- Has my patient volume increased?

- Have I added higher‑risk procedures since I set these limits?

- Are my personal assets higher now (home equity, investments), making a catastrophic judgment more painful?

You don’t chase unlimited coverage. But you also don’t leave 2024‑level assets protected by 2005‑level limits.

3. Entities, Employers, and Side Gigs

Make sure all of these are clearly understood and correctly named:

- Your personal name

- Any professional corporation, LLC, or partnership you practice through

- Any DBA (doing business as) names

- Your primary employer and any locums agencies

Common pattern I see: physician forms an LLC for moonlighting, assumes their hospital’s malpractice somehow extends to that work. It does not. Different entity, different tax ID, different coverage.

If you’re doing:

- Locums

- Moonlighting

- Telemedicine outside your main job

…you likely need separate malpractice coverage or a written endorsement. Guessing is not a strategy.

4. Exclusions and Conditions

Do not just look at the nice summary page. The real teeth are in the exclusions and conditions.

Red flags to watch for:

- Exclusions for:

- Telemedicine

- Certain procedures (OB, spine, pain injections, aesthetics, bariatrics, abortions, etc.)

- Clinical trials or experimental therapies

- Conditions like:

- Mandatory risk‑management course attendance

- Specific documentation or consent requirements

- Licensing/credential status at time of service

If something in your routine practice appears in the exclusion section, that’s an immediate reason to call your broker or carrier.

Practical Workflow: How to Make Reviews Actually Happen

You’re busy. I know that. So make this simple and repeatable.

Here’s how to build malpractice reviews into your year without hating your life:

| Step | Description |

|---|---|

| Step 1 | Set annual review date |

| Step 2 | Gather policies and contracts |

| Step 3 | Check core details |

| Step 4 | Call broker or insurer |

| Step 5 | Document review notes |

| Step 6 | Update coverage |

| Step 7 | Set reminder for next renewal |

| Step 8 | Any changes in practice? |

- Pick a month for your annual review and set a recurring calendar reminder

- Keep a digital folder with:

- Current policy

- Past policies (for retro dates)

- Employment contracts with malpractice clauses

- Use a simple one‑page checklist:

- Policy type, limits, retro date

- States, locations, procedures covered

- Entities named

- Exclusions reviewed

- Any “I’m not sure” → email or call your broker/insurer and get written answers

You don’t need to turn into an insurance lawyer. You just need to stop flying blind.

FAQs: Physician Malpractice Policy Reviews

1. Is once a year really enough to review my malpractice policy?

Once a year is enough for a full, structured review as long as you also do event‑based checks whenever your practice changes: new job, new state, new procedures, new side gigs. If your practice is extremely dynamic—lots of locums, frequent state switching—you may want a brief self‑check every 3–6 months.

2. What’s the single most important thing to confirm during each review?

For claims‑made policies: your retroactive date and who’s responsible for tail coverage if you leave. That combo determines whether years of your work are actually protected. For occurrence policies: that all your locations and services are covered with appropriate limits.

3. My employer provides malpractice coverage. Do I still need to review anything?

Yes. Employer‑provided coverage is great, but you still need to know:

- The policy type (claims‑made vs occurrence)

- Whether they or you pay for tail if you leave

- Whether coverage includes side work, telemedicine, or only employer‑billed services

- Whether your past work is covered under their policy’s retro date

Relying fully on HR or “we take care of it” is how you end up uncovered for moonlighting or prior employment.

4. I’m doing telemedicine in multiple states. How often should I review my coverage?

At minimum annually, but practically you should review every time you add a new state or new telemedicine platform/employer. Confirm in writing that:

- The insurer covers that state

- The licensing, consent, and venue issues are accounted for

- Your limits are still appropriate for the expanded exposure

5. When is the right time to involve an insurance broker or risk manager?

Any time you:

- Switch jobs or contract types (W‑2 to 1099, employed to independent)

- Change states

- Add higher‑risk procedures or new service lines

A good broker will walk you through options and highlight hidden risks. If you don’t have one, it’s worth choosing one who routinely works with physicians in your specialty.

6. How do I know if my malpractice limits are too low?

Compare:

- Typical limits in your state and specialty (ask your broker, colleagues, or specialty society)

- Your patient volume and procedure risk

- Your personal asset level and risk tolerance

If you’re in a high‑risk specialty with growing assets and you’re still sitting on the bare legal minimum limits, you’re probably underinsured. Annual review is when you adjust.

7. What’s the biggest mistake physicians make with malpractice reviews?

They assume “no news is good news.” They never look at their policies, trust HR blindly, and only discover gaps after a claim hits or when they change jobs and get handed a $60,000 tail quote. The fix is simple: one deliberate annual review plus a check whenever your practice meaningfully changes.

Key points to walk away with:

- Do a full review at least once a year, plus any time your job, state, scope, or side gigs change.

- Always know your policy type, retro date, limits, and tail responsibilities before signing contracts or changing employers.

- Treat malpractice coverage as a living part of your risk and financial planning, not a one‑time checkbox you handled years ago.