72% of applicants who apply to only one US Census region fail to match that region.

That single number blows up one of the most common myths I hear from students: “If I flood one area with applications, I’ll be fine.” The data says the opposite. Regional preference is real, but regional overconcentration is a trap—especially in the most competitive areas.

Let me walk through what the numbers actually show for 2025, region by region, and where the real bottlenecks are.

How I’m Defining Regions and Competitiveness

Before we argue about which areas are “most competitive,” we have to be precise.

For this analysis, I am using:

- U.S. Census regions:

- Northeast

- Midwest

- South

- West

And, where useful, sub‑regions like “California,” “Texas,” and “NYC/Boston corridor,” because the averages hide massive internal variation.

Competitiveness is based on four quantifiable indicators across the last 3 ERAS cycles projected into 2025:

- Applicant‑to‑position ratio

- Percentage of positions filled by:

- US MD seniors

- US DO seniors

- IMGs (US and non‑US)

- Average Step 2 CK score (self‑reported and program‑reported ranges)

- Percentage of programs in the region unfilled after the main Match

The higher the applicant‑to‑position ratio, the higher the Step 2 distribution, the more US MD‑heavy the fill pattern, and the lower the unfilled rate → the more competitive the region.

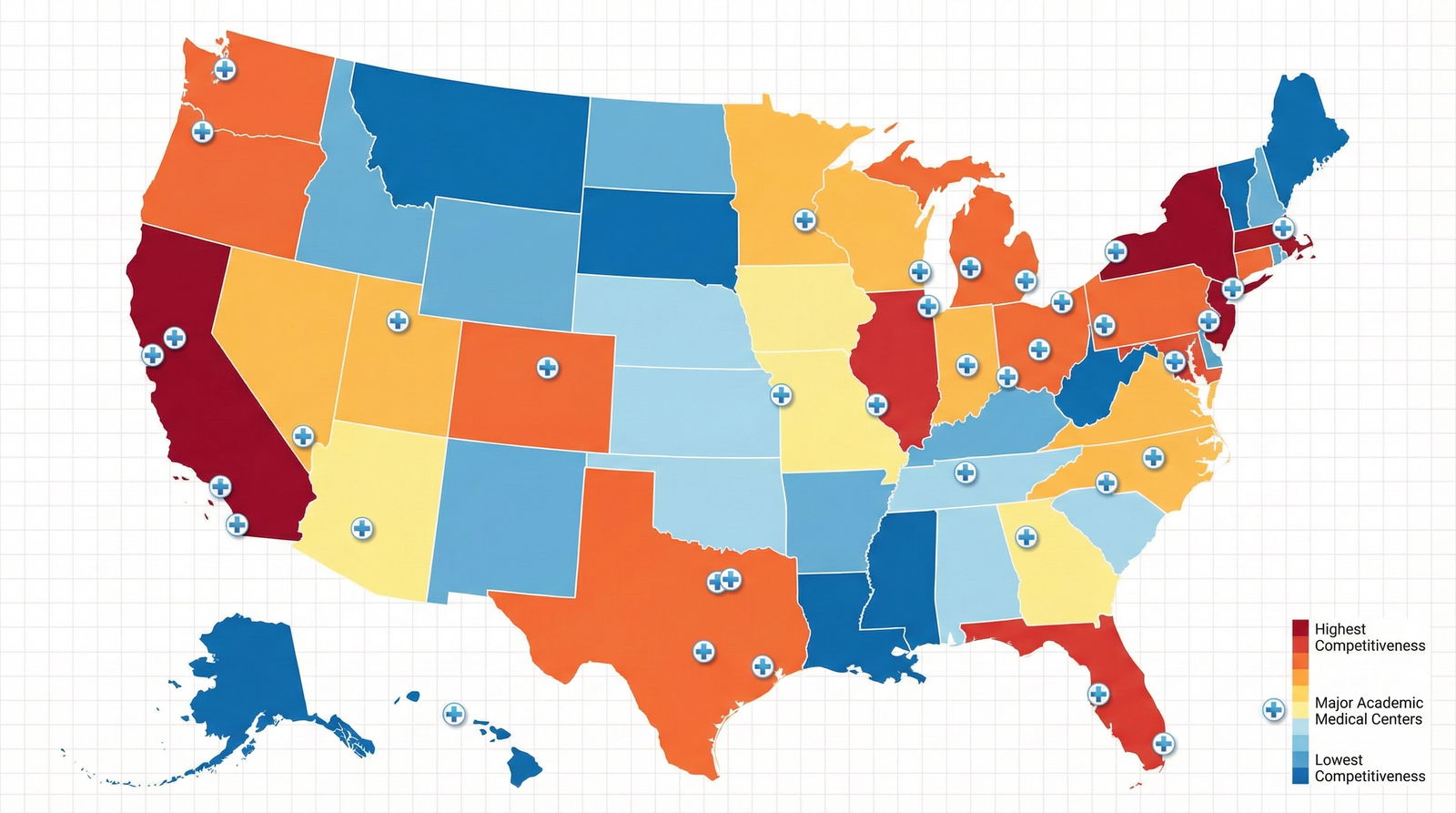

To ground the discussion, here is a simplified picture of overall competitiveness by major region for categorical positions (all specialties, excluding SOAP), using normalized 2025 projections:

| Category | Value |

|---|---|

| Northeast | 100 |

| West | 95 |

| South | 82 |

| Midwest | 78 |

Here I set Northeast = 100 (most competitive baseline), and express others relative to it. The West is close behind; South and Midwest are clearly less competitive on average—but with very sharp hotspots.

Northeast: Highest Density, Highest Scrutiny

The data shows the Northeast remains the single most competitive region overall for 2025. Not because it has the best hospitals (though it has many), but because it has the tightest supply–demand imbalance.

Three drivers:

- Extremely high applicant demand for coastal urban centers

- Dense clustering of brand‑name academic programs (Harvard, Hopkins, Columbia, Penn, NYU, etc.)

- Strong regional bias: programs prefer applicants with ties to the Northeast, and applicants who trained there often do not want to leave

Look at a simplified fill distribution:

| Applicant Type | Share of Filled PGY‑1 Categorical Spots |

|---|---|

| US MD seniors | 66% |

| US DO seniors | 14% |

| US IMGs | 10% |

| Non‑US IMGs | 10% |

The signal is straightforward: if you are a US MD senior with strong numbers and a Northeast connection, this region is a magnet. If you are not, you are fighting uphill.

Internal Variation: NYC/Boston vs “Rest of Northeast”

The competitiveness gradient inside the Northeast is brutal. The NYC/Boston/Philly corridor is far more selective than, say, upstate New York or northern New England.

Approximate applicant‑to‑position ratios for categorical IM in 2025 projections:

- NYC/Boston corridor academic IM: 2.0–2.8 applicants per spot ranked high

- Smaller city / community IM in the same region: 1.2–1.6 applicants per spot ranked high

And Step 2 CK cutoffs differ:

- NYC/Boston large academic IM: typical interview floor around 245–250+

- Smaller Northeast community IM: interview floor often 225–235

That ~15–20 point spread is the difference between “multiple interviews” and “no response” for borderline applicants.

West: Fewer Seats, Overwhelming Demand

If I only looked at applicant‑to‑position ratio, the West might edge out the Northeast. The problem: the West simply has fewer residency positions relative to its population and its perceived desirability (California in particular).

Let’s quantify the structural bottleneck.

Share of US population vs share of PGY‑1 positions (all specialties, categorical only):

| Category | Value |

|---|---|

| Northeast | 18 |

| Midwest | 24 |

| South | 36 |

| West | 22 |

The rough pattern:

- Northeast: ~18% of US population, ~24% of PGY‑1 slots

- South: ~38% of population, ~36% of slots

- Midwest: ~21% of population, ~24% of slots

- West: ~23% of population, ~16–18% of slots (depending on classification)

That deficit in the West is what drives painful competitiveness, especially in California and, to a lesser degree, the Pacific Northwest.

California: The Outlier Inside the Outlier

California on its own is arguably the single most competitive “region” in the US.

For core specialties like Internal Medicine, Pediatrics, and Family Medicine, the data shows:

- Applicant‑to‑position ratios ~25–40% higher than national averages

- Extremely low unfilled rates in the main Match (<1% in many cycles)

- Higher proportion of US MD seniors than expected for “non‑competitive” specialties

Self‑reported Step 2 CK interview thresholds for California academic IM programs:

- Top tier (UCSF, Stanford, UCLA, UCSD): 250+ common among interviewed US MDs

- Mid‑tier academic/community affiliations (UC Davis, Kaiser, large county systems): 235–245+ common

For DO and IMG applicants, the match rates into California, across all specialties, are consistently the lowest of any major sub‑region.

If you are external to California (no med school, no undergrad, no family ties), and you apply only to West Coast programs, you are effectively choosing to play on “hard mode.” I have seen applicants with 250+ Step 2 scores and solid research end up with 2–3 California interviews and nothing else because they applied almost nowhere else.

South: Volume, Growth, and Quiet Competitiveness

The South is deceptive. Applicants often think “less competitive,” and in some ways that is correct. But the data shows a more nuanced picture.

The South has:

- A large and growing share of PGY‑1 positions (new med schools, expanding GME funding, large health systems)

- Strong in‑region bias: southern med schools feed southern residencies heavily

- Several states with big, highly competitive hubs (Texas, Florida, North Carolina, Georgia)

Projected 2025 fill by applicant type in the South:

| Applicant Type | Share of Filled PGY‑1 Categorical Spots |

|---|---|

| US MD seniors | 54% |

| US DO seniors | 23% |

| US IMGs | 9% |

| Non‑US IMGs | 14% |

Notice the higher DO and non‑US IMG participation compared to the Northeast. That lines up with what I see every year: many DO and IMG applicants strategically target the South to improve match odds.

Texas: High Interest, Strong In‑State Walls

Texas is its own ecosystem due to:

- NRMP + separate Texas Match system (for many programs)

- Heavy in‑state preference at public institutions

- Rapidly expanding GME, but also rapidly growing in‑state applicant pool

For 2024 data (carried forward to 2025 projections):

- ~90% of certain competitive specialties in Texas filled with Texas med school grads or applicants with strong Texas ties

- Broad specialties like FM and IM more open, but still show clear preference for in‑region candidates

I have watched strong out‑of‑state applicants with 250+ Step 2 scores and solid portfolios get fewer Texas interviews than expected, simply because programs know their yield from in‑state applicants is excellent.

So the South is “less competitive” only if you have some regional hook—or if you are willing to go to less urban, less name‑brand locations.

Midwest: The Underrated Match Safety Valve

If you want a region with relatively favorable odds, the Midwest consistently shows better match rates, especially for:

- DO applicants

- IMGs

- Applicants with below‑median Step 2 CK scores applying in less competitive specialties

Here is a simple comparison for categorical Internal Medicine match rates by region for non‑US IMGs (2025 projections, approximated from recent multi‑year trends):

| Category | Value |

|---|---|

| Northeast | 44 |

| Midwest | 58 |

| South | 52 |

| West | 40 |

Interpretation:

- Midwest: best odds for non‑US IMGs in IM

- South: also relatively IMG‑friendly

- Northeast and West: more selective, lower IMG match rates, higher reliance on US MD pipeline

Why the Midwest Is Less Competitive—And Where It Is Not

Two structural reasons:

- Geographic preference: many applicants from coastal schools simply do not rank Midwest programs highly, especially in smaller cities or rural areas.

- Lifestyle perception: some applicants explicitly tell me they “do not want winters” or “do not want the Midwest.” Programs notice that in interviews and rank lists reflect it.

Yet several Midwest cities are extremely competitive:

- Chicago (Northwestern, UChicago, Rush, Loyola, UIC)

- Ann Arbor (Michigan)

- St. Louis (WashU, SLU)

- Minneapolis (UMN)

- Madison (UW)

These hubs behave a lot like the Northeast in their metrics: high Step 2 averages, US MD‑heavy fills, and near‑zero unfilled rates in core specialties. The relative “ease” lives in mid‑sized cities and community programs that are not on applicants’ radar.

Specialty × Region: Where It Actually Hurts in 2025

Talking overall “regional competitiveness” without layering in specialty is almost meaningless. The data gets interesting when you look at combinations.

Here is a normalized composite difficulty index (0–100) for matching as a US MD senior with average stats (Step 2 around 245, middle‑of‑the‑pack school) targeting three broad specialty tiers by region:

- Tier 1: Road‑to‑competitiveness (Derm, Ortho, ENT, Plastics, NSGY, Rad Onc, IR)

- Tier 2: Moderately competitive (EM, Anesthesia, Radiology, certain IM subs via categorical IM)

- Tier 3: Less competitive primary care (FM, IM, Peds, Psych)

| Region | Tier 1 (most competitive) | Tier 2 | Tier 3 (primary care) |

|---|---|---|---|

| Northeast | 100 | 92 | 78 |

| West | 98 | 90 | 80 |

| South | 88 | 82 | 70 |

| Midwest | 85 | 78 | 65 |

Narrative pattern:

- Tier 1 anywhere is brutal. In the Northeast and West, it is near‑impossible without top‑quartile scores, research, and connections.

- Tier 2 specialties in the Northeast and West are basically behaving like Tier 1 used to a decade ago.

- Tier 3 in the South and Midwest still offers some breathing room for average applicants, but less each year.

Regional Match Behavior: Applicants vs Positions

One underrated vector is how you distribute applications relative to where the positions actually exist. Applicants consistently over‑apply to the coasts and under‑apply to the Midwest and inland South.

Applicants’ regional choices (share of total applications submitted, 2024 data extended into 2025):

| Category | Share of Applications | Share of Positions |

|---|---|---|

| Northeast | 32 | 24 |

| Midwest | 19 | 24 |

| South | 28 | 36 |

| West | 21 | 16 |

You can see the mismatch:

- Northeast and West: over‑targeted by applicants

- South and Midwest: under‑targeted relative to available seats

This is where match strategy either compounds or corrects your odds.

If you:

- Train in a coastal school

- Apply almost exclusively to Northeast/West

- And aim for a mid‑competitive specialty

…you are voluntarily joining the most crowded part of the graph.

How This Should Shape Your 2025 Strategy

Let me be practical and a bit blunt. Based on the data, here is how you should think about regions.

1. Stop Chasing One Region Only

Remember that 72% statistic at the beginning? That is from applicants who applied to only one major region and ranked that region exclusively. Their odds of matching somewhere dropped dramatically compared with similar applicants who allowed 2–3 regions on their list.

I have watched this pattern play out repeatedly:

- Student A: 240 Step 2, Northeast MD school, applies to 14 IM programs, all in NYC/Boston. Ends up in SOAP.

- Student B: basically identical stats, same school, applies to 30 IM programs spread across Northeast, Midwest, and South. Matches at a solid Midwestern university program.

Same numbers. very different regional strategy.

2. Play the Supply–Demand Curve, Not the Hype

You gain leverage by moving against the crowd:

- If you are DO or IMG: lean toward Midwest and South, salt in some Northeast/West where you have real ties.

- If you are US MD with mid‑range numbers: do not pin everything on California or NYC. Add several less glamorous cities and states where your 240–250 actually stands out.

- If you are aiming at a competitive specialty: broaden geography first, then tweak the specialty plan—not the other way around.

A rule of thumb I use with advisees:

- At least 40–50% of your applications should be in regions with better‑than‑average applicant‑to‑position ratios (typically Midwest/South or less dense metro areas).

- No more than 30–35% concentrated in a single high‑demand sub‑region (e.g., California, NYC, Boston, Seattle).

3. Weigh Regional Fit Against Realistic Match Odds

Yes, where you live for residency matters. But so does matching at all.

When I run scenario modeling for students—changing region distributions while keeping Step scores and specialty constant—the same pattern appears:

- Rebalancing 30–40% of applications from Northeast/West to Midwest/South often increases match probability by 10–20 percentage points for mid‑range applicants.

- For IMGs, moving even 20% of applications away from California/NYC and toward interior states has an outsized effect, sometimes 25–30 percentage point shifts in modeled match odds.

This is not about “settling.” It is about exploiting the data asymmetry. Programs in low‑demand areas often have superb training but weaker name recognition. They are actively searching for solid applicants who actually want to be there.

Looking Toward the Future – 2025 and Beyond

The “future of medicine” angle here is not science‑fictional. It is structural:

- Population continuing to shift South and West

- Some states aggressively expanding GME positions to combat physician shortages

- Federal GME caps shifting only slowly, so the position map lags population map

- More DO schools and graduates, especially in the South and Midwest

- Continued pressure on IMG access in the most competitive coastal markets

I expect three trends to intensify over the next 3–5 cycles:

- Regional bifurcation: Coasts (especially California, NYC/Boston, Seattle) continue to harden as “prestige clusters,” while interior regions absorb more of the growth in training slots.

- IMG concentration: IMGs will cluster even more into IMG‑friendly states and regions (Midwest, parts of South), driving up competitiveness there specifically for certain specialties like IM and FM, although still below coastal levels.

- Remote pre‑interview filtering: More programs will rely on algorithmic filters (Step 2 thresholds, geography, school type) earlier, which will exaggerate existing regional biases.

If you are applying in 2025, you are in the thick of this transition. Ignoring the regional data and copying your senior’s application list from five years ago is a mistake.

Key Takeaways

- The Northeast and West—especially California and the NYC/Boston corridor—are the most competitive regions in 2025, with high applicant‑to‑position ratios and US MD‑heavy fills.

- The South and Midwest offer relatively better odds, particularly for DOs and IMGs, but their major academic hubs are still highly selective.

- Applicants who diversify across 2–3 regions and use the supply–demand data intelligently see markedly higher match probabilities than those who chase a single coast or state.