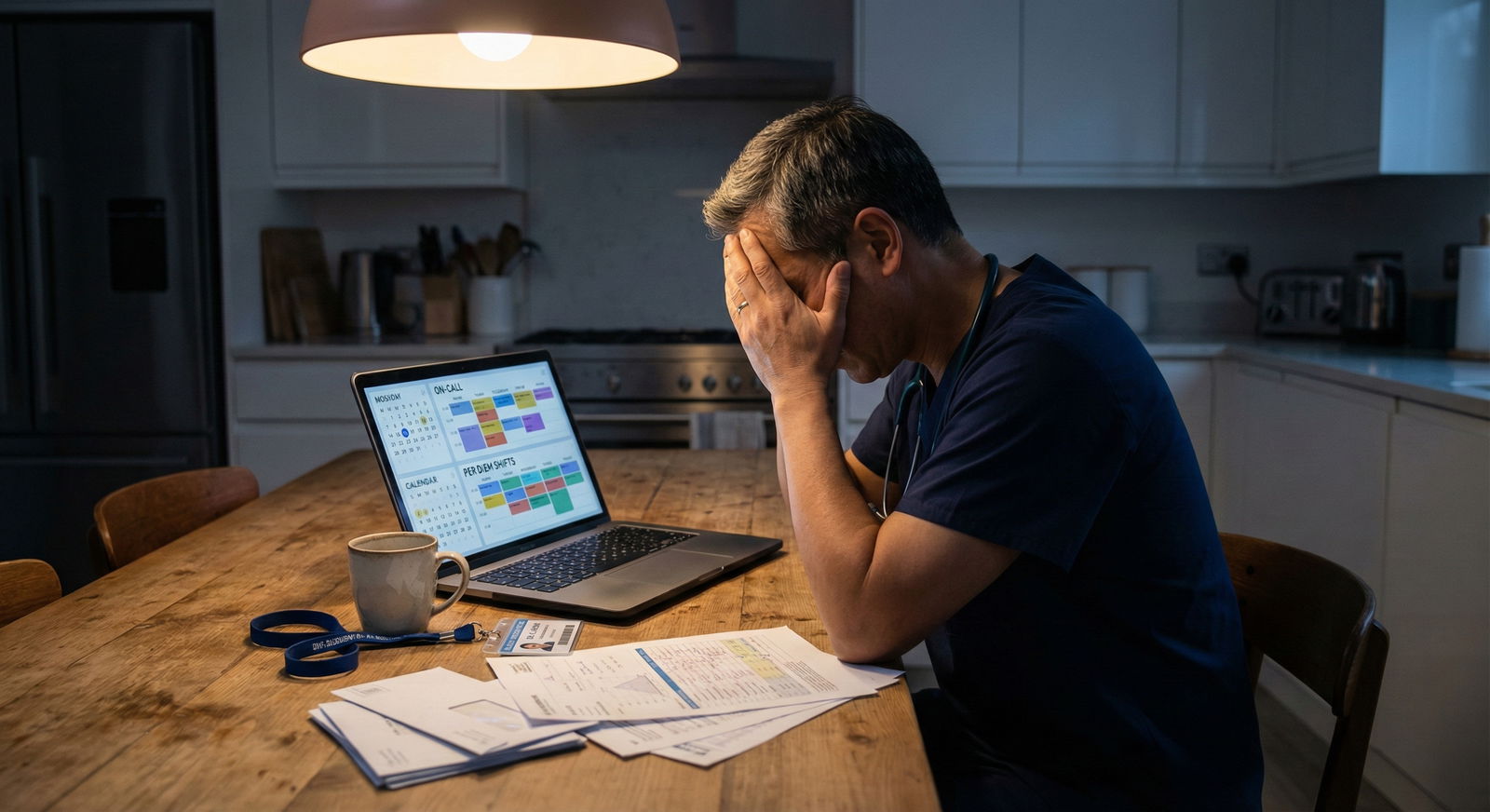

You’ve got two offers in front of you. One pays more, but the benefits are…meh. The other has rich benefits, a pension, maybe student loan help, but the base salary looks weak. Your group chat is useless because half of them just say, “Take the money,” and the other half scream, “Think about retirement!”

Here’s what you’re actually up against: you’re not comparing salary vs salary. You’re comparing two completely different total compensation systems plus two completely different lifestyles. If you try to do this in your head, you’ll get it wrong.

Let me walk you through how to do this like an adult who reads their own contract.

Step 1: Put Everything Into a Single Currency: Dollars Per Year

You cannot compare “more PTO” vs “401(k) match” vs “loan repayment” by vibes. Pick a single unit: after-tax dollars per year.

First, list everything each offer includes:

- Base salary

- Expected (realistic) bonus / RVU / productivity

- Call pay, extra shifts, moonlighting pathways

- Health, dental, vision

- Retirement match (401k/403b/457, pension, etc.)

- Student loan repayment

- CME money and days

- PTO (vacation, sick, holidays)

- Disability and life insurance

- Malpractice coverage (claims-made vs occurrence, and tail)

- Other weird perks (sign-on, relocation, childcare, housing, equity, etc.)

Now, convert each one that you reasonably can into dollars.

Here’s a simple side-by-side to keep yourself honest:

| Component | Offer A (High Salary, Thin Benefits) | Offer B (Lower Salary, Rich Benefits) |

|---|---|---|

| Base Salary | $350,000 | $300,000 |

| Bonus (realistic) | $20,000 | $10,000 |

| Retirement Match | $0 | $24,000 (8% match) |

| Student Loan Help | $0 | $20,000/year (5 years) |

| Health Insurance | $8,000 employer, $6,000 you | $16,000 employer, $2,000 you |

| PTO | 3 weeks | 6 weeks |

You’re not trying to be perfect. You’re trying to be directionally correct and strip away marketing.

Step 2: Put a Realistic Dollar Value on Each Major Benefit

Let’s break down the big confusing items and how to price them.

1. Retirement Benefits (Match vs Pension vs Nothing)

If you ignore retirement benefits, you’re leaving huge money on the table.

Common setups:

- No match: you can still contribute, but it’s your money only.

- Match (like “up to 6%” or “8% of salary”): this is free money.

- Pension: defined benefit, usually based on years of service and final/best-3 salary.

How to value:

- Match: If they match 8% and your salary is $300k → $24k/year. That’s straight-up additional compensation. Multiply by at least 0.7 if you want a conservative after-tax “feel” (since most of this will be taxed when you withdraw), but I usually just count it dollar-for-dollar.

- Pension: messier, but roughly:

- If they say “2% of final salary per year of service,” and you might stay 20 years:

- 2% × 20 = 40% of final salary annually in retirement.

- On $350k, that’s $140k/year. That’s probably worth millions in present value.

- I treat a good pension as equivalent to at least $30k–$60k/year in extra compensation if you’re likely to stay 10+ years.

- If they say “2% of final salary per year of service,” and you might stay 20 years:

If one offer has big match + pension and the other has nothing, the “lower salary” might be fake. The difference often exceeds $30k/year in real value.

2. Health Insurance

Everyone claims “great benefits.” Translation: wildly different.

You care about:

- Monthly premium you pay

- Deductible

- Out-of-pocket max

- Employer contribution to HSA (if applicable)

- Whether your spouse/kids are covered cheaply or expensively

Quick and dirty method:

- Look at your expected family usage (primary care, a few specialist visits, maybe a kid with asthma).

- Use a health plan cost calculator or just do this:

- Add: your annual premium payments + likely out-of-pocket.

- Compare Offer A vs Offer B.

If Offer A makes you pay $8k more per year for the same practical coverage, that’s an $8k pay cut. Period.

3. Student Loan Repayment

This one is easy to value, and people still mess it up.

If they say: “We’ll pay $100k over 5 years,” ask:

- Is it:

- $20k/year paid directly to your servicer (best)

- Forgiven only if you complete a term (clawback if you leave early)

- Taxable or not (most private employer repayment is taxable)

Rule of thumb:

- $20k/year loan repayment is… $20k/year.

- If there’s a clawback, I mentally hair-cut it by 20–30%, especially if I’m not sure I’ll stay.

Loan help often beats a slightly higher salary if you’re drowning in 6–7% interest debt.

Step 3: Convert Time Off and Schedule Into Money (and Sanity)

This is where most physicians screw up. You say “3 vs 6 weeks vacation, but the pay is better so whatever.”

Bad take.

PTO: How Much Is a Week Worth?

Take your total cash comp (salary + realistic bonus + average call pay) and divide by weeks worked.

If Offer A: $370k and 48 working weeks → ~$7,700/week

If Offer B: $310k and 46 working weeks → ~$6,700/week

The difference of 2 extra weeks off is worth ~ $13k in “time value” plus actual rest. That’s not trivial. Especially if the higher-paid gig quietly expects you to keep working when “off.”

Here’s how to think:

- If you’re burned out, extra PTO is worth more than the raw math.

- If your life is simple, young, hungry for experience or moonlighting, less PTO might be ok.

Schedule, Call, and “Hidden” Work

Benefits don’t compensate for a miserable schedule.

Ask each employer:

- Typical weekly schedule (clinic/OR/rounding/admin)

- Realistic patient volume or RVU expectation

- Call:

- Frequency (q4, q6, home vs in-house)

- Post-call expectations (are you still working a full next day?)

- Weekend burden

- After-hours:

- Messages, inbox, refills, results

- Are those counted toward RVUs or just free labor?

Now, imagine your real hours:

- Offer A: 4 clinic days, 1 admin; q4 call, no protected refills time → maybe 55–60 hr/week.

- Offer B: 4 days, q8 call, protected admin time → 45–50 hr/week.

That 10-hour weekly difference is 520 hours/year. That’s like another 3–4 weeks of full-time work. If the “better salary” offer is only $20–30k more but requires 500+ more hours…you’re selling your time cheap.

Step 4: Don’t Underestimate Malpractice and Tail Coverage

If you see “claims-made, no tail provided,” your spidey sense should go off.

Rough breakdown:

- Occurrence policy: more expensive, but you don’t need tail. Safer for you.

- Claims-made with tail covered by employer: fine.

- Claims-made and you pay tail: that tail bill can easily be:

- $30k–$70k+ in some specialties (OB, surgery)

- Due when you leave, not when you’re ready.

If Offer A gives you a higher salary but sticks you with tail and Offer B pays less but fully covers malpractice (with tail), I mentally amortize tail over ~5 years.

Example:

- Likely tail: $60k.

- You think you’ll stay ~5 years.

- That’s $12k/year effective hit to Offer A.

So that “$20k more salary” is really $8k more. Before you’ve priced any other benefits.

Step 5: Map Out a 5-Year Picture, Not Just Year 1

Year 1 numbers lie. You need to see 5-year trajectories.

Things to ask about:

- Salary progression:

- Any automatic COL raises?

- RVU targets ratcheting up?

- Partnership track:

- Buy-in amount

- Realistic income after partnership (not fantasy, ask actual numbers)

- How many in last 5 years made it on time?

- Loan repayment term:

- How long does it last? 3, 5, 10 years?

- Vesting on retirement and pension:

- Do you have to stay 3–5 years to keep the match or pension credits?

Do a rough 5-year table. Something like:

Year-by-year for each offer:

- Base + bonus

- Retirement contributions

- Loan repayment

- Likely extras (call, moonlighting)

- Subtract unique costs (tail risk, higher health costs, unpaid call)

You’ll see patterns:

- One job looks better in year 1 but flattens.

- The other looks weaker initially but crushes it long term with match, pension, partnership, or step-ups.

Step 6: Don’t Ignore the Non-Financial “Benefits” That Will Make or Break You

Money isn’t the only axis. But instead of hand-waving “culture,” be specific.

I look at five big non-financial categories:

Clinical environment

- Support staff ratios

- EMR functionality

- Access to subspecialists

- How they handle unsafe workloads

Leadership and stability

- Who runs the group? Physicians or corporate?

- Has the group been replaced recently?

- Any recent buyouts or mergers?

Career control

- Can you shape your practice over time?

- Options for admin roles, teaching, research, niche clinics.

Location and lifestyle

- Commute

- Schools/spouse job/support system

- Cost of living (huge; $300k in rural Midwest is not $300k in coastal city)

Exit options

- Will this job give you good experience and references if you need to leave?

- Does the non-compete box you in geographically?

Here’s the blunt reality: a job with strong, sane culture and okay money almost always beats a top-paying sweatshop in a few years. Burnout is expensive. It kills your earning potential, your health, and your relationships.

Step 7: Use a Structured Comparison Instead of Gut Feel

At this point, you have a pile of notes. Turn it into a simple structure.

I like a two-part frame:

Hard numbers (what it pays):

- Effective annual cash compensation

- Annual value of retirement and loan benefits

- Annualized cost/savings from health insurance

- Amortized cost of malpractice tail (if applicable)

Weighted intangibles (what it costs your life):

- Schedule and call burden (1–10)

- Culture and leadership trust (1–10)

- Long-term growth (1–10)

- Location and family fit (1–10)

Give yourself permission to say: “I’ll take $25k less for a job that is clearly better for my life.” That’s not weakness. That’s rational.

| Category | Value |

|---|---|

| Compensation | 30 |

| Schedule/Call | 25 |

| Location & Family | 20 |

| Culture & Leadership | 15 |

| Career Growth | 10 |

Step 8: When Moonlighting and Side Income Change the Equation

Since we’re in the moonlighting and benefits world, let’s talk about that wildcard.

If one job:

- Has a lighter schedule, more predictable hours, and no non-compete issues…

You may be able to:

- Moonlight in EDs, urgent cares, telemedicine

- Build a niche (procedures, aesthetics, consulting, expert witness work)

- Teach, precept, or do locums on the side

And that can be worth another $20k–$80k/year if you want it. Quietly.

Compare that to:

- A high-paying job that also drains all usable time and energy, leaving zero bandwidth to moonlight.

So the “lower salary” + flexible schedule job might actually produce more total income, plus better work–life balance, if you’re strategic.

| Step | Description |

|---|---|

| Step 1 | Two Job Offers |

| Step 2 | Calculate total annual comp |

| Step 3 | Adjust for schedule and hours |

| Step 4 | Value benefits and retirement |

| Step 5 | Consider higher comp even with worse benefits |

| Step 6 | Prioritize benefits and lifestyle |

| Step 7 | Map 5 year projection |

| Step 8 | Choose offer with best mix of money and life |

| Step 9 | Need max income now? |

| Step 10 | Moonlighting options? |

FAQs (Exactly 7)

1. How much less salary is “worth it” for better benefits?

I’ve seen plenty of situations where taking $20k–$40k less in salary made sense because the other offer had: strong retirement match, excellent health coverage for a family, and solid loan repayment. Once you run the numbers, it’s common to find that “lower salary” actually has equal or higher total compensation. If after everything the “worse-paying” job is still $20k behind but gives you a sane schedule and you’re already above your basic financial goals, I’d still call that a good trade.

2. Is a pension really that big a deal compared to a higher salary now?

Yes. A real pension is massively underrated by younger physicians. If staying 10+ years is realistic, a pension can replace 30–50% of your income in retirement, guaranteed, and you don’t have to manage it. That’s like having a multimillion-dollar portfolio someone else funded. If one job has a pension and the other doesn’t, I treat that as easily $30k–$60k/year of hidden value, sometimes more.

3. How should I value extra PTO compared to salary?

Do the math. Take total annual compensation and divide by weeks worked to get a “weekly value.” If Offer A works out to $7,500/week and Offer B to $6,500/week, two extra weeks off is about $13k in “pay equivalent.” Then layer on your own burnout risk. If you’re already crispy around the edges, extra PTO is probably worth more than the raw dollar calculation.

4. What if one job has way higher RVU potential but no guarantee?

Assume your base plus a conservative bonus, not the fantasy numbers being sold to you. Ask for historical data: median RVUs and earnings for physicians in your specialty and practice type at year 1, 3, and 5. If they won’t share that, that’s a red flag. I discount heavily any offer that requires heroic productivity just to reach “average” pay.

5. How do I factor in non-competes when comparing offers?

Non-competes are a real cost in career flexibility. If one job’s non-compete would force you to uproot your family to change jobs, that’s a hidden liability. I don’t try to put a precise dollar value on it, but I weigh it like this: if two offers are close, and one has a brutal non-compete and the other is mild or none, I lean hard toward the flexible one. Especially early in your career.

6. Should I ever choose the worse-benefits job purely for a prestigious name?

Rarely. Fancy hospital letterhead doesn’t pay your loans or fix burnout. The only time I’d seriously consider worse benefits for prestige is if you’re early-career, the name clearly opens doors you specifically care about (fellowship, research, academic leadership), and you’re willing to treat it as a 2–3 year stepping stone. But then be honest: many “prestigious” places are just underpaying and overworking you because they can.

7. What’s the simplest practical way to decide between two very different offers?

Do this:

- Build a one-page side-by-side with total annual dollars (salary, bonus, retirement match, loan repayment, health cost differences).

- Write down actual expected weekly hours and number of call nights/weekends.

- Score each job 1–10 on culture, location, and long-term opportunity.

If one job clearly wins on both money and life, you’re done. If one wins on money and the other on life, ask yourself directly: “Am I optimizing for maximum dollars, or for a sustainable, good life?” Then pick accordingly and stop re-litigating the decision every week.

Key points to keep in your head:

- Always compare total compensation, not just salary. Retirement, health, loans, and tail coverage can swing the numbers tens of thousands of dollars.

- Your time, schedule, and sanity are part of the compensation package. A “higher-paying” job that quietly demands 10+ more hours a week can be a worse deal in reality.

- Benefits that build long-term security—retirement, pension, loan help, stable culture—usually beat an extra bump in base salary over the long run.