The worst retirement plan for a physician is binary: one day full throttle, the next day nothing. You need a staged exit. Locums is the bridge—if you use it intentionally, on a timeline.

Below is a stepwise, time‑anchored guide from “thinking about cutting back” to “fully retired with your legal and financial house in order.” I will assume you are a physician or advanced practice clinician, but the structure works for most high‑income professionals.

Phase 1: 5–7 Years Before Full Retirement – Design the Exit, Not Just the Number

At this point you should stop thinking only about “my number” and start designing “my exit path.”

Months 0–6: Reality Check and High‑Level Plan

In the first six months:

- Pull a complete financial snapshot:

- Net worth (assets minus debts)

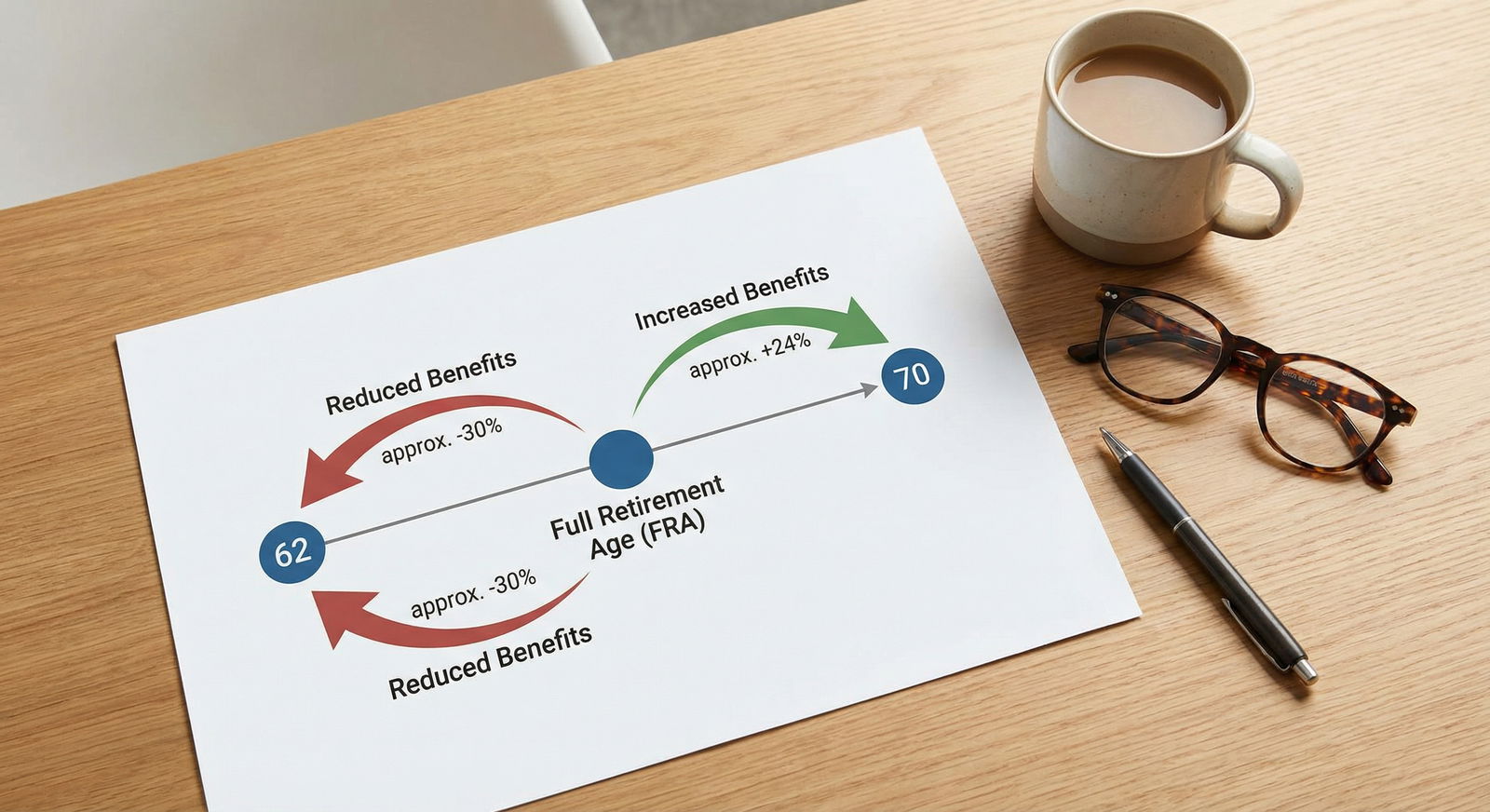

- Guaranteed income (pensions, Social Security estimates, annuities)

- Retirement account balances (401(k), 403(b), 457, IRA)

- Taxable accounts and practice equity, if any

- Clarify your target:

- Ideal “full stop” retirement age

- Minimum annual spending you actually use (not fantasy budgets)

- Non‑negotiables: maintaining current home vs. downsizing, supporting adult children, etc.

Then meet with:

- Fee‑only financial planner (preferably not selling products).

- Tax professional (CPA or EA) who understands physician income and entity structures.

- Estate planning attorney (if you have not updated documents in 5+ years).

Your task in this window is not to optimize down to the last dollar. It is to answer three blunt questions:

- Can you retire now if you had to stop working tomorrow?

- If not, how much annual income shortfall exists?

- How much of that shortfall could be replaced with part‑time or locums work, and for how many years?

| Feature | Full Clinical Role | Locums/Part-Time |

|---|---|---|

| Income Level | Highest | Moderate |

| Schedule Control | Low | High |

| Benefits (health, etc.) | Strong | Weak/Variable |

| Malpractice Coverage | Employer provided | Varies by contract |

| Tax Complexity | Moderate | Higher |

At the end of this 6‑month block you should have:

- A draft retirement age range: e.g., “Clinically full‑time through 64, then 3 years of locums, fully retired by 68.”

- A high‑level income ladder: how much you need from work each year as you taper.

Months 6–18: Start Structuring for Flexibility

Now you quietly re‑engineer your financial and legal structure so you can step down in stages without chaos.

During this 12‑month window:

Maximize flexibility in savings vehicles

- Increase contributions to taxable brokerage accounts if most of your money is locked in tax‑deferred accounts you cannot or do not want to tap heavily before 70.

- Simplify scattered accounts. Roll old 401(k)s into a central IRA or current plan if it improves investment options and RMD planning.

Build a “transition fund”

- Aim for 1–2 years of bare‑bones spending in cash or short‑term bonds.

- Purpose: to cover any gaps if locums work dips, or you decide to stop suddenly.

Review legal and liability basics

- Update or create:

- Will

- Durable power of attorney

- Health care proxy / living will

- If you own a practice or are a partner:

- Review buy‑sell agreements.

- Understand how and when capital accounts are paid out.

- Clarify disability vs. retirement triggers.

- Update or create:

At this point you should see the outline of a staged path:

- Full‑time → reduced FTE → locums/consulting → fully retired.

You are not announcing anything yet. You are building the scaffolding.

Phase 2: 3–5 Years Before Full Retirement – Start the Gradual Step‑Down

This is where people either execute a smart taper or panic‑quit. You are going to execute.

Year 1 of This Phase: Move From Full‑Time to “Strategic Full‑Time”

At this point you should:

Negotiate your current role with an exit in mind

- Reduce or eliminate:

- Extra call

- Committees

- Non‑core admin roles that do not enhance your exit options

- Increase:

- Any work that builds portable value (e.g., telemedicine experience, procedural volume for in‑demand skills, reputation at potential locums sites).

- Reduce or eliminate:

Start exploring locums markets

- Quietly register with 1–2 locums agencies (CompHealth, Weatherby, Barton, etc.) to learn:

- Typical pay rates

- Credentialing timelines

- Demand by region and specialty

- Ask very specific questions:

- Who pays malpractice, and is it claims‑made or occurrence?

- Is tail coverage provided when a contract ends?

- Average assignment length and notice for cancellations.

- Quietly register with 1–2 locums agencies (CompHealth, Weatherby, Barton, etc.) to learn:

Run detailed projections with and without locums income

Use conservative assumptions. For example:

| Category | Clinical Salary | Locums/Consulting | Portfolio Withdrawals |

|---|---|---|---|

| Now | 300000 | 0 | 0 |

| Year 3 | 150000 | 80000 | 30000 |

| Full Retirement | 0 | 0 | 90000 |

By the end of this first year you should know:

- Whether a locums phase is financially necessary, or primarily lifestyle.

- Rough timing: “Start locums in 2 years, do 2–4 years part‑time.”

Years 2–3 of This Phase: Formalize the Timeline

Now you start putting dates on paper.

Month 0–3 of this sub‑phase

- Decide:

- Your exit date from full‑time employment (or from partnership).

- The approximate start date for locums.

- Discuss quietly with:

- Your spouse/partner.

- Your financial planner.

- If applicable, practice leadership (only if you are ready to commit).

Month 3–12

Contract and benefits review

- Understand:

- What you lose when you cut back hours (health insurance, disability, life, retirement match).

- Vesting schedules for any pensions or equity.

- Quantify the cost of replacing benefits as a locums worker:

- Individual health insurance or COBRA bridge.

- Private disability or decision to drop it close to retirement.

- Term life needs shrinking or disappearing as you approach full retirement.

- Understand:

Tax planning for variable income

- Work with your CPA to:

- Set up estimated tax payments that assume fluctuating locums income.

- Decide if establishing an S‑corp or LLC for 1099 locums work makes sense.

- Plan for “gap years” of lower income to convert some IRA dollars to Roth at favorable tax brackets.

- Work with your CPA to:

Liability and tail coverage planning

- Clarify:

- Does your current employer provide tail coverage when you leave?

- For how long and for what scope of practice?

- If not covered:

- Get quotes for individual tail.

- Weigh the cost versus your risk tolerance and likelihood of late claims.

- Clarify:

By the end of this phase you should have written milestones, something like:

- Age 63: step down from 1.0 FTE to 0.6 FTE.

- Age 65: leave permanent job, start 0.4 FTE locums.

- Age 68: end clinical work entirely, live on portfolio + pensions.

Phase 3: 12–24 Months Before Leaving Permanent Employment – The Pivot to Locums

This is the tactical phase. Dates are set. Now you line everything up so the first day out of your “real job” is not a financial cliff.

12–18 Months Before: Lock in Health, Legal, and Credentialing

At this point you should:

Secure health coverage plan A and B

- If you are under 65:

- Decide if you will use:

- Spouse’s employer plan.

- COBRA from your current employer.

- ACA marketplace plan.

- Decide if you will use:

- If near or over 65:

- Enroll in Medicare Parts A and B on time.

- Decide on Medigap vs. Medicare Advantage.

- Model the cost difference between working slightly longer to keep employer health care vs. paying out of pocket.

- If you are under 65:

Start locums credentialing early

- Many hospitals take 3–6 months to credential.

- You should:

- Collect all licenses, DEA, certifications, procedure logs.

- Clean up any NPDB issues or board actions (if present, handle them proactively with agencies).

- Aim to have at least one signed locums agreement 3–6 months before your full‑time job end date.

Tighten estate and asset protection

- Update:

- Beneficiaries on all retirement and insurance accounts.

- Trusts, if you use them.

- Review:

- Umbrella liability insurance coverage (generally $2–5M).

- Any state‑specific asset protections for retirement accounts and home equity.

- Update:

6–12 Months Before: Turn the Knobs on Income and Spending

Now you “test drive” the locums lifestyle while still protected by your main job.

At this point you should:

Gradually reduce:

- Lifestyle inflation. Start living closer to your planned retirement budget.

- Call or highest‑stress shifts as much as contractually possible.

If allowed:

- Trial a very small locums commitment (e.g., one weekend a month) to:

- See how travel, charting systems, and new teams feel.

- Confirm the pay and expense structure is what you expected.

- Trial a very small locums commitment (e.g., one weekend a month) to:

With your planner:

- Finalize your initial withdrawal strategy:

- Which accounts to tap first.

- How much of your living costs you expect to cover from:

- Locums income.

- Portfolio income.

- Pensions/social security.

- Finalize your initial withdrawal strategy:

| Category | Value |

|---|---|

| Full-Time | 100 |

| Locums Phase | 60 |

| Fully Retired | 0 |

(Think of this as: percentage of expenses paid by employment income. The rest comes from your assets.)

By 3–6 months before leaving permanent employment you should have:

- A signed locums contract starting within 1–2 months of your exit.

- Health insurance lined up without gaps.

- Cash reserves of 12+ months of planned spending.

Phase 4: First 1–3 Years of Locums – The Controlled Slow‑Down

This is where most people either drift aimlessly or manage it like a business. You will manage it.

Months 0–6 of Locums: Stabilize Income and Systems

Your agenda in the first 6 months:

Track real numbers, not guesses

- Monthly:

- Locums gross income.

- Taxes set aside (I recommend a separate tax savings account).

- Travel and lodging costs.

- Unpaid downtime between assignments.

- Compare to your earlier projections. Adjust quickly if your net is lower than expected.

- Monthly:

Dial in a sustainable schedule

- Decide:

- Number of weeks per month you actually like working.

- Whether long stretches (2–4 weeks at a time) or short stints (3–5 days) fit your energy and family life better.

- Avoid being the “hero” who keeps adding shifts just because you are asked. You are buying your time back; do not resell it blindly.

- Decide:

Tax and retirement contributions

- For 1099 income:

- Establish SEP‑IRA, solo 401(k), or similar if still adding to retirement accounts makes sense.

- Make quarterly estimated taxes based on a realistic income run rate.

- Explore Roth conversions in low‑income months or years.

- For 1099 income:

Months 6–24: Systematic Step‑Down

At this point you should treat locums as a descending staircase, not a plateau.

Year 1 of Locums:

- Set a maximum annual work target:

- Example: “No more than 20 weeks this year.”

- Mid‑year:

- Recalculate whether you are still on track for your final retirement age.

- If your portfolio performed well or expenses are lower than expected, consider trimming next year’s locums target.

Year 2 of Locums:

- Intentionally cut:

- Total weeks worked by 10–25%.

- Highest stress or least enjoyable sites.

- Rationally assess:

- Are you working out of financial necessity or habit?

- What is the marginal benefit of each extra week vs. the marginal cost in energy and time?

Put a hard date in writing: “No matter what, I will not work clinically past X date unless a major financial shock occurs.” Then share it with your spouse/partner and planner. Accountability matters.

Phase 5: Final 12–18 Months Before Full Retirement – Unwinding Clinical and Legal Risk

Now you prepare for “no more charts, no more shifts.”

12–18 Months Before Final Exit: Commit to the Off‑Ramp

At this point you should:

Confirm your “enough”

- Update projections with:

- Current portfolio value.

- Latest Social Security or pension numbers.

- Realistic spending based on the last 2–3 years.

- Run a few bad‑case scenarios (poor market sequence, health shock) with your planner. If those still work at a reasonable confidence level, you are done working for money.

- Update projections with:

Align locums contracts

- Inform agencies and sites of your planned stop date.

- Decline assignments that extend past that date, even if the money looks great.

- Avoid signing new long‑term contracts that would create pressure to continue.

Malpractice and tail one more time

- Confirm:

- How long claims can be brought in your state for your specialty.

- Whether your locums agencies or employers are truly providing tail or just coverage for work done while under contract.

- If needed:

- Price a personal “retired physician” tail policy.

- Document all coverage information in an accessible file for your spouse/family.

- Confirm:

6–12 Months Before: Transition to a Retirement‑Ready Financial Setup

This window is about simplifying.

You should:

- Reduce:

- Number of investment accounts and custodians.

- Number of bank and credit card accounts.

- Finalize:

- Automatic monthly withdrawals from your portfolio to your checking account.

- Social Security start date (if not already active).

- Any pension or annuity paperwork.

Legally:

- Re‑review estate documents for:

- Executor and trustee choices (are they still appropriate and willing?).

- Guardian provisions (if you have dependents).

- Ensure your spouse/partner or key family member:

- Knows how to reach your financial planner, CPA, attorney.

- Has copies or access to essential documents and account lists.

Phase 6: The First 12 Months Fully Retired – Protect the Transition

You have stopped all clinical work. No shifts. No locums. Now the risks change.

Months 0–6: Watch Cash Flow and Risk

At this point you should:

Treat the first year as a live experiment

- Track:

- Actual monthly spending vs. planned.

- How you feel about withdrawals from accounts (some people under‑spend out of fear).

- Do not jump back into work at the first sign of discomfort; instead, revisit the plan and your expectations.

- Track:

Re‑evaluate risk exposure

- Portfolio:

- Confirm your asset allocation is retirement‑appropriate (not still in “accumulation” mode).

- Legal:

- Verify malpractice tail is in place and documented.

- Maintain umbrella coverage and review limits.

- Portfolio:

Guard against “I am bored, I will take a few shifts” syndrome

- If you truly want to contribute:

- Consider non‑clinical roles: teaching, mentoring, committee work with defined scope and zero clinical liability.

- If you go back to locums, treat it as a conscious new phase, not a casual hobby; it reopens legal and financial risk.

- If you truly want to contribute:

Months 6–12: Lock In the New Normal

By the end of the first year fully retired you should:

- Have:

- A spending pattern that feels sustainable.

- Income streams aligned (portfolio, pensions, Social Security) without needing work.

- Schedule:

- Annual reviews with your planner and CPA.

- Periodic updates with your estate attorney if laws change or your wishes shift.

At this point you are no longer a clinician dabbling in retirement. You are retired, with a clean financial and legal structure behind you.

The Core Moves That Make This Work

Condensed to the essentials:

- Design a multi‑stage exit 5–7 years out: full‑time → reduced → locums → stop.

- Use the locums phase intentionally: pre‑planned duration, declining workload, clear financial targets.

- Clean up legal, malpractice, and health coverage before you step away from permanent employment, not after.

Follow the timeline with discipline and you will not “fall” into retirement. You will arrive there on purpose.