The math for living on a resident salary in coastal cities is brutal. Not dramatic. Just…brutal.

If you’re looking at programs in places like San Francisco, Boston, NYC, Seattle, San Diego, LA, Miami, DC, and your stomach drops every time you see average rent—yeah, same. You’re not being irrational. The numbers really don’t make sense on paper.

Let me walk through the worst-case fears you probably have and separate the “this will really hurt” from the “this will actually be okay if you plan it right.”

The Basic Horror: Resident Salary vs Coastal Rent

Let’s start with why your brain is screaming.

| Category | Value |

|---|---|

| NYC | 73500 |

| Boston | 72000 |

| San Francisco | 78000 |

| Seattle | 70000 |

| Miami | 65000 |

That looks decent. Then you remember: that’s before taxes, before health insurance, before retirement, before parking, before…everything.

Quick and dirty reality check (very rough numbers):

- 72k salary

- After federal/state/local taxes, Social Security, Medicare, health insurance → you might see ~4,000–4,300/month in your account (varies a lot, but this is ballpark).

- Median rent for a one-bedroom in a lot of coastal cities: $2,400–3,500+.

So yeah. One check for rent. The other check for…food and existing as a mammal.

You’re not overreacting if you’re thinking:

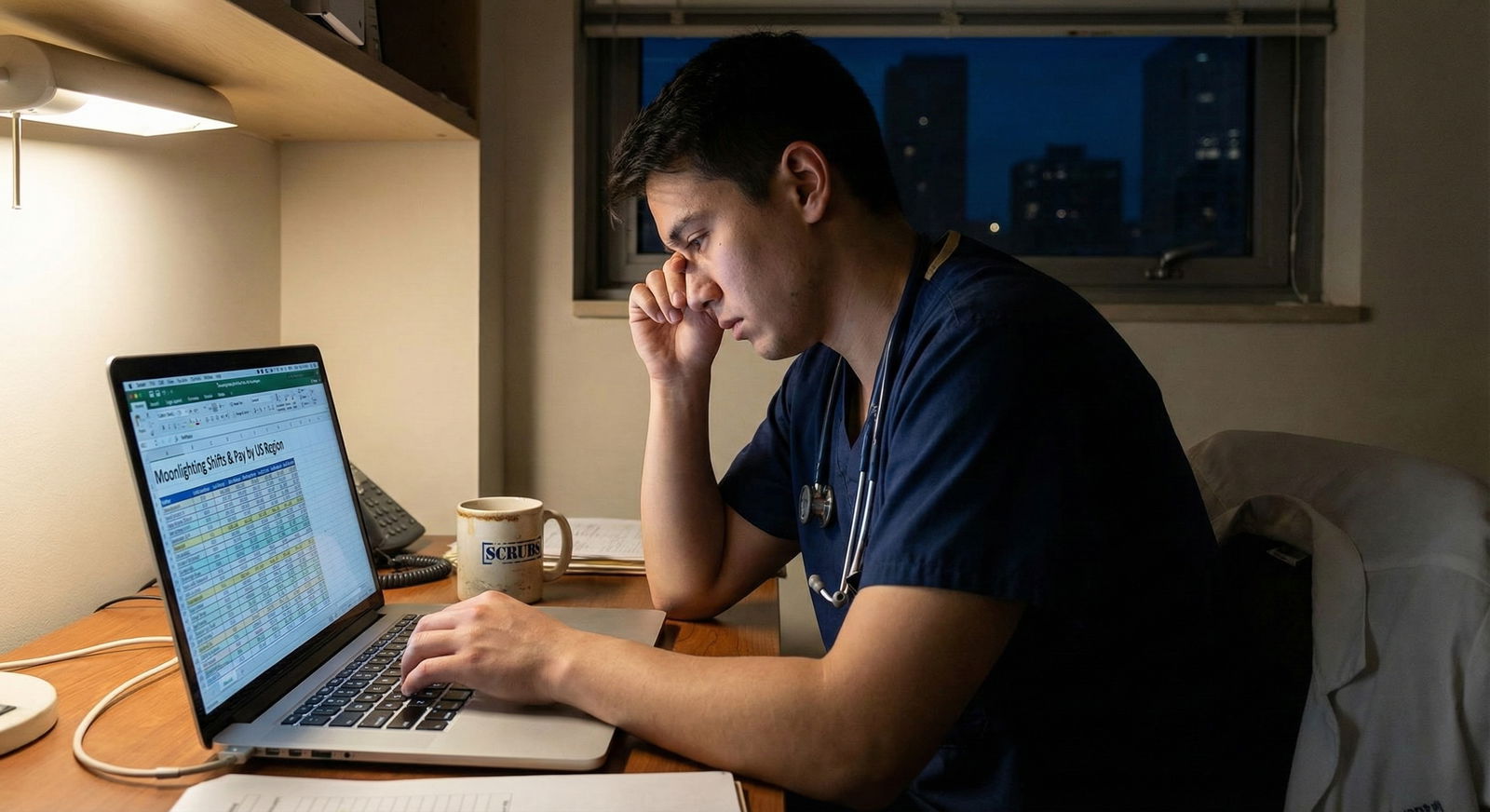

- “Will I need to moonlight just to not go into credit card debt?”

- “What if I literally can’t afford to move there?”

- “What if I match somewhere I can’t afford and I’m just stuck?”

These are rational questions. People have quit residency over finances. Not tons. But it happens.

So let’s talk what’s actually possible vs catastrophic thinking.

Are Residents Actually Surviving in These Cities?

Short answer: yes. But almost nobody is “comfortable.” And the ones who look comfortable usually have one of three things:

- Family money

- A high-earning partner

- No meaningful debt + extreme frugality

The rest? They’re making tradeoffs that the glossy brochure doesn’t mention.

Here’s what I’ve seen over and over in coastal programs:

- People sharing 2-bedroom apartments with 2–3 residents (sometimes couples in one room)

- Studio apartments 45–60 minutes away by bus/train because it’s $800 cheaper

- Residents with 200–300k in med school loans making income-driven payments as low as possible just to breathe

- No car if possible (parking + insurance + gas is a bloodbath in some cities)

- Groceries from Aldi/Trader Joe’s and Costco splits, eating hospital food whenever it’s free

- Side hustles during elective months or research years (tutoring, USMLE prep, etc., where allowed)

Is it glamorous? No. But this isn’t some impossible puzzle. It’s more like: this will suck and you’ll need a plan.

The Worst-Case Scenarios You’re Scared Of (And What Actually Happens)

Let’s name the nightmares.

1. “What if I literally can’t pay rent?”

If you go in with zero cushion, maxed credit cards, and no idea of the area, this is not impossible. That’s what’s terrifying.

But here’s how people usually prevent “I can’t pay rent” from becoming real:

- Programs often pay a moving stipend (not all, but many).

- You can often get a residency relocation loan/credit card with 0% intro APR for 12–18 months. Dangerous if abused, very helpful if used carefully.

- Many residents move in with co-residents and split housing costs heavily the first year—3–4 people in a place that “should” house 2.

The true “I can’t pay rent” cases usually look like:

- Unexpected major expense (car dies, medical issue) + no emergency fund

- High fixed costs from before residency (car payment, big credit card debt, expensive phone plan)

- Trying to live like a normal mid-20s professional in a city that thinks you’re a software engineer, not a resident

Is the risk fake? No. But it’s not some random lightning strike. It’s predictable enough that you can plan around it.

2. “What if I have to choose between food and loan payments?”

People do not starve to pay their loans. That’s what income-driven repayment is for.

If you’re US-based with federal loans, you can:

- Use an income-driven plan (like SAVE) where monthly payments during residency are relatively low (sometimes a few hundred dollars or less depending on your debt and family size).

- Temporarily reduce or pause payments if something catastrophic happens.

Interest still accrues. It’s not pretty. But you’re not going to get your residency ruined because you didn’t pay the exact full amount every single month. Loan servicers are annoying, but they’re not sending people to collections at 6 months into residency or calling your PD because you missed a payment.

3. “What if I match somewhere I can’t afford and I’m just stuck and miserable?”

This one hits hard.

Reality:

- Residents do sometimes transfer programs, but it’s rare and messy. Don’t count on that as an escape plan.

- You can downgrade your lifestyle more than you think: move further out, get more roommates, give up a car, take in-family financial help, etc. It can get very bare-bones, but “impossible” is less common than “miserable but functional.”

- Most programs know their city is expensive. Some have:

- Housing lists with cheaper landlord contacts

- Subsidized hospital housing (NYC, SF, Boston places sometimes)

- Meal stipends, call-room snacks, etc.

The misery is real. But the “I literally cannot exist in this city on this salary” scenario is rarer than it feels at 2am.

Straight Talk: Which Coastal Cities Are Kinda Financially Hostile?

Let’s not pretend they’re all equal.

| City | Rent Pressure | Car Needed? | Usual Roommate Count |

|---|---|---|---|

| San Francisco | Very High | Usually No | 2–3+ |

| New York City | Very High | No | 1–3 |

| Boston | Very High | No | 1–3 |

| Seattle | High | Maybe | 1–2 |

| San Diego/LA | High | Often Yes | 1–3 |

The ones that hurt the most:

- Cities with high rent and you still basically need a car (LA, San Diego parts, some Bay Area spots)

- Cities with local taxes on top of state/federal (NYC especially)

- Programs without much in the way of housing support or stipends

So if you’re anxious, you’re not imagining it. Some of these setups are structurally unfair.

Concrete Ways Residents Actually Make It Work

Here’s the unpretty, real-life toolkit.

1. Housing is the battlefield. Decide early how far you’ll go.

Before you rank:

- Look up what current residents are doing. Not the brochure. Ask on interview day: “Where do most interns live and how much do they pay?” Push for real numbers.

- Decide your sacrifice zone:

- Would you accept a 60–75 min commute to pay $900 less per month?

- Could you share a room with someone the first year?

- Can you handle 3 roommates and no real living room?

You don’t need to know the exact apartment, but you should know how extreme you’re willing to go if the math is bad.

2. Build a small, ugly emergency fund before you start

Not 6 months of expenses. That’s fantasy.

Target: 2–3k minimum if you can. More if possible.

That amount:

- Covers move-in costs (security deposit, first month, maybe broker fee)

- Buys you a small cushion if your first paycheck is delayed or smaller than expected

Even if you’re already in med school debt up to your eyeballs, that 2–3k can be the difference between “I’m drowning but functional” and “I’m taking out a 25% APR credit card”.

3. Preempt the recurring money leaks

Stuff that really screws residents:

- High car payment from med school

- Luxury phone plan from college days

- Subscription creep (multiple streaming services, gym you don’t use, etc.)

Do the boring, unsexy prune:

- Downsize your phone plan now

- Lose unused subscriptions

- If your car payment is absurd and the car is not essential, consider selling before residency

The less monthly fixed stuff you have, the more wiggle room for rent and food.

Should You Avoid Coastal Cities Entirely?

This is where the anxiety really spikes: “Am I an idiot if I rank these places at all?”

You’re not. But you need to be strategic, especially if:

- You’re single

- You have high loans and no outside financial support

- You’re risk-averse and money stress wrecks your mental health

Some things that actually matter more than people admit:

Program support:

Ask them, straight up:- “Do you offer subsidized housing or have relationships with specific buildings?”

- “Is there a meal stipend? Free parking?”

- “What percentage of residents own cars vs don’t?”

- “What does an average PGY-1 pay in rent?”

Cost-of-living adjustments:

Not every coastal program adjusts salary meaningfully. A 70k salary in SF is not remotely the same as 70k in a Midwest city.Your specialty’s earning trajectory:

If you’re going into something with relatively strong earning power later (cards, derm, ortho, anesthesia, etc.), the “I suffer now, but later life is fine” mindset is more realistic. If you’re thinking peds, psych, FM in a high-cost coastal city long term, you’re signing up for financial tension for a long time.

Mental Health Side: Being Poor While Everyone Thinks You’re Rich

No one warns you about this part enough.

You’ll be:

- Overworked

- Underpaid relative to responsibility

- Surrounded by people in the same city who are mid-level tech workers making 2–3x your income with normal weekends and real apartments

It messes with your head. You feel behind, even though you’re doing one of the hardest jobs out there.

You’re not weak for caring about money. You are allowed to want:

- Not to panic every time your card runs

- A door on your bedroom

- Enough cushion that one unexpected bill doesn’t break you

If being constantly on financial edge makes you spin out, that’s a real factor. Rank lists aren’t just about prestige and case volume. They’re also about: “Can I live like a human for 3+ years?”

Practical Pre-Residency Checklist If You’re Terrified About Money

Here’s what you can actually do now:

Pull your real numbers:

Total debt, interest rates, minimum payments. No more vague “I owe a lot.” You need the actual numbers.Use a realistic residency budget calculator:

Take a PGY-1 salary for a program you’re eyeing, subtract 30–35% for taxes/benefits, then plug in:- Estimated rent (based on what residents told you, not Zillow fantasy)

- Groceries, transit, phone, minimum loan payment See what’s left. If it’s $50, that’s a wakeup call.

Ask every program blunt, money-related questions on interview day or second looks:

- “What’s the average commute time from where residents can actually afford to live?”

- “Do most residents feel financially stressed, or is the stipend decent for this area?”

- “Is moonlighting allowed later on?”

Mentally separate “nice to have” from “must have”:

- Car: must-have in some cities, luxury in others

- Own studio: luxury in almost every coastal city unless you have help

- Living alone at all: often a luxury in early training

Future-of-Medicine Angle: This System Is Broken (You’re Not The Problem)

Let me be blunt: the fact that residents keeping hospitals functioning 24/7 are struggling to pay rent in the cities they serve is disgusting.

You’re not greedy for wanting a livable wage. You’re not lazy for being scared of call plus crushing rent. And the dissonance—“everyone calls me a hero while I share a bedroom”—is real.

There’s movement:

- Some states have pushed for resident unionization and pay increases

- Hospitals in ultra-high-cost cities are getting pressured to offer housing stipends

- Younger cohorts are more vocal and organized about this stuff

But you can’t wait for the system to become humane overnight. You have to make decisions based on the reality right now.

That might mean:

- Choosing a less “sexy” city where you can breathe financially

- Ranking a strong mid-tier program in a cheaper area over a big-name coastal one

- Being okay with not living downtown near the cool bars during residency because your sanity is more important than Instagram

That’s not failure. That’s survival.

| Step | Description |

|---|---|

| Step 1 | Considering Coastal Program |

| Step 2 | Plan roommates or longer commute |

| Step 3 | Housing likely manageable |

| Step 4 | Delay ranking high cost programs or cut expenses now |

| Step 5 | Rank based on training and support |

| Step 6 | Rent > 40 percent take home? |

| Step 7 | Any emergency fund? |

FAQs (Exactly 6)

1. Is it irresponsible to rank a program in a super expensive city if I have 250k+ in loans?

Not automatically. But it is irresponsible to do it without running the numbers. If your take-home pay is barely covering rent + food and your loan payment (even on an income-driven plan) tips you into the red every month, that’s not a “grind” problem, that’s a math problem. You can absolutely choose a coastal city with that debt, but you should be honest about tradeoffs: roommates, long commute, aggressively low spending, maybe no car, and accepting that you’ll rely on income-driven repayment for a while.

2. Do programs actually help you find affordable housing, or is that just brochure fluff?

Some do. Many…kind of. The most common real help:

- Email lists or resident-made housing guides

- Tips on specific buildings/landlords used to residents

- Occasionally subsidized housing near the hospital (more common in NYC/Boston-type places)

On interview day, ask, “If I matched here, what specific housing support do you provide? Not just listings—do you have reserved units, subsidies, or partnerships?” If they dance around this, assume you’re mostly on your own.

3. Is it possible to live alone in a coastal city on a PGY-1 salary?

Possible? Yes. Common? Not really, unless:

- You’re willing to live far out in a tiny place

- You’re okay with spending 50–60% of your take-home on rent

- You have help (partner/family money/side income)

Most residents in high-cost cities don’t live alone, especially PGY-1. If living alone is a core non-negotiable for your mental health, that might be a reason to de-prioritize certain cities or find programs with unusually strong compensation or housing options.

4. Should I get a car if I match in a coastal city?

Depends heavily on the city and specific hospital. NYC, central Boston, some SF locations: a car is more liability than asset (parking alone can be ridiculous). LA, San Diego, some Bay suburbs: no car can be a nightmare. Before deciding, ask residents: “Do most interns have cars? Are there shifts where leaving without a car is unsafe or impossible?” If 80% of them say you need one, build that into your budget before ranking.

5. Will taking out an extra personal/relocation loan for residency screw me long-term?

It depends how much and how you use it. A small relocation loan or 0% intro APR credit card to cover moving and deposits—used conservatively and paid down once you stabilize—is pretty normal. The danger is using it to sustain an inflated lifestyle (living alone in a luxury building) instead of bare necessities. If you’re borrowing more to pretend you earn 120k instead of 70k, that can haunt you later.

6. What’s one red-flag answer from a program about cost of living?

If you ask, “Do residents struggle with the cost of living here?” and they say something like, “Well, I mean, everyone manages, it’s just a matter of priorities,” and give you zero specifics—be careful. Programs that know their residents are stretched will usually acknowledge it and talk about:

- Housing hacks residents use

- Recent pushes for salary increases

- Any stipends or support they do have

Vague “You’ll be fine” answers in a city where studios are $3,000 are a red flag.

Open a notes app right now and write down three programs you’re considering in high-cost coastal cities. For each, find the PGY-1 salary, estimate realistic rent from what residents told you, and do a 60-second budget sketch. If one of them leaves you with almost nothing left over each month, mark it. That’s your signal to dig deeper before you rank.