The idea that you might pick the “wrong” specialty and ruin your financial future is not irrational. It’s actually the only rational response to how opaque and high‑stakes this choice feels.

You’re not crazy for obsessing over money. You’d be crazy not to.

Let’s talk about that.

1. The nightmare loop in your head (you’re not alone)

Here’s the loop I hear over and over:

“I’ll choose a lower‑paid field because I like it now… then I’ll be 40, burned out, making half what my surgery/anesthesia friends make, drowning in loans, with kids to support, and it’ll be too late to change. I’ll resent everything and everyone, including my patients.”

That sound familiar?

Or maybe it’s the opposite:

“I’ll chase a high‑paid specialty so I don’t have to stress about money… then I’ll hate my day‑to‑day life, feel trapped by the paycheck and the sunk time, and I’ll wake up at 45 realizing I sold my soul for RVUs and a Tesla.”

That one’s just as real.

Here’s the part people lie about: there is no specialty that makes both of those fears go away. There is no “perfect” choice that guarantees you’ll never feel regret, or anxiety, or “what if I’d done X instead.”

So if you’re waiting to feel 100% certain before you commit, you’re going to be waiting forever. The real question isn’t “How do I avoid all regret?” It’s:

“How do I make a choice where, even on my worst day, I don’t feel like I completely screwed myself financially?”

That’s a different, and much more manageable, problem.

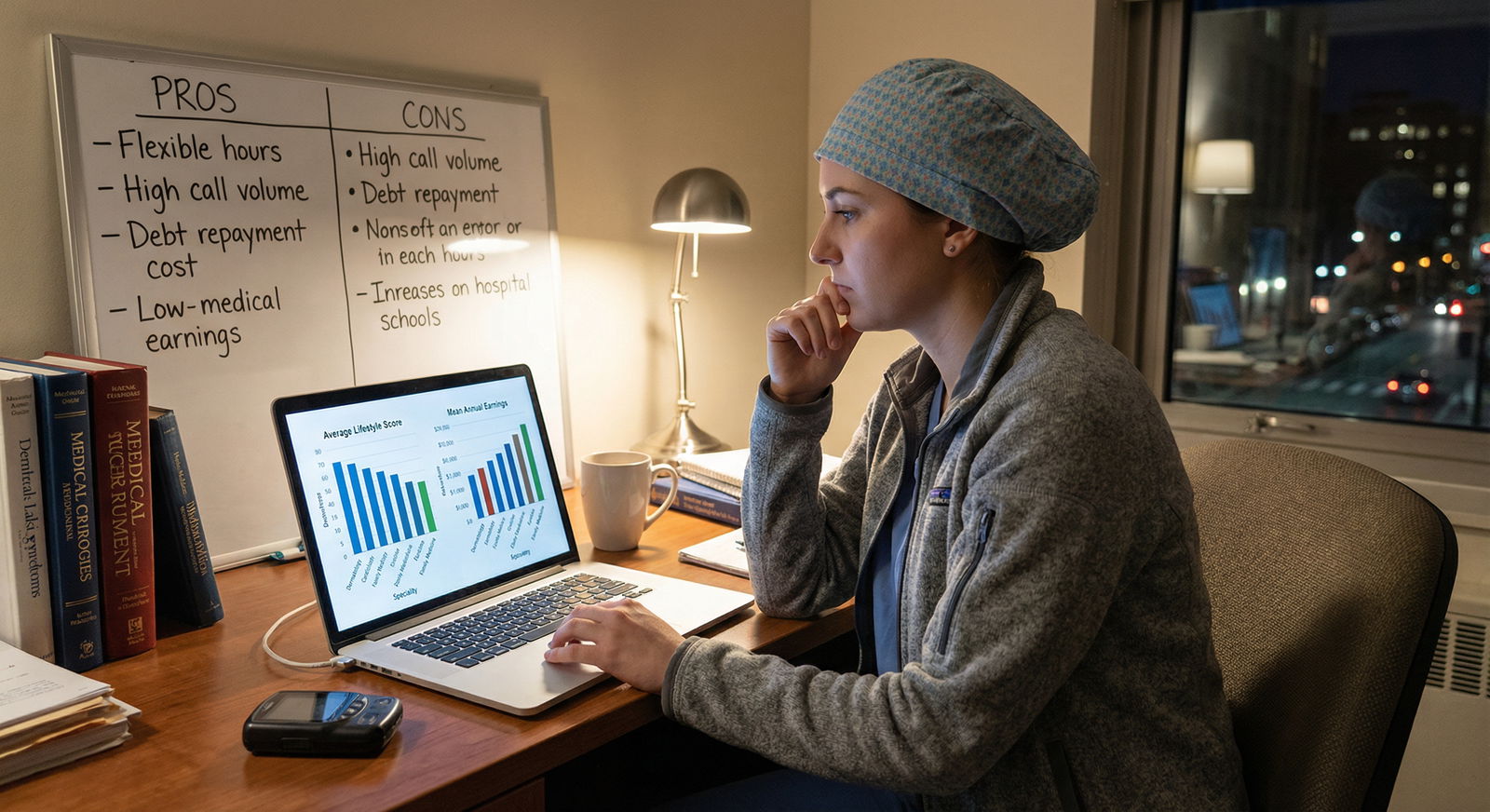

2. What money actually looks like by specialty (not the fantasy version)

Let’s be blunt: the income gap between specialties is huge. Pretending it’s not is just dishonest.

Rough, ballpark attending numbers (US, private practice, full‑time, typical reports you see tossed around):

| Specialty | Typical Range (USD) |

|---|---|

| Orthopedic Surgery | $600k–$900k+ |

| Neurosurgery | $650k–$1M+ |

| Interventional Cards | $600k–$800k+ |

| Anesthesiology | $450k–$650k |

| Radiology | $450k–$650k |

| EM | $350k–$500k |

| IM / Hospitalist | $250k–$350k |

| Pediatrics | $220k–$320k |

Now combine that with med school debt. Not the fake numbers schools print on brochures. I mean the real stuff I see:

- $250k–$400k total loans is extremely common.

- $500k+ isn’t rare if you had undergrad loans + interest + high COL city.

So yeah, specialty income matters. A lot.

But here’s the twist that most anxious applicants miss:

Your financial life is not just “specialty income.” It’s:

- Years spent not earning (extra fellowship, long residencies)

- How you manage money in the first 5–10 attending years

- Where you live and your lifestyle creep

- Whether you use loan forgiveness / smart repayment options

- Whether you trap yourself in golden handcuffs

A pediatrician who lives like a resident for 5 years and pays down loans aggressively can end up in a better place than an orthopedic surgeon who immediately buys a $1.5M house, two cars, and says yes to every lifestyle upgrade.

So yes, the starting line is different. But the race is still very losable, even in a high‑paying field.

3. The hidden timeline: when money actually starts to matter

Your brain is telling you a story that goes like this: “The day I finish residency, my life is financially made or destroyed by my specialty.”

That’s… not how it plays out.

| Period | Event |

|---|---|

| Training - MS1-4 | Medical School 4y |

| Training - PGY1-3 | IM/Peds 3y |

| Training - PGY1-5 | Gen Surg 5y |

| Training - PGY1-7 | Neurosurg 7y |

| Attending - Early Career | Age 30-40 |

| Attending - Peak Earnings | Age 40-55 |

Here’s the pattern I’ve watched:

- During training, basically everyone is poor. IM resident, ortho resident, peds resident — all in the same cheap housing, same crappy cars, same Costco memberships.

- The first 3–5 attending years are where you can either build massive momentum or dig yourself a decade‑long hole.

- Specialty income really separates people in the mid‑career years, especially if they kept their lifestyle under control early.

What that means for your fear of regret:

You’re not locked into financial disaster just because you don’t pick a “highest paid” field.

You’re also not automatically safe just because you do.

What protects you is how you treat those first 5 attending years.

So when you ask, “Will I regret going into [lower‑pay] specialty instead of ortho/anesthesia/derm?” you actually need to be asking:

“If future me earns $250k–300k instead of $600k, can I handle that life if I’m smart early on?”

That’s a completely different conversation than “Will I starve?” You won’t. The real fear is: “Will I feel stupid compared to my peers?” That’s an ego and expectation problem, not a survival one.

4. The honest trade-offs: high pay vs high regret

Let’s rip off the band‑aid. Every choice has a regret path built in.

Path 1: You chase the highest paid specialties

Maybe you like procedural stuff, you’re okay with long training, and you’ve convinced yourself that making $600k+ will solve most of your stress.

Upsides you already know:

- Massive lifetime earnings

- Faster ability to pay off loans

- More margin for things like private schools, big house, fancy trips

- Often more negotiating power and job options

But the downsides no one admits out loud:

- Extra years of training = more years at $70k instead of $400k+

- These fields can be physically brutal and high‑stakes (ortho, neurosurg, interventional cards)

- High burnout fields: EM, anesthesia in some markets, radiology with insane RVU targets

- You can absolutely feel financially trapped: “I hate this, but I can’t walk away from $700k.”

I’ve watched people in high‑pay specialties googling “nonclinical jobs for physicians” at 2 a.m. in between cases. They aren’t magically happy because of the checks.

Path 2: You pick a middle/low‑paid but “you” field

IM, peds, psych, FM, maybe even academics in a specialty that pays less.

Upsides:

- Shorter training in some cases

- Often more flexibility in jobs, locations, part‑time schedules

- Less pressure cooker culture in certain programs

- Sometimes better alignment with your actual personality and values

Downsides (the ones that keep you up at night):

- You will absolutely have friends making 2–3x what you make

- Loan payoff feels slower and more suffocating if you’re not intentional

- In high COL areas, $250k–300k can feel tight with kids + daycare + rent/mortgage

- Mid‑career, you might feel underpaid for the emotional load you carry

Let me be blunt: if you choose a lower‑paid specialty and then live like a high‑earner, yes, you will regret it. You will feel constantly behind.

But that’s not a specialty failure. That’s a financial behavior failure.

5. How to think about money before you pick your specialty

This is where you can actually lower your odds of long‑term regret.

Stop thinking “Which specialty makes me the most money?”

Start thinking: “Which specialty gives me a combination of:

- An income that can support the life I want

- A day‑to‑day I don’t hate

- A training length I can tolerate

- Flexibility to pivot if my interests change?”

And then layer money on top of that, intelligently.

Here’s a mental exercise that helps:

Scenario test: you on a “modest” attending salary

Pick a realistic lower‑end attending salary for your field:

- IM/hospitalist: $250k

- Peds: $220k

- Psych: $260k

- EM: $350k

- Anesthesia: $400k

- Ortho: $550k

Now imagine:

- You’re 35

- You have $200k in loans remaining, 6–7 years left to kill them

- You live in a mid‑cost city (not NYC/SF)

- You have or want 1–2 kids

Would that income level:

- Allow you to pay $2–3k/month toward loans?

- Cover a modest mortgage or rent, childcare, basic retirement savings?

- Leave some room for travel, hobbies, not eating instant ramen every night?

For most of those numbers, the answer is yes, if you’re not trying to live like a tech CEO.

Your brain keeps jumping to “But I COULD be making double that.”

That’s where the regret monster lives.

You need to decide if the extra money is worth:

- The extra years in training (and lost earning years)

- The lifestyle, call, and stress of the higher‑paid fields

- The personality/culture of those specialties

Sometimes it is. Sometimes it absolutely isn’t.

6. Worst‑case scenarios (and why they’re not actually the end)

Your anxiety is going to go here no matter what, so let’s go there on purpose.

Worst‑case #1: You choose a lower‑paid specialty and feel poor forever

This is what you’re picturing:

- Peds or FM, $220k–250k, high COL city, $400k loans, two kids

- Daycare $3k/month, rent or mortgage $3–4k/month

- Loans feel like a second rent, saving for retirement feels impossible

- Your ortho friend’s Instagram is all “ski trips + boat + brand new house”

This scenario sucks. I won’t pretend it doesn’t.

But here’s the part your brain skips:

You have levers you can pull:

- Geography (move to a lower‑COL area, often with higher pay for primary care)

- Job type (hospital employed vs private vs locums)

- Repayment (PSLF, IDR, aggressive payoff as needed)

- Side income (teaching, urgent care shifts, telehealth, admin work later)

| Category | Value |

|---|---|

| NYC | 240 |

| Chicago | 260 |

| Midwest town | 280 |

| Rural area | 320 |

Plenty of FM and peds docs move to lower‑COL areas, earn $280k–320k, and live very comfortably.

So the “poor forever” story is usually “I insist on living in an expensive city with a low‑paid field and a high‑lifestyle expectation.” That’s not destiny. It’s a choice.

Worst‑case #2: You choose a high‑paid field and hate your life

Picture this:

- You match ortho, neurosurg, or interventional anything

- 6–7+ years of brutal hours, constant pressure, missed holidays

- You get through it, you’re making $700k, but your life is OR–home–OR–charting

- You’re exhausted, emotionally flat, and you don’t even want the fancy stuff you bought

That regret is very real, and money doesn’t fix it.

Your outs here:

- Changing practice setting

- Dropping call, going part‑time (yes, even in high‑paid fields)

- Switching tracks later (admin, leadership, industry, less intense niches)

You will almost never see Instagram posts from the anesthesiologist who quietly went 0.6 FTE because they couldn’t take full‑time call anymore. But it happens.

Both “worst cases” have exits. They’re not pretty, but they exist.

So you’re not locking yourself into a torture chamber for 40 years with this one decision, even if it feels like it.

7. Questions that actually help (instead of spiraling)

Here are better questions to obsess over than “What’s the highest paid specialty?”

Ask yourself:

On a bad day in this specialty, would more money make the core problem go away?

- If the answer is “No, I’d still hate the type of work,” that’s a bad sign.

Can I imagine living on the lower end of the pay scale for this field without constant financial panic — if I’m moderately responsible?

- If the answer is “Not in NYC but yes somewhere cheaper,” that’s workable.

Do I like the training years enough to survive them?

- You don’t skip straight to the $600k. You live the residency and fellowship first.

Does this specialty give me options (different practice types, geographies, part‑time later)?

- Flexibility is an undervalued antidote to regret.

If you can answer “yes” to at least 2–3 of those for a specialty, you’re in a pretty safe zone.

8. Concrete moves to protect future‑you financially (whatever you pick)

You want something actionable so your brain can shut up a little. Here:

- Learn the basics of loan repayment: PAYE/REPAYE/SAVE, PSLF, refinancing. Don’t wait until PGY3.

- Commit — in writing — that for the first 3–5 attending years, you will:

- Live in housing you could have afforded as a senior resident + modest bump

- Drive your current car until it actually dies

- Set automatic payments for loans and retirement before lifestyle stuff

- Run actual numbers, not vibes. Use a simple calculator:

- Input: expected salary, loans, interest rate, repayment plan

- See: monthly payment, time to payoff, leftover money

If you do that, most reasonably paid specialties become financially viable.

If you don’t, no specialty is high‑paid enough to save you from yourself.

9. What you’re actually afraid of (and how to be okay with it)

You’re not just afraid of money. You’re afraid of:

- Watching peers “win” the money game faster than you

- Feeling stupid for not picking the “smart” financial specialty

- Being stuck in something you don’t love and feeling underpaid

- Not being able to give your future family the life you imagine

Those are valid fears. They’re also not solved by chasing the highest salary number on a spreadsheet.

People regret low‑paid fields when they feel powerless.

People regret high‑paid fields when they feel trapped.

So your real job isn’t “pick the perfect specialty.”

It’s “pick a specialty that gives me enough income + enough flexibility, then use money deliberately instead of emotionally.”

You’re allowed to weigh money heavily. You’re allowed to rule out fields that don’t pay enough for the life you want. That doesn’t make you shallow; it makes you honest.

Just don’t lie to yourself that the top of the pay chart equals the bottom of your anxiety. It doesn’t.

Final thought

Three things to carry with you:

- Any mainstream specialty can support a solid life if you treat your early attending years like part of your training financially.

- High pay doesn’t immunize you against regret; low pay doesn’t doom you to it. Your behavior and expectations matter more than the raw number.

- You’re not choosing “rich vs poor.” You’re choosing which problems you’re willing to deal with — and money is only one part of that equation, not the whole thing.