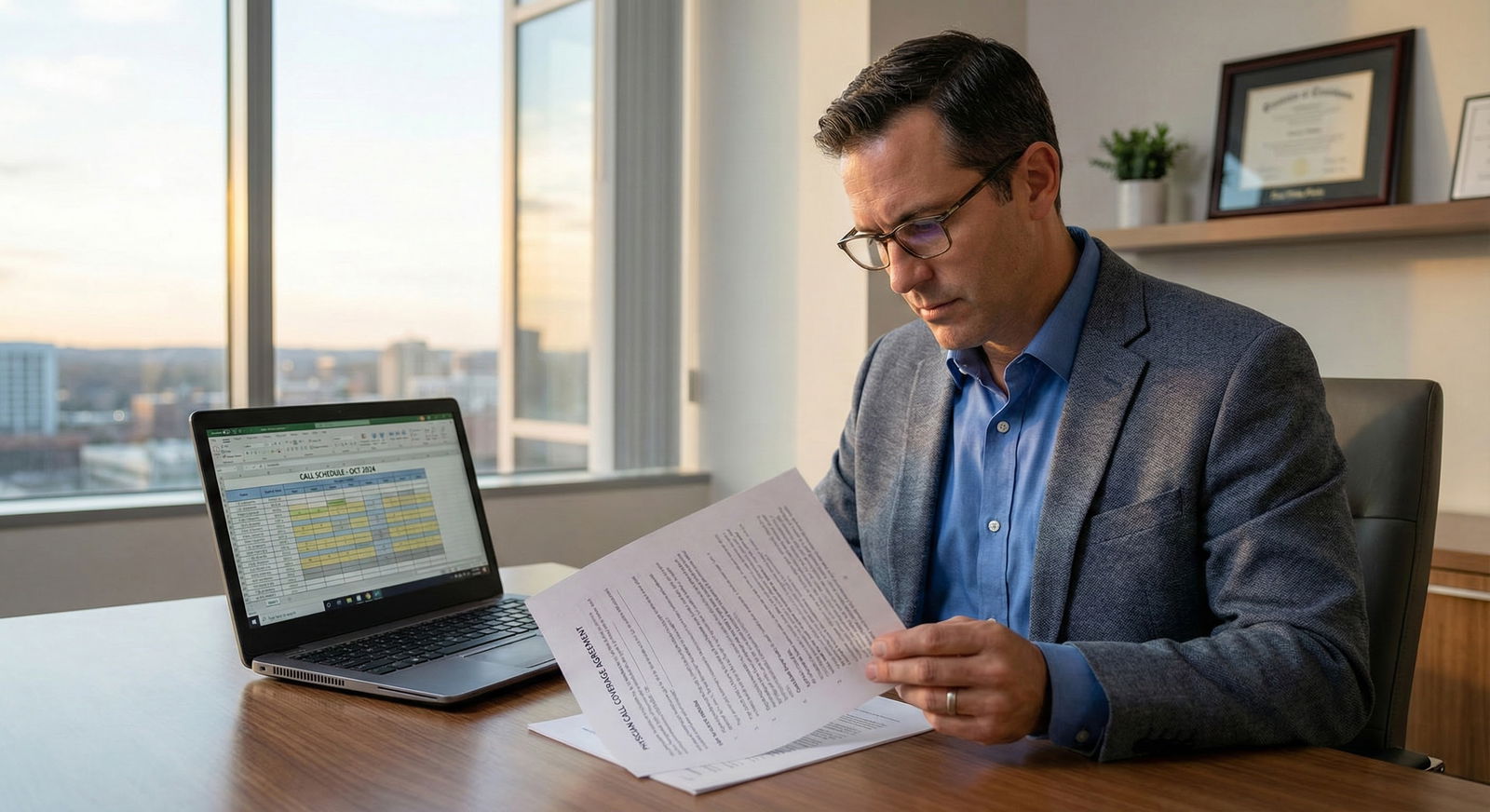

You are six months from finishing fellowship. The offer looks strong: solid base salary, RVU bonus, relocation, sign-on. Then you hit the paragraph on call coverage. It is three sentences long, vague, and references a “call stipend program determined by the group.” Your stomach drops.

This is where people get burned.

Let me walk through how call coverage compensation actually works in the real world: stipends, credits/banks, and buyouts. How to structure it. What to push for. What is garbage and what is fair.

1. Start With Reality: Call Is Work, Not a “Professional Obligation”

Hospitals and groups love to frame call as a “professional responsibility” or “shared duty.” That framing is not an accident. It is a negotiation tactic.

You need a different framing in your head: call is high‑value, high‑risk, often unsustainable work that must be explicitly compensated and bounded.

Common situations I see:

- Newly hired hospitalist “includes call” and ends up on every third night, no extra pay.

- General surgeon joins a small town group; night call is “shared equally,” but 2 of the 4 partners quietly take buyouts, leaving the new hire taking 15–20 days a month.

- Cardiologist offered a “call stipend” that sounds good… until they learn partners are getting a different rate and a separate hospital stipend.

You want three things in writing:

- What call you are required to take.

- How every unit of call is compensated.

- How call responsibilities can change and how compensation must change with them.

If any of those are missing from the contract, you are volunteering for future conflict.

2. The Three Big Structures: Stipends, Credits, and Buyouts

At a high level, call coverage compensation tends to fall into three buckets.

Let me break down each.

A. Call Stipends (Cash for Availability)

This is the most straightforward: you get paid a fixed amount per call shift, per night, or per weekend, regardless of how busy it is.

Common forms:

- Per weekday night (e.g., $400–$1,200)

- Per weekend day or 24‑hour block (e.g., $1,000–$3,000+ depending on specialty and region)

- Per backup call (lower rate, but still something)

Stipends can be:

- Paid by the hospital directly (medical staff coverage)

- Paid by the private group out of a hospital coverage contract

- Paid by the employer (health system, academic department) as an internal policy

Key problems I see all the time:

- “Stipend” is mentioned once in the offer letter with no dollar amount.

- The stipend is “subject to change annually at the discretion of the group.”

- New hires get a lower rate than partners, and the contract does not lock in parity.

You need the exact numbers and the mechanism for change.

| Scenario | Typical Range per 24h Call |

|---|---|

| General IM hospitalist | $250 – $800 |

| General surgery | $800 – $2,500 |

| Ortho (trauma-capable) | $1,000 – $3,000 |

| Cardiology (invasive) | $1,000 – $3,000+ |

| OB/GYN | $600 – $1,800 |

These numbers vary wildly by region and competition, but if your offer is dramatically below this and call is busy, you should be asking direct questions.

What you want in the contract:

- The actual stipend rate(s)

- When it is paid (pay period, monthly, quarterly)

- What counts as a “call day” (in-hospital vs beeper, 12 vs 24 hours)

- Whether stipends differ for weekday vs weekend vs holiday

And this phrase, or close to it:

“Any reduction in call stipend rates shall require physician’s written consent, and any material change in call frequency shall trigger good cause renegotiation of call stipends.”

If they push back hard on that, that is data. They plan to move the goalposts.

B. Call Credits / Banks (Internal Accounting Systems)

Credits are an internal currency that many groups use to make call feel “fair.” One call shift equals some number of credits; each physician has a target annual credit number. Extra credits can be:

- Paid out in cash at a set rate

- Used for extra vacation

- Traded with colleagues

On paper, this is elegant. In reality, it can be opaque and weaponized.

Typical setup:

- Weeknight call: 1 credit

- Weekend 24h call: 2–3 credits

- Holiday call: 3–4 credits

Let me give you an example of why you must be careful.

You join a 6‑physician orthopedics group. Their call bank system:

- Each partner must take 30 credits per quarter.

- The hospital pays the group $30,000 per month for ED ortho call.

- The group assigns credits to cover the ED schedule and “pays” $400 per credit internally.

But the contract they offer you:

- Requires “participation in the call schedule at the discretion of the group.”

- Says nothing about credit values.

- Says nothing about your right to be paid for extra credits.

You now have:

- No floor.

- No control over credit valuation.

- No guarantee of parity with partners.

The right way to do this in your contract:

- Define the credit system.

- Define your expected annual credit target.

- Define how extra credits are compensated, with a dollar amount.

Example contract language structure (condensed):

- “Call is tracked using a credit system.”

- “Physician’s annual target is 120 credits.”

- “Call above 120 credits per calendar year shall be compensated at $500 per credit.”

- “Call credit values by shift type are attached as Exhibit B and may not be reduced without physician’s written consent.”

You also want the right to see the math. If the hospital pays $360,000 per year for call coverage and the group “values” a call credit at $250, but somehow partners receive larger distributions, you are subsidizing them.

C. Buyouts (Paying to Avoid Call)

Buyouts are where the games gets serious. These usually appear in:

- Mature private groups with aging partners

- High‑burnout specialties (OB, neurosurgery, ortho, GI)

- Markets where a hospital is desperate to keep a service line open

There are two sides:

- The hospital pays the group to cover call.

- Within the group, individual physicians pay or receive money based on taking or avoiding call.

You might see:

- Senior partners paying a set amount per year (e.g., $80,000) to be “out of call.”

- A per‑shift buyout rate internally (e.g., $1,000 for someone to cover your call).

- A retirement phase‑down where partners progressively reduce call and pay increasing amounts.

The traps for you as a new hire:

- You are not eligible for buyout for 3–5 years.

- You are required to “backfill” call for partners who buy out.

- You do not participate proportionally in the hospital’s call coverage stipend.

Here is the ugly version I have literally seen:

- Hospital pays group $600,000 per year for neurosurgery ED call.

- Group has 4 partners, 2 of whom buy out and pay the group $100,000 each to be out of call.

- The other 2 (one of whom is the new hire) cover essentially all the call.

- At year end, call income ($600k + $200k buyouts) is pooled and split equally 4 ways.

So the two covering call are effectively subsidizing the two not taking call. The contract for the new hire simply says, “Physician is required to participate in call coverage as assigned by the group. Distributions of call income are determined in accordance with group policies, which may change from time to time.”

That clause should make you walk.

You want clear provisions on:

- Whether you can buy out of call in the future and at what formula.

- How call income (hospital stipends, internal buyouts) is allocated.

- Whether there is a “sweat equity” component (those taking more call get more of the pie).

A reasonable structure:

- Define a “call pool” for all call-related income.

- Allocate a base share to all full‑time physicians (say 50% equally).

- Allocate the remaining 50% proportionally based on credits or days of call actually taken.

Nothing perfect. But much better than equal split regardless of call.

3. How Call Interacts With Your Base, RVUs, and Duties

Another move employers pull: “We pay above‑market base, so call is included.” Which usually means they are paying slightly above MGMA median base and then silently expecting you to take a crushing call burden.

You want to separate:

- Base salary (for scheduled clinical time, non‑call work)

- Variable pay (RVU bonuses, quality, etc.)

- Call pay (for availability and/or actual call work)

These are not interchangeable.

| Category | Value |

|---|---|

| Base Salary | 55 |

| RVU/Bonus | 25 |

| Call Stipends | 15 |

| Other Incentives | 5 |

Three specific questions to ask:

Are call visits/procedures billable and credited to me for RVUs?

- If yes, then call stipends are truly “availability” pay.

- If no, then call stipends need to be significantly higher, because call is uncompensated clinical work.

Are call stipends counted toward my bonus thresholds?

- Some systems quietly exclude them, which affects benefit calculations and “total comp.”

Is my FTE definition tied to call?

- Example: “1.0 FTE includes 1 in 4 call.” That is a trap. If you go to 0.8 FTE and they keep you at 1 in 4 call “for coverage needs,” you just got a pay cut to take the same call.

Your contract should define:

- FTE expectations in clinic/OR hours, not call.

- Call as a separate duty with separate compensation.

- Whether call changes your RVU expectations (for better or worse).

4. Structuring Fair Call Financially: Concrete Models

Let’s walk through a few real‑world models I have seen that actually work.

Model 1: Simple Per‑Shift Stipend + RVUs

Used by many hospitalist and ED groups.

Structure:

- Base salary covers scheduled shifts (e.g., 15 shifts/month).

- Each additional night call shift beyond that is a flat stipend.

- Any billable work from call is credited as RVUs and paid via standard RVU bonus.

Contract elements:

- “Physician shall be scheduled for X shifts per month.”

- “Call shifts beyond this scheduled number shall be compensated at $Y per shift.”

- “Professional services provided while on call shall be credited to the physician.”

Upside: Very clean. Easy to calculate. Harder for the employer to manipulate.

Model 2: Call Bank + Tiered Thresholds

Used in multi‑specialty private practices.

Structure:

- Each type of call has assigned credits.

- Each physician has an annual credit target (e.g., 100 credits).

- Credits 0–100: no additional pay (considered baseline group duty).

- Credits 101–130: paid at $400/credit.

- Credits 131+ : paid at $600/credit.

This adds a premium for heavy call takers and also disincentivizes partners from offloading huge volumes of call onto one person unless they pay up.

Key contractual protections:

- Fixed credit target in contract, or formula for adjusting it.

- Floor rate for credits above target.

- Clear definition of what happens if new physicians join (credit targets should adjust).

Model 3: Call Pool with Proportional Distribution

Used when hospital pays a large stipend.

Structure:

- Hospital pays a lump sum annually for call coverage.

- Group defines a “call pool” for this money.

- Each call shift earns a “unit.”

- At year end, the call pool is divided by total units to determine $ per unit, and then each physician is paid units × rate.

This directly ties compensation to call taken.

Must be in writing:

- Which income streams go into the call pool (explicit list).

- Unit values by shift type.

- How changes are approved.

Any clause that says “call pool distributions shall be at the discretion of the board” is basically a blank check for partners to favor themselves.

5. Contract Language: What You Need in Black and White

Let me be blunt. If call compensation is not clearly defined in your contract or an attached exhibit, assume the worst.

| Step | Description |

|---|---|

| Step 1 | Review Offer |

| Step 2 | Request detailed call terms |

| Step 3 | Compare to benchmarks |

| Step 4 | High risk - reconsider |

| Step 5 | Negotiate rates and limits |

| Step 6 | Add call schedule limits |

| Step 7 | Include change/renegotiation clause |

| Step 8 | Sign or walk |

| Step 9 | Call described clearly? |

| Step 10 | Employer willing to specify? |

Elements you want clearly addressed:

Call Type and Scope

- Inpatient vs outpatient.

- Primary vs backup call.

- In‑house vs beeper.

- Shared for which hospitals.

Frequency and Limits

- “Physician shall not be required to take primary call more frequently than 1 in X weekdays and 1 in Y weekends, absent physician’s written consent.”

- “Holiday call shall be equitably distributed.”

Compensation Mechanics

- Per shift / per credit / per unit rate.

- Distinction between weekday, weekend, holiday, in‑house.

- Payment timing.

Changes Over Time

- Triggers for renegotiation: if new hospital added, if call burden increases beyond some threshold, if additional service line added (e.g., STEMI call on top of general cardiology call).

- Requirement for mutual written agreement for any reduction in rates or large increases in frequency.

Dispute Resolution

- If the group has a call policy manual, have it incorporated by reference and attached as an exhibit.

- “In the event of conflict between the manual and the agreement, the agreement controls.” That one sentence has saved people a lot of pain.

6. Benchmarking: How Do You Know If the Offer Is Garbage?

You will not always find granular call compensation data in MGMA or AMGA reports. But you can triangulate.

Use:

- MGMA total compensation vs median for your specialty and region.

- Your expected call intensity vs peers.

- Whether your call is “required hospital coverage” (high value) vs “optional practice call.”

If you are:

- At or below median total comp.

- Taking higher call frequency than typical (e.g., 1 in 3 instead of 1 in 5).

- And there is no explicit call compensation.

Then you are underpaid.

| Category | Value |

|---|---|

| Low call | 4,475 |

| Moderate call | 6,500 |

| High call | 8,520 |

| Very high call | 12,520 |

Translation of that chart: once call gets above a certain level, total comp should rise meaningfully. If it does not, you are subsidizing the system.

Practical benchmark data sources:

- Colleagues at nearby hospitals (yes, you actually text them and ask).

- Alumni a few years out.

- Specialty‑specific job boards that sometimes list call stipends explicitly.

- Your specialty society (many have compensation survey PDFs if you ask).

7. Tactics for Negotiating Call Coverage Terms

You are not going to rewrite the group’s entire call system as a new hire. But you can carve out protections for yourself.

A few very specific tactics:

Anchor on fairness, not greed.

“I want my call burden and compensation to be aligned with the other physicians and with market norms. Can we put that in writing?”Use hypothetical changes.

“If the hospital adds a second campus and we have to cover that ED as well, how would call compensation adjust? Can we include a clause that triggers renegotiation if call frequency increases by more than 20 percent?”Ask for exhibits and policy documents.

“You mentioned a call credit system; can you attach the current call policy as an exhibit to the contract so we are working from the same version?”Push for floors, not precise permanent numbers.

If they balk at stating $1,200/night, ask for “no less than $1,000/night, consistent with current policy,” and then get current policy in writing.Tie termination rights to abusive changes.

“If my required call frequency increases by more than 25 percent without a corresponding increase in compensation, I want the right to terminate with 60 days’ notice without penalty.”

If they refuse any and all boundaries on call, believe them. Call will be whatever they need it to be.

8. Red Flags That Should Make You Pause (Or Walk)

I will be very direct here. These patterns almost always go badly for the new physician:

- “Call is shared fairly among the group; details are in our policy manual” with no numbers in your contract.

- “We do not individually compensate for call; it is part of being a partner here,” but partners are quietly receiving hospital call stipends through the LLC.

- Any statement like “Don’t worry, we take care of each other. We will work it out later.” That is code for “we will do whatever benefits us.”

Specific phrases that are trouble:

- “At the sole discretion of the group.”

- “Subject to change from time to time without the need for an amendment.”

- “Physician agrees to accept such call assignments as may be reasonably required by Employer to meet patient care needs.” (with no maximum)

You might still sign. Sometimes you need the job, or the location is non‑negotiable for family reasons. But do not lie to yourself about the risk.

FAQ (Exactly 6 Questions)

1. Should I ever accept a job where call is not separately compensated?

Sometimes, but only if the overall package clearly accounts for it. For example, small‑town FM with OB where total comp is significantly above market and call is lighter than typical. Even then, you want explicit limits on call frequency and some language tying total comp or future raises to call burden. In high‑intensity specialties (surgery, cardiology, neurology), “call included” with no structure is almost always a bad trade.

2. How do I handle a group that refuses to put call details into the contract and insists it is “policy only”?

You push once, clearly: “I am willing to follow group policy, but I need the key parameters—maximum frequency, basic compensation structure—in the contract or as an attached exhibit for me to sign.” If they still refuse, you have learned what you need to know. That group wants the ability to change your call world without your consent. You decide if the location or opportunity is worth that level of vulnerability.

3. What is a reasonable maximum call frequency to accept as a new attending?

Depends on specialty. For hospitalists, 7 on / 7 off setups are standard, but “pager call” on off weeks should be minimal. For surgical specialties, anything more frequent than 1 in 3 primary call for an extended period is punishing and should come with strong compensation and a path to 1 in 4 or 1 in 5 as recruitment continues. For medicine subspecialties, 1 in 4–6 is typical. The real question is: how often are you actually called in, and how many hours of sleep do you lose? That needs to match the stipend.

4. How do I find out what others in my market are getting for call stipends?

You ask directly. Text your co‑residents who graduated last year. Call that alum two years ahead of you who went to the community group nearby. Ask your fellowship PD if they can connect you with someone in that city. You do not need exact numbers from 20 people. Three data points from similar markets are usually enough to know if your offer is laughable or within a reasonable range.

5. Can call compensation violate Stark or anti‑kickback laws?

Yes. Hospitals cannot just shovel money at a group for call in a way that is grossly above fair market value or tied directly to referral volume. That is why you will often hear “FMV” language. For you personally as an employed physician, the risk is mostly upstream. You want to make sure call compensation is described as FMV, and that any hospital‑paid stipends are clearly outlined. If something feels off (e.g., “we code this as consulting, not call”), that is a sign to have a health care attorney review it.

6. What if the group promises to “review” call compensation after I make partner?

You treat that as a non‑promise. If your call terms as an employee are bad, and the only fix is a vague future “partner review,” assume you will be stuck until you have enough leverage to walk. If they truly intend to improve things at partnership, they can at least put the partnership‑track call structure in writing now: partner buyout options, partner call pools, partner credit rates. “Trust us, it gets better” is not a plan; it is a delay tactic.

Key points to remember:

- Call is work. It needs explicit structure: frequency, compensation, and limits all in writing.

- Stipends, credits, and buyouts can all be fair or abusive; the difference is transparency and your contractual protections.

- Any employer that insists on vague, discretionary control over your call is telling you exactly where you rank in their priorities. Believe them.