Offer Comparison Blueprint: Ranking Physician Contracts Side by Side

It is June. You just finished fellowship. Your inbox has three PDFs titled something like:

- “Employment Agreement – Final Draft”

- “Offer Letter – Please Review”

- “Physician Services Agreement”

They all look…fine. Reasonable salary, some bonus language, malpractice, vacation. HR tells you they are “standard.” Your co-fellow says, “That looks good. I would just sign.”

This is how people walk into bad contracts.

You are not going to do that.

You are going to build a simple, ruthless system to rank these offers side by side so the best choice becomes obvious. No hand-waving. No “vibe-based” decisions. Numbers, priorities, and clear tradeoffs.

Here is the blueprint.

Step 1: Set Your Non‑Negotiables Before You Look at Numbers

You cannot compare offers until you know what actually matters to you. Otherwise the biggest salary will blind you, and you will ignore the landmines.

Sit down, 20–30 minutes, no phone. Answer these blunt questions:

Location reality

- Where must you be? Region, city size, family proximity.

- What is off the table? (e.g., “No more than 1 hour from a major airport,” or “No rural call where I am the only surgeon in a 100‑mile radius.”)

Workload and lifestyle

- Max clinic days per week? Max call nights per month?

- Inpatient vs outpatient ratio you can tolerate?

- Are you okay with frequent weekends or not?

Career and procedure needs

- Do you need a specific case volume to maintain skills or qualify for boards/credentialing?

- Academic vs private vs employed by health system—what actually fits your personality?

Risk tolerance

- Are you fine with eat-what-you-kill RVU setups, or do you need stable base pay for a few years?

- Are you willing to sign your life away with a 50‑mile non‑compete? (You probably should not.)

Turn the answers into a short list:

- 3–5 non‑negotiables (must have or it is a no)

- 5–7 high‑priority items (strong preference, but can trade if compensated)

You will use this list as your filter. Any offer that breaks a non‑negotiable is out, no matter the money.

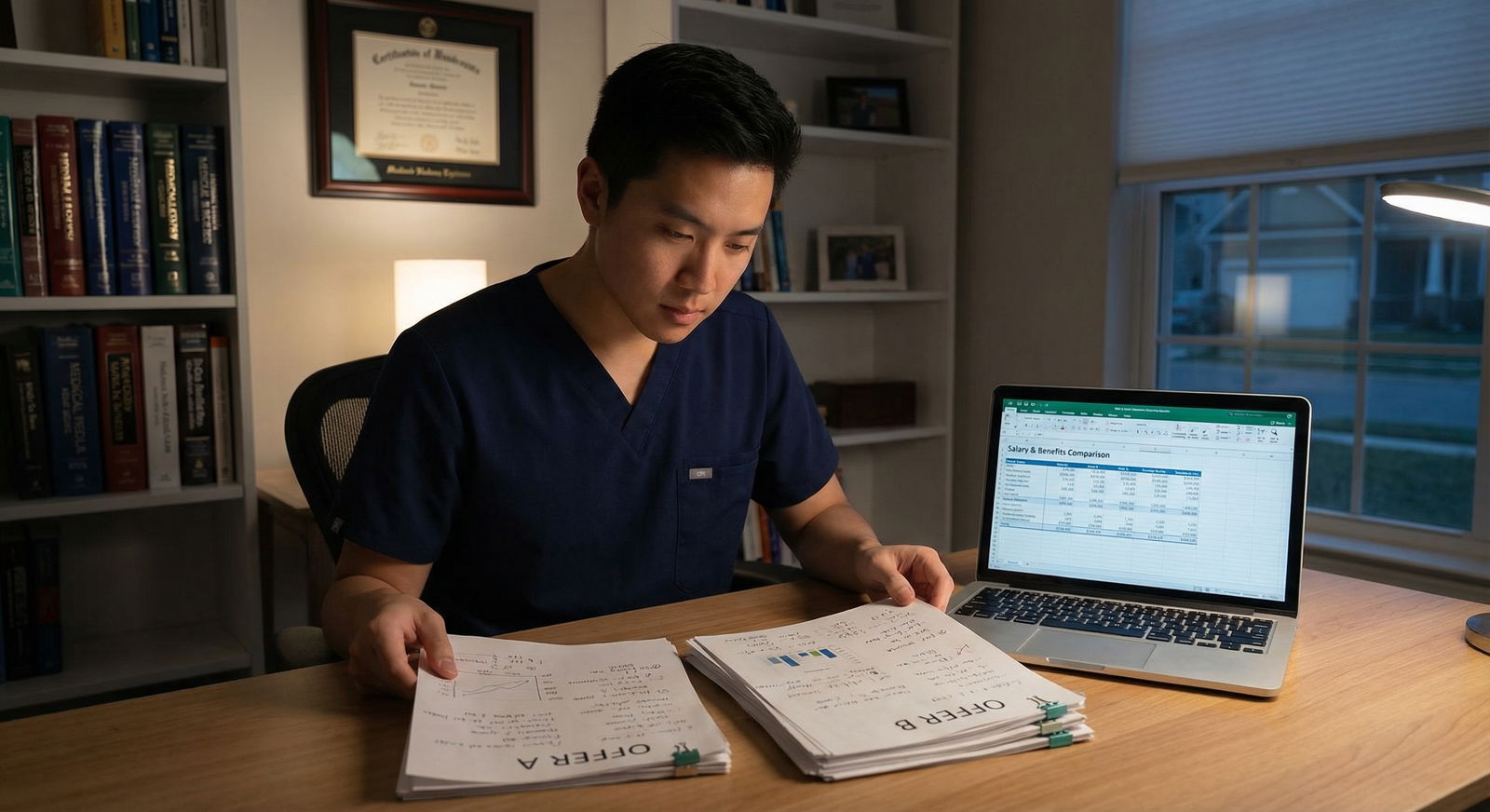

Step 2: Build a Comparison Table (This Is Your Control Panel)

You need all offers on one page. Not swimming in PDFs.

Create a spreadsheet (or a large sheet of paper). Columns = each offer. Rows = contract elements.

Here is a clean starting template of comparison factors:

| Category | Example Factors |

|---|---|

| Compensation | Base, bonuses, RVU rate, guarantees |

| Schedule & Call | Clinic days, call frequency, weekends |

| Benefits | Health, disability, retirement, CME |

| Malpractice | Claims vs occurrence, tail, coverage limits |

| Autonomy & Duties | RVU targets, admin time, procedures allowed |

| Restrictive Covenants | Non-compete, non-solicit, moonlighting |

| Exit Terms | Term length, without-cause notice, penalties |

Now, line by line, fill it in from the contracts.

This is tedious. Do it anyway. You catch 90% of problems just by forcing the language into plain numbers and terms.

Step 3: Normalize the Money – Apples to Apples

Biggest trap in contract comparison: looking at base salary only. You have to translate each offer into expected year‑1 and year‑3 compensation, then compare.

3.1 Break down compensation into pieces

For each offer, pull out:

- Base salary (year 1, 2, 3 if different)

- Productivity bonus structure

- RVU threshold

- Dollars per RVU above threshold

- Quality or admin bonuses

- Signing bonus and repayment terms

- Relocation bonus and repayment terms

- Loan repayment (who gets paid, schedule)

- Stipends (call, medical director, etc.)

Then sketch likely compensation:

Estimate your RVUs or collections

Use your specialty norms or MGMA data if you have it. If you have no clue, ask a trusted attending in your specialty what a typical RVU/year is for a normal effort job in that setting.Calculate expected bonus

Example:- Offer A:

- Base: 260k

- RVU threshold: 4,500

- Per RVU above: $45

- You estimate: 5,500 RVUs

- Bonus: (5,500 – 4,500) × $45 = 1,000 × 45 = $45,000

- Expected total: 305k

- Offer A:

Add guaranteed extras (not one-time gimmicks)

- Stable admin stipends

- Reliable call pay (if truly consistent)

Keep sign‑on and relocation separate These are temporary sugar. Good to have, but they do not make a bad structure good.

To help you think in relative terms, here is a simple visualization of how total comp can differ when you factor in productivity:

| Category | Value |

|---|---|

| Offer A | 305000 |

| Offer B | 340000 |

| Offer C | 290000 |

Offer B might be a higher earner if you are okay with higher RVU expectations; Offer C might be safer, steadier, but capped.

3.2 Adjust for cost of living

A 300k job in San Francisco is not the same as 300k in Omaha.

Do a quick and dirty adjustment:

- Use any online cost-of-living calculator

- Convert each salary to a “normalized” amount based on one reference city

Example: If City A is 20% cheaper than your reference city and offers 280k, that is roughly like 336k in the expensive city.

You are not doing academic economics. You just want to see who is effectively paying more.

Step 4: Quantify Lifestyle – Do Not Hand‑Wave It

Money blindspots are one issue. Lifestyle blindspots are worse.

You need to convert schedule and call into something you can actually compare: hours and impact.

4.1 Capture the true workload

For each offer, write:

- Clinic days per week

- Session length (half days or full days)

- Average patients per day

- Inpatient weeks per year

- Call type:

- In‑house vs beeper

- Primary vs backup

- Call frequency:

- Weeknights per month

- Weekends per month

- Holidays per year

- Expected admin time (protected or not)

Then translate to:

- Estimated weekly hours

- Estimated nights/weekends disrupted

If HR says, “Our physicians typically work 4 clinical days and one admin day,” ask the current docs, “How many hours per week are you actually in the hospital/clinic or charting?”

You will see this pattern often:

Offer B pays 40k more but effectively buys that by using your evenings and weekends as cheap labor.

4.2 Plot salary vs hours

Simple math:

Estimated total comp / estimated hours per year = dollars per hour of your life.

This is not exact. It does not have to be. The point is to see which job gives you more life per dollar or more dollar per hour.

Step 5: Score the Key Domains

Now you have:

- Money numbers

- Workload estimates

- Contract restrictions

- Benefits and malpractice details

Time to rank.

Create 5–7 scoring domains, each 1–10:

- Compensation

- Lifestyle / workload

- Practice fit (scope, procedures, team)

- Restrictions & risk (non‑compete, termination, tail)

- Career growth (leadership, teaching, research, partnership track)

- Location & family factors

- Culture (from your interview gut feeling and what current docs say)

Assign weights to each category based on your priorities:

- If you are burnt out: lifestyle might be 30–40% of your decision.

- If you are carrying 400k in loans and single: compensation might be 35–40%.

Example weighting and scoring:

| Category | Weight | Offer A Score | Offer B Score | Offer C Score |

|---|---|---|---|---|

| Compensation | 0.30 | 7 | 9 | 6 |

| Lifestyle | 0.30 | 8 | 5 | 9 |

| Practice Fit | 0.15 | 9 | 7 | 7 |

| Restrictions/Risk | 0.15 | 6 | 4 | 8 |

| Location/Family | 0.10 | 8 | 6 | 7 |

Weighted totals:

- Offer A: (7×0.30) + (8×0.30) + (9×0.15) + (6×0.15) + (8×0.10) = 2.1 + 2.4 + 1.35 + 0.9 + 0.8 = 7.55

- Offer B: … = 6.65

- Offer C: … = 7.45

Now you have something concrete. Offer A slightly edges C based on your own weights, even though B might pay more.

Is this “perfect”? No. But it forces your brain to stop fixating on one dimension.

Step 6: Systematically Review the Legal Landmines

You do not need to be a lawyer. But you do need a checklist and you absolutely should have a health‑care contracts attorney review the final candidate(s).

Here is the problem: 3 contracts, each 25–40 pages. Easy to miss the stuff that really matters.

Use this focused checklist.

6.1 Non‑compete and non‑solicit

For each offer, write down:

- Radius (miles)

- Duration (years)

- Scope (only your specialty? any clinical work?)

- Triggers (does it apply if they terminate you without cause?)

Typical red flags:

- Radius > 20–25 miles in urban areas

- Duration > 2 years

- Applies even if they terminate you without cause

- Prevents telemedicine or any form of medical work in wide regions

If your specialty is location‑dependent (peds subspecialty with one children’s hospital in town), a 25‑mile non‑compete is effectively a “leave the city” clause.

6.2 Malpractice and tail coverage

You must know:

- Claims‑made vs occurrence policy

- Who pays for tail coverage and under what conditions

Scenarios that should make you pause:

- “Employer provides claims‑made coverage; physician responsible for tail upon departure for any reason” – that tail can be $30k–$150k+ in some specialties.

- Tail is only provided if you have been there X years and leave on “good terms” (often vaguely defined)

For each offer, assign a malpractice risk score from 1–10. Low risk = they cover tail in all common scenarios (end of contract, non‑renewal, termination without cause).

6.3 Termination and without‑cause notice

Key questions:

- Can either party terminate without cause? (They should not be able to keep you locked in while having one‑sided exit power.)

- What notice is required? 60–90 days is common and reasonable.

- Are there any penalties or clawbacks triggered by a normal resignation?

Pay attention to:

- Signing bonus or relocation repayment obligations if you leave before a set period (commonly 2–3 years)

- Loan repayment clawbacks

- Any “liquidated damages” language tied to leaving

Visualize the termination and risk flow:

| Step | Description |

|---|---|

| Step 1 | Physician employed |

| Step 2 | Check contract term |

| Step 3 | Review repayment clauses |

| Step 4 | Check notice requirement |

| Step 5 | Delay exit or renegotiate |

| Step 6 | Submit notice in writing |

| Step 7 | Work through notice period |

| Step 8 | Separation complete |

| Step 9 | Want to leave? |

| Step 10 | Within initial term? |

| Step 11 | Can afford penalties? |

Any job that looks great but traps you with ridiculous tail costs + non‑compete + repayment should drop in your rankings.

Step 7: Build a “What Could Go Wrong?” Scenario for Each Offer

This is the test almost no one does.

For each offer, write one short page answering:

- If this job goes badly in 18 months, what happens to me?

- Can I work in the same city?

- Can I afford to leave?

- Do I owe money back?

- Will my board certification or case logs suffer?

- What if:

- Volumes are lower than promised?

- A senior partner leaves and you inherit their call?

- The hospital is acquired and leadership flips?

You are not predicting doom. You are stress‑testing your options.

Then sketch a quick risk profile:

| Category | Value |

|---|---|

| Offer A | 3 |

| Offer B | 7 |

| Offer C | 4 |

Where 1 = very low risk (flexible, easy exit) and 10 = high risk (locked in, expensive exit, uncertain volumes).

Offers with high compensation but high risk deserve aggressive negotiation padding. Or rejection.

Step 8: Talk to Actual Physicians in That Practice

This is not optional. You are about to bind your life to strangers.

You want:

- One physician who has been there >5 years

- One junior hire from the past 1–3 years

- If someone recently left, see if you can find them

Questions to ask (on the phone, not email):

- “How many hours are you actually working per week?”

- “How has the call schedule changed over the past 2–3 years?”

- “Did your compensation match what they described when you signed?”

- “Have you ever seen someone leave? How did the group/administration handle it?”

- “What is the most frustrating part of working here that they probably did not show me?”

Listen for:

- Consistent themes (good or bad)

- Hesitation or evasive answers about turnover, call, and compensation transparency

- Whether they warn you in physician code language: “It is…fine” usually means it is not fine.

Your culture score and risk score may change drastically after these calls. Adjust your rankings.

Step 9: Reduce to a Shortlist and Re‑Negotiate with Purpose

By now, you should have:

- Completed comparison table

- Weighted scores

- Red‑flag assessment (non‑compete, tail, exit)

- Real‑world intel from current physicians

You will likely see:

- One offer that looks objectively weak → drop it.

- Two offers that are in the running for different reasons.

Pick your top one or two based on the scoring and your gut alignment with your non‑negotiables. Now you negotiate, but not like a desperate resident asking for “more money please.”

You negotiate like this:

Identify 3–5 concrete changes that would move your top offer from “good” to “excellent.”

Examples:- Increase base from 260k to 285k OR lower RVU threshold by 500 RVUs.

- Limit non‑compete radius from 35 miles to 15 miles.

- Employer pays 100% of tail cost under all no‑fault separation scenarios.

- Define call caps in writing (e.g., “No more than 1 in 4 weekends averaged over a quarter.”)

Prioritize them:

- Tier 1 (must try to get): maybe base/RVU change + non‑compete fix.

- Tier 2 (good to get): CME bump, signing bonus, small schedule tweak.

Present them in one clean, professional communication.

Do not drip endless micro‑asks. You look disorganized.

Leverage your other offers without bluffing:

- “I have another offer in [City] at [X compensation] with [Y call schedule]. I prefer your group and this location, and if we can address these specific points, I am ready to commit.”

Hospital systems expect this. Private groups may be prickly, but if they walk away because you asked for reasonable changes, that tells you something about how they will be as partners.

Step 10: Use a Simple Decision Framework to Sign and Move On

At some point you have to stop optimizing and decide. Otherwise you will stall for months and lose offers.

Here is a clean decision framework:

- Does the final contract meet all non‑negotiables?

- If no → reject. No exceptions.

- Are all major red flags either:

- Removed, or

- Compensated by clearly higher pay or shorter commitment period?

- Does your weighted score + gut impression put this in the top slot?

If yes, you sign. Not because it is flawless. Because it is a professionally chosen risk that fits your life and goals better than the alternatives.

To visualize the overall journey from offers to decision:

| Step | Description |

|---|---|

| Step 1 | Receive multiple offers |

| Step 2 | Define non negotiables |

| Step 3 | Create comparison table |

| Step 4 | Normalize compensation |

| Step 5 | Score lifestyle and risk |

| Step 6 | Talk to current physicians |

| Step 7 | Rank offers with weights |

| Step 8 | Negotiate key terms |

| Step 9 | Have attorney review |

| Step 10 | Sign contract |

| Step 11 | Top offer acceptable? |

Then you get back to doing what you trained for, instead of living in spreadsheet world.

FAQ (Exactly 4 Questions)

1. How many offers should I realistically compare before deciding?

For most physicians, 2–4 solid offers is the sweet spot. One offer leaves you without leverage and often blind to market realities. More than 5 and you drown in noise and decision fatigue. If you have many preliminary conversations, narrow down to the 2–3 that meet your non‑negotiables, then request formal written offers from those only. Compare those deeply. Ignore the rest.

2. Is it worth paying a physician contract attorney if my offer looks “standard”?

Yes. A few hundred to a couple thousand dollars for a focused review can save you tens of thousands later in tail coverage, repayment obligations, or restrictive covenants. “Standard” just means “what works for the employer.” You do not need them to wordsmith every line, but you do need a clear read on: non‑compete enforceability, termination clauses, malpractice/tail obligations, and any sneaky repayment or penalty language. Have them review your final top 1–2 offers, not every draft from day one.

3. Should I always take the highest paying offer if my loans are huge?

No. High pay with punishing call, unstable volumes, or brutal non‑competes can trap you in a burnout factory that you cannot leave without moving states or writing a massive check. Use the hourly earnings estimate and risk scoring. Somewhat lower pay with reasonable hours and flexible exit terms often leaves you better off in 3–5 years, especially if it lets you moonlight or build side income. You want sustainable earning, not a two‑year sprint into the wall.

4. What if my favorite location has the worst contract on paper?

Then you have a real tradeoff, and you should be honest about it. First, push hard on negotiation using your other offers as leverage. Try to fix the worst parts: non‑compete, tail, call expectations. If they refuse to budge, ask yourself: “If this job implodes in 18 months, am I okay with the likely fallout?” If the answer is no—because of risk, money, or reputation—step back. It is better to work a few years in a second‑choice city with a strong contract and then return later, than to lock yourself into a bad local deal that poisons your long‑term plans.

Key points:

- Force every offer into the same frame: numbers, hours, risk, and restrictions. No guessing.

- Use weighted scoring tied to your real priorities, not someone else’s idea of a “dream job.”

- Negotiate the top 1–2 offers hard on the few contract terms that truly change your life: compensation structure, non‑compete, malpractice/tail, and exit flexibility.