Most physicians misunderstand partnership offers—and they pay for it for the next 20 years.

Let me be blunt. The biggest money decisions in a physician’s career are not their first attending job, their specialty choice, or even their retirement plan. It is how they handle equity, buy-ins, and buy-outs in practice partnerships.

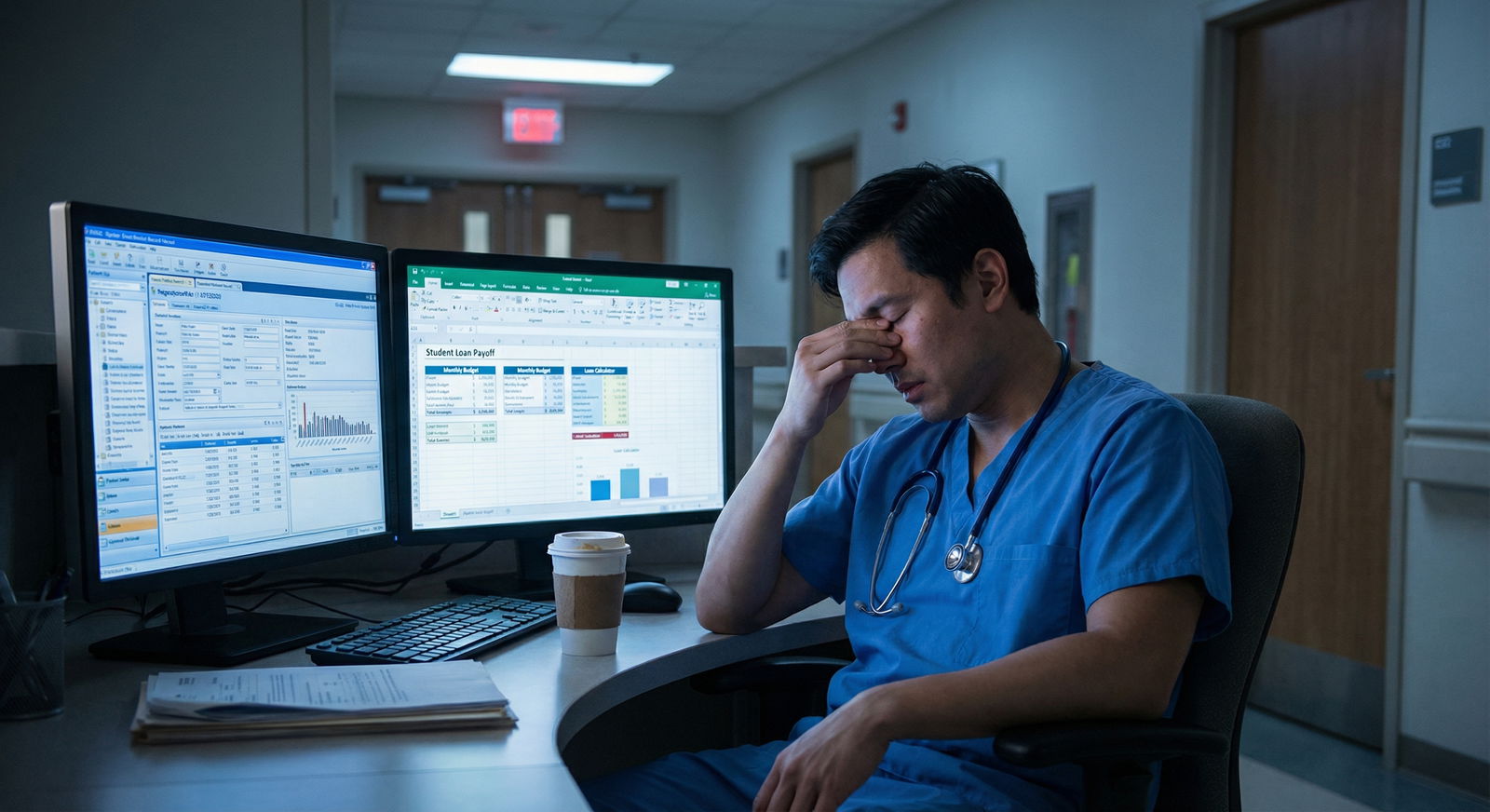

I have watched smart clinicians sign “great” partnership tracks that quietly siphoned $100,000+ a year away from them because they did not understand how equity, distributions, and buy-out clauses really worked. On paper it looked fine. In math, it was ugly.

Let me break this down, specifically.

1. What “Partnership” Really Means (Financially, Not Emotionally)

Most recruiting pitches treat “partnership” like a title or a rite of passage. That is the wrong lens. Partnership is a capital and cashflow structure.

Financially, partnership usually implies three things:

- You own equity in the practice entity (or related entities: real estate, ancillaries).

- You share in profits (distributions) beyond straight salary.

- You have a claim on something when you leave (buy-out), subject to the contract.

Everything else—governance, meetings, “voting rights”—is secondary to those three.

The three main money streams

Think of a physician-owner’s economic package as:

- W-2 or K-1 “salary/guarantee” for clinical work

- Profit distributions based on equity percentage

- Equity value changes: what you pay to get in (buy-in) vs what you receive when you exit (buy-out)

That third bucket is the one people ignore until it bites them.

2. Equity Structures: What Exactly Are You Buying?

Equity is not abstract “ownership.” You need to know: ownership of what, and how is it valued?

Common structures in physician practices:

- Single entity professional corporation / LLC

- Professional entity + separate real estate LLC

- Professional entity + ancillary entities (ASC, imaging, labs, PT)

- Multi-tier groups, sometimes with a management company in the mix

| Step | Description |

|---|---|

| Step 1 | Physician Owners |

| Step 2 | Practice Entity |

| Step 3 | Real Estate LLC |

| Step 4 | Ancillary Entity ASC |

| Step 5 | Clinical Revenue |

| Step 6 | Rent Income |

| Step 7 | Facility Fees |

If a recruiter or senior partner says, “You buy in after two years for $300,000,” your immediate question should be: buy in to what?

- Only the professional practice?

- Practice + real estate?

- Practice + ASC?

- Different prices for different entities?

I have seen groups where younger partners thought “I’m a full partner” but discovered later they had no stake in the building or the surgery center. Those were reserved for “founders” or a closed inner ring. The RVU bonus looked fine, but the real money was in the rent and facility fees—permanently off-limits to them.

3. The Buy-In: How It Is Priced, Structured, and How It Can Screw You

First question: Is the buy-in price grounded in reality?

There are three common ways practices set buy-in prices:

Arbitrary / legacy number

“Everyone has always paid $250,000” with no updated valuation. Red flag.“Book value” / tangible assets only

Based on equipment, furniture, A/R adjustments. Often understates real economic value, but at least it is defendable.Full fair market value (FMV), including goodwill

Based on EBIT/EBITDA multiples, sometimes via external appraiser. Common in large, sophisticated groups, or private-equity-backed models.

Here is why you care: if the group is using an inflated or stale “FMV” and you are paying in with after-tax dollars over several years, you are effectively funding current partners’ retirement with very little upside.

| Method | Includes Goodwill? | Typical Risk to New Partner |

|---|---|---|

| Legacy fixed price | Sometimes | Unknown, can be very high |

| Book value only | No | Moderate to low |

| FMV with goodwill | Yes | High if growth is limited |

Second: How do you actually pay the buy-in?

Most groups do not demand a suitcase of cash. Instead, you see:

- Payroll deduction over 3–7 years

- Reduced distributions until you “catch up”

- Bank financing (often personal guarantee)

- Combination models

Each route has different tax and risk consequences. Quick example:

- Buy-in: $300,000

- Paid over 5 years via payroll deduction

- Interest rate: 6%

- Annual pre-tax payment: about $70,000

- After-tax (assuming ~40% combined tax): ~ $42,000 less take-home per year

If your “partner comp” is advertised as $550,000, but your buy-in drag is $70,000/year pre-tax for five years, your effective comp is closer to $480,000 during that phase. Compare that honestly to alternative offers.

| Category | Advertised Partner Comp 550k | Effective Comp After Buy-In |

|---|---|---|

| Year 1 | 550 | 480 |

| Year 2 | 550 | 480 |

| Year 3 | 550 | 480 |

| Year 4 | 550 | 480 |

| Year 5 | 550 | 480 |

Third: Are you buying in at the same terms as future partners?

Watch this one. If the practice values keep rising (or are being reported as rising), and each new generation of partners pays a higher buy-in than the last, the real “winners” are the senior cohorts who essentially “sell” the same economic engine repeatedly.

Ask blunt questions:

- How much did the last three classes of partners pay for buy-in?

- How was that number determined each time?

- Has any partner refused partnership due to buy-in cost?

No reasonable answer = walk away or discount the offer heavily.

4. Equity vs Compensation: You Are Not Paid Only on RVUs Anymore

Once you are a partner, your income typically has two parts:

- Compensation tied to your personal production (or collections), often via a formula

- Distributions from profits based on equity share

Those two can either align nicely or conflict badly.

Common partner compensation formulas

You will see variations on these themes:

- Pure eat-what-you-kill: You get X% of your own collections, plus equal share (or ownership share) of overhead / ancillaries.

- Hybrid: Base salary + % of collections above a threshold.

- Pool model: All revenue pooled, then distributed based on some formula (wRVU, FTE, seniority, etc.).

Here is the trap: if your compensation formula already heavily rewards production, the actual dollar value of “equity” may be relatively small—except for ancillaries/real estate. Conversely, some groups depress partner “salary” and push most income into profit distributions, which can be tax-efficient but also hazier to analyze.

5. The Buy-Out: The Clause Everyone Glances At, Then Regrets

If you only remember one thing from this: the buy-in only makes sense relative to the buy-out.

I want you to think like this:

- “If I pay $X to get in and receive $Y to get out, what is my net equity gain or loss, and over how many years?”

Most contracts massively restrict what a departing partner receives. Common mechanisms:

- Fixed formula based on book value only

- Cap on goodwill repayment (or zero goodwill)

- Phased payouts over years, often contingent on non-compete compliance

- Significant carve-outs: “no value paid for accounts receivable”, “no value paid for future income streams”, etc.

Quick reality check example:

- Buy-in: $300,000 at age 38

- Buy-out formula: 50% of capital account + no goodwill, expected around $150,000 at age 65

- You essentially “subsidized” retiring partners by $150,000 over your career

But in some well-structured groups, it cuts the other way:

- Buy-in at 38: $250,000

- Strong growth, reinvestment in ancillaries, conservative distributions

- Buy-out at 65: $700,000 over 5 years

- Net “equity gain”: $450,000, plus years of extra distribution income in-between

Same words (“buy-in,” “buy-out”), radically different economics.

| Category | Value |

|---|---|

| Unfavorable Deal | -150 |

| Favorable Deal | 450 |

Payout terms matter as much as payout amount

Check for:

- Time horizon of buy-out payments (lump sum vs 3–10 years)

- What happens if the group’s financial health declines after you leave—are payments guaranteed?

- Are buy-out payments subordinated to bank loans, PE preferences, or other obligations?

- Is the buy-out accelerated or reduced if you die or become disabled?

I have seen senior partners expecting a six-figure annual buy-out stream get cut in half when a practice sold to private equity and legacy obligations were “renegotiated.” The contract language allowed it.

6. Private Equity, Hospital Employment, and How They Distort Partnership Math

If private equity or a hospital system is anywhere near this practice, you have a different game.

Private equity–backed groups

Here is the pattern:

- Existing partners do a recapitalization and sell to PE at a multiple (say 8–12x EBITDA).

- They roll some portion into equity in the new MSO/holding company.

- New “partners” after the deal are often offered “equity” that is far less powerful and much more expensive.

You need to ask:

- Am I buying into the local practice entity only, or the PE parent / MSO?

- At what valuation multiple is my equity being priced? (If you are buying at a 12x multiple, your upside is limited.)

- Do I have the same class of shares or a subordinated class with less control and worse exit terms?

The ugly version: new physicians pay high buy-ins into a heavily leveraged structure, with minimal chance of a second big liquidity event. They are essentially employees plus some risky equity lottery tickets.

Hospital or health-system “partnership”

Many hospital-employed models abuse the word “partner.” In most, you are never a true equity owner in the practice cashflow. You might receive:

- Leadership stipends

- Quality or gainsharing bonuses

- Shared governance roles

But you are not buying in or out of a capital asset in the traditional sense.

If a hospital promises “partner track,” demand written clarity on:

- Do I ever own an equity stake in a revenue-generating entity?

- Do I have any buy-out rights at retirement?

Often the answer is no. Which is fine, as long as you do not confuse it with real private practice partnership economics.

7. Concrete Examples: Same Specialty, Very Different Money

Let us run a simplified side-by-side. Two cardiology offers in a mid-size city.

| Feature | Group A (Traditional PP) | Group B (PE-backed) |

|---|---|---|

| Associate salary | 450k | 525k |

| Partner advertised comp | 700k | 650k |

| Buy-in amount | 300k | 400k |

| Entities included | Practice + ASC | Practice only |

| Buy-out at retirement | ~500k | None guaranteed |

| Non-compete radius | 15 miles | 25 miles |

On the surface, Group B looks richer in the short term: higher associate and near-equal partner comp. But dig into the mechanics:

- Group A buy-in covers practice + ASC. Profits from ASC distributions often add six figures a year.

- Group A has a defined buy-out formula with historical precedent.

- Group B’s “equity” is practice-level only; ASC and imaging are at the PE holding level with tight control and opaque valuation. No contractual buy-out.

Fast forward:

- 10 years as a partner in Group A: extra ASC distributions + ultimate buy-out could add >$1–2M over that decade.

- 10 years in Group B: higher early salary, but minimal terminal value and less control over call, staffing, and strategy.

Which is “better”? Depends on your risk tolerance, horizon, and tolerance for corporate oversight. But if you ignore the equity mechanics and chase the highest year-1 salary, you are playing the wrong game.

8. How to Diligence a Partnership Offer Like an Adult

You do not need an MBA. You need discipline and a bit of courage.

Here is the checklist I give physicians when they are staring at a “partnership track” offer.

1. Demand the actual documents

Not just a one-page summary or what the recruiter says.

You want:

- Employment agreement (associate phase)

- Partnership agreement / shareholder agreement

- Operating agreements for each related entity (ASC, imaging, real estate, MSO)

- Current capitalization table showing ownership by partner

If they refuse to show ownership structure or buy-out formulas pre-signing, consider that your answer.

2. Quantify the full-in, full-out picture

You should be able to answer, in actual numbers:

- How much will I pay in buy-in, in what form, over what timeline?

- What would a currently retiring partner receive as a buy-out today, in dollars and timing?

- What has been the historical partner compensation (median, not the “top earner”) for the last 3–5 years?

Back-of-the-envelope projections are fine, but do them.

| Category | Value |

|---|---|

| Year 1 | 450 |

| Year 3 | 600 |

| Year 5 | 680 |

| Year 7 | 720 |

| Year 10 | 780 |

3. Look for asymmetries between senior and junior partners

Red flags I see repeatedly:

- Senior partners have guaranteed buy-outs; junior partners’ buy-outs are “subject to board approval” or capped.

- Different share classes with different voting or distribution priorities.

- “Frozen” equity for founders that does not dilute as new partners come in.

Ask: “Is there any class of ownership with rights I will not have?” Then verify in the documents.

4. Understand the non-compete + buy-out interaction

Some contracts explicitly condition payment of buy-out on you honoring a non-compete for X years. If you breach, they can withhold unpaid buy-out sums. That effectively chains you to the region if you want to collect what is owed.

In other words: the buy-out and the non-compete are one financial instrument. Analyze them together.

9. Tax and Legal Nuances That Actually Matter

I will not drown you in tax code, but a few details change net outcomes a lot.

Capital vs ordinary income

- Buy-in payments are typically made with after-tax dollars (from your salary).

- Some buy-out payments may be treated as capital gains, some as ordinary income, depending on structure and jurisdiction.

If you pay in with taxed dollars and receive out with partially capital-gains treatment, that is more favorable than the reverse. A good physician-focused CPA can model this quickly.

Entity type and distributions

- S-corp vs partnership/LLC vs C-corp status affects how profit distributions are taxed and how payroll taxes apply.

- If most of your partner income is K-1 distribution, you may save on employment taxes versus pure salary. But you give up some W-2 retirement plan contributions.

Again, the structure is part of your total comp—not just the headline number.

10. When To Walk Away

Some partnerships are financially toxic. I will call them out:

Walk away if you see:

- Opaque buy-in pricing that keeps rising with no clear valuation method

- No written, enforceable buy-out formula for your class of equity

- Different share classes where your class has weak rights and unclear value

- Heavy private equity overhead fees draining practice profit with no path to a second liquidity event for you

- Leadership that gets defensive or evasive when you ask for clarity

You are not insulting anyone by asking how your money will work. The groups that react poorly are telling you exactly what your future conversations will look like—only the stakes will be higher.

FAQ (Exactly 5 Questions)

1. Is a high buy-in always a bad sign?

No. A high buy-in can be perfectly reasonable if it buys you into genuinely valuable assets: profitable ancillaries, appreciated real estate, or a highly stable, high-margin practice. The key is whether (a) the buy-in is tied to a defensible valuation, (b) existing partners paid proportionally similar amounts, and (c) there is a credible, contractual buy-out structure that lets you recoup and grow that equity over time. High buy-in with weak or nonexistent buy-out = bad. High buy-in with solid, historically honored buy-out = potentially very good.

2. Should I ever accept “partnership” without any buy-out rights?

You can, but call it what it is: enhanced employment with a bonus structure, not true ownership. If you are paid very well annually and do not care about terminal value or legacy, that may be fine. For many physicians, though, having zero equity value at retirement after decades of “partnership” feels like a betrayal—even if the contract technically allowed it. If there is no buy-out, I expect higher ongoing compensation as the trade-off.

3. How much weight should I give to ancillaries (ASC, imaging, etc.) in a partnership decision?

A lot. In many specialties—orthopedics, GI, cardiology, ophthalmology—the real economic engine is ancillaries and facility fees. A partnership that includes meaningful equity in those entities can easily add $100,000–300,000 per year to your income plus substantial exit value. The flip side: if ancillaries are carved out for a small subset of partners or for the PE parent, your upside is capped even if your “practice” comp looks strong.

4. Is it worth paying a healthcare attorney and CPA to review my partnership offer?

Yes, if the numbers are significant—and they usually are. A few thousand dollars in professional review against a career-long cashflow differential in the hundreds of thousands is an obvious trade. Choose people who routinely work with physician groups and understand both healthcare regulations and small-business partnership structures. Generic employment lawyers miss critical practice-specific landmines.

5. How long should a reasonable partnership track be before buy-in?

Most competitive groups land in the 1–3 year range. Longer than that (4–5+ years as an “associate”) can be acceptable only if (a) associate compensation is very strong, (b) the criteria for partnership are transparent and objective, and (c) the buy-in terms are locked in early, not left to “future discussion.” If you are on year 4 of a “2-year partnership track” with moving goalposts, you are not on a partnership track. You are a permanent employee subsidizing the owners.

Key takeaways:

- Never evaluate a partnership offer on salary alone; the real money is in equity mechanics—what you pay in, what you get out, and everything in between.

- Demand concrete numbers and documents on buy-ins, ownership structure, and buy-outs, and model your cashflows over at least a decade, not just year one.

- If the structure is opaque, asymmetric, or impossible to explain in plain language, assume you are the one on the losing end—and be willing to walk.